Refinance House Paperwork Needed

Introduction to Refinancing a House

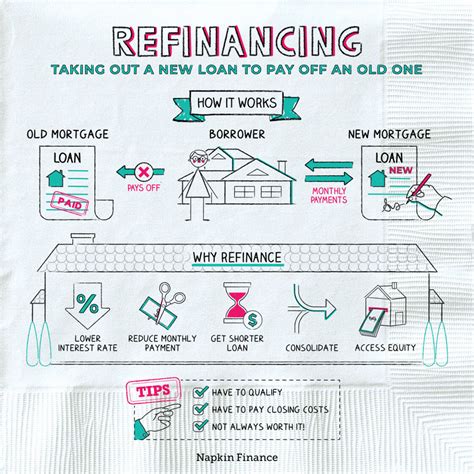

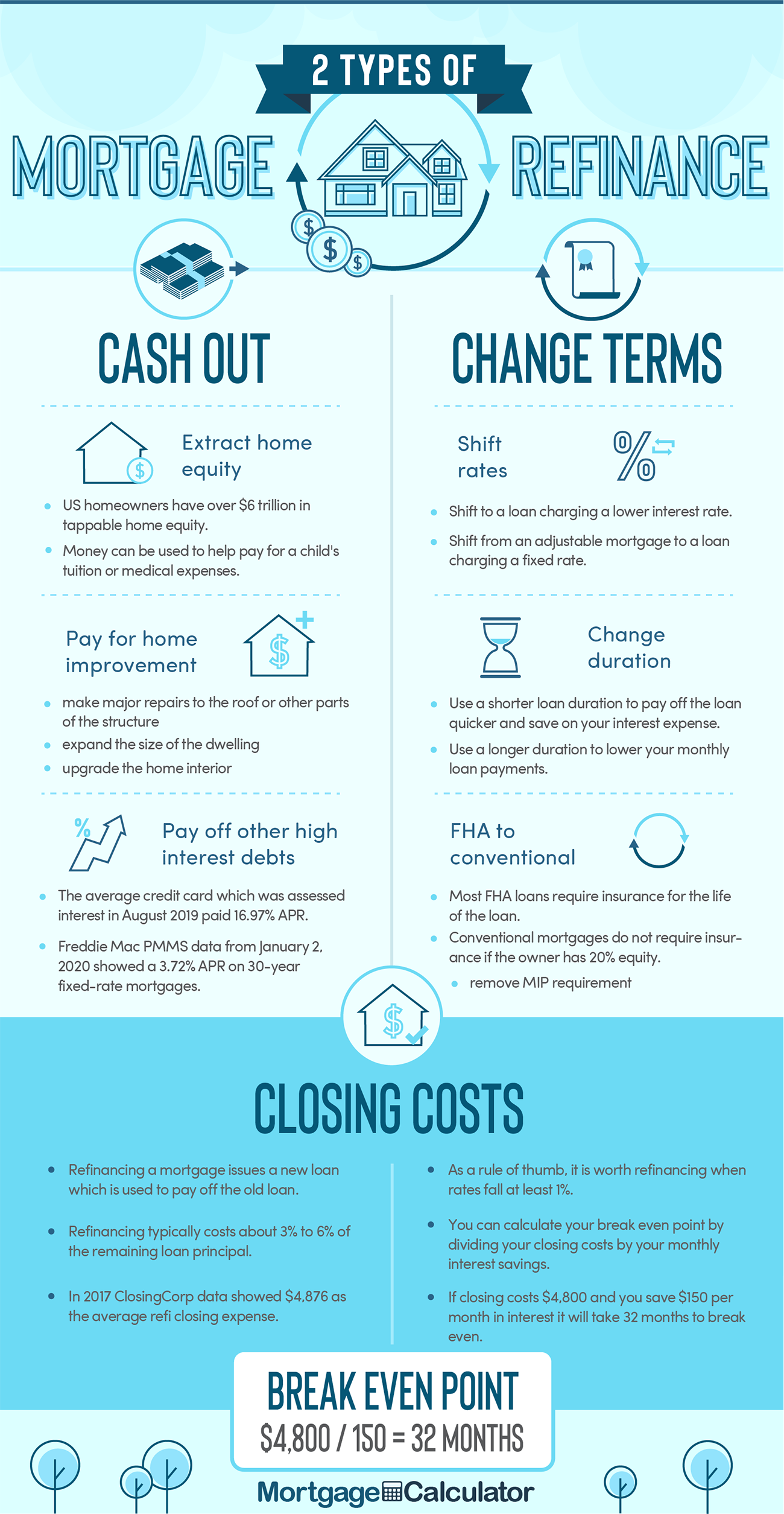

Refinancing a house can be a great way to lower monthly mortgage payments, tap into home equity, or switch from an adjustable-rate to a fixed-rate loan. However, the process of refinancing a house can be complex and requires careful planning and preparation. One of the key steps in the refinancing process is gathering the necessary paperwork. In this article, we will discuss the various documents and information that are typically required to refinance a house.

