Hire Caregiver Paperwork Requirements

Introduction to Hiring a Caregiver

When hiring a caregiver, whether for oneself, a family member, or as part of a professional service, it’s essential to understand the various paperwork requirements involved. These requirements can vary significantly depending on the jurisdiction, the type of care needed, and the employment status of the caregiver. In this comprehensive guide, we will delve into the key paperwork requirements, legal considerations, and best practices for hiring a caregiver.

Understanding the Types of Caregivers

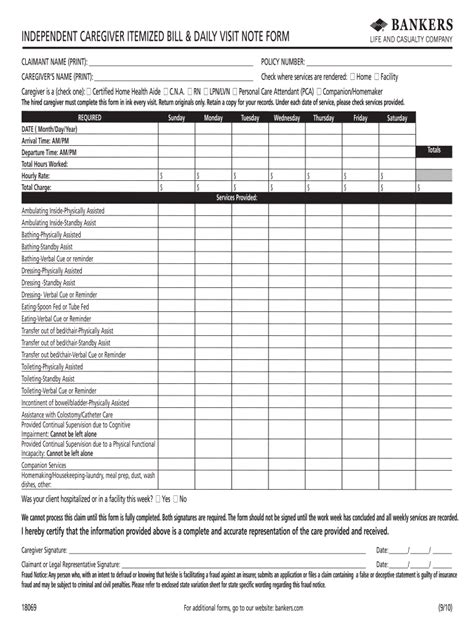

Before diving into the paperwork, it’s crucial to understand the different types of caregivers and their implications on the hiring process. Caregivers can be: - Independent Contractors: Individuals who work on their own and are not employed by an agency. Hiring an independent contractor involves different paperwork and legal considerations compared to hiring an employee. - Employees: Individuals who work directly for a family or an organization. Employing a caregiver as an employee involves more rigorous paperwork, including employment contracts, tax forms, and potentially workers’ compensation insurance. - Agency Workers: Caregivers hired through a home care agency. In this scenario, the agency typically handles most of the paperwork, but it’s still important for the family to understand their contractual obligations and the caregiver’s employment status.

