Selling House Paperwork Requirements

Introduction to Selling a House

When it comes to selling a house, there are numerous factors to consider, from determining the right price to navigating the complex paperwork involved. The process can be overwhelming, especially for those who are new to real estate transactions. Understanding the necessary paperwork requirements is crucial to ensure a smooth and successful sale. In this article, we will delve into the world of selling house paperwork, exploring the key documents and steps involved in the process.

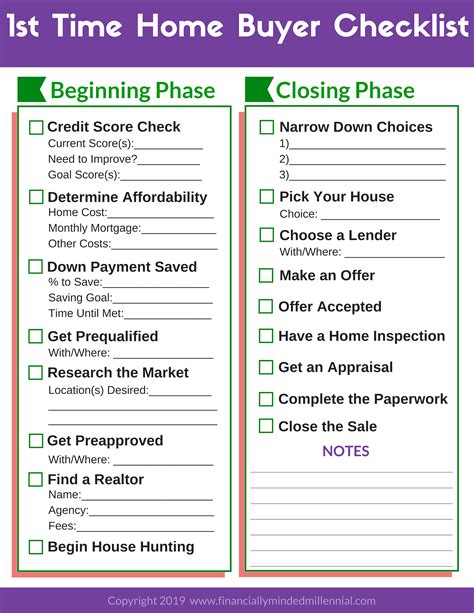

Pre-Sale Preparations

Before listing a house for sale, it’s essential to gather and prepare the necessary documents. This includes: * Title deeds: Proof of ownership, which may include the property deed, title report, or other documents that demonstrate the seller’s right to sell the property. * Property surveys: Documents that outline the property boundaries, including any easements or encumbrances. * Mortgage information: Details about any outstanding mortgages or liens on the property. * Tax records: Proof of paid property taxes, which may be required by the buyer or their lender. * Home inspection reports: Documents that highlight any potential issues with the property, such as termite damage or structural problems.

