Tax Return Paperwork Needed

Introduction to Tax Return Paperwork

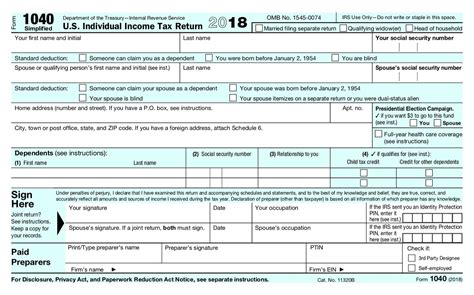

When it comes to filing your tax return, having the right paperwork is essential to ensure you provide all the necessary information to the tax authorities. This includes various documents that prove your income, deductions, and credits. In this article, we will guide you through the different types of tax return paperwork you may need, depending on your individual circumstances.

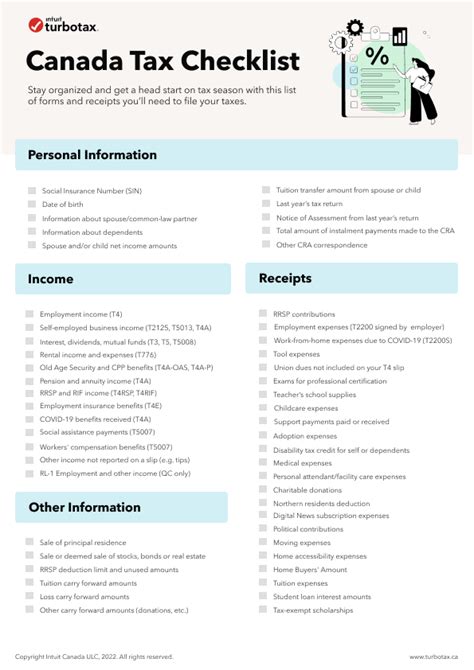

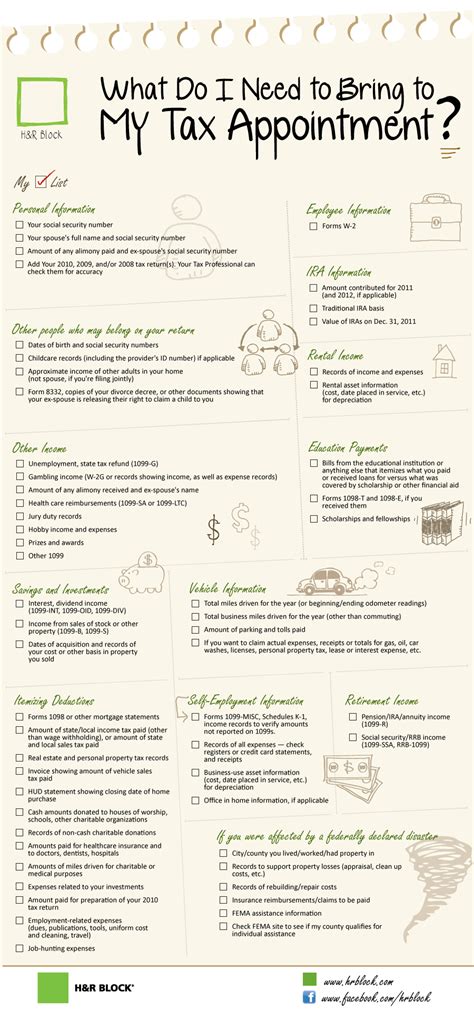

Personal Details and Identification

To start with, you will need to provide personal details and identification documents. These include:

