Itemize Taxes Paperwork Requirements

Understanding Taxes and Paperwork Requirements

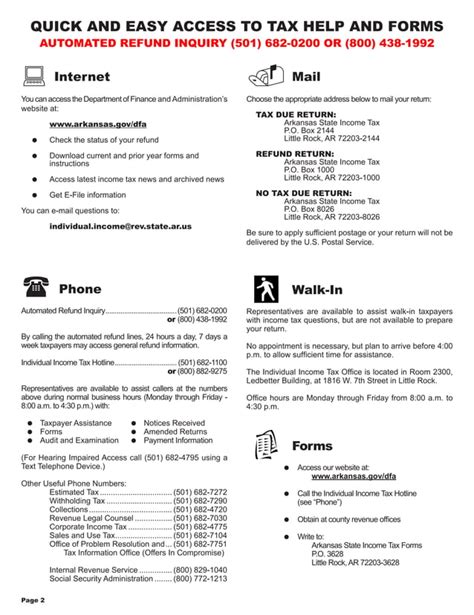

When it comes to managing finances, one of the most critical aspects is understanding and complying with tax regulations. Taxes are a mandatory contribution to the government, and individuals, businesses, and organizations must adhere to specific paperwork requirements to avoid penalties and ensure smooth operations. In this section, we will delve into the world of taxes and explore the necessary paperwork requirements.

Types of Taxes

There are several types of taxes, each with its unique paperwork requirements. Some of the most common types of taxes include: * Income Tax: Tax on an individual’s or business’s income, which includes earnings from employment, investments, and other sources. * Sales Tax: Tax on goods and services sold, typically applied at the point of purchase. * Property Tax: Tax on real estate and other properties, usually paid annually. * Payroll Tax: Tax on employment income, used to fund social security and other government programs.

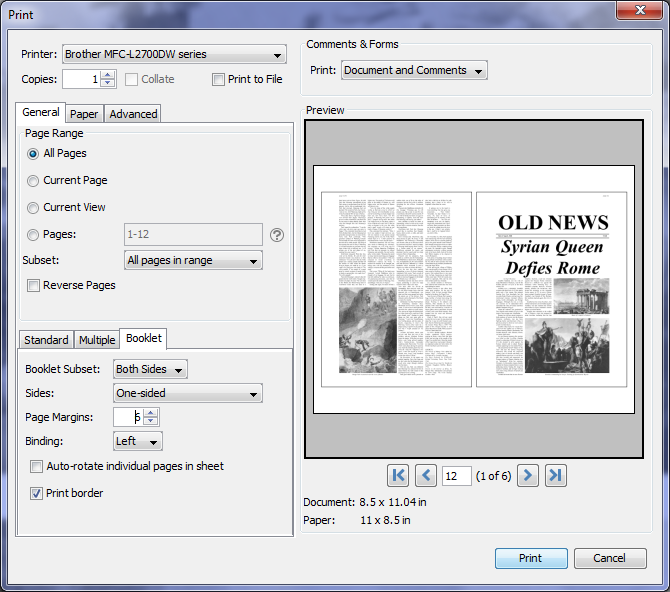

Individual Tax Paperwork Requirements

As an individual, it is essential to understand the necessary paperwork requirements for tax compliance. Some of the key documents include: * W-2 Form: Employers provide this form to employees, outlining their income and taxes withheld. * 1099 Form: Used to report income from freelance work, investments, and other non-employment sources. * Tax Returns: Individuals must file tax returns annually, reporting their income, deductions, and credits. * Supporting Documents: Receipts, invoices, and other records may be required to support tax deductions and credits.

