House Tax Paperwork Needed

Introduction to House Tax Paperwork

When it comes to owning a house, there are several responsibilities that come with it, including handling house tax paperwork. Tax paperwork can be overwhelming, especially for first-time homeowners. However, it is essential to understand the process and the necessary documents required to avoid any penalties or fines. In this article, we will guide you through the process of handling house tax paperwork and provide you with a list of necessary documents.

Understanding House Tax Paperwork

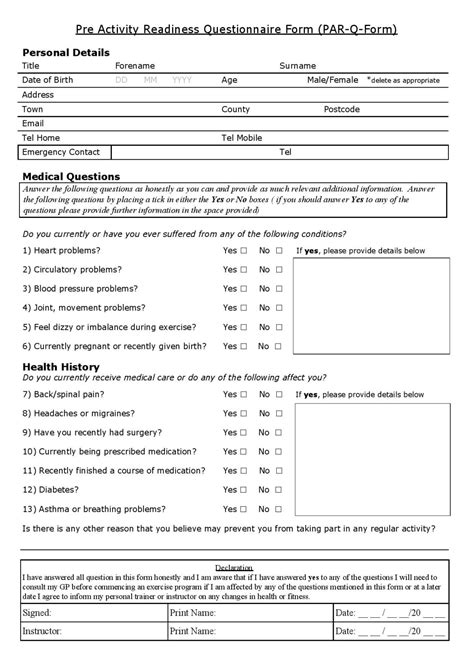

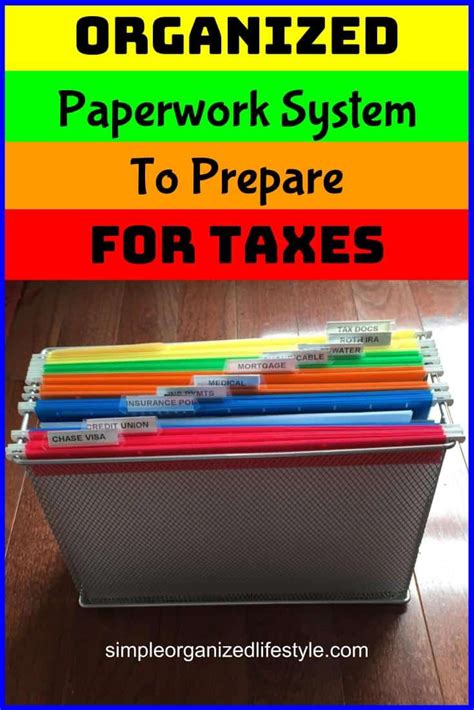

House tax paperwork involves preparing and submitting documents to the relevant authorities to claim tax deductions and credits. The process typically starts with gathering necessary documents, such as property tax bills, mortgage interest statements, and charitable donation receipts. It is crucial to keep these documents organized and easily accessible to ensure a smooth process.

