Taxes Paperwork Needed

Introduction to Tax Paperwork

When it comes to dealing with taxes, one of the most daunting tasks for individuals and businesses alike is navigating the complex web of paperwork required. Tax paperwork is essential for ensuring compliance with tax laws and regulations, but it can be overwhelming, especially for those who are not familiar with the process. In this article, we will delve into the world of tax paperwork, exploring the various documents and forms needed for different tax purposes.

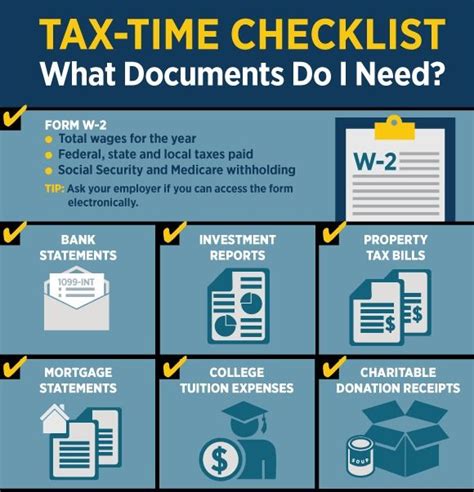

Individual Tax Paperwork

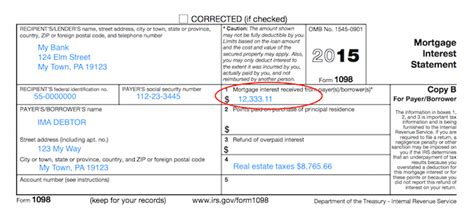

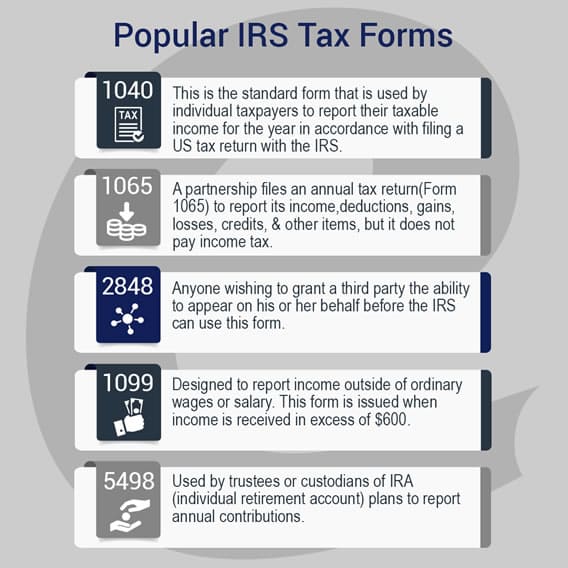

For individuals, tax paperwork typically includes documents that provide information about their income, deductions, and credits. Some of the most common forms and documents needed for individual tax purposes include: * W-2 forms: Provided by employers to show income and taxes withheld * 1099 forms: Used to report income from freelance work, investments, and other sources * Interest statements: From banks and financial institutions to report interest income * Charitable donation receipts: To claim deductions for donations made to qualified charities * Medical expense records: To claim deductions for medical expenses

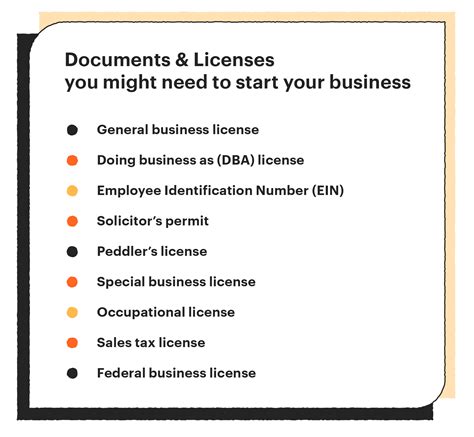

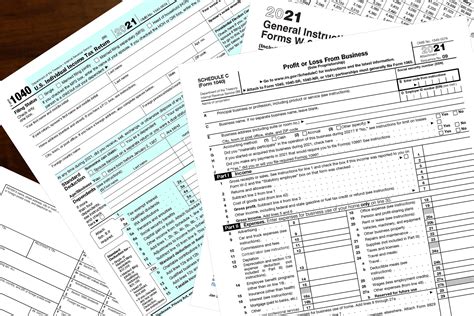

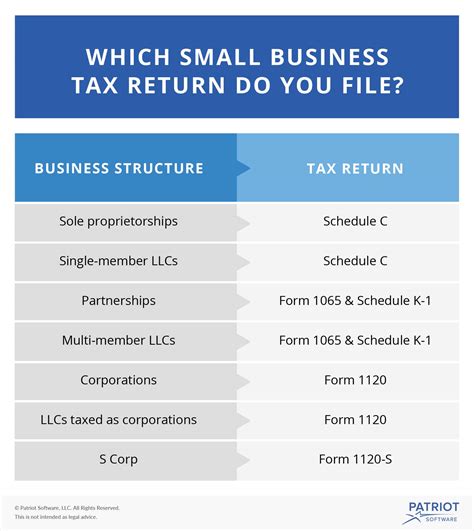

Business Tax Paperwork

Businesses, on the other hand, require a more extensive set of documents to comply with tax regulations. Some of the key forms and documents needed for business tax purposes include: * Business tax returns: Such as Form 1120 for corporations or Form 1065 for partnerships * Financial statements: Including balance sheets and income statements * Expense records: To claim deductions for business expenses * Payroll records: To report payroll taxes and employee information * Sales tax records: To report and pay sales taxes

Other Tax-Related Paperwork

In addition to individual and business tax paperwork, there are other documents and forms that may be required for specific tax purposes. These include: * Estate tax returns: For estates with significant assets * Gift tax returns: For individuals who make large gifts * Tax exemption applications: For organizations seeking tax-exempt status * Tax audit documentation: To support tax returns in the event of an audit

| Document | Purpose |

|---|---|

| W-2 form | To report income and taxes withheld |

| 1099 form | To report income from freelance work and investments |

| Business tax return | To report business income and expenses |

💡 Note: It is essential to keep accurate and detailed records of all tax-related paperwork, as this can help ensure compliance with tax laws and regulations, and reduce the risk of errors or audits.

As we can see, tax paperwork is a complex and multifaceted topic, requiring a range of documents and forms to ensure compliance with tax laws and regulations. By understanding the different types of tax paperwork needed, individuals and businesses can better navigate the tax system and avoid potential pitfalls.

To summarize, the key points to take away are: * Individual tax paperwork includes documents such as W-2 forms, 1099 forms, and interest statements * Business tax paperwork includes documents such as business tax returns, financial statements, and expense records * Other tax-related paperwork includes documents such as estate tax returns, gift tax returns, and tax exemption applications * Accurate and detailed records are essential for ensuring compliance with tax laws and regulations

In the end, staying on top of tax paperwork is crucial for avoiding errors, reducing stress, and ensuring a smooth tax filing process. By being aware of the different types of tax paperwork needed and staying organized, individuals and businesses can save time and hassle, and focus on what matters most – growing and succeeding.

What is the purpose of a W-2 form?

+

The purpose of a W-2 form is to report an individual’s income and taxes withheld to the IRS.

What types of businesses need to file a business tax return?

+

Most businesses, including corporations, partnerships, and sole proprietorships, need to file a business tax return.

What is the deadline for filing individual tax returns?

+

The deadline for filing individual tax returns is typically April 15th of each year.