Tax Paperwork Needed

Introduction to Tax Paperwork

When it comes to managing your finances, one of the most critical aspects is handling tax paperwork. Tax paperwork is a broad term that encompasses various documents and forms required by the government to assess your tax liability. Accuracy and completeness are crucial when dealing with tax paperwork to avoid any penalties or delays in refunds. In this blog post, we will delve into the world of tax paperwork, exploring the different types of paperwork needed, the importance of record-keeping, and tips for making the process smoother.

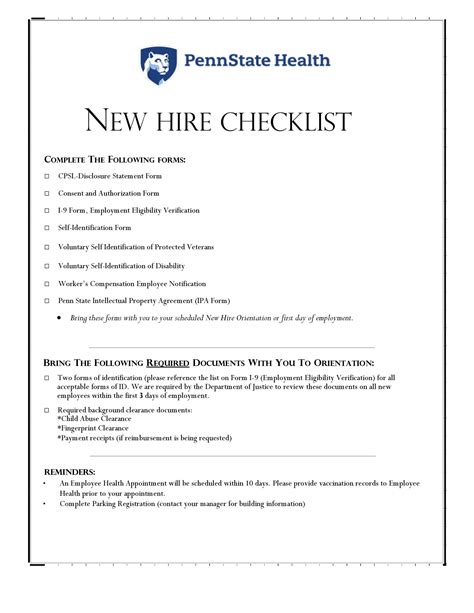

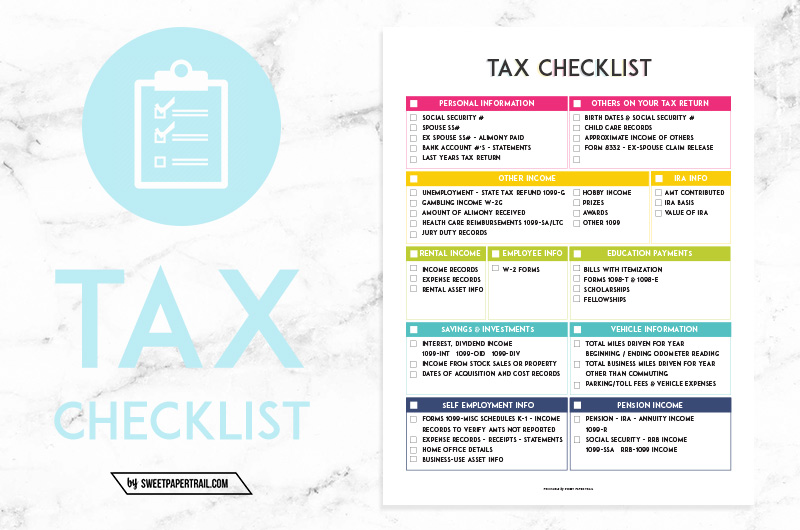

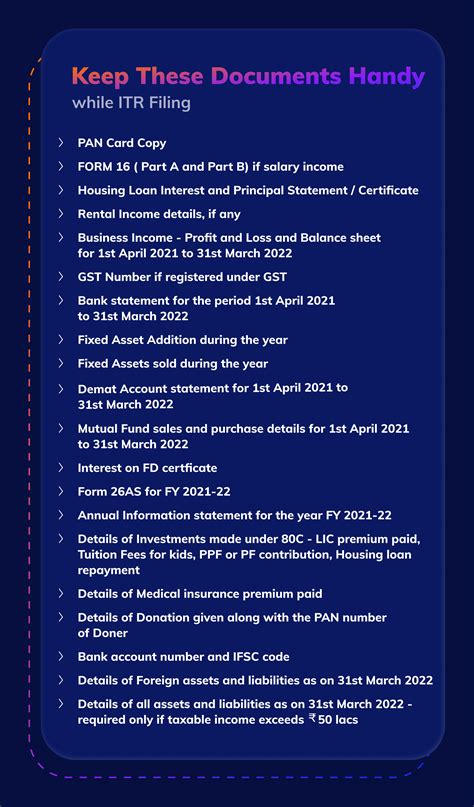

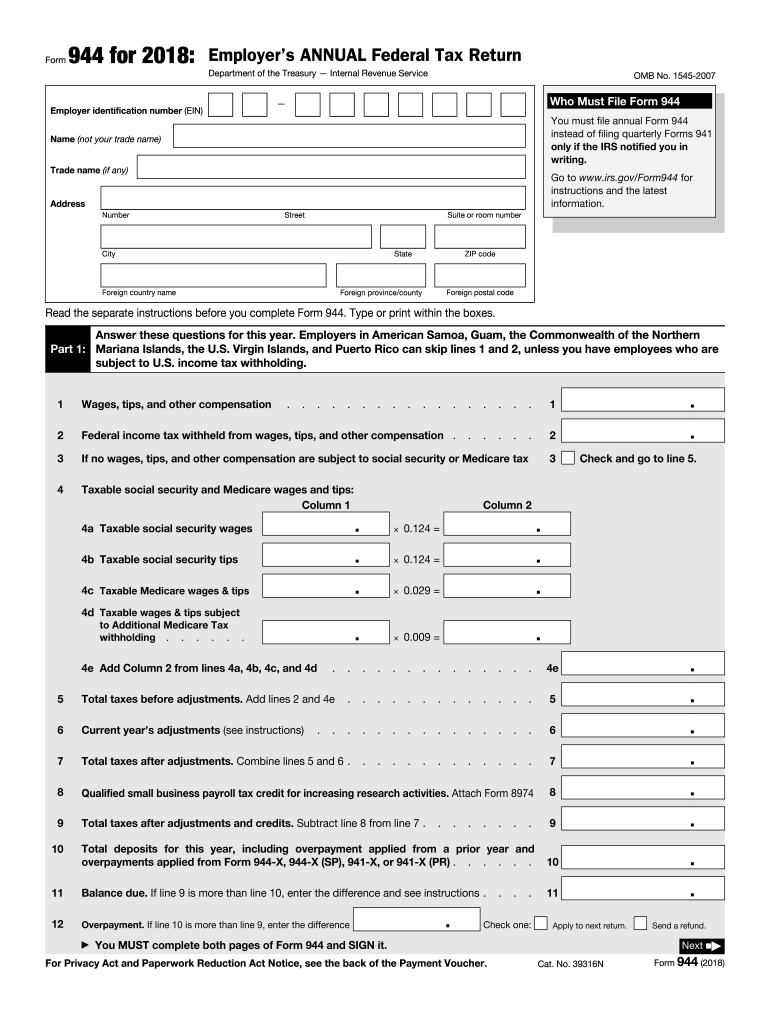

Types of Tax Paperwork

There are several types of tax paperwork that individuals and businesses need to be aware of. Some of the most common include: * W-2 forms: Provided by employers to employees, these forms show the amount of taxes withheld from their income. * 1099 forms: Used to report income from freelance work, investments, and other sources. * Tax returns: The forms submitted to the government to report income and claim deductions and credits. * Receipts and invoices: Necessary for claiming business expenses and deductions. * Records of charitable donations: Needed to claim deductions for donations made to qualified organizations.

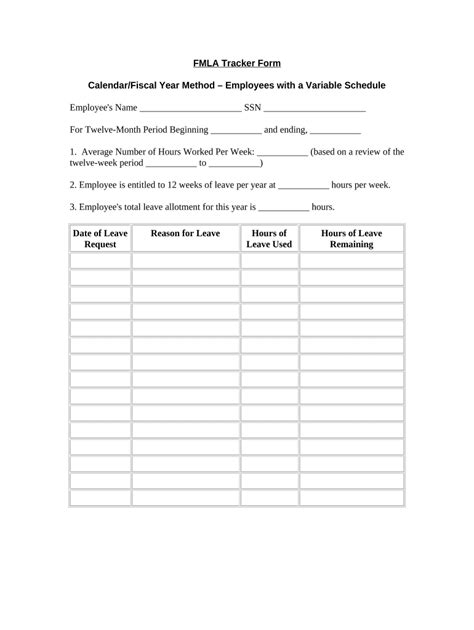

Importance of Record-Keeping

Record-keeping is a vital aspect of tax paperwork. Organized records can help you accurately report your income and expenses, ensuring you take advantage of all the deductions and credits you are eligible for. Moreover, in case of an audit, well-maintained records can provide the necessary evidence to support your tax return. Some tips for effective record-keeping include: * Using a dedicated folder or digital storage for tax-related documents. * Scanning receipts and invoices to create digital copies. * Keeping a log of business miles driven or home office use.

