Mortgage Application Paperwork Needed

Introduction to Mortgage Application Process

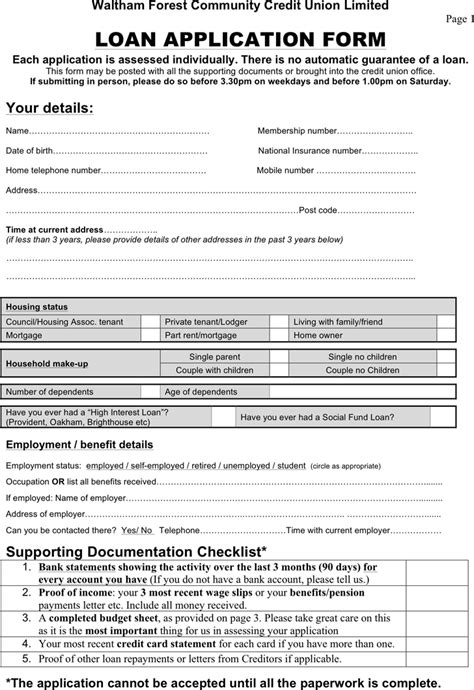

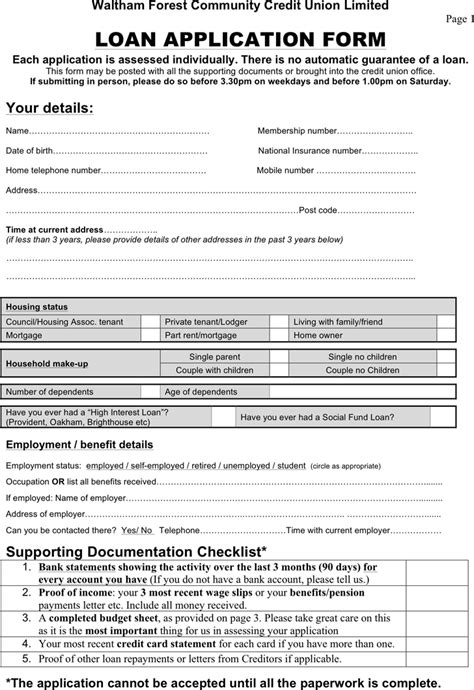

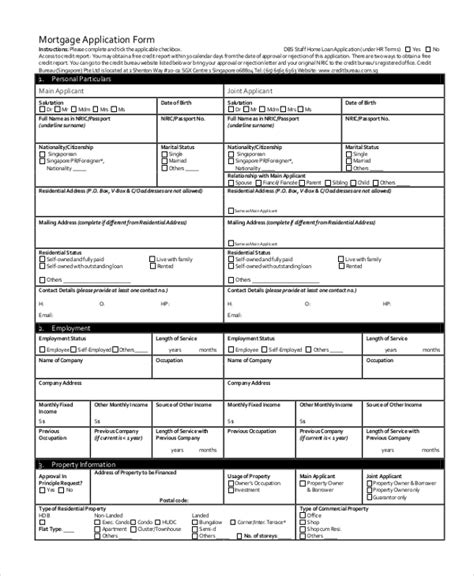

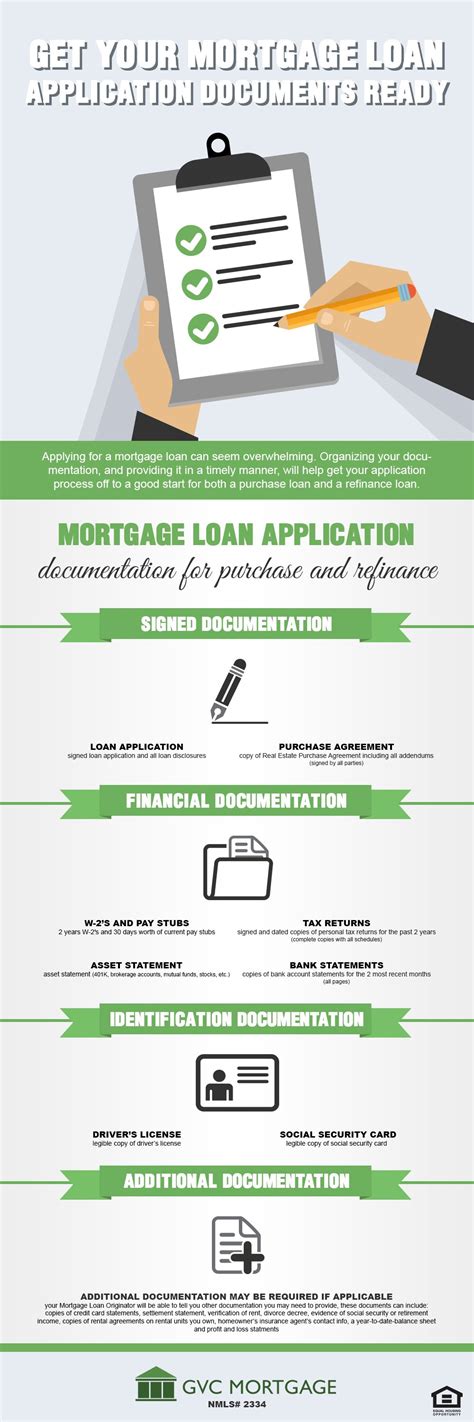

When applying for a mortgage, it’s essential to understand the various documents and paperwork required to ensure a smooth and successful application process. The mortgage application process can be complex and time-consuming, but being prepared with the necessary paperwork can help reduce stress and increase the chances of approval. In this article, we will discuss the different types of paperwork needed for a mortgage application, including income verification, credit reports, and asset documentation.

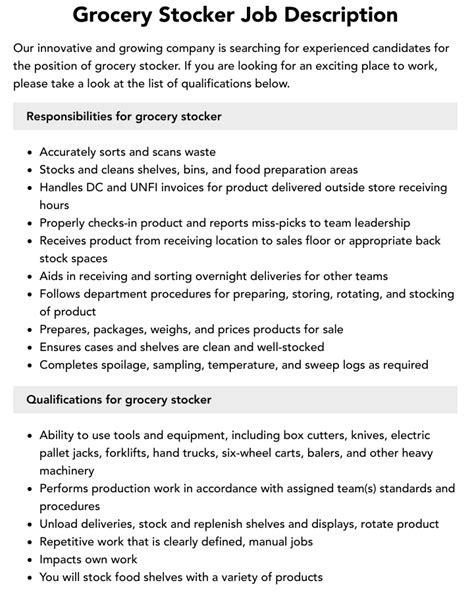

Income Verification Documents

Lenders require income verification documents to assess an applicant’s ability to repay the mortgage. The following documents are typically needed: * Pay stubs for the past 30 days * W-2 forms for the past two years * Tax returns for the past two years * Letters from employers confirming employment and income * Bank statements showing direct deposit of paychecks It’s crucial to provide accurate and up-to-date income information to avoid delays or rejection of the mortgage application.

Credit Report and Score

A credit report and score play a significant role in determining mortgage eligibility and interest rates. Lenders use credit reports to evaluate an applicant’s creditworthiness and history of debt repayment. The following credit-related documents may be required: * Credit reports from the three major credit bureaus (Experian, TransUnion, and Equifax) * Credit scores, which can range from 300 to 850 * Letters explaining any adverse credit history, such as late payments or bankruptcies Maintaining a good credit score can help applicants qualify for better interest rates and terms.

Asset Documentation

Lenders need to verify an applicant’s assets to determine their ability to make a down payment and cover closing costs. The following asset-related documents are typically required: * Bank statements for the past 60 days * Investment account statements, such as 401(k) or IRA accounts * Proof of gifted funds, if applicable * Letters explaining any large deposits or withdrawals Applicants should be prepared to provide detailed information about their assets and explain any unusual transactions.

