File Business Taxes Paperwork

Introduction to Filing Business Taxes

Filing business taxes can be a daunting task, especially for new entrepreneurs or small business owners. The process involves completing and submitting various forms and documents to the relevant tax authorities, which can be time-consuming and overwhelming. However, it is essential to file business taxes accurately and on time to avoid penalties, fines, and even legal action. In this article, we will guide you through the process of filing business taxes, including the necessary paperwork, deadlines, and tips to make the process smoother.

Types of Business Taxes

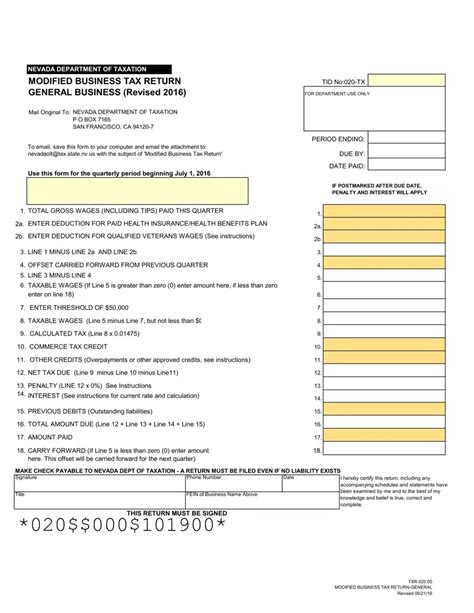

There are several types of business taxes that companies must pay, depending on their structure, size, and industry. The most common types of business taxes include: * Income tax: This is the tax on the company’s profits, which is typically filed annually. * Payroll tax: This tax is withheld from employees’ wages and is used to fund social security and Medicare. * Sales tax: This tax is collected from customers on the sale of goods and services. * Property tax: This tax is levied on the company’s real estate and other assets.