Understanding the Refinancing Process

Before we dive into the paperwork needed to refinance a house, it’s essential to understand the refinancing process. Refinancing involves replacing an existing mortgage with a new one, usually with a lower interest rate or better terms. The process typically involves several steps, including:

- Checking credit scores and history

- Gathering financial documents and information

- Applying for a new loan

- Undergoing an appraisal (if necessary)

- Reviewing and signing loan documents

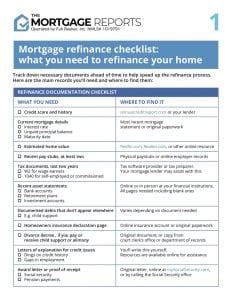

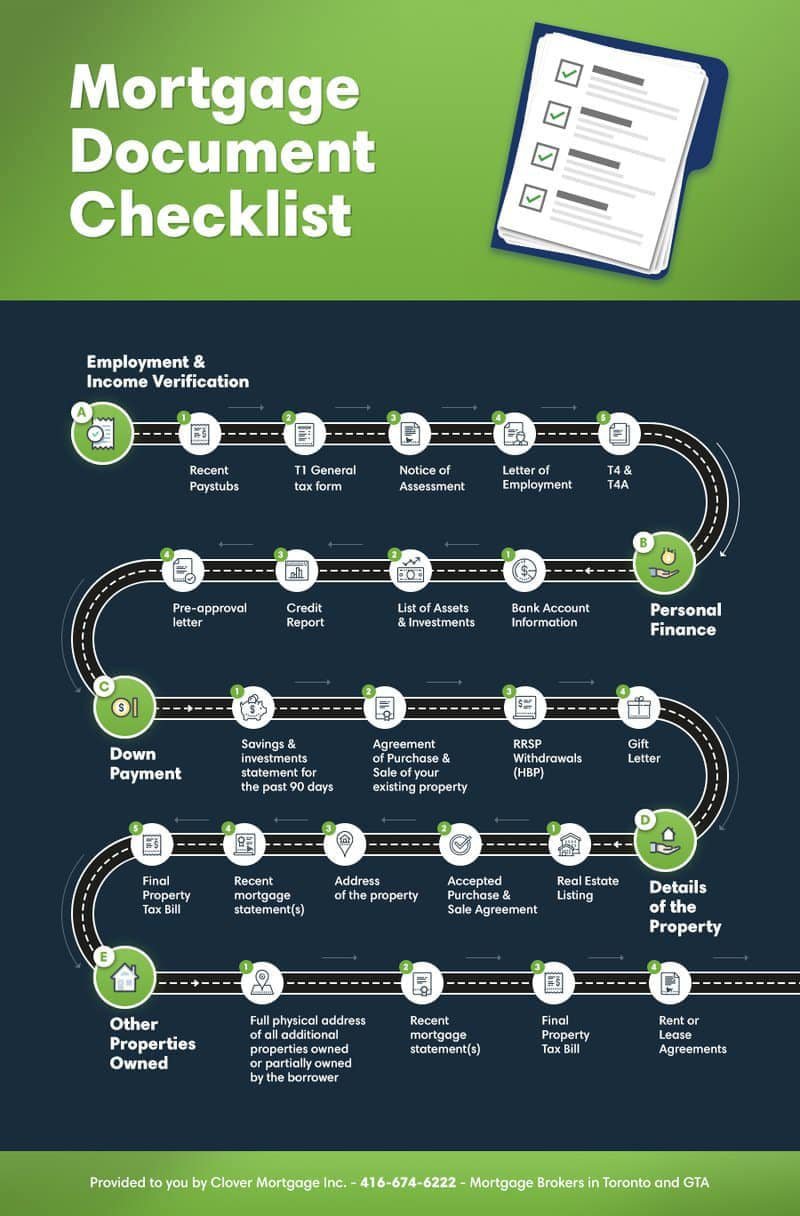

Paperwork Needed to Refinance a House

To refinance a house, you will typically need to provide the following documents and information:

- Identification: A valid government-issued ID, such as a driver’s license or passport

- Income verification: Pay stubs, W-2 forms, and tax returns to demonstrate income and employment

- Credit reports: A credit report from the three major credit bureaus (Equifax, Experian, and TransUnion)

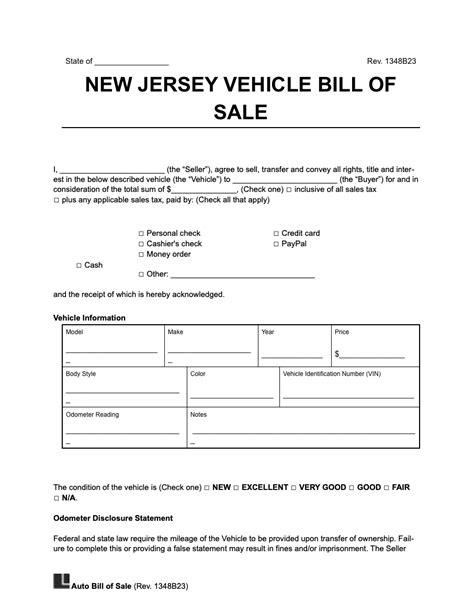

- Property documents: Deed, title, and mortgage statements for the property being refinanced

