Paperwork

File 1099 Tax Forms Easily

You should receive a 1099-MISC form if you earned more than 600 from a client. However, you are still required to report all income earned, regardless of the amount, on your tax return.">Do I need to file a 1099 form if I earned less than 600? +

Introduction to 1099 Tax Forms

When it comes to filing taxes, one of the most important aspects for freelancers, independent contractors, and small business owners is understanding and filing the necessary tax forms, particularly the 1099 series. The 1099 series is a collection of tax forms used to report various types of income that are not subject to withholding, such as freelance work, interest, dividends, and more. In this article, we will delve into the world of 1099 tax forms, explore their different types, and provide a step-by-step guide on how to file them easily.

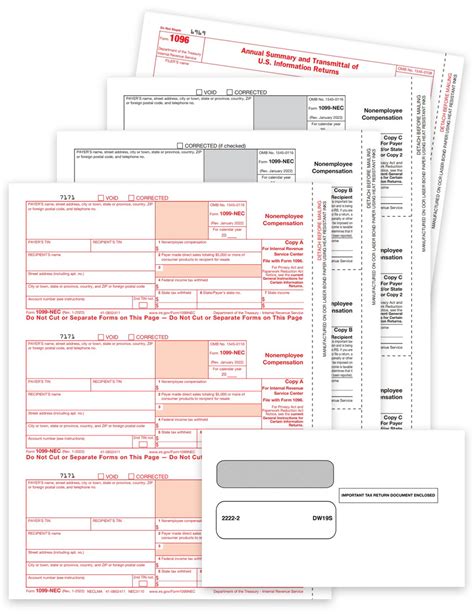