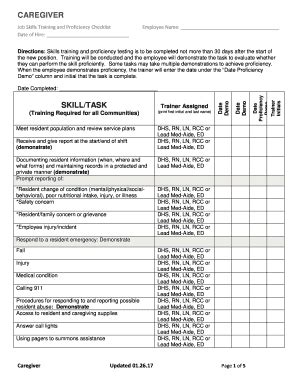

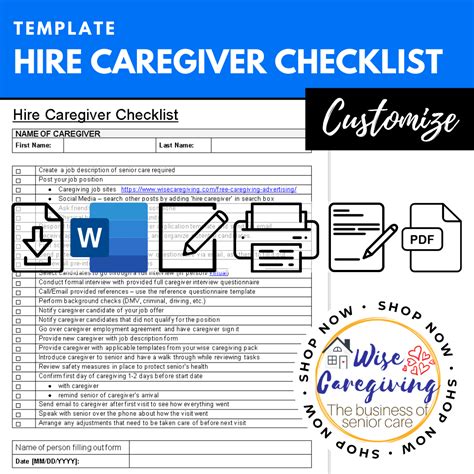

Essential Paperwork for Hiring a Caregiver

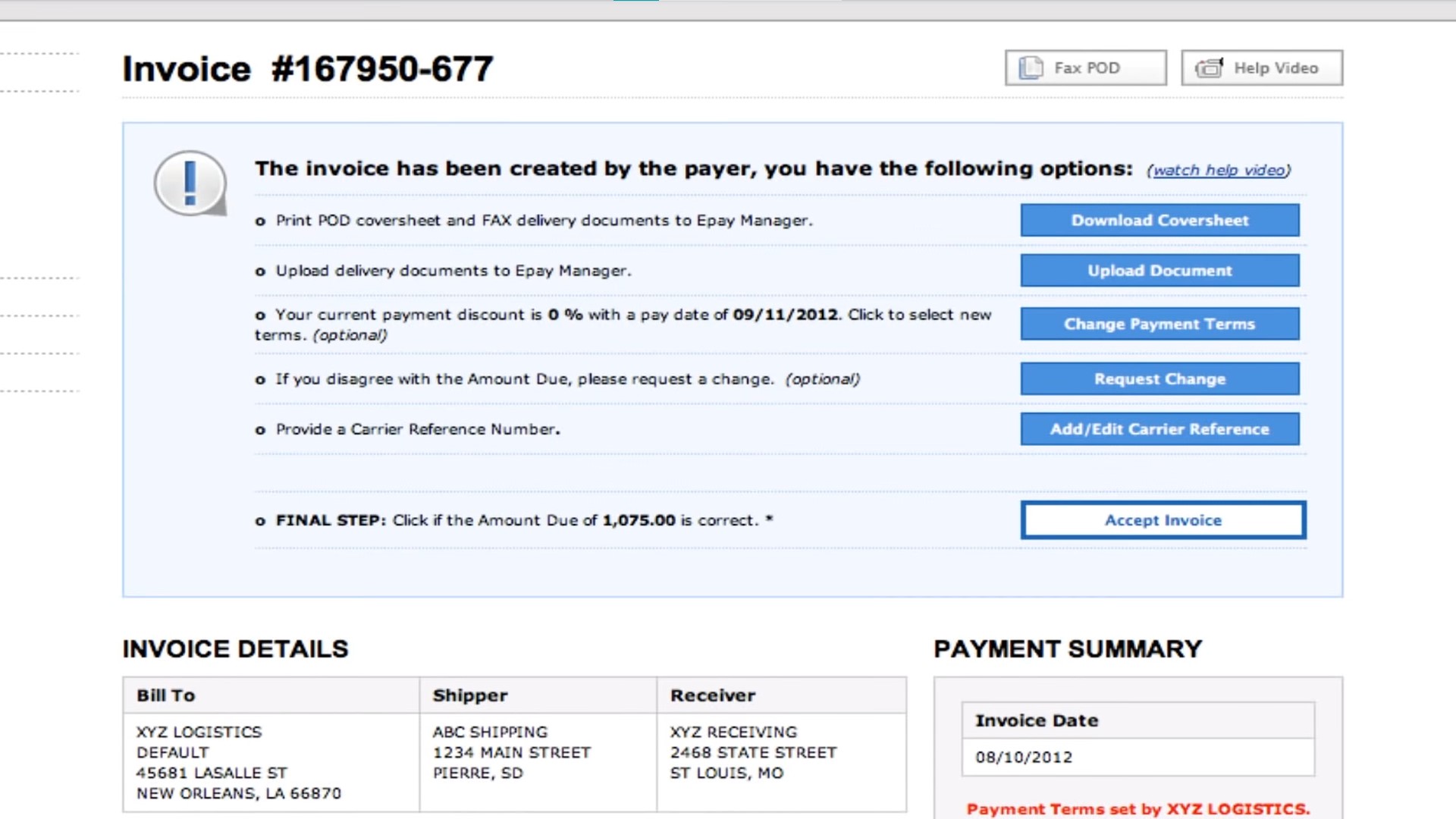

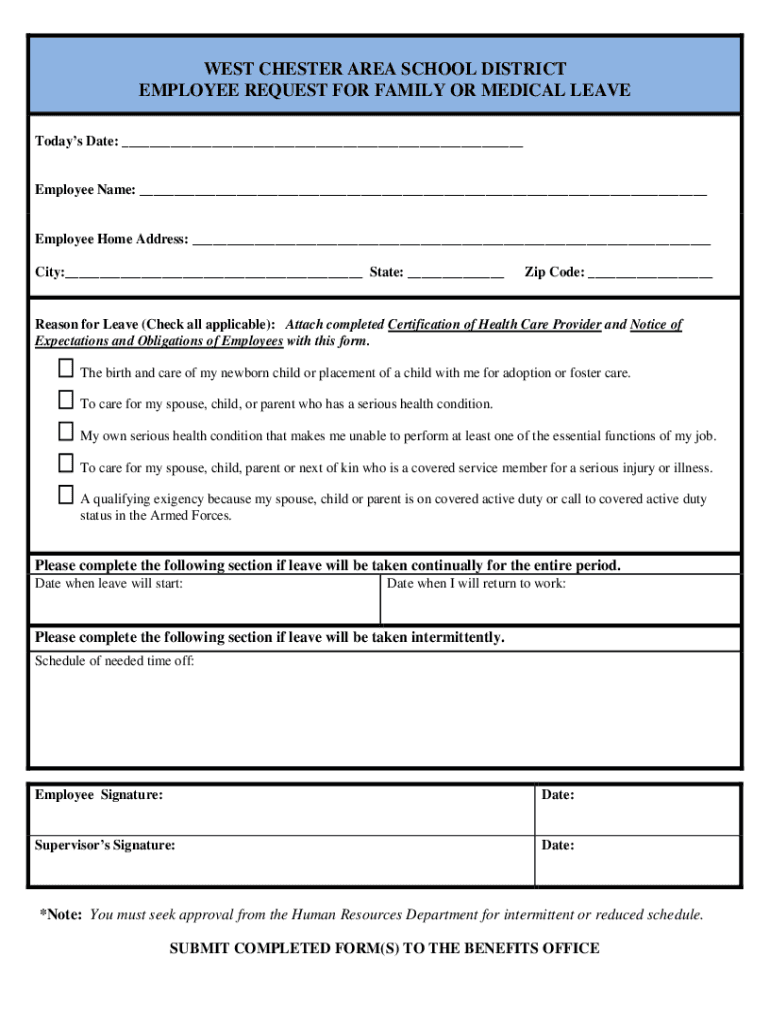

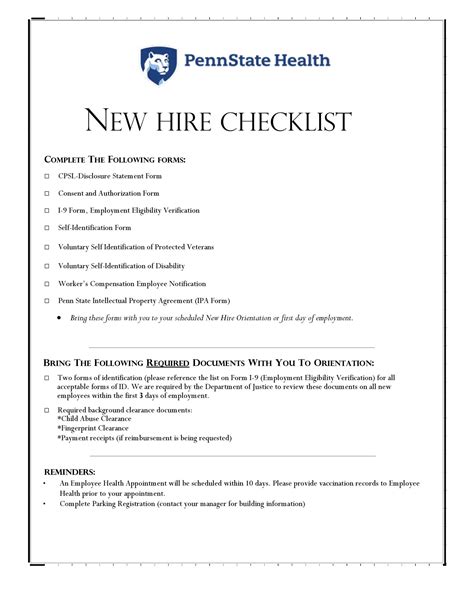

The following are key documents and paperwork requirements to consider when hiring a caregiver: - Employment Contract: Outlines the terms of employment, including job responsibilities, work schedule, compensation, and benefits. It’s a legally binding agreement between the caregiver and the employer. - Tax Forms: For employees, this includes forms like the W-4 for federal income tax withholding and potentially state or local tax forms. For independent contractors, a Form 1099-MISC is used to report payments of $600 or more in a calendar year. - Background Check Consent: Many states require background checks for caregivers. Obtaining consent from the caregiver to conduct these checks is a critical step in the hiring process. - Health Screening: Depending on the nature of the care, health screenings may be necessary to ensure the caregiver does not pose a health risk to the care recipient. - Workers’ Compensation Insurance: If the caregiver is considered an employee, the employer may need to secure workers’ compensation insurance to cover work-related injuries. - Non-Disclosure Agreement (NDA): Especially relevant if the caregiver will have access to sensitive personal or financial information.

Legal Considerations

Legal considerations play a vital role in the hiring process. Employers must comply with all relevant laws, including: - Labor Laws: Minimum wage, overtime, and break requirements vary by state and must be adhered to. - Anti-Discrimination Laws: Employers must not discriminate based on race, color, religion, sex, national origin, age, disability, or genetic information. - Immigration Laws: Verifying the caregiver’s right to work in the country is a critical legal requirement.

