Retirement Paperwork Checklist

Introduction to Retirement Planning

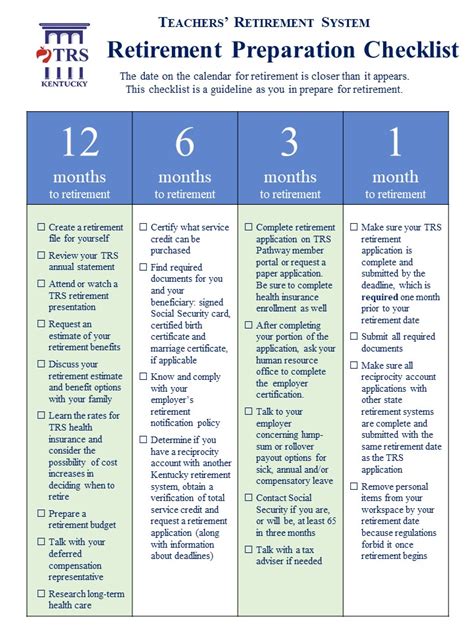

When it comes to retirement, there are numerous factors to consider, from financial security to healthcare and leisure activities. One crucial aspect often overlooked until the last minute is the paperwork involved in retiring. A well-organized approach to handling retirement paperwork can significantly reduce stress and ensure a smoother transition into this new phase of life. This guide is designed to provide a comprehensive checklist for individuals nearing retirement, highlighting key documents and steps to take.

Understanding the Importance of Paperwork in Retirement

Paperwork is an essential part of the retirement process, as it involves claiming benefits, managing healthcare, and organizing financial affairs. Accurate and timely submission of documents can make a substantial difference in the pension or benefits one receives. Moreover, having all necessary documents in order can help retirees and their families navigate any challenges that may arise during retirement.

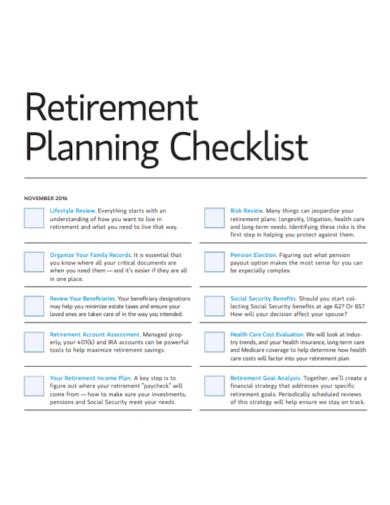

Retirement Paperwork Checklist

To ensure that all bases are covered, consider the following checklist as a starting point for your retirement planning:

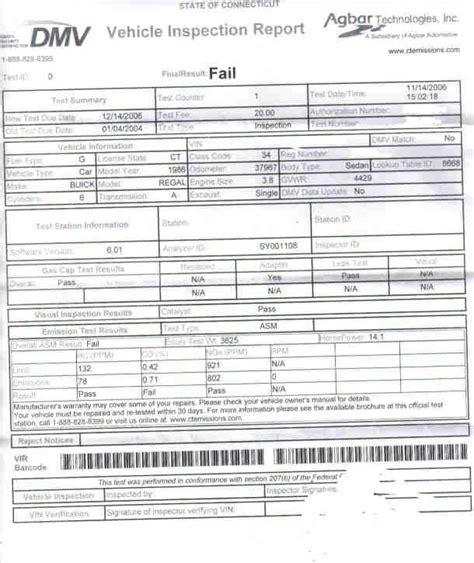

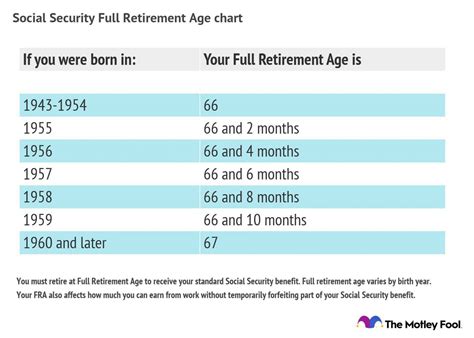

- Social Security Benefits: Apply for Social Security benefits if you haven’t already. This can be done online, by phone, or in person at a local Social Security office.

- Pension Plans: If you have a pension through your employer, contact the plan administrator to understand the process for applying for your pension and the options available for receiving your benefits.

- 401(k), IRA, or Other Retirement Accounts: Review your retirement savings accounts to plan for withdrawals. Consider consulting with a financial advisor to determine the best strategy for your situation.

- Medicare and Health Insurance: Apply for Medicare if you’re nearing eligibility. Research supplemental insurance plans to cover expenses not included under Medicare.

