5 PPP Loan Papers

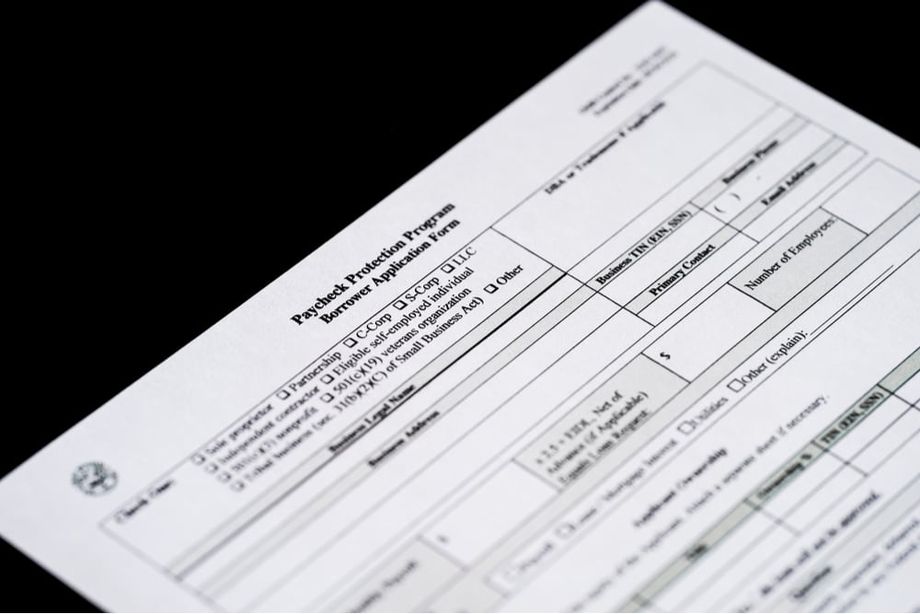

Introduction to PPP Loan Papers

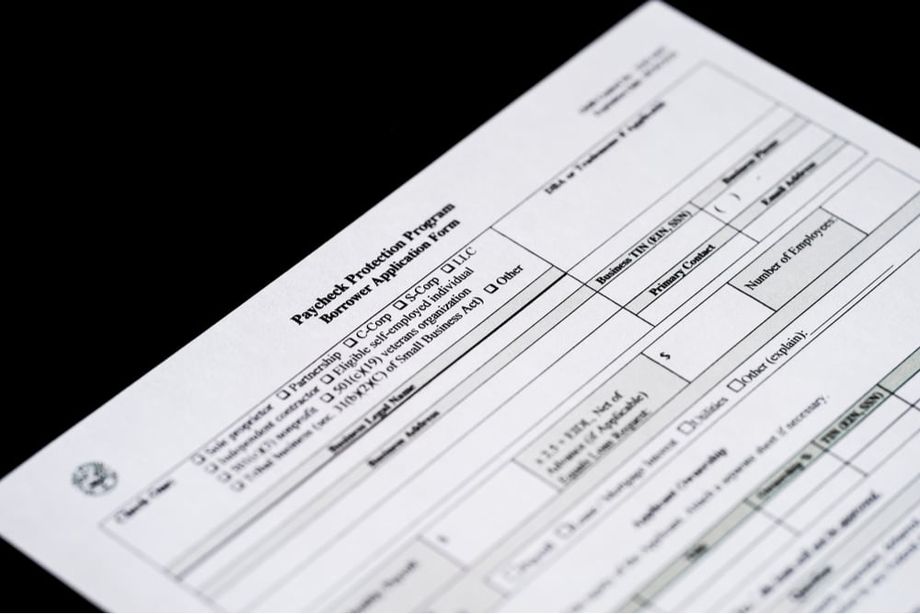

The Paycheck Protection Program (PPP) was a vital part of the CARES Act, aimed at helping small businesses, self-employed individuals, and certain non-profit organizations cope with the financial impact of the COVID-19 pandemic. One of the critical components of applying for a PPP loan was the submission of various documents, often referred to as PPP loan papers. These documents were essential for verifying the eligibility of the applicant, determining the loan amount, and ensuring compliance with the program’s rules. In this article, we will delve into the specifics of these documents, their importance, and the process of applying for a PPP loan.

