Local Taxes Paperwork Requirements

Introduction to Local Taxes Paperwork Requirements

When it comes to managing finances, whether as an individual or a business, understanding and complying with local tax regulations is crucial. The process involves not just calculating and paying the correct amount of taxes but also fulfilling the necessary paperwork requirements. These requirements can vary significantly from one jurisdiction to another, making it essential for taxpayers to stay informed about the specific laws and regulations in their area. In this context, compliance and accuracy are key to avoiding penalties and ensuring a smooth interaction with local tax authorities.

Understanding Local Tax Obligations

To navigate the world of local taxes, it’s vital to first understand the different types of taxes that may be applicable. These can include property taxes, sales taxes, income taxes, and business taxes, among others. Each type of tax has its own set of rules and deadlines for filing and payment. For instance, property taxes are usually paid annually and are based on the value of the property owned. On the other hand, sales taxes are collected by businesses on behalf of the local government and are typically filed and paid monthly or quarterly.

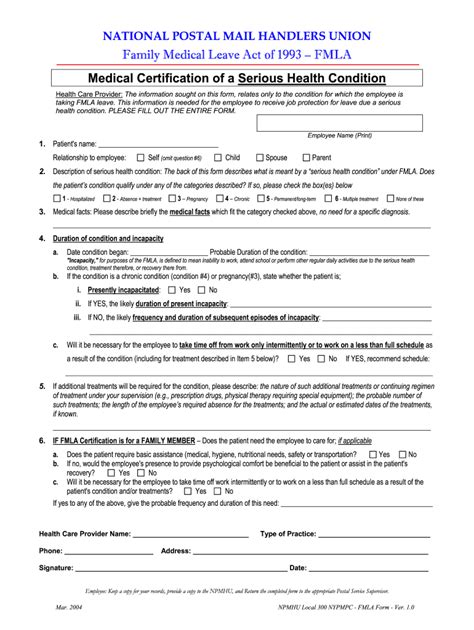

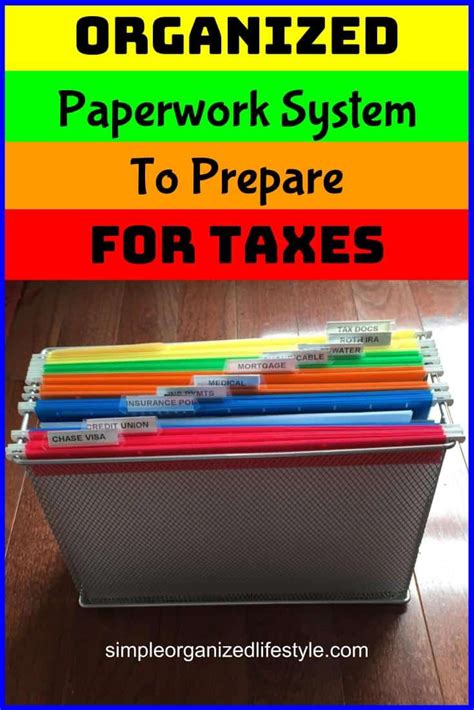

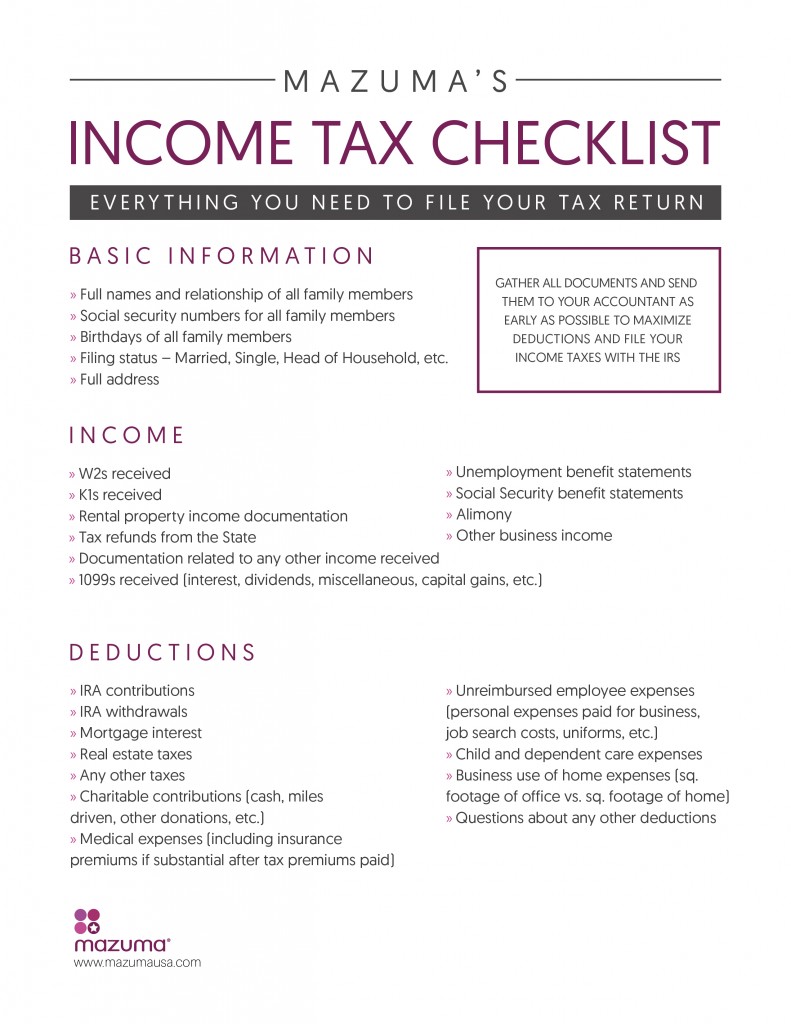

Preparing for Tax Season

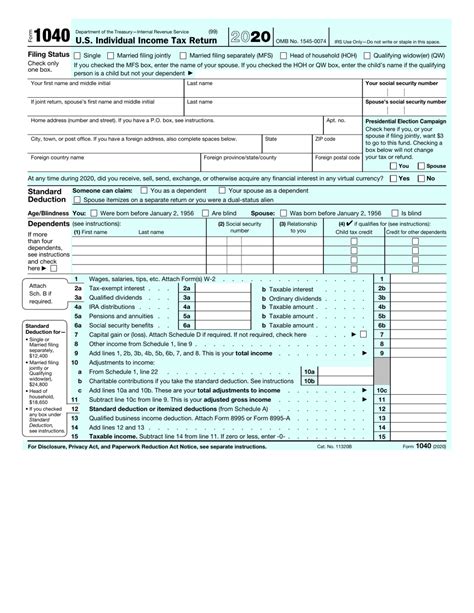

As tax season approaches, individuals and businesses must prepare by gathering all necessary documents and information. This includes: - Income statements and expense records for businesses. - W-2 forms and 1099 forms for individuals, showing income earned. - Receipts for deductions, such as charitable donations or medical expenses. - Property value assessments for property tax calculations. Organizing these documents well in advance can streamline the tax filing process and reduce the likelihood of errors or missed deadlines.