- Appraisal: An appraisal report, if required by the lender

- Insurance: Proof of homeowners insurance and flood insurance (if applicable)

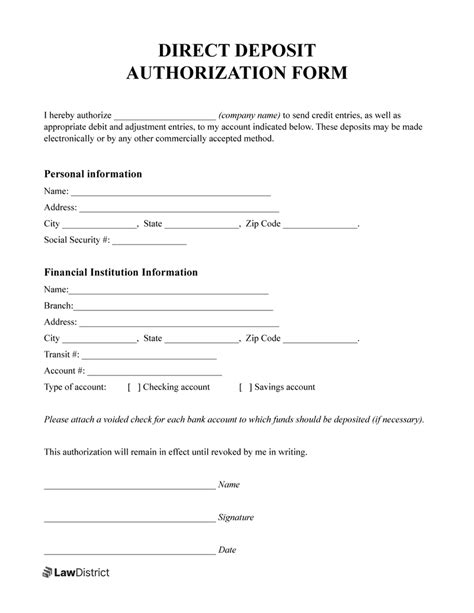

- Loan application: A completed loan application, which will require information about the property, loan terms, and borrower financials

📝 Note: The specific documents required may vary depending on the lender, loan program, and borrower circumstances.

Additional Requirements for Specific Loan Programs

Some loan programs may require additional documentation or information. For example:

- FHA loans: An FHA case number, appraisal report, and proof of mortgage insurance premium payments

- VA loans: A certificate of eligibility, DD Form 214, and proof of military service

- USDA loans: A rural area eligibility map, income limits, and proof of rural residency

- Jumbo loans: Additional financial documentation, such as investment accounts and business tax returns

Organizing Your Paperwork

To make the refinancing process smoother, it’s essential to organize your paperwork and have all the necessary documents readily available. You can use a checklist or a folder to keep track of the required documents and information. It’s also a good idea to make digital copies of your documents, in case you need to access them quickly.

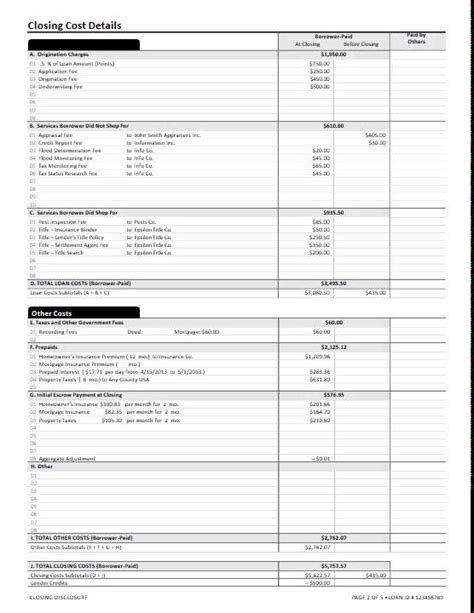

Submission and Review Process

Once you have gathered all the necessary paperwork, you will need to submit it to your lender for review. The lender will review your application, verify the information, and order an appraisal (if necessary). The review process typically takes several days to several weeks, depending on the complexity of the loan and the lender’s workload.

| Document | Description |

|---|---|

| Identification | Valid government-issued ID |

| Income verification | Pay stubs, W-2 forms, and tax returns |

| Credit reports | Credit reports from the three major credit bureaus |

| Property documents | Deed, title, and mortgage statements |

| Appraisal | Appraisal report (if required) |

Finalizing the Refinancing Process

After the lender has reviewed and approved your application, you will need to sign the loan documents and complete the refinancing process. This typically involves:

- Reviewing and signing the loan agreement

- Transferring funds to pay off the existing loan

- Recording the new deed and mortgage

📝 Note: The final steps of the refinancing process may vary depending on the lender and loan program.

In summary, refinancing a house requires careful planning, preparation, and organization. By gathering the necessary paperwork and information, you can make the process smoother and increase your chances of approval. It’s essential to understand the refinancing process, additional requirements for specific loan programs, and the submission and review process. With the right preparation and guidance, you can successfully refinance your house and achieve your financial goals.

What is the first step in the refinancing process?

+

The first step in the refinancing process is to check your credit scores and history.

What documents do I need to provide to refinance a house?

+

You will typically need to provide identification, income verification, credit reports, property documents, and appraisal (if required).

How long does the refinancing process take?

+

The refinancing process typically takes several days to several weeks, depending on the complexity of the loan and the lender’s workload.