5 Tax Papers Needed

Understanding Tax Papers: A Comprehensive Guide

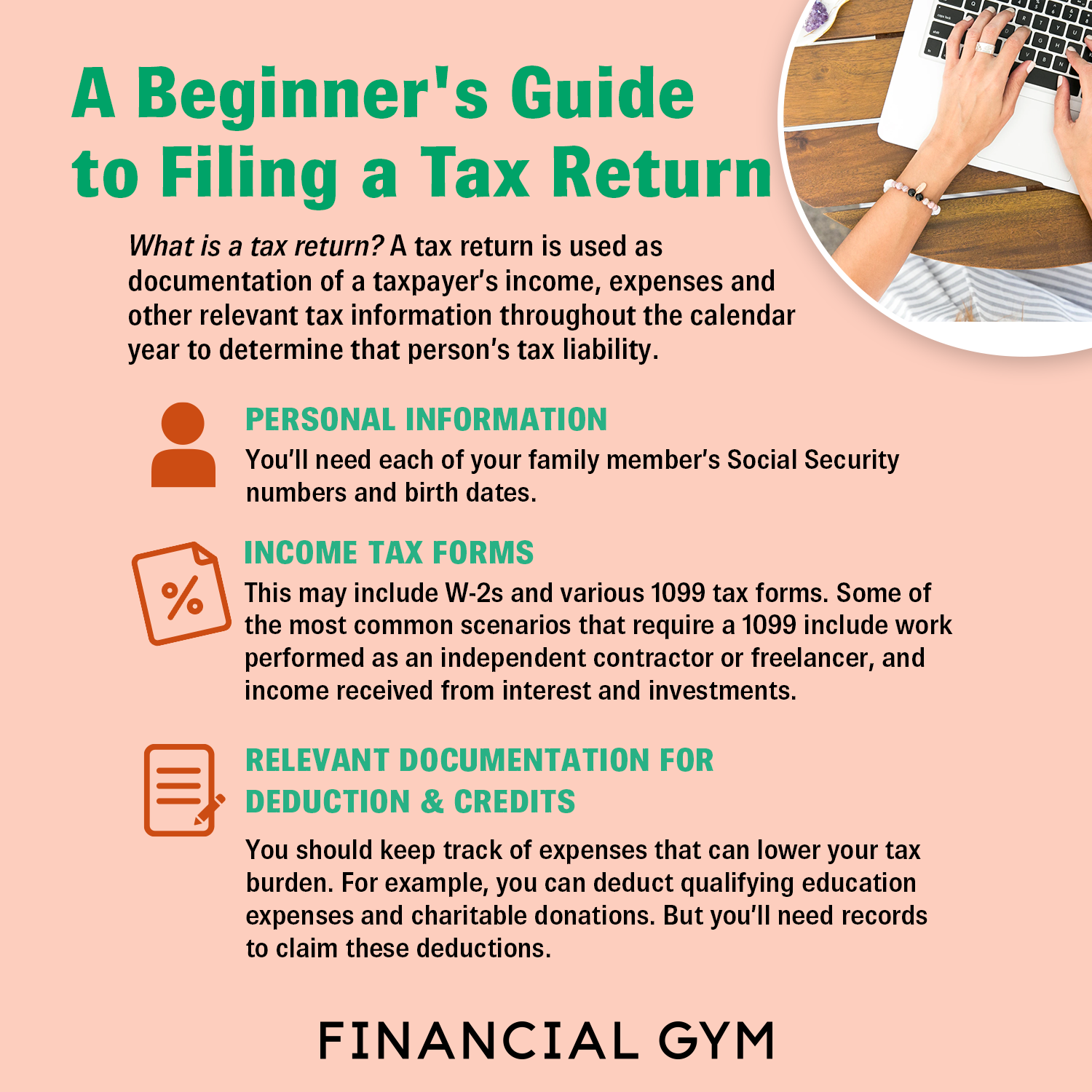

When it comes to managing your finances, especially during tax season, having the right documents can make all the difference. Tax papers are essential for filing your taxes, ensuring you’re compliant with all tax laws, and potentially saving you money through deductions and credits. In this guide, we’ll explore five key tax papers you might need, along with explanations of their importance and how to use them effectively.