- Your social security number or tax identification number

- Proof of identity, such as a passport or driver’s license

- Proof of address, such as a utility bill or bank statement

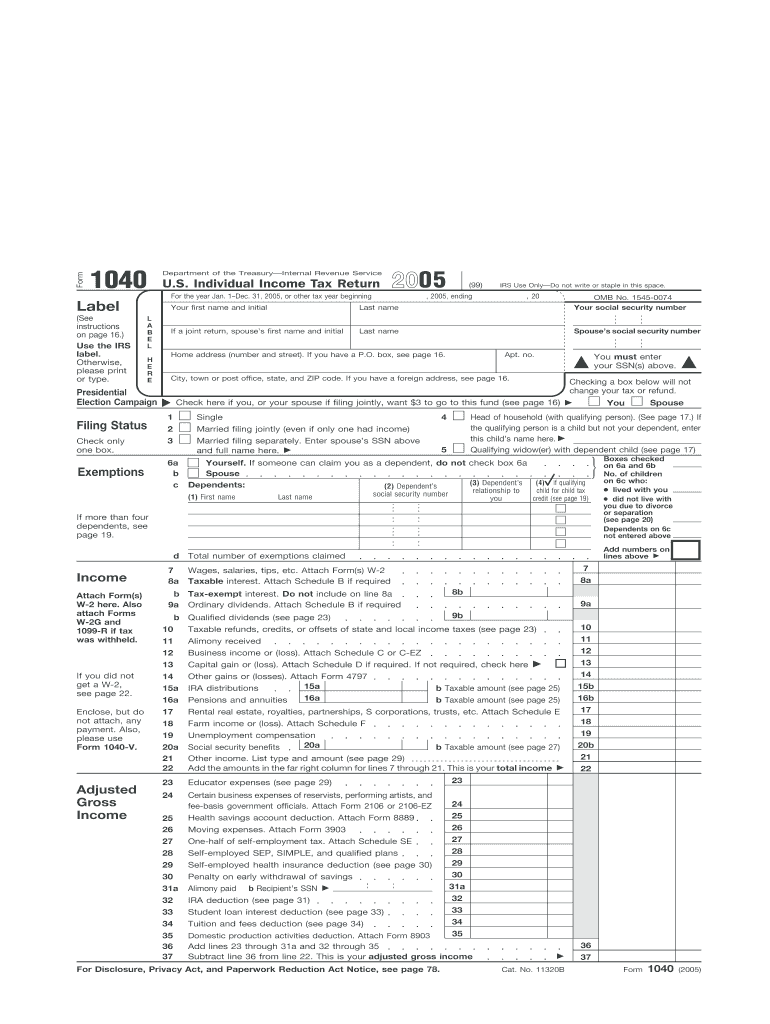

Income-Related Documents

Next, you will need to gather documents related to your income. These may include:

- W-2 forms from your employer, showing your income and taxes withheld

- 1099 forms for freelance or self-employment income

- Interest statements from banks and investments (1099-INT)

- Dividend statements (1099-DIV)

- Capital gains statements (1099-B)

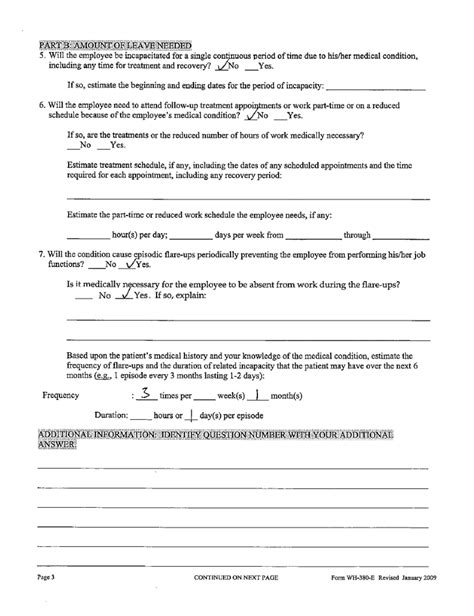

Deductions and Credits

In addition to income-related documents, you may also need paperwork to support your deductions and credits. These can include:

- Receipts for charitable donations

- Medical expense receipts

- Receipts for home improvements or energy-efficient upgrades

- Education expense receipts (e.g., tuition fees, student loan interest)

- Childcare expense receipts

Business-Related Documents (if applicable)

If you are self-employed or have a business, you will need to provide additional documents, such as:

- Business income statements

- Expense receipts (e.g., office supplies, travel expenses)

- Asset depreciation schedules

- Business use of home expenses (e.g., home office deduction)

Other Relevant Documents

Depending on your individual circumstances, you may also need to provide other documents, such as:

- Alimony payment records

- Child support payment records

- Proof of disability or retirement income

- Foreign income statements (if applicable)

| Document Type | Description |

|---|---|

| W-2 | Employer-issued form showing income and taxes withheld |

| 1099 | Form showing freelance or self-employment income |

| 1099-INT | Interest statement from banks and investments |

| 1099-DIV | Dividend statement |

| 1099-B | Capital gains statement |

📝 Note: It is essential to keep accurate and detailed records of all your tax-related documents, as this will help you file your tax return efficiently and avoid any potential errors or audits.

In the end, having the right tax return paperwork is crucial to ensure a smooth and efficient tax filing process. By gathering all the necessary documents and keeping accurate records, you can minimize the risk of errors or audits and maximize your deductions and credits. Remember to review the specific requirements for your situation and seek professional help if needed. By doing so, you can ensure that your tax return is processed correctly and you receive the refund you are eligible for.

What documents do I need to file my tax return?

+

You will need to provide personal details and identification documents, income-related documents, deductions and credits paperwork, and other relevant documents, such as business-related documents or foreign income statements.

How do I know what tax forms I need to fill out?

+

The tax forms you need to fill out will depend on your individual circumstances, such as your income, deductions, and credits. You can use tax preparation software or consult with a tax professional to determine which forms you need to complete.

What is the deadline for filing my tax return?

+

The deadline for filing your tax return will depend on your location and the tax authority’s requirements. In general, the deadline is around April 15th for individuals, but it’s essential to check with your local tax authority for specific deadlines and any potential extensions.

Can I file my tax return electronically?

+

Yes, you can file your tax return electronically using tax preparation software or the tax authority’s online portal. Electronic filing is often faster and more convenient than paper filing, and it can also help reduce errors and processing time.

What happens if I miss the deadline for filing my tax return?

+

If you miss the deadline for filing your tax return, you may face penalties and interest on any taxes owed. It’s essential to file as soon as possible and pay any outstanding taxes to minimize these penalties. You may also be able to request an extension or file for a waiver of penalties in certain circumstances.