Tax Paperwork for Dependents

Understanding Tax Paperwork for Dependents

When it comes to filing taxes, having dependents can significantly impact your tax return. Whether you’re a parent, guardian, or caregiver, claiming dependents on your tax return can lead to substantial tax savings. However, navigating the complex world of tax paperwork for dependents can be overwhelming. In this article, we’ll break down the essential information you need to know about tax paperwork for dependents, including the necessary forms, qualifications, and potential benefits.

Who Qualifies as a Dependent?

To claim someone as a dependent on your tax return, they must meet specific qualifications set by the Internal Revenue Service (IRS). There are two main types of dependents: qualifying children and qualifying relatives. A qualifying child is a child who is under the age of 19, or under 24 if they’re a full-time student, and has lived with you for more than six months of the year. A qualifying relative, on the other hand, is someone who has lived with you for the entire year, or is related to you, such as a parent, grandparent, or sibling.

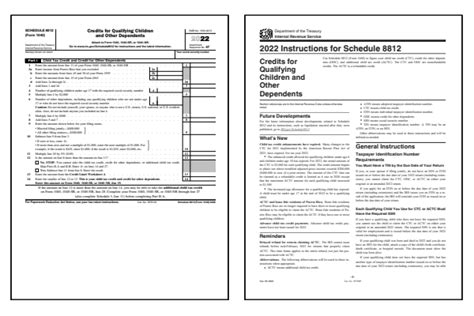

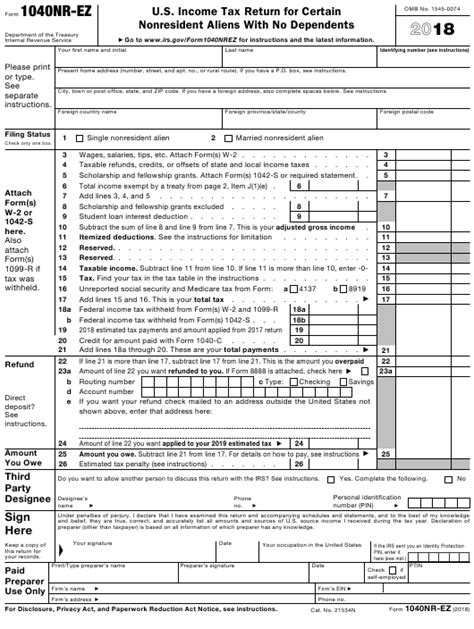

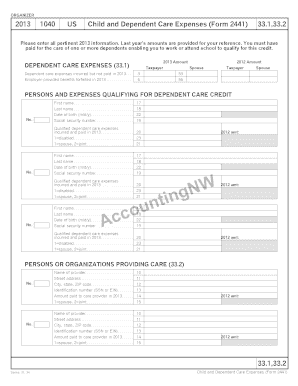

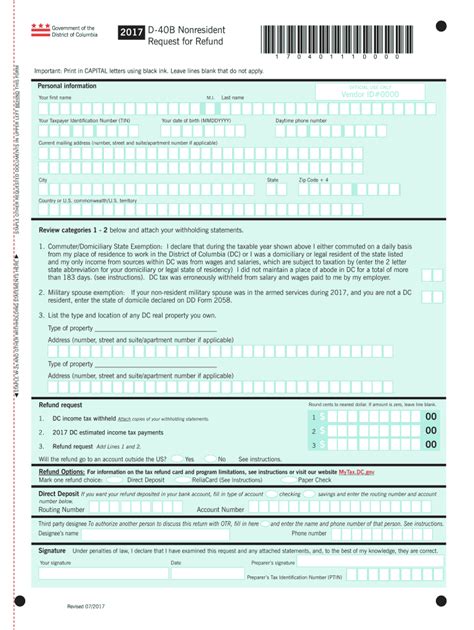

Necessary Tax Forms for Dependents

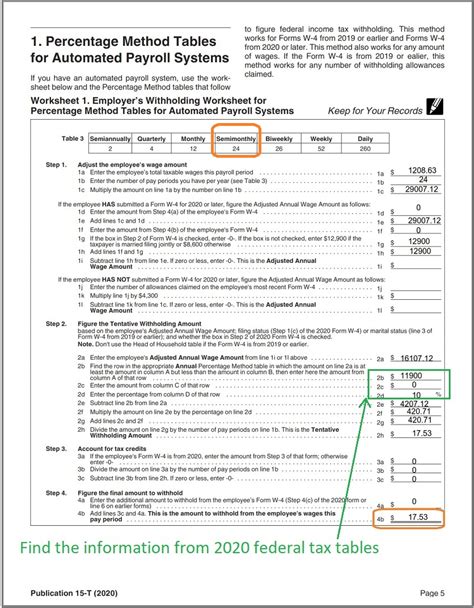

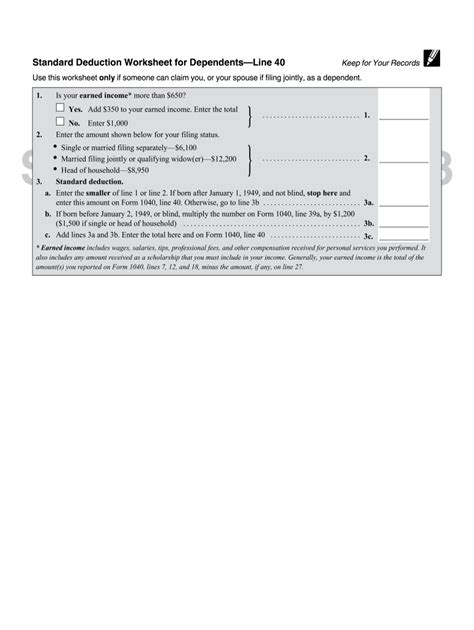

When claiming dependents on your tax return, you’ll need to complete several tax forms. The most common forms include: * Form 1040: This is the standard form for personal income tax returns. * Form 1040A: This form is used for dependents who have income from sources like investments or self-employment. * Form 8615: This form is used to calculate the Kiddie Tax, which applies to children with unearned income from investments. * Form 2120: This form is used to calculate the Multiple Support Declaration, which is required when multiple people claim the same dependent.