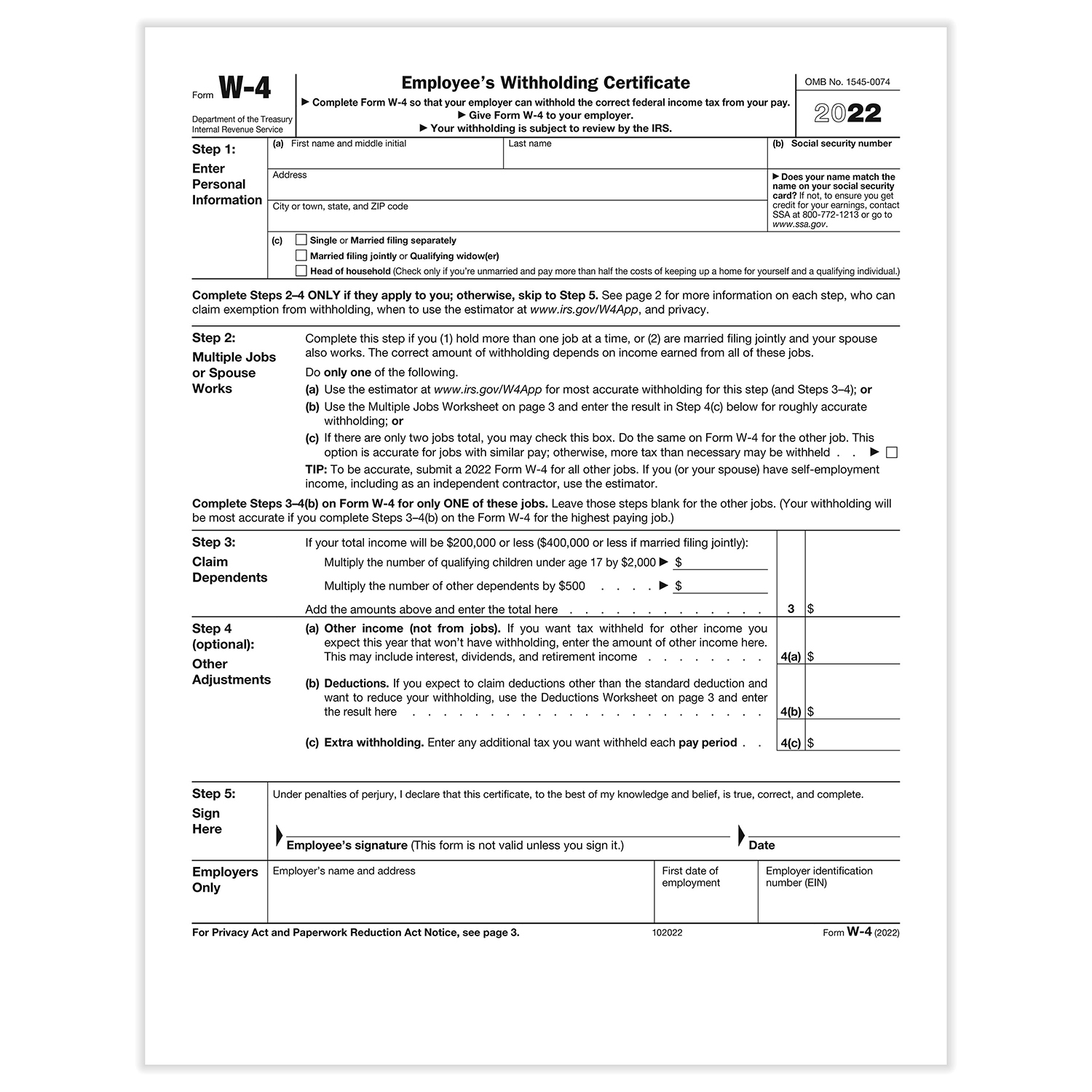

1. W-2 Forms: Reporting Your Income

The W-2 form, or Wage and Tax Statement, is one of the most critical tax papers you’ll need. Your employer is required to provide you with a W-2 form by January 31st of each year, detailing your income and the taxes withheld from your paycheck. This form is crucial for filing your personal tax return, as it reports your income and the amount of taxes you’ve already paid. Ensure that the information on your W-2 is accurate, as any discrepancies can lead to delays or issues with your tax return.

