File Taxes Canada Paperwork Requirements

Introduction to Filing Taxes in Canada

Filing taxes in Canada can seem like a daunting task, especially with the amount of paperwork required. However, understanding the process and gathering all the necessary documents can make it much simpler. The Canada Revenue Agency (CRA) requires individuals to file their taxes annually, and there are specific paperwork requirements that must be met. In this article, we will guide you through the process of filing taxes in Canada, highlighting the necessary paperwork and providing tips to make the process smoother.

Required Documents for Filing Taxes

To file your taxes in Canada, you will need to gather several documents. These include:

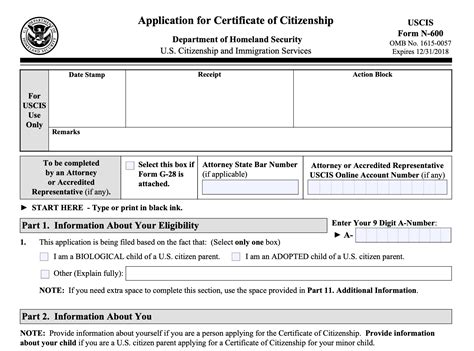

- T1 General Form: This is the main tax return form that you will need to fill out. It can be downloaded from the CRA website or obtained from a tax services office.

- T4 Slips: These slips are provided by your employer and show your income and deductions for the year.

- T5 Slips: If you have investments, such as stocks or mutual funds, you will receive a T5 slip showing your investment income.

- RRSP Receipts: If you have contributed to a Registered Retirement Savings Plan (RRSP), you will need to include your receipts with your tax return.

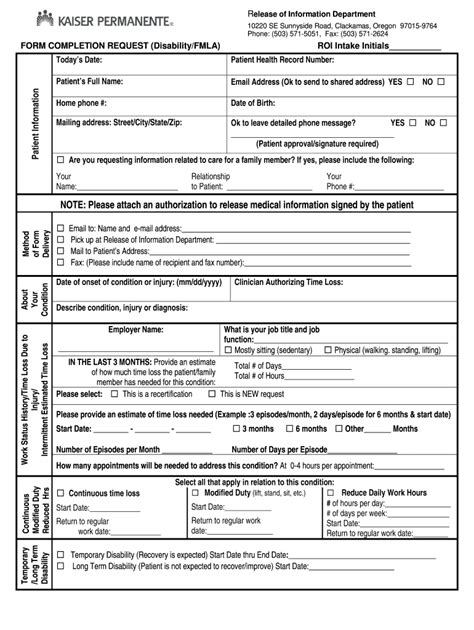

- Medical Expense Receipts: If you have medical expenses that you want to claim, you will need to keep receipts for these expenses.

- Charitable Donation Receipts: If you have made charitable donations, you will need to keep receipts for these donations.

- Child Care Expense Receipts: If you have paid for child care, you will need to keep receipts for these expenses.

Additional Documents for Specific Situations

Depending on your situation, you may need to provide additional documents. These include:

- Separation or Divorce Documents: If you are separated or divorced, you may need to provide documents related to your separation or divorce, such as a separation agreement or divorce decree.

- Child Support Documents: If you are paying or receiving child support, you will need to provide documents related to your child support payments.

- Disability Tax Credit Documents: If you are applying for the disability tax credit, you will need to provide documents from your doctor or other medical professional.

Filing Taxes Online

The CRA offers an online filing system called NETFILE. This system allows you to file your taxes electronically, which can be faster and more convenient than mailing in your return. To use NETFILE, you will need to:

- Download and install the NETFILE software from the CRA website

- Gather all of your tax documents and information

- Follow the prompts to fill out your tax return

- Submit your return electronically

Filing Taxes by Mail

If you prefer to file your taxes by mail, you will need to:

- Gather all of your tax documents and information

- Fill out your tax return using the T1 General Form

- Attach all required documents and receipts

- Mail your return to the CRA

📝 Note: Make sure to keep a copy of your tax return and all supporting documents for your records.

Tax Filing Deadlines

The deadline for filing your taxes in Canada is April 30th of each year. However, if you owe taxes, it is recommended that you file your return as soon as possible to avoid interest and penalties. If you are self-employed, the deadline for filing your taxes is June 15th.

Tax Credits and Deductions

There are several tax credits and deductions available in Canada that can help reduce your tax liability. These include:

- Basic Personal Amount: This is a tax credit that is available to all individuals, regardless of their income level.

- Spousal Amount: If you have a spouse or common-law partner, you may be eligible for this tax credit.

- Child Tax Benefit: If you have children under the age of 18, you may be eligible for this tax credit.

- Medical Expense Tax Credit: If you have medical expenses, you may be eligible for this tax credit.

- Charitable Donation Tax Credit: If you have made charitable donations, you may be eligible for this tax credit.

| Tax Credit | Description |

|---|---|

| Basic Personal Amount | A tax credit available to all individuals, regardless of their income level. |

| Spousal Amount | A tax credit available to individuals with a spouse or common-law partner. |

| Child Tax Benefit | A tax credit available to individuals with children under the age of 18. |

| Medical Expense Tax Credit | A tax credit available to individuals with medical expenses. |

| Charitable Donation Tax Credit | A tax credit available to individuals who have made charitable donations. |

In summary, filing taxes in Canada requires gathering various documents, including the T1 General Form, T4 slips, and receipts for expenses such as medical expenses and charitable donations. Understanding the paperwork requirements and taking advantage of available tax credits and deductions can help make the process smoother and reduce your tax liability. By following the steps outlined in this article, you can ensure that you are meeting all of the necessary paperwork requirements and taking advantage of the tax credits and deductions available to you.

What is the deadline for filing taxes in Canada?

+

The deadline for filing taxes in Canada is April 30th of each year. However, if you are self-employed, the deadline is June 15th.

What documents do I need to file my taxes in Canada?

+

You will need to gather documents such as the T1 General Form, T4 slips, and receipts for expenses such as medical expenses and charitable donations.

Can I file my taxes online in Canada?

+

Yes, you can file your taxes online in Canada using the NETFILE system. This system allows you to file your taxes electronically, which can be faster and more convenient than mailing in your return.