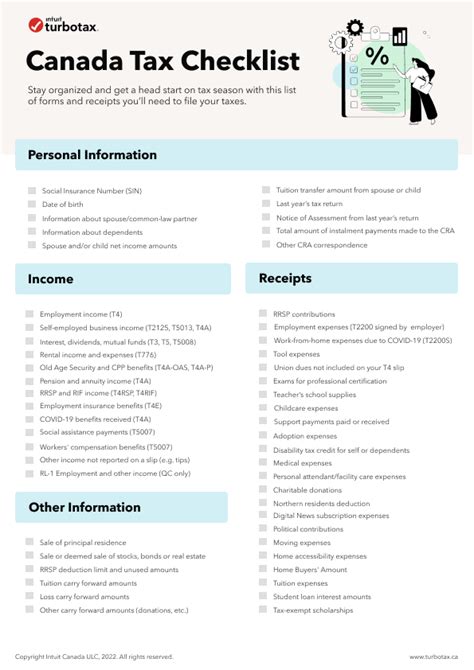

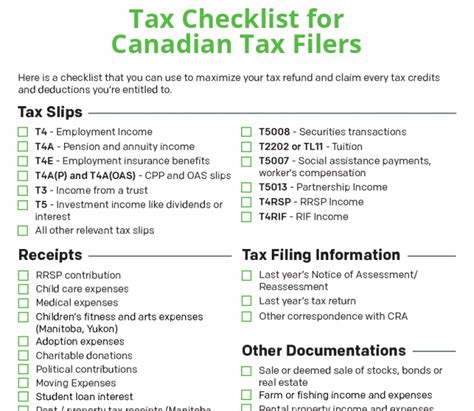

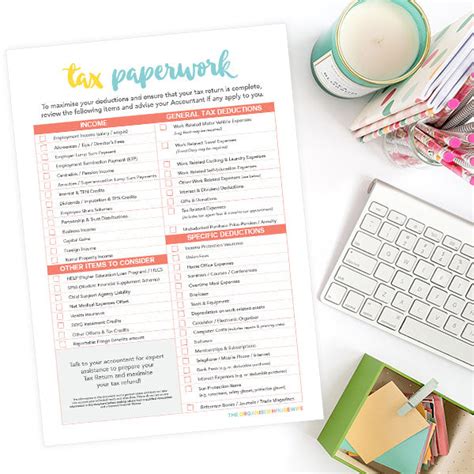

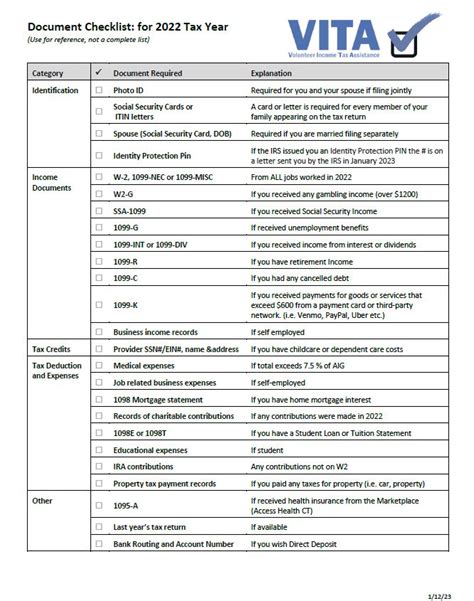

Necessary Documents for House Tax Paperwork

Here are some of the essential documents needed for house tax paperwork: * Property tax bills: These bills are usually sent by the local government and show the amount of taxes owed on the property. * Mortgage interest statements: These statements show the amount of interest paid on the mortgage and can be used to claim tax deductions. * Charitable donation receipts: Donations made to charitable organizations can be claimed as tax deductions, and receipts are necessary to support these claims. * Home improvement records: Records of home improvements, such as renovations and repairs, can be used to claim tax deductions. * Insurance premiums: Insurance premiums paid on the property can be claimed as tax deductions.

📝 Note: It is essential to keep all these documents organized and easily accessible to ensure a smooth process.

Steps to Handle House Tax Paperwork

Handling house tax paperwork involves several steps, including: * Gathering necessary documents * Reviewing and organizing documents * Preparing tax returns * Submitting tax returns * Following up on tax returns

Here is a more detailed explanation of each step: * Gathering necessary documents: This involves collecting all the necessary documents, such as property tax bills, mortgage interest statements, and charitable donation receipts. * Reviewing and organizing documents: This involves reviewing all the documents to ensure they are accurate and complete, and organizing them in a way that makes it easy to access the information needed. * Preparing tax returns: This involves using the gathered documents to prepare tax returns, either manually or using tax software. * Submitting tax returns: This involves submitting the prepared tax returns to the relevant authorities, either online or by mail. * Following up on tax returns: This involves following up on the submitted tax returns to ensure they are processed correctly and any refunds or payments are made.

Benefits of Handling House Tax Paperwork Correctly

Handling house tax paperwork correctly can have several benefits, including: * Avoiding penalties and fines: Correctly handling house tax paperwork can help avoid penalties and fines associated with late or incorrect submissions. * Claiming tax deductions and credits: Correctly handling house tax paperwork can help claim tax deductions and credits, such as mortgage interest and charitable donations. * Reducing tax liability: Correctly handling house tax paperwork can help reduce tax liability, resulting in a lower tax bill. * Increasing refunds: Correctly handling house tax paperwork can help increase refunds, resulting in a higher refund amount.

Common Mistakes to Avoid

Here are some common mistakes to avoid when handling house tax paperwork: * Failing to keep accurate records: Failing to keep accurate records can make it difficult to claim tax deductions and credits. * Missing deadlines: Missing deadlines can result in penalties and fines. * Incorrectly preparing tax returns: Incorrectly preparing tax returns can result in errors and delays. * Failing to follow up on tax returns: Failing to follow up on tax returns can result in delays and errors.

| Document | Description |

|---|---|

| Property tax bills | Shows the amount of taxes owed on the property |

| Mortgage interest statements | Shows the amount of interest paid on the mortgage |

| Charitable donation receipts | Supports claims for charitable donations |

In the end, handling house tax paperwork correctly is crucial to avoid penalties and fines, claim tax deductions and credits, reduce tax liability, and increase refunds. By following the steps outlined in this article and avoiding common mistakes, homeowners can ensure a smooth and successful house tax paperwork process.

What is the purpose of house tax paperwork?

+

The purpose of house tax paperwork is to prepare and submit documents to the relevant authorities to claim tax deductions and credits.

What are the necessary documents for house tax paperwork?

+

The necessary documents for house tax paperwork include property tax bills, mortgage interest statements, charitable donation receipts, home improvement records, and insurance premiums.

How can I avoid common mistakes when handling house tax paperwork?

+

To avoid common mistakes when handling house tax paperwork, make sure to keep accurate records, meet deadlines, correctly prepare tax returns, and follow up on tax returns.