- Life Insurance and Annuities: Review your life insurance policies and annuities. Determine if they still align with your needs and consider adjustments as necessary.

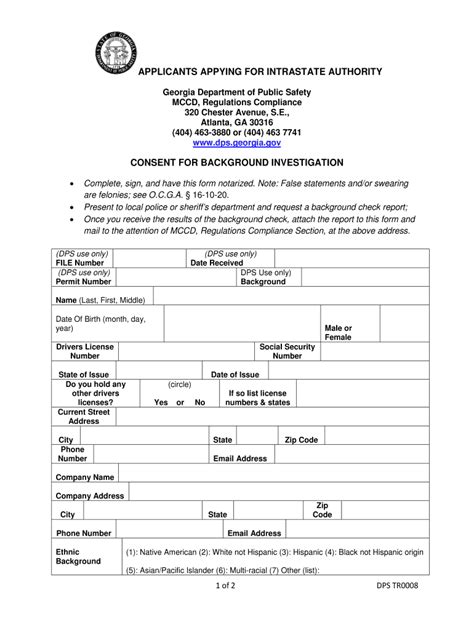

- Estate Planning: Update your will, powers of attorney, and consider setting up a trust if appropriate. Ensure your estate plan reflects your current wishes and circumstances.

- Tax Planning: Consult with a tax professional to understand how retirement income may impact your tax situation and plan accordingly.

Organizing Your Documents

Keeping track of all the paperwork involved in retirement can be daunting. Here are some tips for organizing your documents:

- Create a Digital Folder: Scan your documents and save them to a secure, password-protected digital folder. This can be on your computer, an external hard drive, or a cloud storage service.

- Use a Filing System: Physical documents should be stored in a fireproof safe or a safe deposit box at your bank. Use folders and labels to keep documents categorized and easy to find.

- Share Access: Ensure that a trusted individual knows where your documents are and how to access them in case of an emergency.

📝 Note: Regularly review and update your documents to reflect any changes in your personal, financial, or health situation.

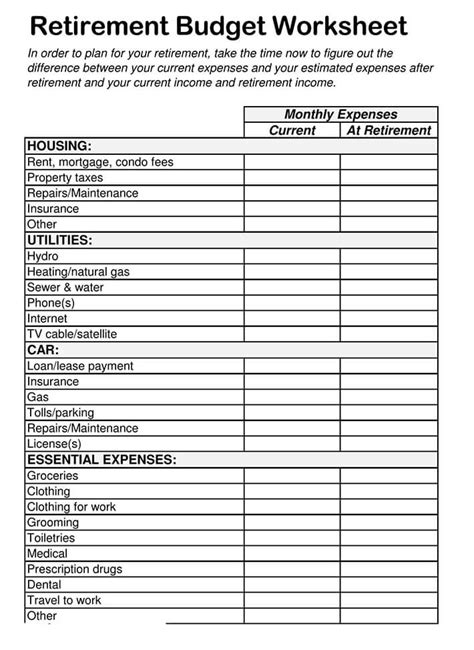

Financial Planning for Retirement

A critical component of retirement planning is financial security. This involves not just saving enough but also planning how you will manage your finances during retirement. Consider the following aspects:

- Budgeting: Create a budget that accounts for your expected income and expenses during retirement.

- Investment Strategies: Review your investment portfolio to ensure it’s aligned with your retirement goals and risk tolerance.

- Inflation Planning: Factor in the potential impact of inflation on your purchasing power during retirement.

Health and Wellness in Retirement

Retirement is also a time to focus on health and wellness. Consider the following:

- Staying Active: Engage in physical activities that you enjoy, which can help maintain physical health and mental wellbeing.

- Social Connections: Nurture your social connections and consider joining clubs or groups that align with your interests to combat loneliness.

- Healthcare Planning: Understand your healthcare options, including Medicare and supplemental insurance, to ensure you’re prepared for any health challenges that may arise.

| Category | Description |

|---|---|

| Financial | Pension, 401(k), IRA, Social Security |

| Healthcare | Medicare, supplemental insurance, health savings accounts |

| Legal | Will, powers of attorney, trusts |

As you prepare for retirement, remember that planning is key. By taking a thorough and organized approach to your retirement paperwork and planning, you can look forward to a more secure and enjoyable retirement.

In summary, retirement planning involves a multifaceted approach that includes managing paperwork, organizing documents, planning financially, focusing on health and wellness, and ensuring that all legal and personal affairs are in order. By carefully considering each of these aspects and taking proactive steps, individuals can better prepare themselves for the challenges and opportunities that retirement presents.