Hire 1099 Employee Paperwork Needed

Introduction to Hiring 1099 Employees

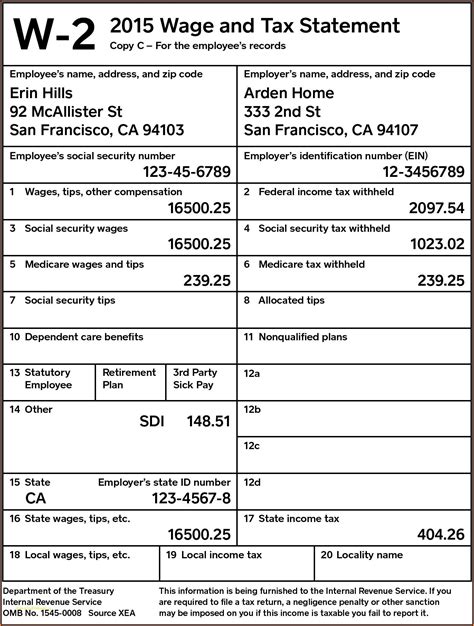

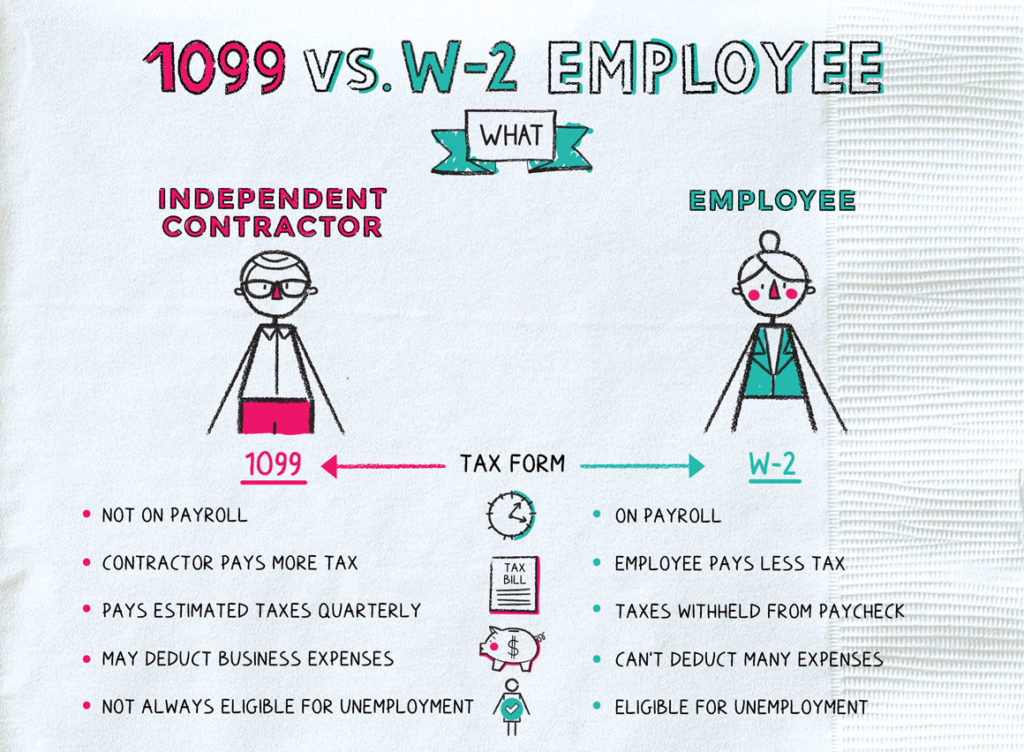

When you decide to hire a 1099 employee, also known as an independent contractor, it’s essential to understand the difference between 1099 employees and W-2 employees. A 1099 employee is considered self-employed and is responsible for their own taxes, benefits, and work schedule. On the other hand, a W-2 employee is a traditional employee who receives a salary or hourly wage, and the employer withholds taxes and provides benefits.

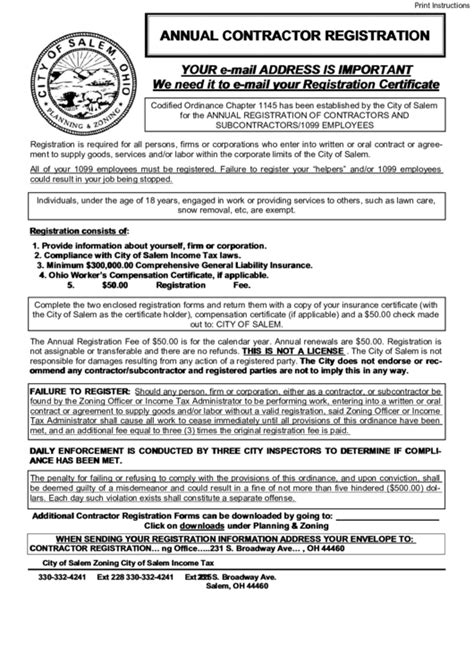

To hire a 1099 employee, you’ll need to complete specific paperwork to ensure compliance with tax laws and regulations. In this article, we’ll guide you through the necessary paperwork and steps to hire a 1099 employee.