Best Practices for Hiring

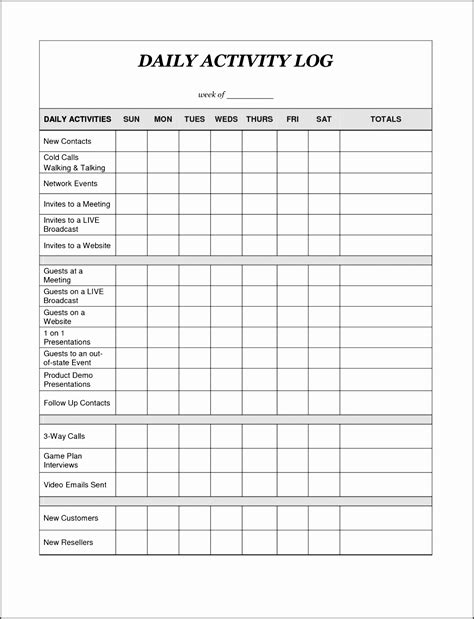

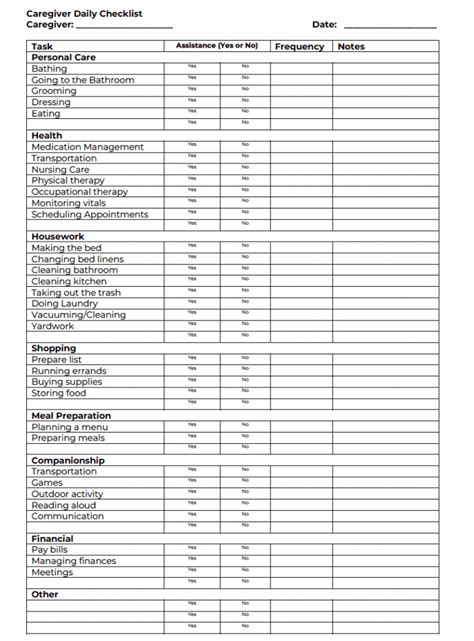

To ensure a smooth hiring process and a positive working relationship, consider the following best practices: - Clearly Define Job Responsibilities: Ensure the caregiver understands their duties and expectations. - Conduct Thorough Interviews: Assess the caregiver’s experience, skills, and compatibility with the care recipient’s needs. - Check References: Verify the caregiver’s previous work experience and reputation. - Maintain Open Communication: Regularly discuss the care recipient’s needs, any issues that arise, and the caregiver’s performance.

💡 Note: Always consult with a legal professional to ensure compliance with all local, state, and federal laws when hiring a caregiver.

Conclusion and Next Steps

Hiring a caregiver involves a significant amount of paperwork and legal considerations. By understanding the types of caregivers, essential paperwork, legal requirements, and best practices, individuals can navigate this complex process more effectively. Whether hiring independently or through an agency, prioritizing compliance and open communication can lead to a more successful and beneficial care arrangement for all parties involved.

What are the primary paperwork requirements when hiring a caregiver as an employee?

+

The primary paperwork requirements include an employment contract, tax forms (such as W-4), background check consent, and potentially workers’ compensation insurance. The specific requirements can vary depending on the jurisdiction and the nature of the care.

How do I determine if a caregiver should be classified as an independent contractor or an employee?

+

The classification depends on the level of control the employer has over the caregiver’s work, the caregiver’s independence, and the permanency of the working relationship. Generally, if the employer has significant control over how, when, and where the work is done, the caregiver is likely an employee. Consultation with a legal or tax professional is recommended to ensure proper classification.

What role does a home care agency play in the paperwork process?

+

A home care agency typically handles most of the paperwork related to the caregiver’s employment, including background checks, tax forms, and employment contracts. However, the family or individual hiring the caregiver through the agency should still understand their contractual obligations and the terms of service.