5 Refinancing Papers

Introduction to Refinancing

Refinancing is a financial strategy that involves replacing an existing loan with a new one, typically to secure a lower interest rate, reduce monthly payments, or tap into the equity built up in a property. It’s a common practice in the mortgage industry, where homeowners refinance their homes to take advantage of better loan terms. However, refinancing is not limited to mortgages; it can be applied to various types of loans, including auto loans, personal loans, and student loans. In this article, we’ll delve into the world of refinancing, exploring its benefits, types, and process.

Benefits of Refinancing

Refinancing can offer several benefits, including: * Lower interest rates: Refinancing can help borrowers secure a lower interest rate, which can lead to significant savings over the life of the loan. * Reduced monthly payments: By extending the loan term or reducing the interest rate, refinancing can lower monthly payments, making it easier for borrowers to manage their debt. * Debt consolidation: Refinancing can be used to consolidate multiple debts into a single loan, simplifying finances and reducing the risk of missed payments. * Access to equity: Refinancing can provide access to the equity built up in a property, allowing borrowers to tap into their home’s value to fund home improvements, pay off debt, or cover unexpected expenses. * Improved loan terms: Refinancing can offer more favorable loan terms, such as switching from a variable-rate loan to a fixed-rate loan or removing private mortgage insurance (PMI).

Types of Refinancing

There are several types of refinancing, including: * Rate-and-term refinancing: This type of refinancing involves replacing an existing loan with a new one that has a lower interest rate or more favorable terms. * Cash-out refinancing: This type of refinancing involves borrowing more than the existing loan balance, allowing borrowers to tap into their home’s equity. * Cash-in refinancing: This type of refinancing involves paying down the loan balance, either by making a lump-sum payment or by increasing the monthly payment amount. * Streamline refinancing: This type of refinancing is a simplified process that allows borrowers to refinance an existing loan with a new one that has a lower interest rate or more favorable terms, without requiring an appraisal or credit check.

Refinancing Process

The refinancing process typically involves the following steps: * Application: The borrower submits an application to the lender, providing financial information and documentation. * Pre-approval: The lender reviews the application and provides a pre-approval, which outlines the loan terms and conditions. * Appraisal: The lender orders an appraisal to determine the property’s value. * Credit check: The lender checks the borrower’s credit score and history. * Loan processing: The lender processes the loan, reviewing the application and documentation. * Closing: The borrower signs the loan documents, and the new loan is disbursed.

📝 Note: The refinancing process can vary depending on the lender and the type of loan. It's essential to research and compares lenders to find the best option.

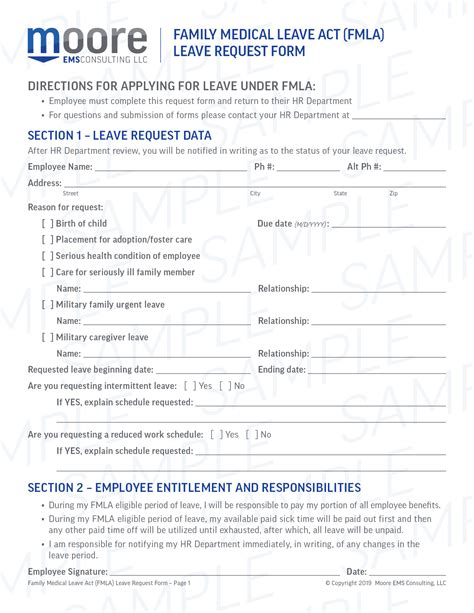

Refinancing Papers

When refinancing a loan, it’s essential to understand the various documents involved in the process. Here are five refinancing papers you should be familiar with: * Refinance application: This document is used to apply for a refinance loan, providing financial information and documentation. * Good faith estimate: This document outlines the loan terms and conditions, including the interest rate, loan amount, and closing costs. * Appraisal report: This document provides an independent assessment of the property’s value. * Loan estimate: This document provides a detailed breakdown of the loan costs, including the interest rate, loan amount, and closing costs. * Closing disclosure: This document provides a final breakdown of the loan costs, including the interest rate, loan amount, and closing costs.

| Document | Description |

|---|---|

| Refinance application | Used to apply for a refinance loan |

| Good faith estimate | Outlines loan terms and conditions |

| Appraisal report | Provides an independent assessment of the property's value |

| Loan estimate | Provides a detailed breakdown of loan costs |

| Closing disclosure | Provides a final breakdown of loan costs |

In summary, refinancing is a financial strategy that involves replacing an existing loan with a new one, typically to secure a lower interest rate, reduce monthly payments, or tap into the equity built up in a property. Understanding the benefits, types, and process of refinancing is essential to making informed decisions about your finances. By familiarizing yourself with the various refinancing papers, you can navigate the process with confidence and secure the best loan terms for your needs.

What is refinancing?

+

Refinancing is a financial strategy that involves replacing an existing loan with a new one, typically to secure a lower interest rate, reduce monthly payments, or tap into the equity built up in a property.

What are the benefits of refinancing?

+

The benefits of refinancing include lower interest rates, reduced monthly payments, debt consolidation, access to equity, and improved loan terms.

What is the refinancing process?

+

The refinancing process typically involves submitting an application, pre-approval, appraisal, credit check, loan processing, and closing.