Paperwork

Finance a Car in Washington Paperwork Needed

Introduction to Financing a Car in Washington

When it comes to financing a car in Washington, there are several steps you need to take to ensure a smooth and successful process. One of the most critical aspects of car financing is the paperwork required. In this article, we will guide you through the necessary paperwork needed to finance a car in Washington, making it easier for you to understand and prepare for the process.

Understanding the Paperwork Requirements

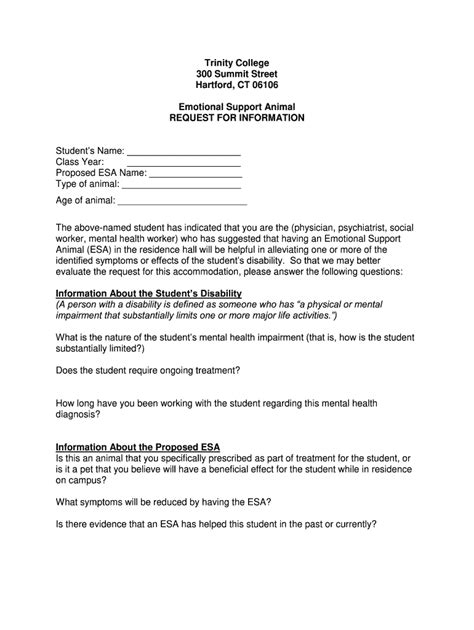

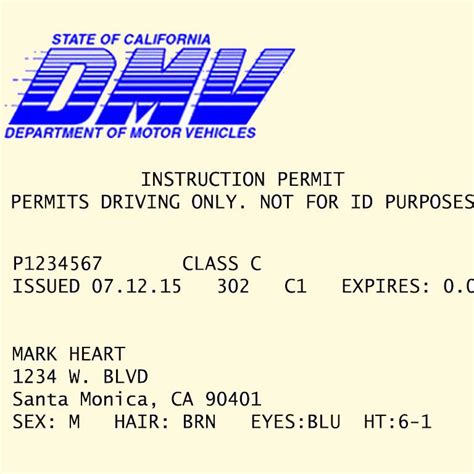

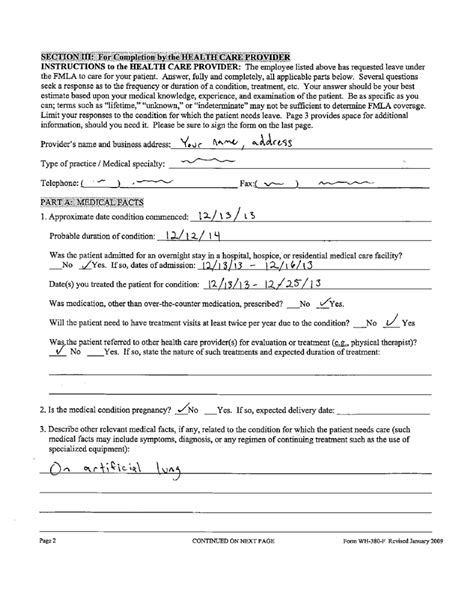

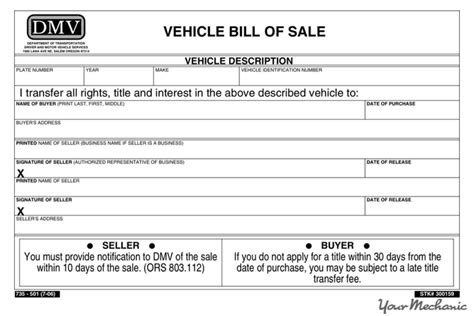

To finance a car in Washington, you will need to provide various documents to the lender or dealership. These documents are essential to verify your identity, income, employment, and creditworthiness. The primary paperwork requirements include: * Identification: A valid government-issued ID, such as a driver’s license or passport * Income verification: Pay stubs, W-2 forms, or tax returns to prove your income * Employment verification: A letter from your employer or a recent pay stub to confirm your employment * Credit report: A credit report from one of the major credit bureaus to assess your credit score and history * Insurance information: Proof of insurance or a quote from an insurance provider

Additional Documents for Special Cases

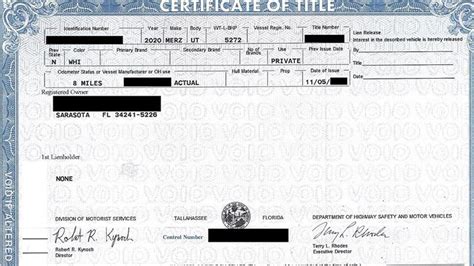

In some cases, you may need to provide additional documentation, such as: * Co-signer information: If you have a co-signer, you will need to provide their identification, income verification, and credit report * Trade-in information: If you are trading in a vehicle, you will need to provide the title, registration, and any outstanding loan information * Down payment verification: If you are making a down payment, you will need to provide proof of the payment, such as a bank statement or cashier’s check

