Paperwork

File Pension Paperwork Easily

Introduction to Pension Paperwork

Pension paperwork can be a daunting task, especially for those who are not familiar with the process. Understanding the requirements and gathering necessary documents are crucial steps in ensuring a smooth and efficient filing process. In this article, we will guide you through the process of filing pension paperwork, highlighting the key steps and requirements to help you navigate this complex task.

Preparation is Key

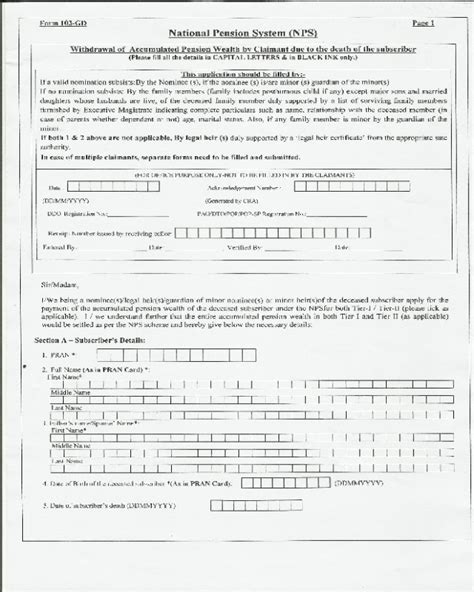

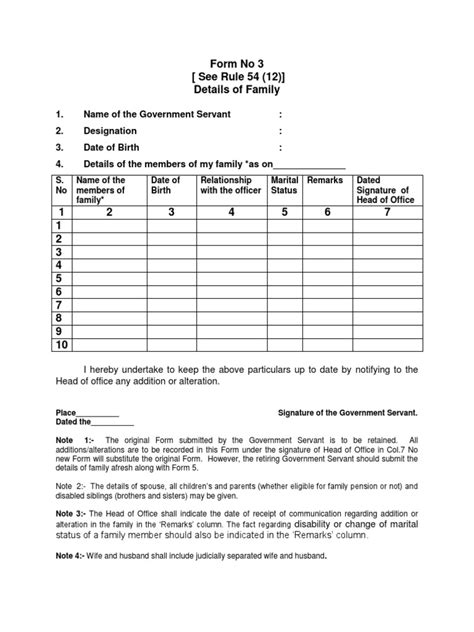

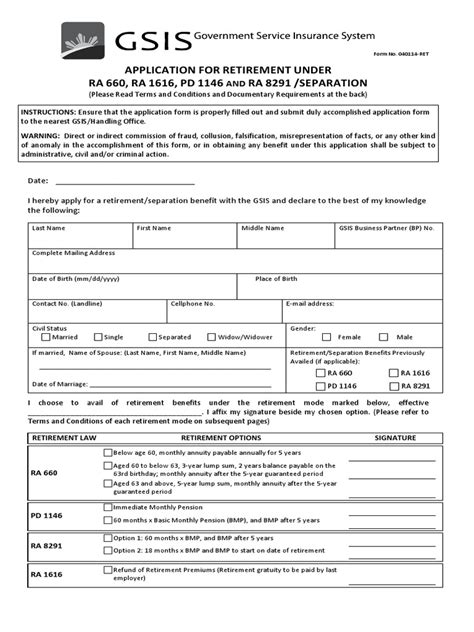

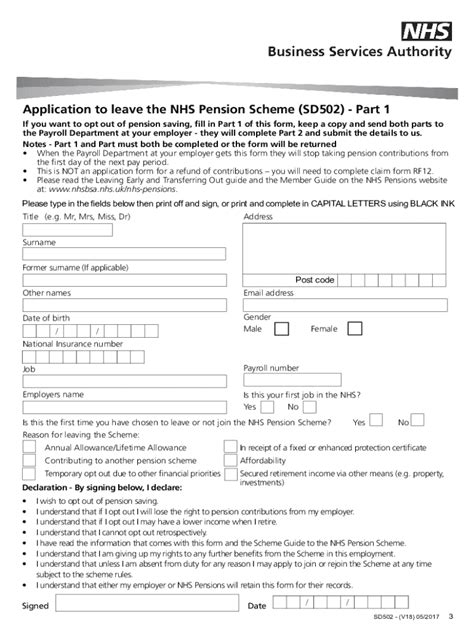

Before starting the pension paperwork process, it is essential to gather all necessary documents. These may include: * Identification documents (e.g., driver’s license, passport) * Proof of employment and income * Proof of retirement or eligibility for pension * Spouse’s or dependent’s information (if applicable) * Any other relevant documents required by the pension provider

📝 Note: It is crucial to ensure all documents are accurate and up-to-date to avoid any delays or complications in the filing process.

Understanding Pension Types

There are various types of pensions, including: * Defined Benefit (DB) pension: A traditional pension plan that provides a guaranteed income based on salary and years of service. * Defined Contribution (DC) pension: A plan where the employer contributes a fixed amount to an individual account, and the benefit is based on the account balance. * Hybrid pension: A combination of DB and DC plans.

Filing Pension Paperwork

The filing process typically involves the following steps: * Completing the application form: This may involve providing personal and employment information, as well as details about your pension eligibility. * Submitting required documents: Ensure all necessary documents are attached to the application form. * Reviewing and signing the application: Carefully review the application for accuracy and completeness before signing.

Online Filing Options

Many pension providers offer online filing options, which can simplify the process and reduce paperwork. Benefits of online filing include: * Convenience: File from anywhere, at any time * Speed: Applications are processed faster * Accuracy: Reduced risk of errors or missing information

Tips for a Smooth Filing Process

To ensure a smooth and efficient filing process: * Start early: Allow plenty of time to gather documents and complete the application. * Seek assistance: If needed, consult with a financial advisor or pension expert. * Double-check: Verify all information for accuracy and completeness.

Common Mistakes to Avoid

When filing pension paperwork, common mistakes to avoid include: * Incomplete or inaccurate information * Missing or outdated documents * Failure to review and sign the application

📝 Note: Avoiding these common mistakes can help prevent delays or complications in the filing process.

Conclusion and Final Thoughts

Filing pension paperwork requires attention to detail and a thorough understanding of the process. By gathering necessary documents, understanding pension types, and following the filing process, you can ensure a smooth and efficient experience. Remember to start early, seek assistance if needed, and double-check all information to avoid common mistakes.

What documents do I need to file my pension paperwork?

+

The required documents may include identification, proof of employment and income, proof of retirement or eligibility for pension, and spouse’s or dependent’s information (if applicable).

Can I file my pension paperwork online?

+

Yes, many pension providers offer online filing options, which can simplify the process and reduce paperwork.

What are the benefits of online filing?

+

The benefits of online filing include convenience, speed, and accuracy, as well as reduced risk of errors or missing information.