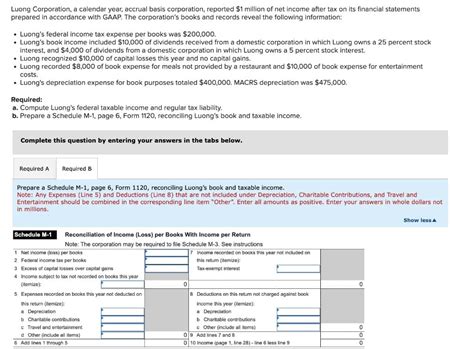

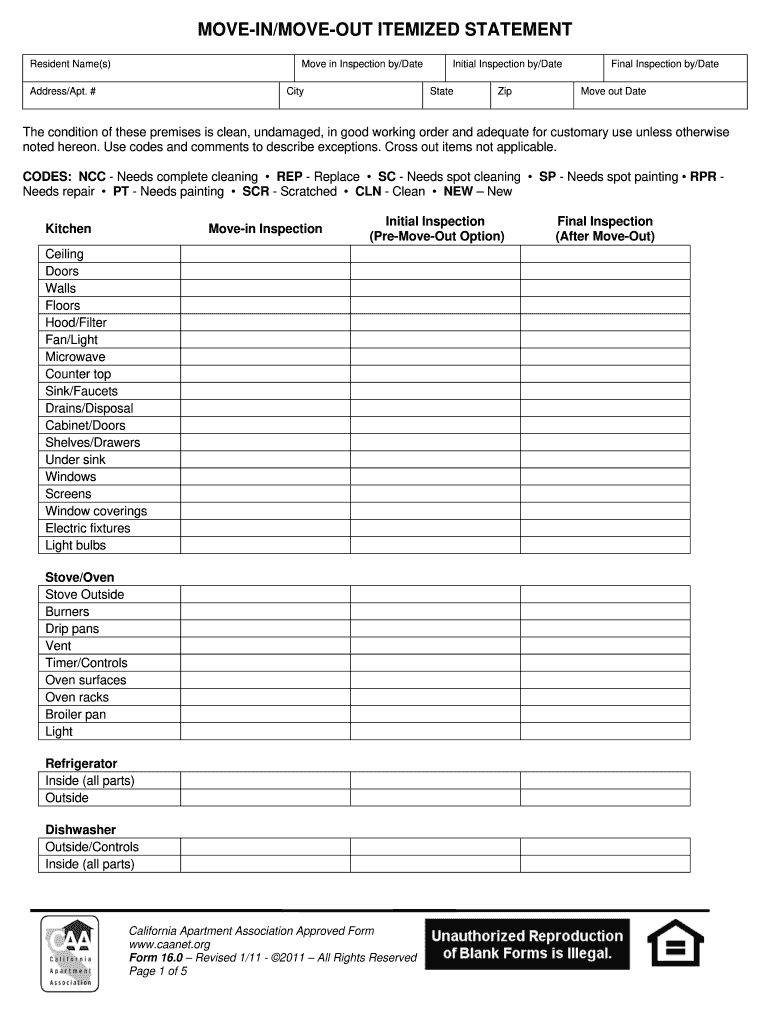

Business Tax Paperwork Requirements

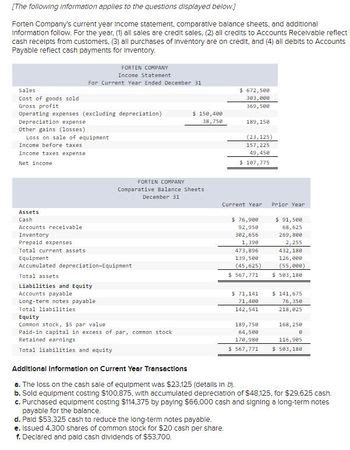

Businesses have more complex tax paperwork requirements, including: * Business Tax Returns: Companies must file tax returns, reporting their income, expenses, and taxes owed. * Employment Tax Returns: Businesses with employees must file employment tax returns, reporting payroll taxes and other employment-related taxes. * Sales Tax Returns: Companies must file sales tax returns, reporting sales tax collected and owed. * Financial Statements: Businesses may need to provide financial statements, such as balance sheets and income statements, to support tax returns.

Important Deadlines and Penalties

It is crucial to meet tax deadlines and avoid penalties. Some key deadlines include: * Tax Filing Deadline: Typically April 15th for individual tax returns and March 15th for business tax returns. * Extension Deadline: Taxpayers can request an extension, but must still pay any owed taxes by the original deadline. * Penalty Fees: Failure to file or pay taxes on time can result in penalty fees, interest, and even audits.

📝 Note: It is essential to consult with a tax professional or accountant to ensure compliance with all tax regulations and paperwork requirements.

Tax Paperwork Requirements for Specific Industries

Certain industries have unique tax paperwork requirements, such as: * Healthcare: Healthcare providers must comply with specific tax regulations, including reporting requirements for Medicare and Medicaid. * Financial Services: Financial institutions must adhere to strict tax regulations, including reporting requirements for investments and transactions. * Real Estate: Real estate businesses must comply with tax regulations, including reporting requirements for property sales and rentals.

| Industry | Tax Paperwork Requirements |

|---|---|

| Healthcare | Medicare and Medicaid reporting, HIPAA compliance |

| Financial Services | Investment reporting, transaction reporting, anti-money laundering compliance |

| Real Estate | Property sales and rental reporting, tax deductions for depreciation and interest |

In summary, understanding tax paperwork requirements is crucial for individuals, businesses, and organizations. By complying with tax regulations and meeting deadlines, taxpayers can avoid penalties and ensure smooth operations. It is essential to consult with a tax professional or accountant to ensure compliance with all tax regulations and paperwork requirements.

What are the consequences of not filing taxes on time?

+

Failure to file taxes on time can result in penalty fees, interest, and even audits. It is essential to meet tax deadlines to avoid these consequences.

What are the tax paperwork requirements for businesses?

+

Businesses must file tax returns, reporting their income, expenses, and taxes owed. They must also file employment tax returns, sales tax returns, and provide financial statements to support tax returns.

Can I request an extension for filing taxes?

+

Yes, taxpayers can request an extension, but must still pay any owed taxes by the original deadline. It is essential to consult with a tax professional or accountant to ensure compliance with all tax regulations and paperwork requirements.