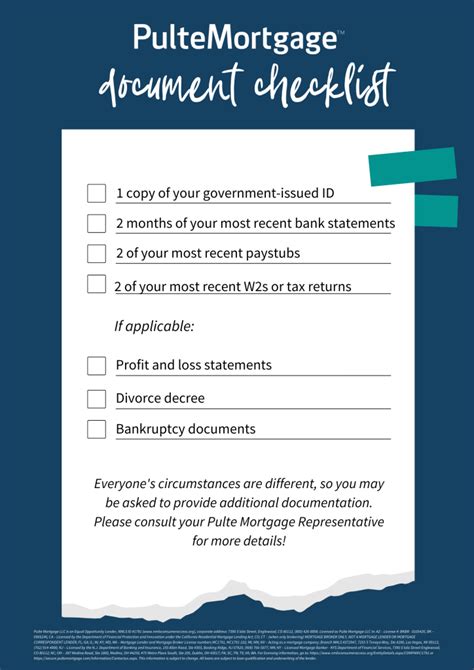

5 Documents Needed

Introduction to Essential Documents

When it comes to personal and financial security, having the right documents in place is crucial. These documents not only help in organizing your affairs but also ensure that your wishes are respected in case of an emergency or upon your passing. In this article, we will explore five essential documents that everyone should have.

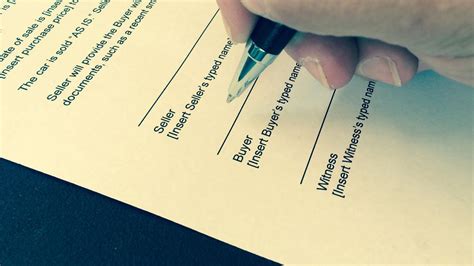

1. Last Will and Testament

A Last Will and Testament is a legal document that outlines how you want your assets to be distributed after your death. It allows you to appoint an executor who will carry out your wishes as stated in the will. This document is vital for ensuring that your estate is managed according to your desires and that your loved ones are taken care of. Without a will, the state laws will dictate how your assets are divided, which might not align with your intentions.

2. Power of Attorney

A Power of Attorney (POA) is a document that grants someone you trust the authority to make financial and healthcare decisions on your behalf if you become incapacitated. This document is crucial for ensuring that your finances and health are managed according to your wishes even when you cannot make decisions for yourself. There are different types of POA, including durable POA which remains in effect even if you become incapacitated, and springing POA which only takes effect upon your incapacitation.

3. Advance Directive

An Advance Directive, also known as a living will, is a document that specifies the medical treatment you want to receive if you become terminally ill or permanently unconscious. This document allows you to make your wishes known regarding end-of-life care, including whether you want to receive life-sustaining treatments such as ventilators or artificial nutrition and hydration. Having an Advance Directive ensures that your medical wishes are respected even if you cannot communicate them yourself.

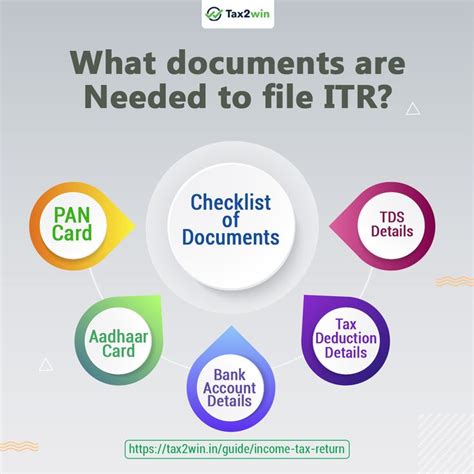

4. Insurance Policies

Insurance policies, including life insurance, health insurance, and disability insurance, are essential for protecting your finances and the well-being of your loved ones. These policies provide financial support in case of unexpected events such as death, illness, or injury. They can help cover medical expenses, replace lost income, and ensure that your dependents are financially secure.

5. Estate Inventory

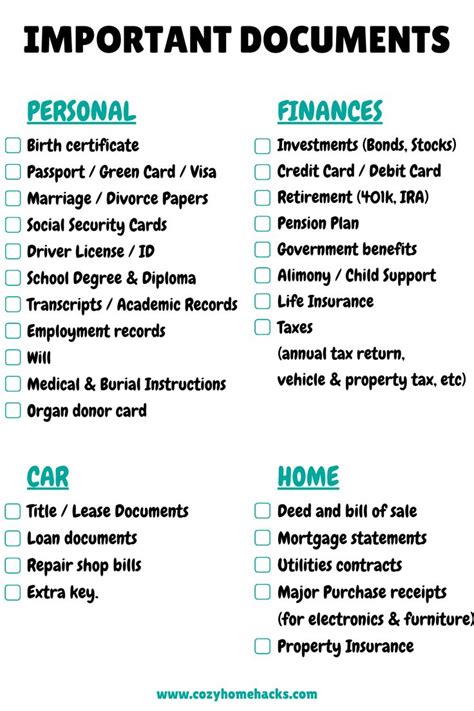

An Estate Inventory is a document that lists all of your assets, including real estate, vehicles, bank accounts, investments, and personal property. This document is vital for ensuring that your executor and heirs are aware of your assets and can distribute them according to your will. Keeping an updated estate inventory also helps in tax planning and estate administration.

💡 Note: It's essential to review and update these documents regularly to ensure they reflect your current wishes and circumstances.

In terms of organizing these documents, it’s a good idea to keep them in a safe and accessible place, such as a fireproof safe or a safe deposit box. You should also make sure that your executor and heirs know where to find these documents in case of an emergency.

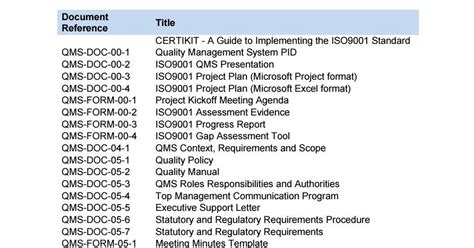

Here is a summary of the documents in a table format:

| Document | Purpose |

|---|---|

| Last Will and Testament | Outlines distribution of assets after death |

| Power of Attorney | Grants authority for financial and healthcare decisions |

| Advance Directive | Specifies medical treatment for end-of-life care |

| Insurance Policies | Provides financial support in case of unexpected events |

| Estate Inventory | Lists all assets for distribution and estate administration |

Having these five documents in place provides peace of mind and ensures that your wishes are respected. It’s a proactive step towards securing your future and the future of your loved ones. By understanding the importance of these documents and taking the time to prepare them, you can safeguard your legacy and make the complex process of estate planning much simpler for those who will be managing your affairs.

In final thoughts, preparing these essential documents is a critical aspect of adulting and financial planning. It requires effort and dedication, but the benefits far outweigh the costs. By being proactive and taking control of your estate planning, you can ensure that your wishes are respected, your loved ones are protected, and your legacy is preserved for generations to come.

What is the purpose of a Last Will and Testament?

+

The purpose of a Last Will and Testament is to outline how you want your assets to be distributed after your death and to appoint an executor who will carry out your wishes.

Why is having a Power of Attorney important?

+

Holding a Power of Attorney is important because it grants someone you trust the authority to make financial and healthcare decisions on your behalf if you become incapacitated.

What is the difference between a durable POA and a springing POA?

+

A durable POA remains in effect even if you become incapacitated, while a springing POA only takes effect upon your incapacitation.