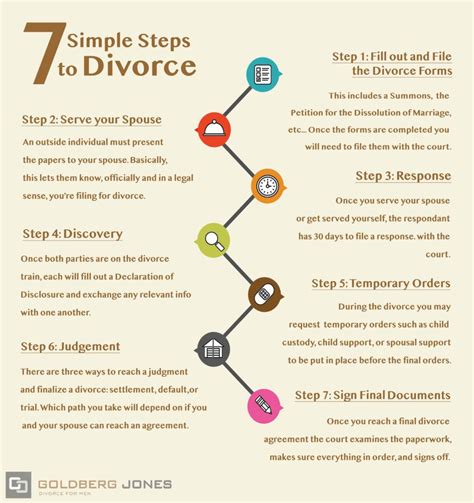

Tips for Managing Tax Paperwork

Managing tax paperwork can be overwhelming, especially for those who are not familiar with the process. Here are some tips to make it more manageable: * Start early: Do not wait until the last minute to gather your tax paperwork. * Use tax software: Utilize tax preparation software to guide you through the process and ensure accuracy. * Consult a professional: If you are unsure about any aspect of your tax paperwork, consider hiring a tax professional. * Stay informed: Keep up-to-date with changes in tax laws and regulations that may affect your tax situation.

| Document | Purpose |

|---|---|

| W-2 | Reports income and taxes withheld from employment |

| 1099 | Reports income from freelance work, investments, etc. |

| Tax Return | Reports income, claims deductions and credits |

📝 Note: It is essential to review your tax paperwork carefully to ensure all information is accurate and complete before submission.

As we move through the complexities of tax paperwork, it becomes clear that organization and attention to detail are key to a successful tax filing experience. By understanding the types of paperwork needed, maintaining accurate records, and following tips for management, individuals and businesses can navigate the tax season with confidence.

In the end, the process of handling tax paperwork, though tedious, is a critical component of financial management. By being proactive, staying informed, and seeking help when needed, you can ensure that your tax paperwork is in order, reducing the risk of errors or penalties. This approach not only simplifies the tax filing process but also contributes to a more transparent and compliant financial environment.