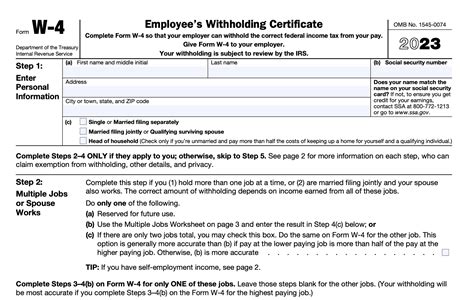

Claiming Dependents on Your Tax Return

To claim dependents on your tax return, you’ll need to provide detailed information about each dependent, including their: * Name and Social Security number * Relationship to you * Residency status * Income and expenses You’ll also need to calculate the dependent exemption, which is a deduction that reduces your taxable income. The dependent exemption can be claimed for each qualifying dependent, and the amount of the exemption varies depending on your income level and filing status.

Potential Benefits of Claiming Dependents

Claiming dependents on your tax return can lead to significant tax savings. Some potential benefits include: * Increased deductions: Claiming dependents can increase your standard deduction or itemized deductions. * Tax credits: You may be eligible for tax credits like the Child Tax Credit or the Dependent Care Credit. * Reduced taxable income: The dependent exemption can reduce your taxable income, which can lower your overall tax liability.

📝 Note: The Tax Cuts and Jobs Act (TCJA) has introduced significant changes to the tax laws, including the elimination of personal exemptions. However, the dependent exemption remains in place, and claiming dependents can still provide substantial tax benefits.

Common Mistakes to Avoid

When claiming dependents on your tax return, it’s essential to avoid common mistakes that can lead to delays or even audits. Some common mistakes include: * Incorrect Social Security numbers * Inconsistent dependent information * Failure to claim the dependent exemption * Ineligible dependents