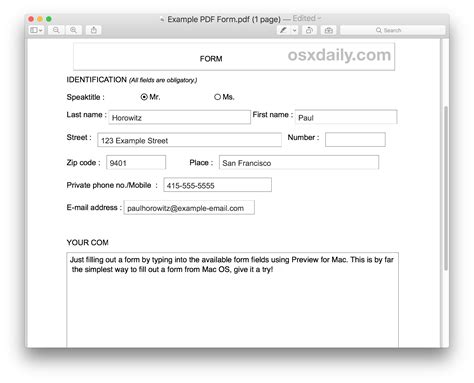

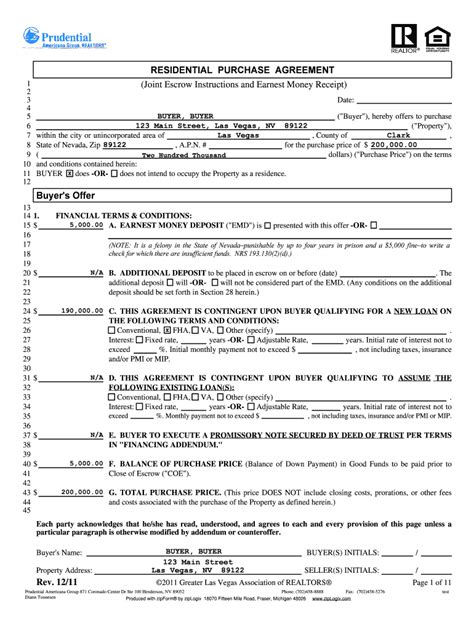

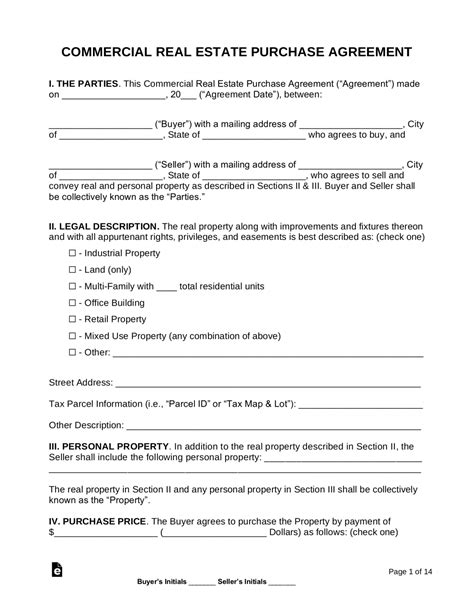

Sale Agreement and Contract

Once a buyer is found, the next step is to draft a sale agreement and contract. This document should include: * Purchase price: The agreed-upon price for the property. * Deposit amount: The amount of money the buyer is required to pay as a deposit. * Settlement date: The date when the sale is finalized, and the property is transferred to the buyer. * Conditions of sale: Any conditions that must be met before the sale can proceed, such as the buyer securing financing or the seller completing repairs. * Warranties and representations: Statements made by the seller about the property, such as its condition or any existing defects.

Disclosure Requirements

Sellers are required to disclose certain information about the property to potential buyers. This may include: * Lead-based paint disclosure: If the property was built before 1978, the seller must disclose the presence of lead-based paint. * Environmental hazards: Disclosure of any environmental hazards, such as asbestos or radon. * Property defects: Disclosure of any known defects or issues with the property, such as termite damage or structural problems. * Neighborhood information: Disclosure of any information about the neighborhood, such as nearby industrial sites or noise pollution.

📝 Note: The specific disclosure requirements may vary depending on the location and type of property being sold.

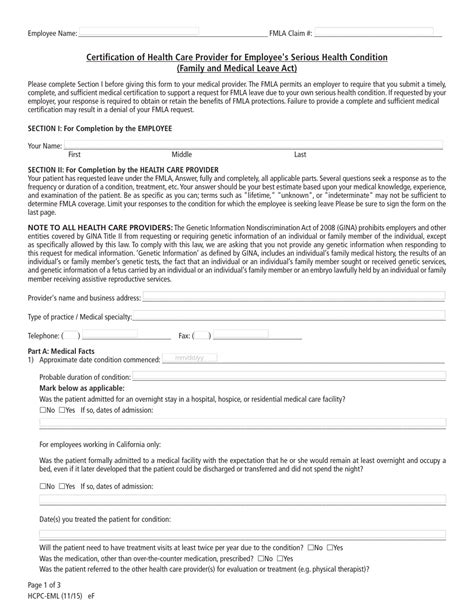

Inspections and Due Diligence

Before finalizing the sale, the buyer will typically conduct inspections and due diligence to ensure they are making an informed purchase. This may include: * Home inspections: A thorough examination of the property to identify any potential issues or defects. * Pest inspections: Inspection for signs of pest infestation, such as termites or rodents. * Environmental inspections: Inspection for environmental hazards, such as asbestos or lead-based paint. * Review of property records: Review of property records to ensure the seller has the right to sell the property and that there are no unexpected liens or encumbrances.

Closing and Settlement

The final step in the sale process is closing and settlement. This is where the buyer and seller meet to sign the final documents and transfer ownership of the property. The necessary documents for closing and settlement include: * Deed: The document that transfers ownership of the property from the seller to the buyer. * Mortgage documents: Documents that secure the buyer’s financing, such as a mortgage note and deed of trust. * Title insurance: Insurance that protects the buyer and lender from any unexpected title issues or defects. * Settlement statement: A document that outlines the final terms of the sale, including the purchase price, closing costs, and any prorations.

| Document | Description |

|---|---|

| Title deeds | Proof of ownership |

| Property surveys | Property boundaries and easements |

| Mortgage information | Outstanding mortgages or liens |

| Tax records | Proof of paid property taxes |

| Home inspection reports | Potential issues with the property |

In summary, selling a house involves a complex array of paperwork and documentation. From pre-sale preparations to closing and settlement, it’s essential to understand the necessary documents and steps involved in the process. By being prepared and knowledgeable, sellers can ensure a smooth and successful sale, and buyers can make informed purchasing decisions.

What is the purpose of a title search?

+

A title search is conducted to ensure the seller has the right to sell the property and that there are no unexpected liens or encumbrances.

What is included in a home inspection report?

+

A home inspection report typically includes information about the property’s condition, including any potential issues or defects, such as termite damage or structural problems.

What is the difference between a sale agreement and a contract?

+

A sale agreement outlines the terms of the sale, including the purchase price and settlement date, while a contract is a legally binding document that outlines the obligations and responsibilities of both the buyer and seller.