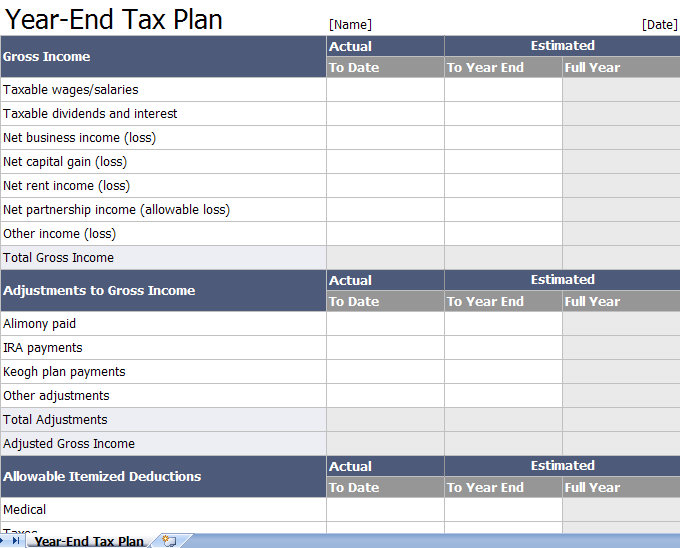

Filing Local Taxes

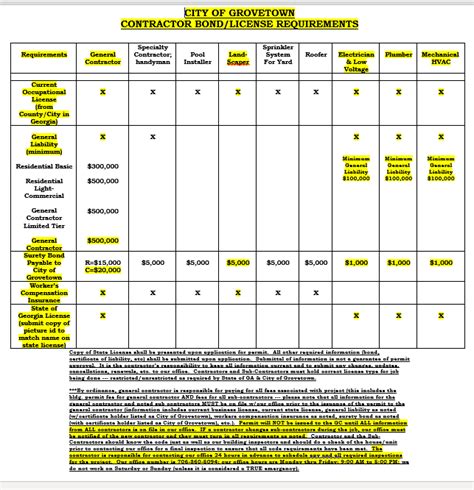

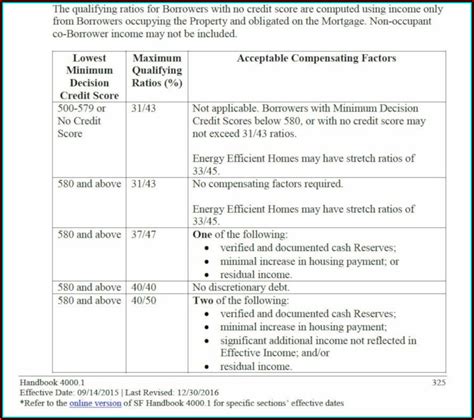

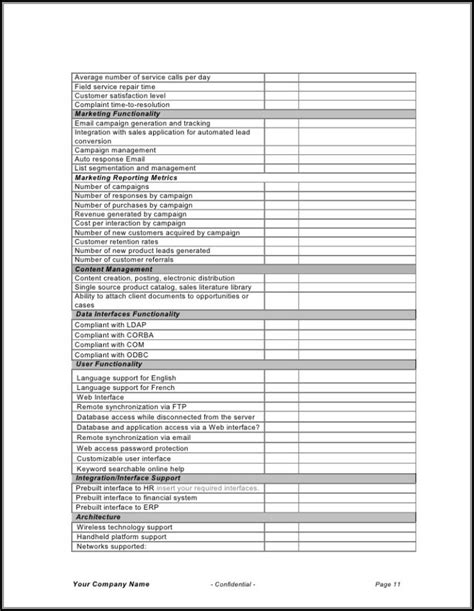

The actual process of filing local taxes involves several steps: 1. Determining the correct forms: Depending on the jurisdiction and type of tax, different forms may be required. For example, a business might need to file a business tax return in addition to a sales tax return. 2. Calculating the tax owed: This involves applying the relevant tax rates to the taxpayer’s income or property value, taking into account any deductions or exemptions. 3. Submitting the return: Returns can often be filed electronically, which is usually faster and more convenient than mailing a paper return. 4. Paying any tax due: Taxpayers must ensure that payment is made by the deadline to avoid late payment penalties.

Importance of Compliance

Compliance with local tax laws is not just about avoiding penalties; it’s also about contributing to the local community. Taxes fund essential public services and infrastructure, such as schools, hospitals, and roads. By fulfilling their tax obligations, individuals and businesses play a vital role in supporting these services.

Common Challenges and Solutions

Despite the importance of complying with local tax regulations, many taxpayers face challenges, such as: - Complexity of tax laws: Understanding the nuances of local tax codes can be daunting. - Keeping track of deadlines: Missing a filing deadline can result in significant penalties. - Accessing necessary forms and information: Taxpayers may struggle to find the correct forms or understand what information is required.

Solutions to these challenges include: - Seeking professional advice: Tax consultants and accountants can provide expert guidance. - Utilizing online resources: Many local tax authorities offer comprehensive websites with forms, instructions, and FAQs. - Staying organized: Using a calendar or reminders to keep track of important dates can help prevent missed deadlines.

Technological Advancements in Tax Filing

The process of filing local taxes has been significantly impacted by technological advancements. Electronic filing (e-filing) has become the preferred method for many taxpayers due to its speed, convenience, and accuracy. Additionally, tax software programs can guide users through the filing process, reducing errors and making compliance easier.

| Method of Filing | Advantages | Disadvantages |

|---|---|---|

| E-filing | Fast, convenient, accurate | Requires internet access and basic computer skills |

| Paper Filing | No need for internet or computer skills | Slower, more prone to errors, less convenient |

💡 Note: Taxpayers should always ensure they have a record of their filing, whether through e-filing confirmation or a mailed receipt for paper filings.

Conclusion and Final Thoughts

In conclusion, navigating the world of local taxes requires a combination of understanding, preparation, and attention to detail. By staying informed about local tax laws, organizing necessary documents, and taking advantage of technological solutions, taxpayers can ensure compliance and contribute to their local communities. As tax regulations continue to evolve, staying adaptable and seeking professional advice when needed will be key to a successful tax filing experience.

What is the difference between state and local taxes?

+

State taxes are levied by the state government, while local taxes are imposed by local jurisdictions such as cities or counties. Each has its own set of laws and rates.

How do I know which tax forms I need to file?

+

The forms required can depend on your income type, business status, and location. Checking the local tax authority’s website or consulting a tax professional can provide the necessary guidance.

Can I file my local taxes online?

+

Yes, most local tax authorities offer the option to file taxes electronically. This method is often faster and more accurate than traditional paper filing.