5 Tax Papers

Understanding the Importance of Tax Papers

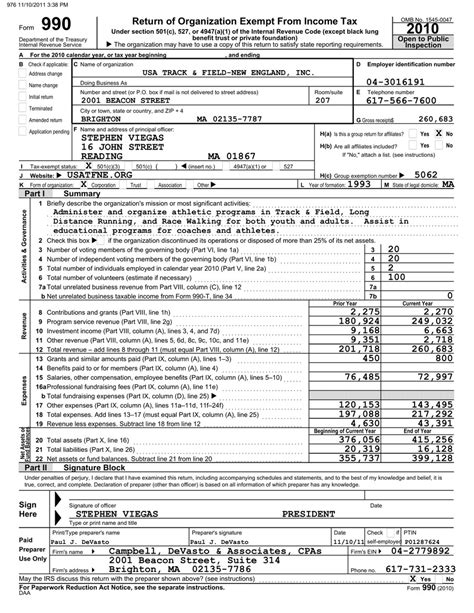

When it comes to managing finances, one of the most critical aspects is dealing with tax papers. Tax papers, or tax documents, are essential for individuals and businesses to maintain accurate records of their income, expenses, and tax obligations. In this article, we will delve into the world of tax papers, exploring their significance, types, and how to manage them efficiently.

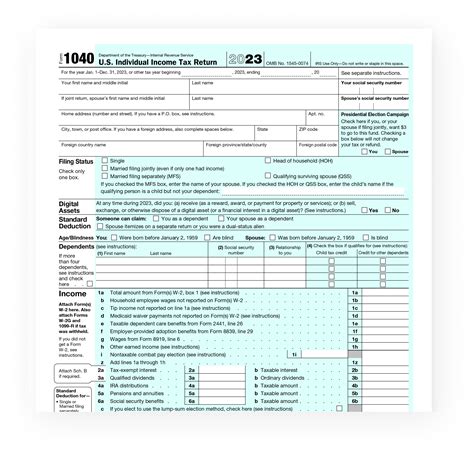

Types of Tax Papers

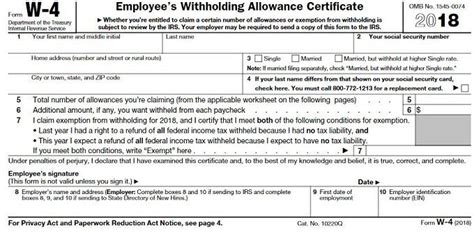

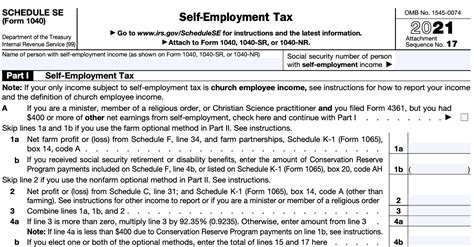

There are various types of tax papers that individuals and businesses need to be aware of. Some of the most common include: * W-2 forms: These forms are used to report income and taxes withheld from employees’ paychecks. * 1099 forms: These forms are used to report income earned by freelancers, independent contractors, and other non-employee workers. * Tax returns: These documents are used to report an individual’s or business’s income, expenses, and tax obligations to the government. * Receipts and invoices: These documents are used to record business expenses and income. * Bank statements: These documents are used to verify income and expenses.

Why Are Tax Papers Important?

Tax papers are crucial for several reasons: * Accuracy: Tax papers help ensure that income, expenses, and tax obligations are accurately recorded and reported. * Compliance: Maintaining accurate tax papers helps individuals and businesses comply with tax laws and regulations. * Audits: In the event of an audit, tax papers provide a clear record of financial transactions, helping to resolve any discrepancies or issues. * Refunds: Tax papers are necessary for claiming tax refunds and credits.