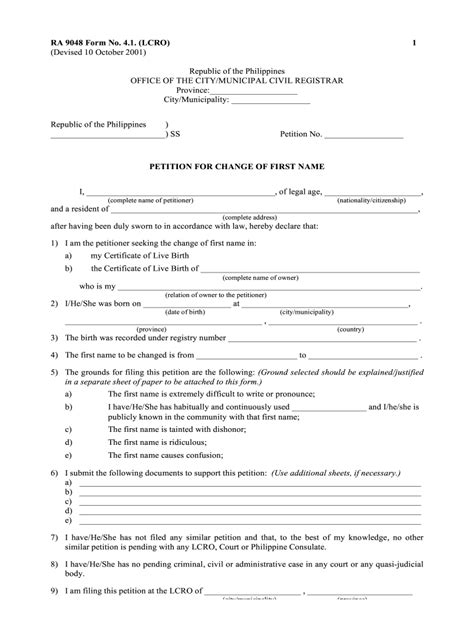

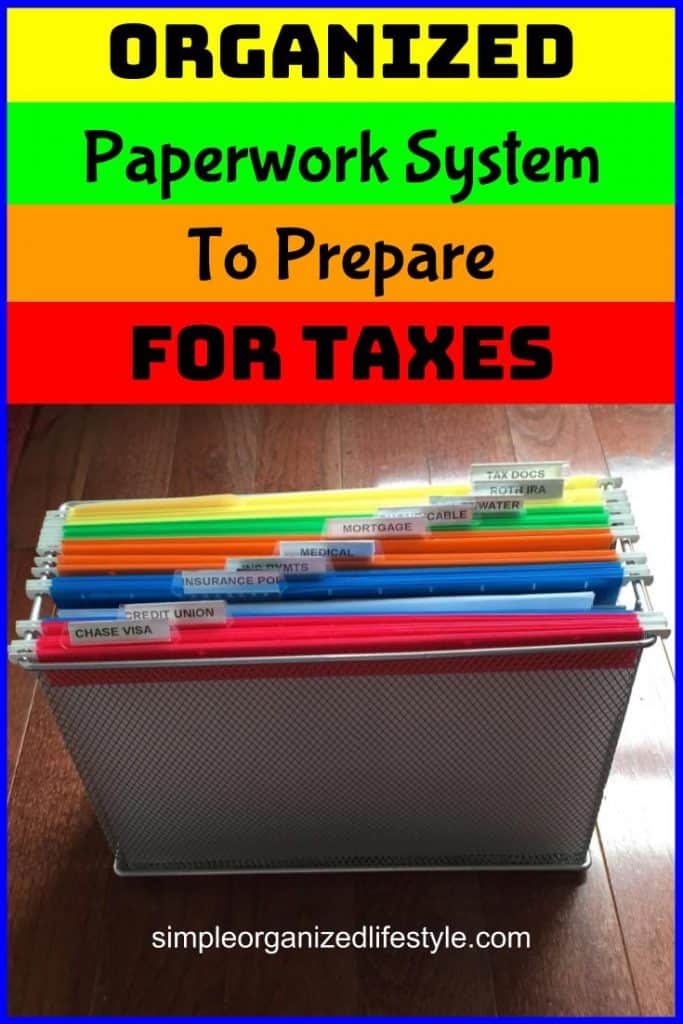

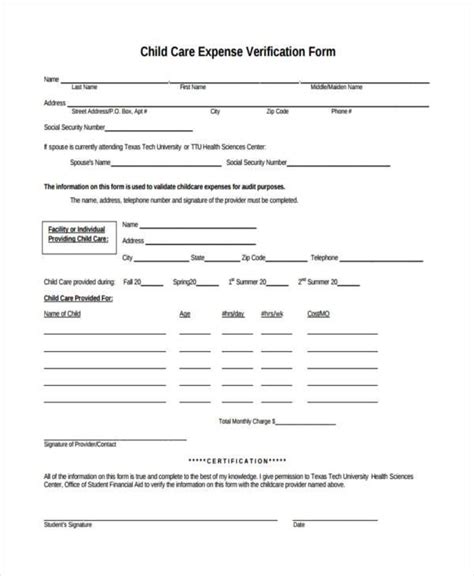

Tax Paperwork Checklist for Dependents

To ensure you have all the necessary paperwork for claiming dependents, use the following checklist: * Birth certificate or adoption papers * Social Security cards or numbers * Proof of residency * Income statements and expense records * Dependent care records, if applicable

| Form | Purpose |

|---|---|

| Form 1040 | Personal income tax return |

| Form 1040A | Dependent income tax return |

| Form 8615 | Kiddie Tax calculation |

| Form 2120 | Multiple Support Declaration |

In the end, understanding tax paperwork for dependents is crucial for maximizing your tax savings and avoiding potential pitfalls. By following the guidelines outlined in this article and seeking professional help when needed, you can ensure a smooth and stress-free tax filing experience. The key takeaways from this article include the importance of claiming dependents, the necessary tax forms, and the potential benefits of claiming dependents. By keeping these points in mind, you can navigate the complex world of tax paperwork for dependents with confidence.

What is the definition of a qualifying child for tax purposes?

+

A qualifying child is a child who is under the age of 19, or under 24 if they’re a full-time student, and has lived with you for more than six months of the year.

What is the Kiddie Tax, and how does it apply to dependents?

+

The Kiddie Tax is a tax on unearned income from investments, such as dividends, interest, and capital gains, that applies to children under the age of 18. The tax is calculated using Form 8615 and is reported on the child’s tax return.

Can I claim a dependent if they live with me but are not related to me?

+

Yes, you can claim a dependent if they live with you and meet the qualifying relative test, even if they are not related to you. However, you must meet the IRS’s requirements for a qualifying relative, which includes providing more than half of their support for the year.