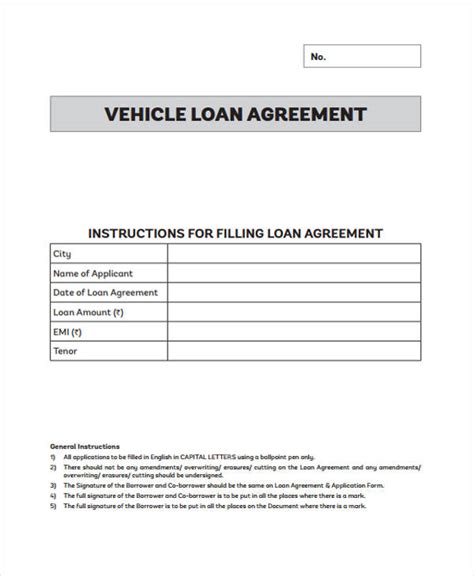

Dealership and Lender Requirements

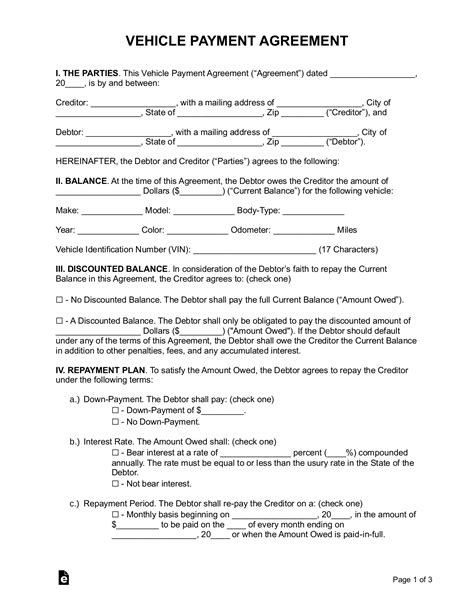

Dealerships and lenders in Washington may have specific requirements for financing a car. It’s essential to check with the dealership or lender to confirm their requirements, as they may vary. Some common requirements include: * Minimum credit score: A minimum credit score to qualify for financing * Maximum loan amount: A maximum loan amount based on your income and creditworthiness * Interest rate: An interest rate that may vary depending on your credit score and loan terms

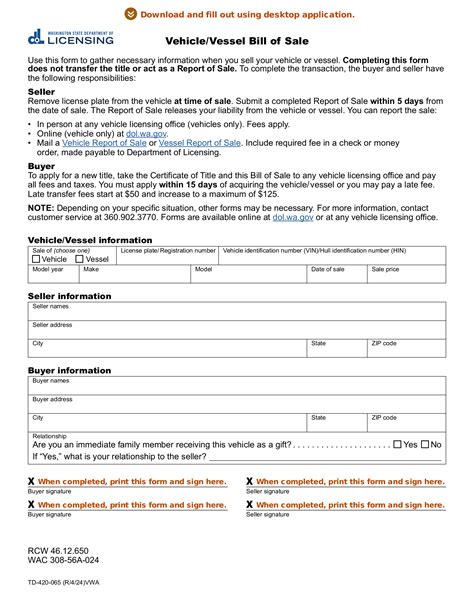

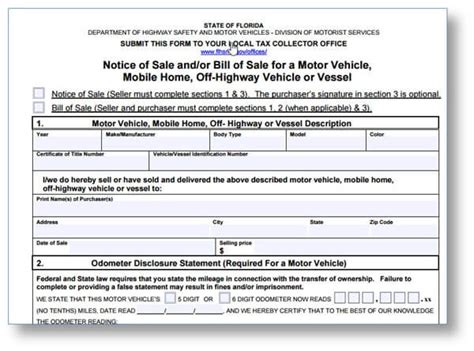

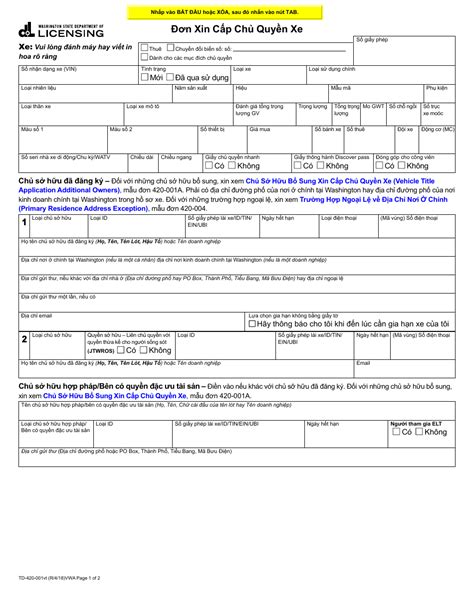

Washington State-Specific Requirements

In Washington state, there are specific requirements for financing a car. For example: * Title and registration: You will need to provide the title and registration for the vehicle * Sales tax: You will need to pay sales tax on the vehicle, which can be financed as part of the loan * Licensing fees: You will need to pay licensing fees, which can be financed as part of the loan

📝 Note: It's essential to review and understand the terms and conditions of the loan before signing any documents.

Financing Options in Washington

There are various financing options available in Washington, including: * Dealership financing: Financing through the dealership * Bank financing: Financing through a bank or credit union * Online financing: Financing through online lenders * Leasing: Leasing a vehicle instead of purchasing

Benefits of Financing a Car in Washington

Financing a car in Washington can have several benefits, including: * Convenience: Financing a car can be a convenient way to purchase a vehicle * Flexibility: Financing options can provide flexibility in terms of loan terms and interest rates * Affordability: Financing can make it more affordable to purchase a vehicle

Conclusion and Final Thoughts

Financing a car in Washington requires careful consideration and preparation. By understanding the necessary paperwork and requirements, you can ensure a smooth and successful process. Remember to review and understand the terms and conditions of the loan before signing any documents. With the right financing option, you can drive away in your new vehicle with confidence.

What are the minimum credit score requirements for financing a car in Washington?

+

The minimum credit score requirements for financing a car in Washington vary depending on the lender and dealership. However, a good credit score is typically considered to be 700 or higher.

What are the typical interest rates for financing a car in Washington?

+

The typical interest rates for financing a car in Washington vary depending on the lender, dealership, and your credit score. However, interest rates can range from 3% to 18% or more.

Can I finance a car in Washington with a co-signer?

+