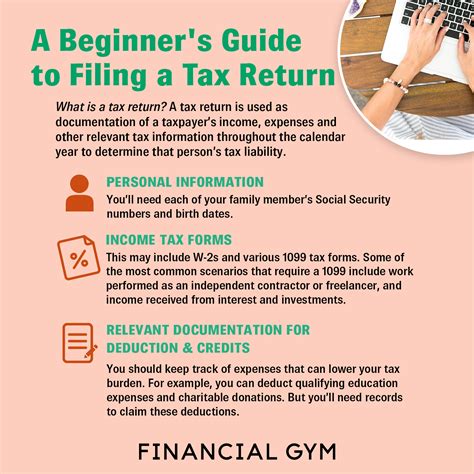

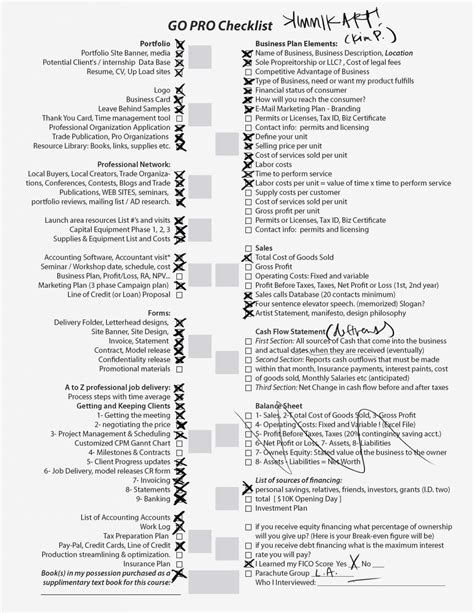

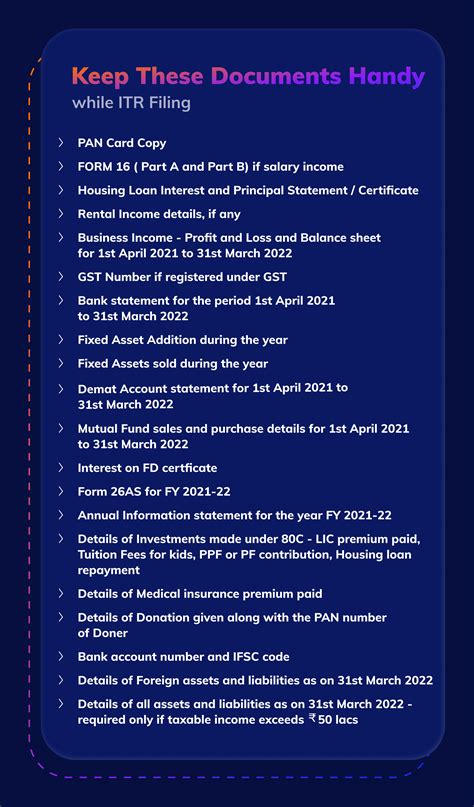

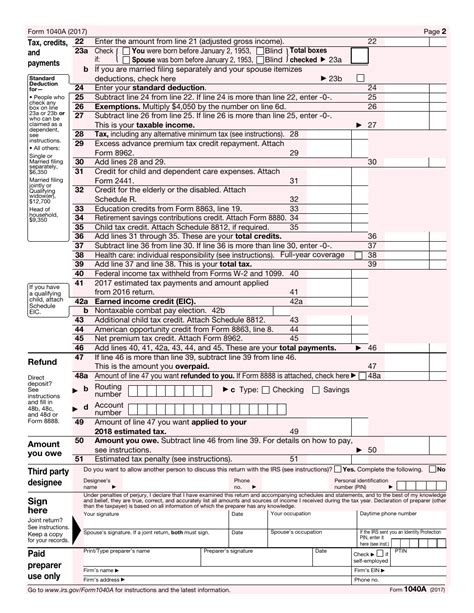

Necessary Paperwork for Filing Business Taxes

To file business taxes, companies need to complete and submit various forms and documents. The necessary paperwork includes: * Form 1040: This is the standard form for individual income tax returns, which is also used by sole proprietors and single-member limited liability companies (LLCs). * Form 1120: This is the form for corporate income tax returns, which is used by C-corporations. * Form 1120S: This is the form for S-corporation income tax returns. * Form W-2: This is the form for reporting employee wages and taxes withheld. * Form 1099: This is the form for reporting income paid to independent contractors and freelancers.

| Form | Description |

|---|---|

| Form 1040 | Individual income tax return |

| Form 1120 | Corporate income tax return |

| Form 1120S | S-corporation income tax return |

| Form W-2 | Employee wages and taxes withheld |

| Form 1099 | Income paid to independent contractors and freelancers |

Deadlines for Filing Business Taxes

The deadlines for filing business taxes vary depending on the type of tax and the company’s fiscal year. The most common deadlines include: * April 15th: This is the deadline for filing individual income tax returns (Form 1040) and corporate income tax returns (Form 1120). * March 15th: This is the deadline for filing S-corporation income tax returns (Form 1120S). * January 31st: This is the deadline for filing Form W-2 and Form 1099.

💡 Note: It is essential to file business taxes on time to avoid penalties and fines. Companies can request an extension of time to file their tax returns, but this must be done before the original deadline.

Tips for Filing Business Taxes

Filing business taxes can be a complex and time-consuming process, but there are several tips to make it smoother: * Hire a tax professional: A tax professional can help companies navigate the tax filing process and ensure that they are taking advantage of all the deductions and credits available. * Keep accurate records: Companies should keep accurate and detailed records of their income, expenses, and taxes paid throughout the year. * Take advantage of tax deductions and credits: Companies can claim various tax deductions and credits, such as the research and development tax credit, to reduce their tax liability. * File electronically: Filing taxes electronically can help reduce errors and speed up the processing time.

In summary, filing business taxes requires careful planning, accurate record-keeping, and attention to detail. By understanding the necessary paperwork, deadlines, and tips for filing business taxes, companies can ensure that they are complying with tax laws and regulations, and minimizing their tax liability. As the tax filing process can be complex and time-consuming, it is essential to stay organized and seek professional help when needed, to avoid any potential issues or penalties.

What is the deadline for filing corporate income tax returns?

+

The deadline for filing corporate income tax returns (Form 1120) is April 15th.

What is the purpose of Form W-2?

+

Form W-2 is used to report employee wages and taxes withheld.

Can companies request an extension of time to file their tax returns?

+

Yes, companies can request an extension of time to file their tax returns, but this must be done before the original deadline.