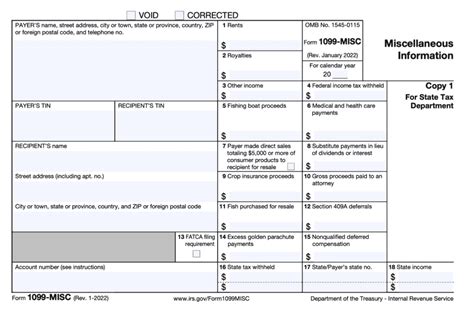

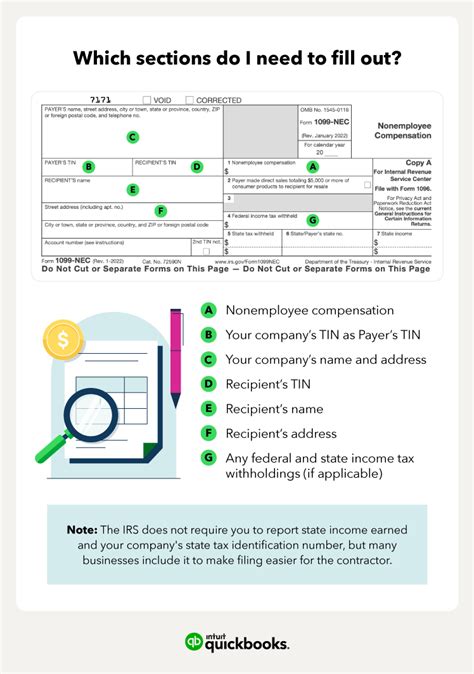

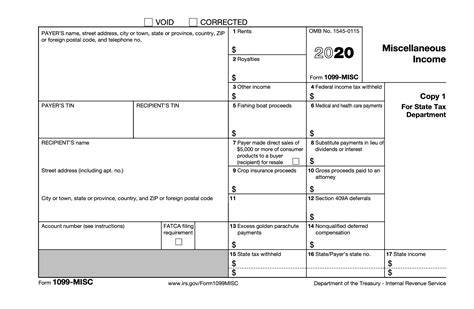

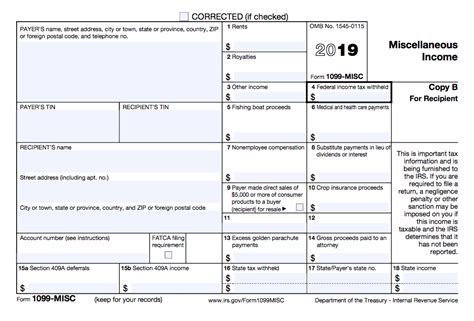

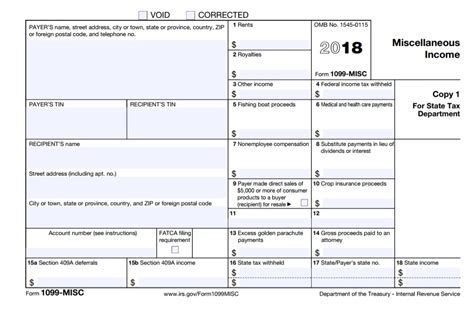

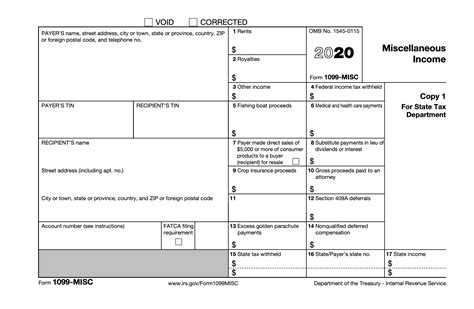

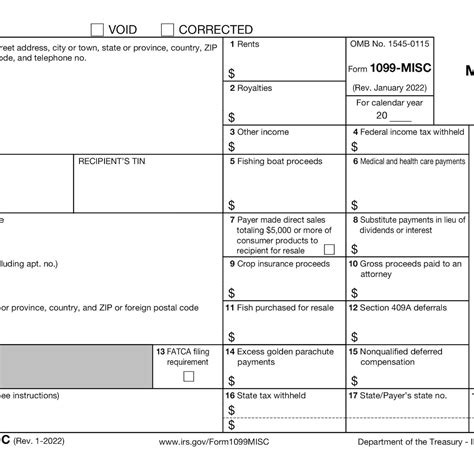

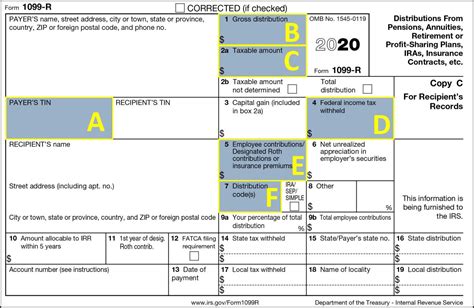

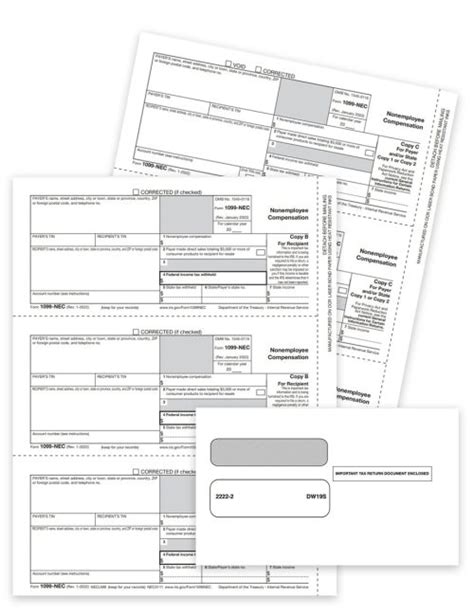

Understanding the Different Types of 1099 Forms

There are several types of 1099 forms, each designed to report different kinds of income. Some of the most common types include: - 1099-MISC: Used to report miscellaneous income, such as freelance work, rents, and royalties. - 1099-INT: Reports interest income, such as from bank accounts. - 1099-DIV: Used for reporting dividend income from investments. - 1099-B: Reports proceeds from the sale of securities, such as stocks and bonds. - 1099-K: For payment card and third-party network transactions.