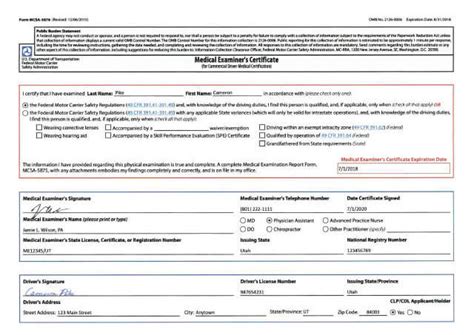

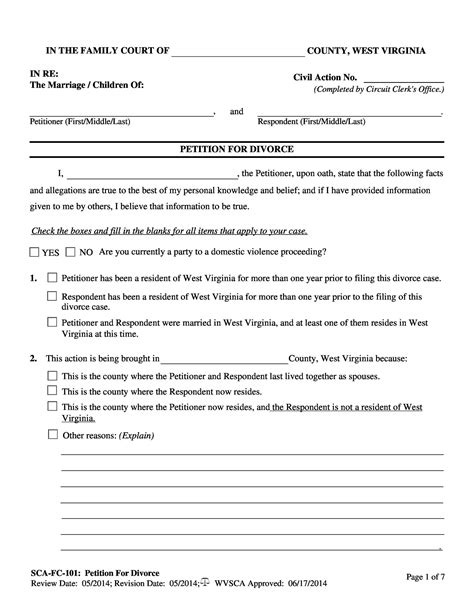

Identification and Residency Documents

Lenders must verify an applicant’s identity and residency to comply with regulatory requirements. The following documents are typically needed: * Government-issued ID, such as a driver’s license or passport * Social Security card or number * Proof of residency, such as a utility bill or lease agreement * Divorce or separation documents, if applicable Accurate and up-to-date identification and residency documents are essential for a successful mortgage application.

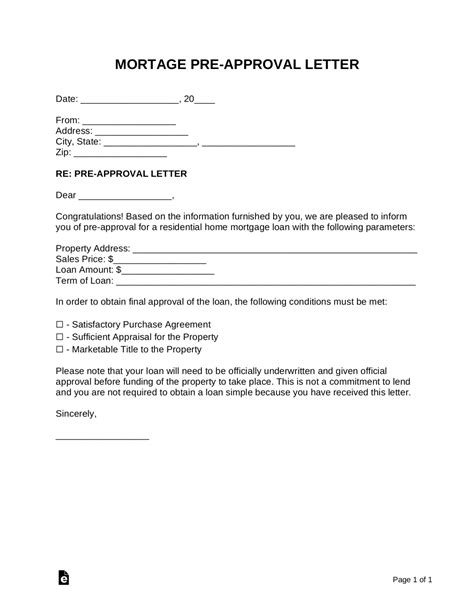

Additional Documents

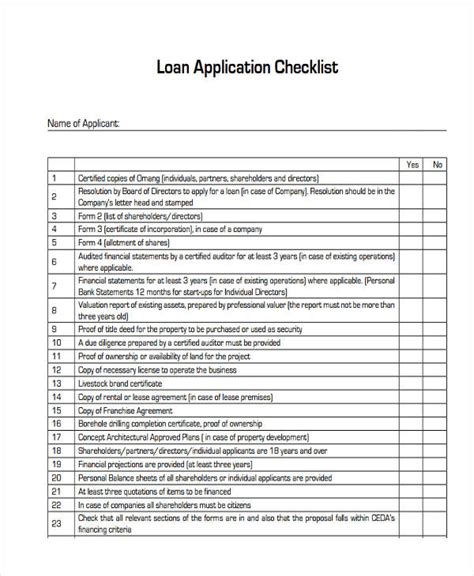

Depending on the type of mortgage and lender, additional documents may be required. These can include: * Appraisal reports for the property * Title reports and insurance * Flood zone determinations * Home inspection reports * Letters explaining any unique circumstances, such as self-employment or non-traditional income It’s essential to check with the lender to determine if any additional documents are needed.

💡 Note: The specific documents required may vary depending on the lender, loan type, and applicant's circumstances. It's crucial to review and understand the lender's requirements before submitting the mortgage application.

Organizing and Submitting Paperwork

Once all the necessary documents are gathered, it’s essential to organize and submit them correctly. This can include: * Creating a checklist to ensure all required documents are included * Making photocopies of all documents * Submitting documents in a timely and efficient manner * Following up with the lender to confirm receipt and review of the documents A well-organized and complete application package can help streamline the mortgage application process and reduce the risk of delays or rejection.

| Document Type | Description |

|---|---|

| Income Verification | Pay stubs, W-2 forms, tax returns, and letters from employers |

| Credit Report and Score | Credit reports, credit scores, and letters explaining adverse credit history |

| Asset Documentation | Bank statements, investment account statements, and proof of gifted funds |

| Identification and Residency | Government-issued ID, Social Security card or number, and proof of residency |

In the end, a successful mortgage application relies on providing accurate and complete paperwork. By understanding the necessary documents and organizing them efficiently, applicants can increase their chances of approval and achieve their goal of becoming a homeowner.

What is the most important document required for a mortgage application?

+

The most important document required for a mortgage application is the credit report, as it plays a significant role in determining mortgage eligibility and interest rates.

How long does it take to process a mortgage application?

+

The processing time for a mortgage application can vary depending on the lender and the complexity of the application, but it typically takes 30-60 days.

Can I apply for a mortgage online?

+

Yes, many lenders offer online mortgage applications, which can be a convenient and efficient way to apply for a mortgage.