Understanding the Purpose of PPP Loan Papers

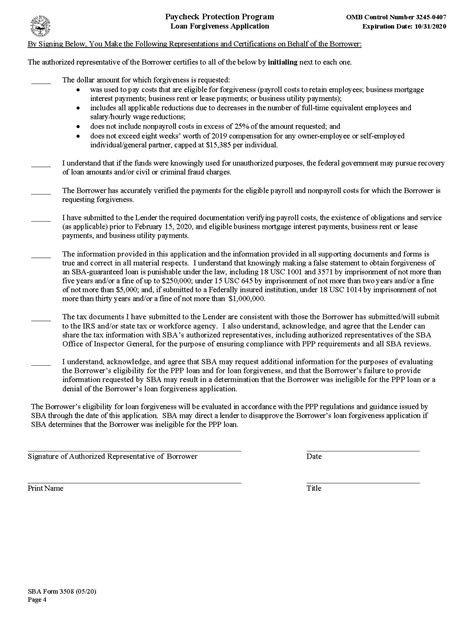

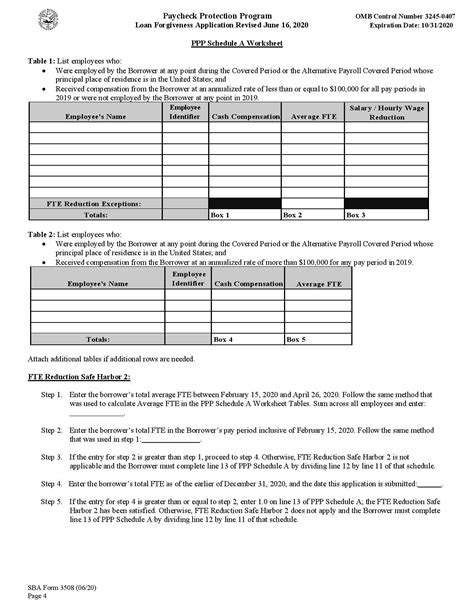

The primary purpose of PPP loan papers was to provide lenders with the necessary information to process loan applications efficiently. These documents helped in verifying the identity of the business, determining the number of employees, and calculating the average monthly payroll costs, which were crucial for determining the loan amount. Additionally, these papers assisted in ensuring that the funds were used for approved purposes, such as payroll costs, rent, utilities, and mortgage interest, to facilitate loan forgiveness.

Key Components of PPP Loan Papers

Several documents were required as part of the PPP loan application process. These included: - Business Tax Returns: Recent tax returns were necessary to verify the business’s income and expenses. - Payroll Records: Documents showing payroll costs, such as payroll processor records, payroll tax filings, or Form 1099-MISC. - Identification Documents: For the business and its owners, such as driver’s licenses, passports, or business licenses. - Proof of Business Existence: Documents like articles of incorporation, bylaws, or a business license. - Lease Agreements and Utility Bills: For businesses applying for loan forgiveness, to prove expenses like rent and utilities.

Importance of Accurate Documentation

Submitting accurate and complete PPP loan papers was vital for a successful application. Inaccuracies or missing documents could lead to delays or even rejection of the loan application. Moreover, for loan forgiveness, businesses needed to maintain detailed records of how the loan funds were used, as these would be required during the forgiveness application process.

Processing and Review of PPP Loan Papers

The processing of PPP loan papers involved several steps: - Initial Review: Lenders conducted an initial review of the submitted documents to ensure all required papers were included and complete. - Verification: Lenders verified the information provided, including the business’s identity, payroll costs, and number of employees. - Loan Approval: Upon successful verification, the loan was approved, and the funds were disbursed to the applicant. - Loan Forgiveness Application: After using the loan funds, businesses could apply for loan forgiveness by submitting additional documents, including those proving the use of funds for eligible expenses.

📝 Note: The SBA and lenders had specific guidelines and deadlines for the submission and review of PPP loan papers, which applicants needed to adhere to for a successful application and potential loan forgiveness.

Challenges and Lessons Learned

The PPP loan program faced several challenges, including high demand, technical issues with the application portal, and confusion over eligibility and forgiveness criteria. Despite these challenges, the program provided critical financial support to many businesses, helping them retain employees and continue operations during a difficult period. Lessons learned from the program include the importance of clear communication, efficient application processes, and flexibility in program design to meet the diverse needs of applicants.

Future of Small Business Support

As the world moves forward from the pandemic, there is a continued need for support programs for small businesses and entrepreneurs. Future initiatives can learn from the successes and challenges of the PPP, incorporating streamlined application processes, clear eligibility criteria, and flexible forgiveness terms to better support the recovery and growth of small businesses.

To summarize, the PPP loan papers played a crucial role in the application and forgiveness process of the Paycheck Protection Program. Understanding the components of these documents and the importance of accurate submission was key to accessing vital financial support during the COVID-19 pandemic. As economic support programs evolve, the lessons learned from the PPP will be invaluable in designing more effective and accessible initiatives for small businesses.

What was the primary purpose of the PPP loan papers?

+

The primary purpose of PPP loan papers was to provide lenders with the necessary information to process loan applications efficiently and to ensure compliance with the program’s rules.

What documents were typically required as part of the PPP loan application?

+

Documents included business tax returns, payroll records, identification documents, proof of business existence, and lease agreements or utility bills for loan forgiveness applications.

Why was accurate documentation important for PPP loan applications?

+

Accurate and complete documentation was crucial for a successful application. Inaccuracies or missing documents could lead to delays or rejection of the loan application.