Required Paperwork for 1099 Employees

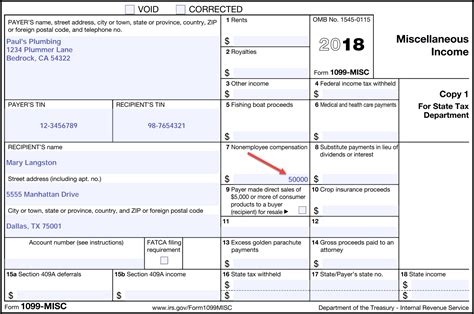

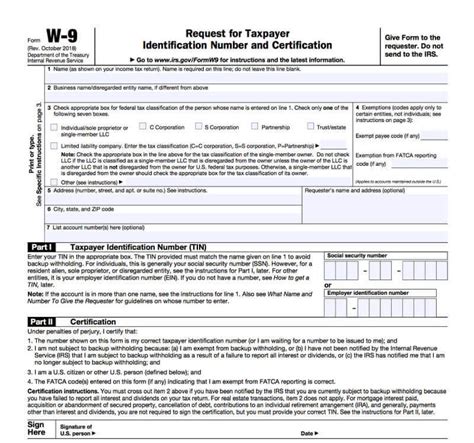

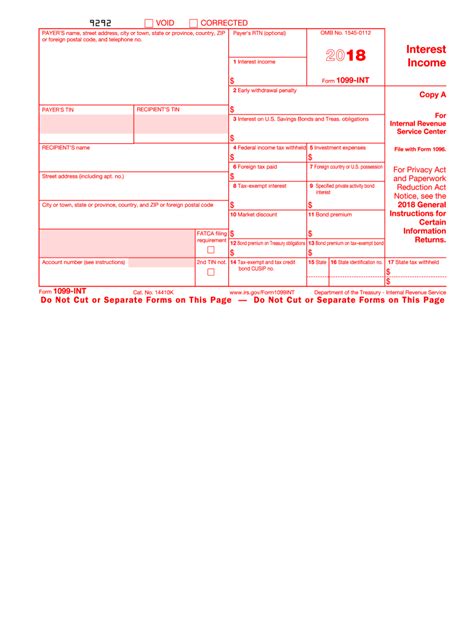

The following paperwork is required when hiring a 1099 employee: * Independent Contractor Agreement: This contract outlines the terms of the working relationship, including the scope of work, payment terms, and responsibilities. * W-9 Form: The W-9 form, also known as the Request for Taxpayer Identification Number and Certification, is used to collect the contractor’s name, address, and taxpayer identification number (TIN) or social security number (SSN). * 1099-MISC Form: The 1099-MISC form is used to report miscellaneous income, such as payments made to independent contractors. You’ll need to complete this form at the end of each tax year to report payments made to the contractor.

📝 Note: It's crucial to maintain accurate records of all paperwork and payments made to 1099 employees, as this information will be used to complete tax returns and other regulatory filings.

Steps to Hire a 1099 Employee

To hire a 1099 employee, follow these steps: * Determine the working relationship: Clearly define the scope of work, payment terms, and responsibilities to ensure both parties understand their roles and expectations. * Obtain necessary paperwork: Collect the independent contractor agreement, W-9 form, and any other required documentation. * Set up payment terms: Establish a payment schedule and method, such as hourly or project-based payments. * Report payments: Complete the 1099-MISC form at the end of each tax year to report payments made to the contractor.

Tax Implications for 1099 Employees

As a business owner, it’s essential to understand the tax implications of hiring 1099 employees. Since 1099 employees are considered self-employed, they are responsible for their own taxes, including: * Self-employment tax: 1099 employees must pay self-employment tax, which covers Social Security and Medicare taxes. * Income tax: 1099 employees must report their income on their tax return and pay income tax accordingly.

| Form | Purpose |

|---|---|

| W-9 | Request for Taxpayer Identification Number and Certification |

| 1099-MISC | Report miscellaneous income, such as payments made to independent contractors |

Benefits and Drawbacks of Hiring 1099 Employees

Hiring 1099 employees can offer several benefits, including: * Flexibility: 1099 employees can work on a project-by-project basis, allowing for flexibility in staffing and workload. * Cost savings: 1099 employees are responsible for their own benefits, taxes, and equipment, which can result in cost savings for the business. However, there are also some drawbacks to consider: * Limited control: As independent contractors, 1099 employees have more control over their work schedule and scope of work. * Tax complexity: The tax implications of hiring 1099 employees can be complex, and businesses must ensure compliance with all tax laws and regulations.

In summary, hiring a 1099 employee requires specific paperwork and steps to ensure compliance with tax laws and regulations. By understanding the benefits and drawbacks of hiring 1099 employees, businesses can make informed decisions about their staffing needs.

The key points to remember when hiring 1099 employees include the required paperwork, such as the independent contractor agreement and W-9 form, and the tax implications, including self-employment tax and income tax. By following the steps outlined in this article and maintaining accurate records, businesses can ensure a successful working relationship with their 1099 employees.

What is the difference between a 1099 employee and a W-2 employee?

+

A 1099 employee is considered self-employed and is responsible for their own taxes, benefits, and work schedule, while a W-2 employee is a traditional employee who receives a salary or hourly wage, and the employer withholds taxes and provides benefits.

What paperwork is required when hiring a 1099 employee?

+

The required paperwork includes an independent contractor agreement, W-9 form, and 1099-MISC form.

What are the tax implications of hiring 1099 employees?

+

1099 employees are responsible for their own taxes, including self-employment tax and income tax, and businesses must report payments made to independent contractors on the 1099-MISC form.