Who Needs to File 1099 Forms?

The necessity to file 1099 forms depends on the type of income received and the amount. Generally, if you are a freelancer, independent contractor, or self-employed individual who has earned more than $600 from a client in a calendar year, you should receive a 1099-MISC form from that client. Similarly, financial institutions are required to send 1099 forms to individuals who have earned interest, dividends, or proceeds from the sale of securities above certain thresholds.

Steps to File 1099 Tax Forms Easily

Filing 1099 tax forms can seem daunting, but by following these steps, you can make the process smoother: 1. Gather All Necessary Documents: Ensure you have all your 1099 forms, as well as any other relevant tax documents, such as your W-2 form if you also have a regular job, receipts for business expenses, and records of any estimated tax payments made. 2. Choose Your Filing Status: Your filing status (single, married filing jointly, etc.) affects your tax rates and deductions. Choose the status that applies to you. 3. Report Your Income: Add up the income reported on all your 1099 forms. You will report this income on your tax return, usually on Schedule C for business income. 4. Calculate Business Expenses: If you are self-employed, you can deduct business expenses on your tax return. Keep accurate records, as these deductions can significantly reduce your taxable income. 5. Complete Your Tax Return: Use tax software or consult a tax professional to help you fill out your tax return (Form 1040) and any necessary schedules. 6. Submit Your Return: Once you have completed your tax return, submit it to the IRS. You can file electronically or by mail.

Tips for Filing 1099 Forms Correctly

- Accuracy is Key: Double-check all the information on your 1099 forms and tax return for accuracy. - Understand Deductions: Familiarize yourself with deductions available for your type of income to minimize your tax liability. - File on Time: The deadline for filing individual tax returns is typically April 15th. Missing this deadline can result in penalties. - Seek Professional Help: If you are unsure about any part of the process, consider hiring a tax professional.

💡 Note: Always keep a copy of your filed tax return and supporting documents for your records, as you may need them in the future for audits or other purposes.

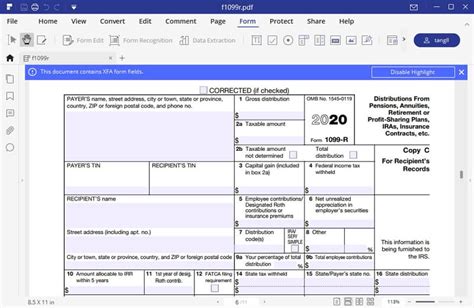

Using Tax Software for Easy Filing

Tax software can make filing 1099 forms significantly easier. These programs guide you through the filing process, ensure you claim all eligible deductions, and can even submit your return electronically. Some popular options include TurboTax, H&R Block, and TaxAct. When choosing software, consider factors such as ease of use, cost, and the types of tax situations it can handle.

Conclusion

Filing 1099 tax forms is a crucial part of managing your finances as a freelancer, independent contractor, or small business owner. By understanding the different types of 1099 forms, gathering all necessary documents, and following the steps outlined above, you can ensure a smooth and accurate filing process. Remember, accuracy and timeliness are key to avoiding penalties and ensuring you receive any refund you are due. Whether you choose to file yourself or seek the help of a tax professional, taking control of your tax obligations is a significant step towards financial stability and success.

What is the deadline for filing 1099 tax forms?

+

The deadline for filing individual tax returns, which include 1099 forms, is typically April 15th of each year.

Do I need to file a 1099 form if I earned less than 600?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>You should receive a 1099-MISC form if you earned more than 600 from a client. However, you are still required to report all income earned, regardless of the amount, on your tax return.

Can I file my 1099 forms electronically?

+

Yes, you can file your tax return, including 1099 forms, electronically through the IRS website or using tax software. Electronic filing is faster and reduces the chance of errors.