Car Insurance Paperwork Requirements

Understanding Car Insurance Paperwork Requirements

When it comes to car insurance, one of the most critical aspects that policyholders often overlook is the paperwork requirements. Having the right documents in place is essential to ensure that your claims are processed smoothly and that you receive the compensation you deserve in the event of an accident or other insured incidents. In this article, we will delve into the world of car insurance paperwork, exploring the necessary documents, their importance, and how to manage them efficiently.

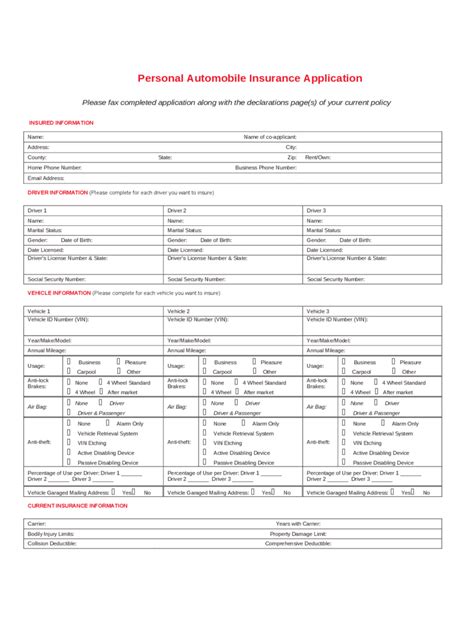

Types of Car Insurance Paperwork

There are several types of paperwork that are typically required for car insurance. These include: * Policy documents: This is the primary contract between you and your insurance provider, outlining the terms and conditions of your coverage. * Identification documents: You may need to provide proof of identity, such as a driver’s license, passport, or state ID. * Vehicle registration: Your vehicle’s registration documents are essential to prove ownership and to verify the vehicle’s details. * Proof of insurance: This document, also known as an insurance card, serves as evidence that you have the required insurance coverage. * Claims forms: In the event of an accident or incident, you will need to fill out a claims form to initiate the process of receiving compensation.

Importance of Accurate Paperwork

Accurate and complete paperwork is crucial for several reasons: * Smooth claims processing: Having all the necessary documents in order can significantly speed up the claims process, ensuring that you receive your compensation promptly. * Avoiding disputes: Complete and accurate paperwork can help prevent disputes between you and your insurance provider, reducing the risk of delayed or denied claims. * Compliance with regulations: In many jurisdictions, having the proper car insurance paperwork is a legal requirement, and failure to comply can result in fines or other penalties.

Managing Your Car Insurance Paperwork

To manage your car insurance paperwork efficiently, consider the following tips: * Keep digital copies: Scan your documents and store them electronically, either on your computer or in cloud storage, to ensure they are easily accessible and backed up. * Organize a physical file: Keep a physical folder or file with all your car insurance documents, including policy documents, identification, and vehicle registration. * Review and update regularly: Periodically review your paperwork to ensure it is up to date and accurate, making any necessary changes or updates.

Common Mistakes to Avoid

When dealing with car insurance paperwork, there are several common mistakes to avoid: * Inaccurate information: Ensure that all information provided is accurate and truthful, as inaccuracies can lead to claims being denied or delayed. * Missing documents: Failing to provide required documents can slow down the claims process or even result in a claim being denied. * Failure to update documents: Failing to update your documents, such as when you move or change vehicles, can lead to complications when filing a claim.

📝 Note: Always keep a record of your interactions with your insurance provider, including dates, times, and details of conversations, as this can be helpful in resolving any disputes or issues that may arise.

Conclusion and Final Thoughts

In conclusion, car insurance paperwork requirements are a critical aspect of having adequate coverage. By understanding the necessary documents, their importance, and how to manage them efficiently, you can ensure a smooth and hassle-free experience when dealing with your car insurance. Remember to keep your documents up to date, accurate, and easily accessible, and avoid common mistakes that can lead to complications. By doing so, you can have peace of mind knowing that you are well-prepared in the event of an accident or other insured incident.

What documents do I need to provide to my car insurance company?

+

You will typically need to provide policy documents, identification, vehicle registration, proof of insurance, and claims forms, among other documents, depending on your specific situation and the requirements of your insurance provider.

How do I keep my car insurance paperwork organized?

+

Consider keeping digital copies of your documents, as well as a physical file, and review and update your paperwork regularly to ensure it is accurate and up to date.

What happens if I don’t have the necessary paperwork for my car insurance?

+

Failing to have the necessary paperwork can lead to delays or complications in the claims process, and in some cases, may even result in a claim being denied. It is essential to ensure you have all the required documents to avoid any issues.