Lender Paperwork Requirements

Introduction to Lender Paperwork Requirements

When applying for a loan, whether it’s for a personal, business, or mortgage purpose, one of the most critical steps in the process is gathering and submitting the required paperwork. Lender paperwork requirements can vary significantly depending on the type of loan, the lender, and the borrower’s circumstances. Understanding these requirements upfront can help streamline the loan application process, reduce the risk of delays, and improve the chances of approval.

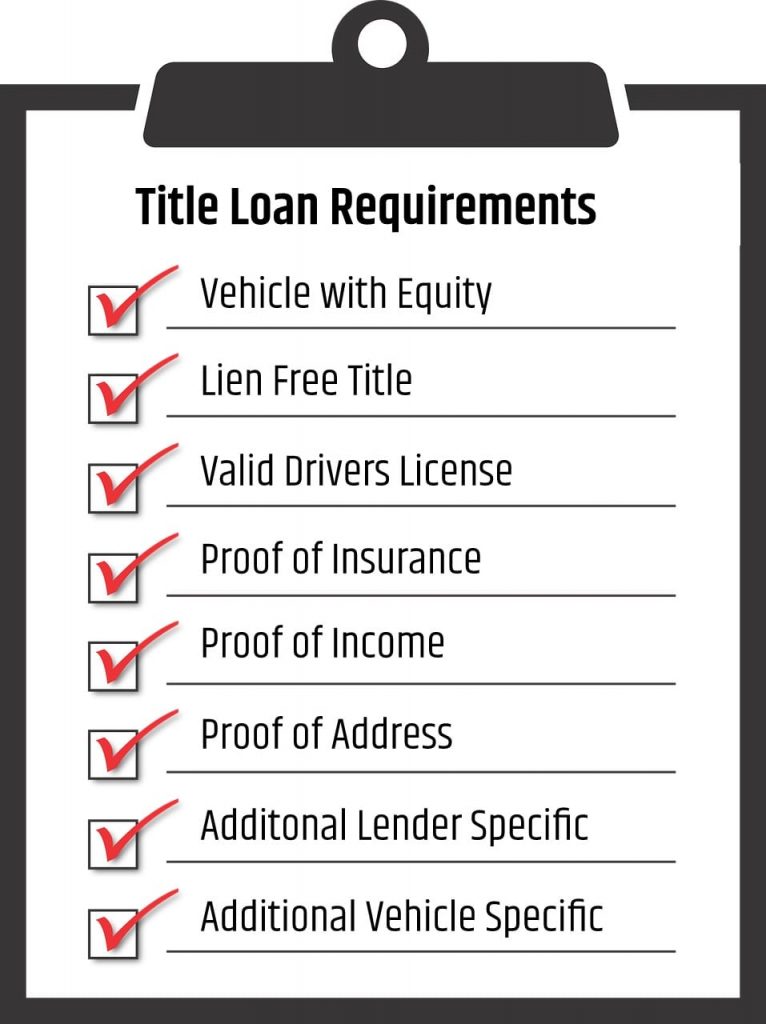

Types of Loans and Their Paperwork Requirements

Different types of loans have distinct paperwork requirements. Here’s a breakdown of some common loan types and the typical documents needed for each:

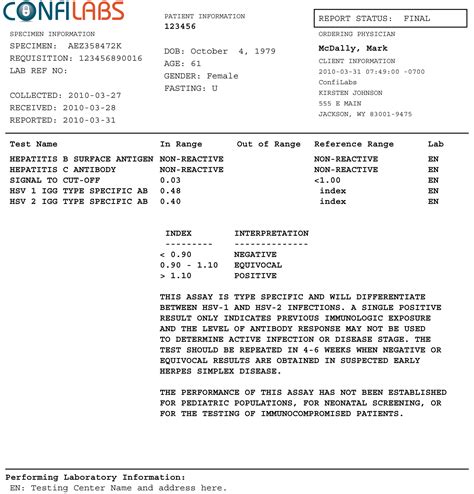

Personal Loans: These loans are for individual use and often require less paperwork compared to business or mortgage loans. Typical documents include:

- Identification (ID)

- Proof of income (pay stubs, W-2 forms)

- Proof of employment

- Bank statements

- Credit reports

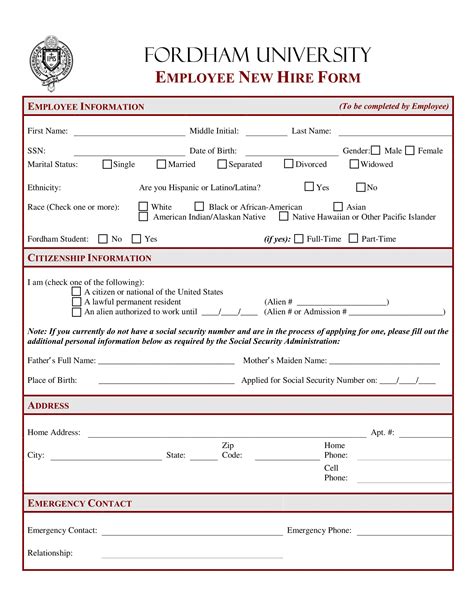

Business Loans: For entrepreneurs and small business owners, the paperwork can be more extensive. Required documents may include:

