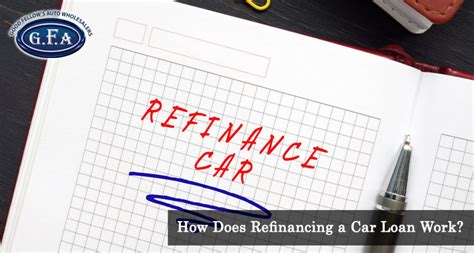

Refinance Car Paperwork Needed

Introduction to Refinancing Your Car

Refinancing your car can be a great way to save money on your monthly payments, lower your interest rate, or even remove a co-signer from your original loan. However, before you can start enjoying the benefits of refinancing, you’ll need to gather the necessary paperwork. In this article, we’ll guide you through the refinance car paperwork needed to make the process as smooth as possible.

Understanding the Refinancing Process

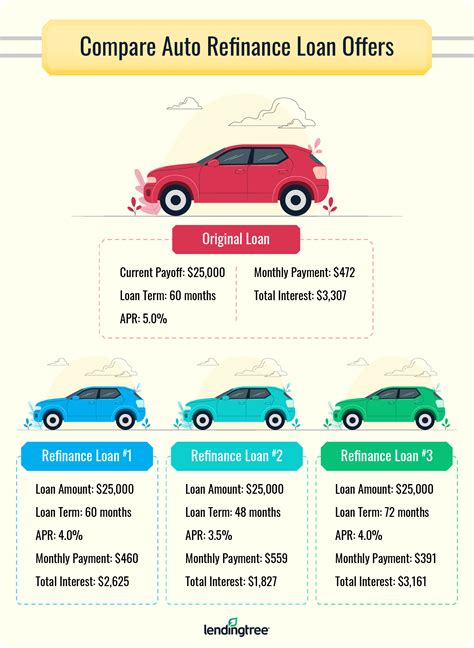

The refinancing process involves replacing your current car loan with a new one, usually with a different lender, to take advantage of better terms. This can be due to various reasons such as improved credit score, lower interest rates, or changes in financial situation. To begin, you’ll need to apply for a new loan, and the lender will require certain documents to process your application.

Documents Required for Refinancing

Here’s a list of the typical refinance car paperwork needed: * Identification: A valid government-issued ID, such as a driver’s license or passport. * Proof of Income: Pay stubs, W-2 forms, or tax returns to demonstrate your income stability. * Proof of Employment: A letter from your employer or recent pay stubs. * Vehicle Information: The vehicle’s make, model, year, and Vehicle Identification Number (VIN). * Current Loan Information: Details about your current loan, including the lender, loan balance, and monthly payment amount. * Insurance Information: Proof of insurance that meets the lender’s requirements. * Title: The car’s title, which may need to be transferred to the new lender. * Registration: The vehicle’s registration, which may also need to be updated.

📝 Note: The exact documents required may vary depending on the lender and your individual circumstances, so it's essential to check with the lender beforehand.

Steps to Refinance Your Car

Once you’ve gathered all the necessary paperwork, you can start the refinancing process: * Check your credit score: Your credit score plays a significant role in determining the interest rate you’ll qualify for. A good credit score can help you secure a better deal. * Research lenders: Compare rates and terms from different lenders to find the best option for your situation. * Apply for refinancing: Submit your application and provide the required documents. * Review and sign the new loan agreement: Carefully review the terms and conditions of the new loan before signing.

Benefits of Refinancing Your Car

Refinancing your car can have several benefits, including: * Lower monthly payments: By extending the loan term or reducing the interest rate, you can lower your monthly payments and make them more manageable. * Lower interest rate: If you’ve improved your credit score or interest rates have dropped since you took out the original loan, you may be able to secure a lower interest rate. * Removing a co-signer: If you had a co-signer on your original loan, you may be able to remove them by refinancing the loan in your name only.

Challenges and Considerations

While refinancing your car can be beneficial, there are also some challenges and considerations to keep in mind: * Fees and charges: Refinancing may involve fees, such as origination fees or prepayment penalties, which can add to the overall cost of the loan. * Loan term: Refinancing may extend the loan term, which can mean paying more in interest over the life of the loan. * Credit score impact: Applying for refinancing can result in a hard inquiry on your credit report, which can temporarily lower your credit score.

Refinancing with Bad Credit

If you have bad credit, refinancing your car may be more challenging, but it’s not impossible. You may need to: * Shop around for lenders: Some lenders specialize in bad credit loans, so it’s essential to compare rates and terms. * Consider a co-signer: Having a co-signer with good credit can help you qualify for a better interest rate. * Be prepared for higher interest rates: Bad credit may result in higher interest rates, so it’s crucial to carefully review the loan terms before signing.

| Document | Description |

|---|---|

| Identification | Valid government-issued ID |

| Proof of Income | Pay stubs, W-2 forms, or tax returns |

| Proof of Employment | Letter from employer or recent pay stubs |

| Vehicle Information | Make, model, year, and VIN |

| Current Loan Information | Lender, loan balance, and monthly payment amount |

| Insurance Information | Proof of insurance that meets lender's requirements |

| Title | Car's title, which may need to be transferred |

| Registration | Vehicle's registration, which may need to be updated |

In summary, refinancing your car requires gathering the necessary paperwork, including identification, proof of income, and vehicle information. By understanding the refinancing process and carefully reviewing the loan terms, you can make an informed decision and potentially save money on your monthly payments. Refinancing can be beneficial, but it’s essential to consider the challenges and limitations, especially if you have bad credit.

What are the benefits of refinancing my car?

+

The benefits of refinancing your car include lower monthly payments, lower interest rates, and the possibility of removing a co-signer from the original loan.

What documents do I need to refinance my car?

+

The typical documents required for refinancing a car include identification, proof of income, proof of employment, vehicle information, current loan information, insurance information, title, and registration.

Can I refinance my car with bad credit?

+

Yes, it is possible to refinance your car with bad credit, but you may need to shop around for lenders, consider a co-signer, and be prepared for higher interest rates.

How long does the refinancing process typically take?

+

The refinancing process can take anywhere from a few days to several weeks, depending on the lender and the complexity of the application.

Will refinancing my car affect my credit score?

+

Refinancing your car may result in a hard inquiry on your credit report, which can temporarily lower your credit score. However, making timely payments on the new loan can help improve your credit score over time.