5 Mortgage Must-Haves

Introduction to Mortgage Must-Haves

When it comes to purchasing a home, there are several factors to consider, and one of the most critical aspects is the mortgage. A mortgage is a significant investment, and it’s essential to approach it with caution and careful planning. In this article, we will explore the 5 mortgage must-haves that every homebuyer should consider before making a decision.

Understanding the Importance of Mortgage Must-Haves

Before diving into the must-haves, it’s crucial to understand why they are essential. A mortgage is a long-term commitment, and making the right choices can save you thousands of dollars in the long run. The 5 mortgage must-haves are designed to help you navigate the complex world of mortgages and make informed decisions that align with your financial goals and situation.

The 5 Mortgage Must-Haves

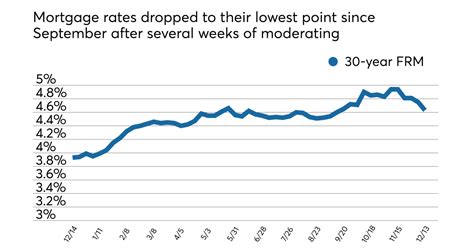

Here are the 5 mortgage must-haves that every homebuyer should consider: * Competitive Interest Rate: A competitive interest rate can save you thousands of dollars over the life of the loan. It’s essential to shop around and compare rates from different lenders to find the best deal. * Flexible Repayment Terms: Flexible repayment terms can help you manage your mortgage payments and avoid financial stress. Look for lenders that offer flexible repayment options, such as offset accounts or repayment holidays. * Low Fees and Charges: High fees and charges can add up quickly, so it’s essential to choose a lender with low or no fees. Look for lenders that offer discounts or waivers on fees, such as establishment fees or monthly fees. * High Loan-to-Value Ratio: A high loan-to-value ratio can help you borrow more money and purchase a more expensive property. However, it’s essential to be cautious and ensure that you can afford the repayments. * Good Customer Service: Good customer service is essential when it comes to mortgages. Look for lenders that offer excellent customer service, such as 24⁄7 support, online portals, and mobile apps.

Additional Considerations

In addition to the 5 mortgage must-haves, there are several other factors to consider when choosing a mortgage. These include: * Credit Score: Your credit score can affect the interest rate you’re offered and the amount you can borrow. It’s essential to check your credit score and work on improving it if necessary. * Income and Expenses: Your income and expenses will affect your ability to repay the mortgage. It’s essential to create a budget and ensure that you can afford the repayments. * Property Value: The value of the property will affect the amount you can borrow and the interest rate you’re offered. It’s essential to research the property market and choose a property that will appreciate in value over time.

Comparing Mortgage Options

Comparing mortgage options can be overwhelming, but it’s essential to find the right mortgage for your situation. Here are some tips for comparing mortgage options: * Use Online Tools: Online tools, such as mortgage calculators and comparison websites, can help you compare mortgage options and find the best deal. * Read Reviews: Reading reviews from other customers can help you understand the pros and cons of different lenders and mortgage products. * Seek Professional Advice: Seeking professional advice from a mortgage broker or financial advisor can help you navigate the complex world of mortgages and find the right mortgage for your situation.

📝 Note: It's essential to carefully review the terms and conditions of any mortgage before signing the contract.

Conclusion and Final Thoughts

In conclusion, choosing the right mortgage is a critical decision that can affect your financial situation for years to come. By considering the 5 mortgage must-haves and additional factors, such as credit score, income, and expenses, you can make an informed decision and find the right mortgage for your situation. Remember to compare mortgage options carefully, read reviews, and seek professional advice to ensure that you’re making the best decision for your financial future.

What is the most important factor to consider when choosing a mortgage?

+

The most important factor to consider when choosing a mortgage is the interest rate. A competitive interest rate can save you thousands of dollars over the life of the loan.

How do I compare mortgage options?

+

You can compare mortgage options by using online tools, such as mortgage calculators and comparison websites, reading reviews from other customers, and seeking professional advice from a mortgage broker or financial advisor.

What is the difference between a fixed-rate mortgage and a variable-rate mortgage?

+

A fixed-rate mortgage has a fixed interest rate for the life of the loan, while a variable-rate mortgage has an interest rate that can change over time. Fixed-rate mortgages offer more stability and predictability, while variable-rate mortgages may offer more flexibility and potential for savings.