Mortgage Paperwork Needed

Introduction to Mortgage Paperwork

When applying for a mortgage, it’s essential to understand the various documents and paperwork required throughout the process. The mortgage application process can be complex and time-consuming, but being prepared with the necessary documents can help streamline the experience. In this article, we will delve into the world of mortgage paperwork, exploring the different types of documents needed and providing tips on how to navigate the process efficiently.

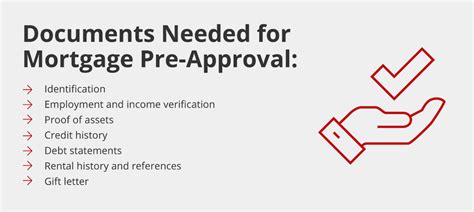

Pre-Approval Documents

Before starting your mortgage application, you’ll need to gather certain documents to get pre-approved. These documents typically include: * Identification: A valid government-issued ID, such as a driver’s license or passport * Income verification: Pay stubs, W-2 forms, and tax returns to demonstrate your income stability * Asset documentation: Bank statements, investment accounts, and retirement accounts to show your assets * Credit reports: Your credit score and history will be evaluated to determine your creditworthiness * Employment verification: A letter from your employer or a copy of your employment contract to confirm your employment status

Mortgage Application Documents

Once you’ve been pre-approved, you’ll need to submit a mortgage application, which will require additional documentation. Some of the key documents needed include: * Loan application: A completed loan application form, which will ask for personal, financial, and property information * Title report: A report that shows the property’s ownership history and any outstanding liens * Appraisal report: An independent assessment of the property’s value * Inspection reports: Reports from inspectors who have evaluated the property’s condition * Insurance information: Proof of homeowners insurance and any other relevant insurance policies

Financial Documents

Lenders will require a range of financial documents to assess your creditworthiness and ability to repay the mortgage. These may include: * Budget and debt information: A breakdown of your income, expenses, debts, and credit obligations * Bank statements: Recent bank statements to show your cash flow and savings * Tax returns: Personal and business tax returns, if applicable * Investment accounts: Statements from investment accounts, such as 401(k) or IRA accounts * Retail accounts: Statements from retail accounts, such as credit card or loan accounts

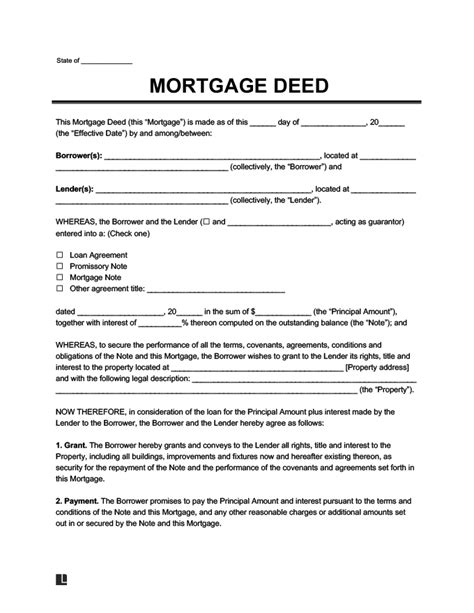

Property-Related Documents

The property itself will also require documentation, including: * Property deed: The legal document that transfers ownership of the property * Property survey: A survey that shows the property’s boundaries and any easements * Home inspection report: A report that identifies any potential issues with the property * Appraisal report: An independent assessment of the property’s value * Title insurance: Insurance that protects the lender and buyer from title defects

Additional Requirements

Depending on the type of mortgage and property, additional documentation may be required. For example: * FHA loans: May require additional documentation, such as a FHA loan application and FHA approval * VA loans: May require a certificate of eligibility and other documentation * USDA loans: May require documentation related to the property’s location and your income

📝 Note: The specific documentation required may vary depending on the lender, loan type, and property location. It's essential to check with your lender to confirm the necessary documents.

Conclusion and Final Thoughts

In conclusion, the mortgage paperwork process can be complex, but being prepared with the necessary documents can help make the experience less overwhelming. By understanding the different types of documents required and gathering them in advance, you can streamline the process and increase your chances of a successful mortgage application. Remember to stay organized, and don’t hesitate to ask your lender if you have any questions or concerns about the required documentation.

What is the first step in the mortgage application process?

+

The first step in the mortgage application process is to get pre-approved, which involves gathering identification, income verification, asset documentation, credit reports, and employment verification.

What is the purpose of a title report?

+

A title report shows the property’s ownership history and any outstanding liens, ensuring that the buyer is aware of any potential issues with the property’s title.

What is the difference between pre-approval and pre-qualification?

+

Pre-qualification is an initial assessment of your creditworthiness, while pre-approval is a more detailed evaluation that involves verifying your financial information and providing a conditional commitment for a specific loan amount.