Managing Tax Papers Efficiently

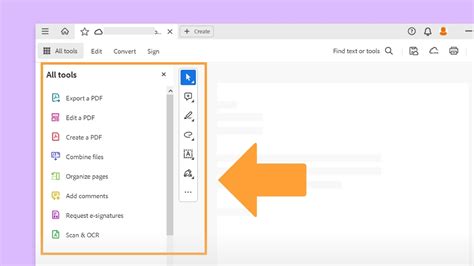

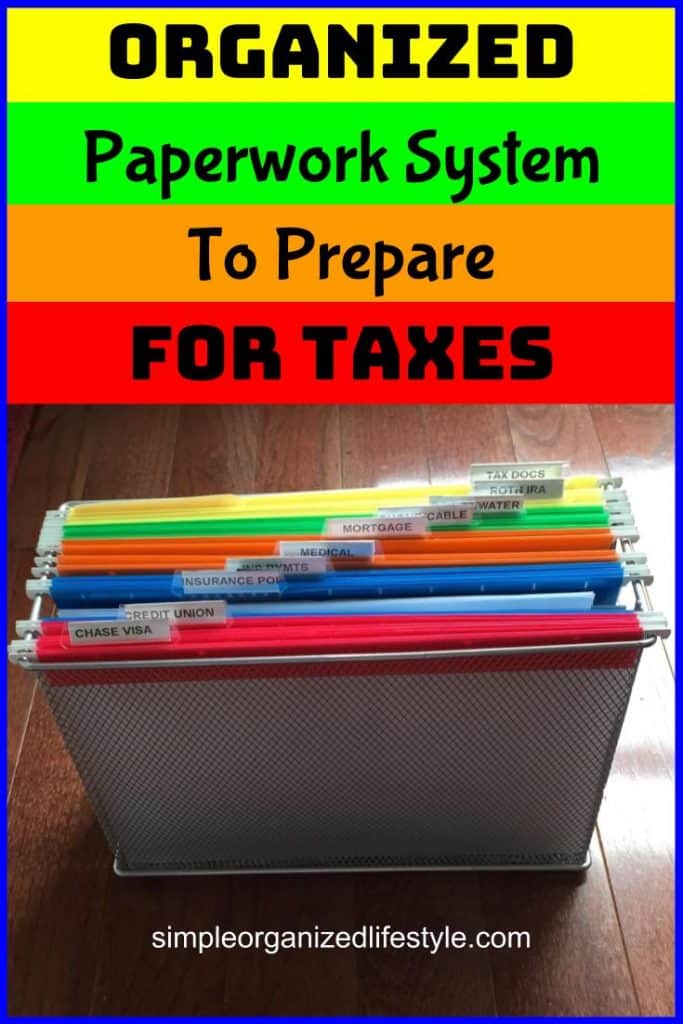

To manage tax papers efficiently, consider the following tips: * Keep digital records: Scan and store tax papers electronically to reduce clutter and increase accessibility. * Use a filing system: Organize tax papers in a logical and easy-to-follow manner, using folders and labels to categorize documents. * Set reminders: Establish reminders for tax-related deadlines, such as filing tax returns or paying quarterly estimates. * Seek professional help: If unsure about managing tax papers or navigating tax laws, consider consulting a tax professional or accountant.

Common Challenges with Tax Papers

Despite their importance, tax papers can be overwhelming and prone to errors. Some common challenges include: * Lost or misplaced documents: Failing to keep track of tax papers can lead to delays and penalties. * Inaccurate or incomplete records: Incomplete or inaccurate tax papers can result in errors, audits, or even fines. * Deadline missed: Failing to meet tax-related deadlines can result in penalties, interest, and lost refunds.

📝 Note: It's essential to keep accurate and up-to-date tax papers to avoid these common challenges and ensure compliance with tax laws.

Best Practices for Tax Paper Management

To avoid common challenges and ensure efficient tax paper management, consider the following best practices: * Stay organized: Maintain a clean and organized workspace, dedicating a specific area for tax papers. * Use tax software: Utilize tax software to streamline the tax preparation process and reduce errors. * Review and update records regularly: Regularly review and update tax papers to ensure accuracy and completeness. * Seek professional help when needed: Don’t hesitate to seek help from a tax professional or accountant if unsure about tax papers or laws.

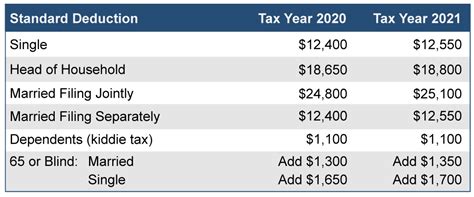

Table of Tax Paper Types

The following table summarizes the different types of tax papers:

| Type of Tax Paper | Description |

|---|---|

| W-2 form | Reports income and taxes withheld from employees’ paychecks |

| 1099 form | Reports income earned by freelancers, independent contractors, and other non-employee workers |

| Tax return | Reports an individual’s or business’s income, expenses, and tax obligations to the government |

| Receipts and invoices | Records business expenses and income |

| Bank statements | Verifies income and expenses |

In summary, tax papers are a critical aspect of financial management, and their importance cannot be overstated. By understanding the different types of tax papers, managing them efficiently, and following best practices, individuals and businesses can ensure compliance with tax laws, avoid common challenges, and maintain accurate records.

What are the most common types of tax papers?

+

The most common types of tax papers include W-2 forms, 1099 forms, tax returns, receipts and invoices, and bank statements.

Why are tax papers important?

+

Tax papers are important for accuracy, compliance, audits, and refunds. They help ensure that income, expenses, and tax obligations are accurately recorded and reported.

How can I manage tax papers efficiently?

+

To manage tax papers efficiently, keep digital records, use a filing system, set reminders, and seek professional help when needed.