- Business plan

- Financial statements (balance sheet, income statement, cash flow statement)

- Tax returns (personal and business)

- Proof of business ownership

- Bank statements (personal and business)

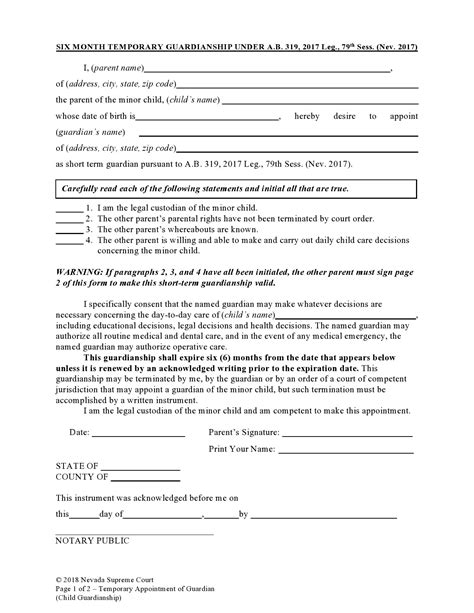

Mortgage Loans: Applying for a mortgage involves a significant amount of paperwork due to the high value of the loan and the property involved. Necessary documents typically include:

- Identification

- Proof of income (pay stubs, W-2 forms, tax returns)

- Proof of employment

- Bank statements

- Credit reports

- Appraisal of the property

- Title insurance

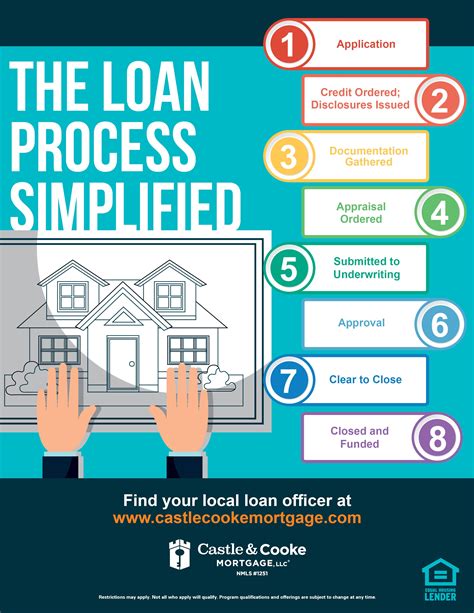

Understanding the Paperwork Process

The process of gathering and submitting lender paperwork requirements involves several steps:

- Pre-approval: Before starting the formal application, many borrowers seek pre-approval to understand how much they can borrow. This step requires minimal paperwork but gives an idea of the loan amount and interest rate.

- Application: The formal loan application process begins with submitting the required documents. This can often be done online, through mail, or in person, depending on the lender’s policies.

- Review and Verification: The lender reviews the submitted documents, verifies the information, and may request additional paperwork if necessary.

- Approval and Loan Offer: If the application is successful, the lender extends a loan offer, including the loan amount, interest rate, repayment terms, and other conditions.

- Closing: For mortgage loans and some business loans, there’s a closing process where the borrower signs the final documents, and the loan is disbursed.

Digitization of Lender Paperwork

The digitization of lender paperwork has significantly simplified the loan application process. Many lenders now offer online platforms where borrowers can upload required documents, track the status of their application, and even sign documents electronically. This digital approach reduces paperwork, speeds up the process, and enhances the overall borrower experience.

Importance of Accuracy and Completeness

Accuracy and completeness of the submitted paperwork are crucial for a successful loan application. Inaccurate or incomplete documents can lead to delays, additional requests for information, or even rejection of the loan application. Borrowers should ensure they understand what documents are required and that they are submitted correctly and on time.

Conclusion

In summary, lender paperwork requirements are a critical component of the loan application process. Understanding these requirements, being prepared, and submitting accurate and complete documents can make a significant difference in the outcome of the application. Whether applying for a personal, business, or mortgage loan, borrowers should approach the process with diligence and attention to detail to navigate the requirements effectively and secure the needed funds.

What is the most common reason for loan application rejection?

+

One of the most common reasons for loan application rejection is incomplete or inaccurate paperwork, along with poor credit history.

Can I apply for a loan online?

+

Yes, many lenders offer online loan application processes where you can submit your documents and track your application status digitally.

How long does the loan application process typically take?

+

The duration of the loan application process can vary significantly depending on the type of loan and the lender. It can range from a few days for personal loans to several weeks for mortgage loans.