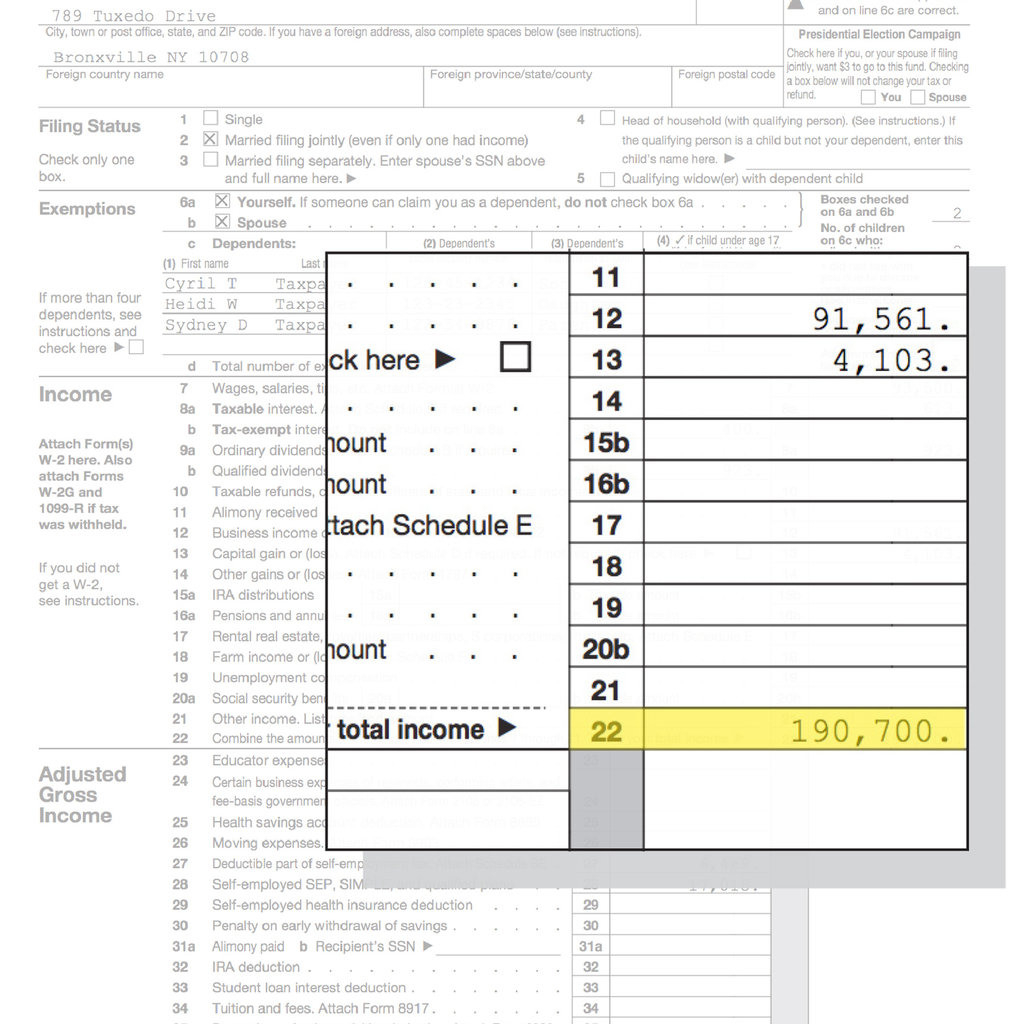

2. 1099 Forms: Income from Non-Employment Sources

If you’re self-employed, an independent contractor, or receive income from other non-employment sources (such as dividends, capital gains, or rent), you’ll receive a 1099 form. There are various types of 1099 forms, each designed for different types of income. For example, the 1099-MISC is used for miscellaneous income, while the 1099-INT reports interest income. These forms are essential for reporting your income accurately on your tax return, as they help you calculate your taxable income and any taxes you might owe.

3. Interest Statements (1098 and 1099-INT): Reporting Interest Income

Interest statements, such as the 1098 for mortgage interest and the 1099-INT for interest income from banks and investments, are crucial for itemizing deductions on your tax return. The 1098 form is particularly useful for homeowners, as it reports the amount of mortgage interest you’ve paid, which can be a significant deduction. Similarly, the 1099-INT helps you report any interest income you’ve earned, which is taxable.

4. Charitable Donation Receipts: Claiming Deductions

If you’ve made charitable donations throughout the year, you’ll need receipts or acknowledgment letters from the charities to claim deductions on your tax return. These charitable donation receipts should include the date and amount of the donation, as well as a statement from the charity confirming that it’s a 501©(3) organization, which is a requirement for the donation to be tax-deductible. Keeping accurate records of your donations can help you maximize your deductions and reduce your taxable income.

5. Medical Expense Records: Deducting Health Care Costs

Finally, if you’ve incurred significant medical expenses throughout the year, you may be able to deduct them on your tax return. Medical expense records, including receipts for prescriptions, doctor visits, hospital stays, and any other health care expenses, are necessary to claim these deductions. It’s essential to keep detailed and organized records, as you can only deduct medical expenses that exceed a certain percentage of your adjusted gross income.

📝 Note: Always review your tax papers carefully for accuracy and completeness. Any errors or missing information can lead to delays or audits.

To ensure you’re taking full advantage of the deductions and credits available to you, consider organizing your tax papers into categories, such as income, deductions, and credits. This can help you navigate the tax filing process more efficiently and reduce the risk of overlooking important documents.

| Document | Purpose |

|---|---|

| W-2 Form | Reports income and taxes withheld from your paycheck. |

| 1099 Forms | Reports income from non-employment sources, such as self-employment or investments. |

| Interest Statements (1098 and 1099-INT) | Reports interest income and mortgage interest paid, which can be used for deductions. |

| Charitable Donation Receipts | Confirms charitable donations, which can be deducted on your tax return. |

| Medical Expense Records | Documents medical expenses, which can be deducted if they exceed a certain percentage of your adjusted gross income. |

In summary, having the right tax papers can significantly impact your ability to file your taxes accurately and efficiently. By understanding the purpose and importance of each document, you can better navigate the tax filing process and potentially reduce your tax liability. Remember to keep your tax papers organized and review them carefully to ensure you’re taking advantage of all the deductions and credits available to you.

What is the deadline for receiving W-2 forms from my employer?

+

Your employer is required to provide you with a W-2 form by January 31st of each year.

Can I deduct all medical expenses on my tax return?

+

No, you can only deduct medical expenses that exceed a certain percentage of your adjusted gross income. The specific percentage may vary, so it’s essential to check the current tax laws and regulations.

Do I need to report all types of income on my tax return?

+

Yes, you are required to report all types of income on your tax return, including income from employment, self-employment, investments, and any other sources.