Paperwork

401k Setup Paperwork Requirements

Introduction to 401k Setup Paperwork Requirements

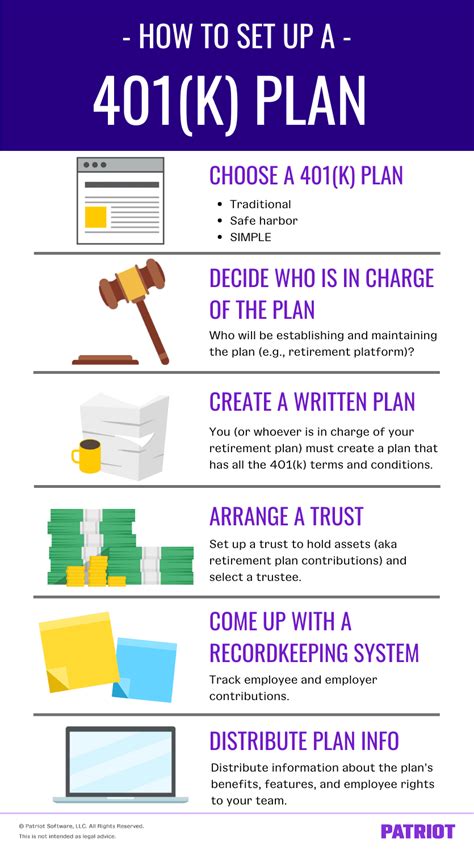

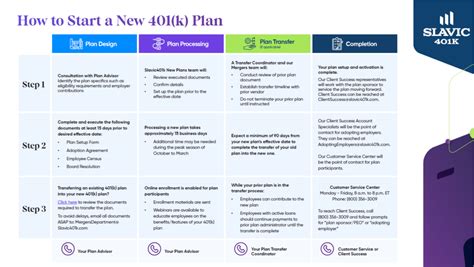

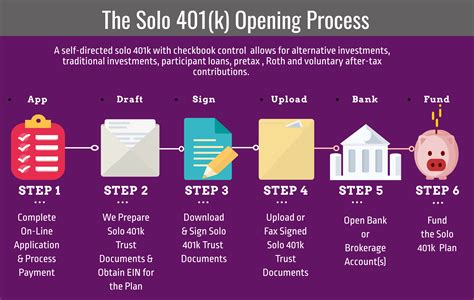

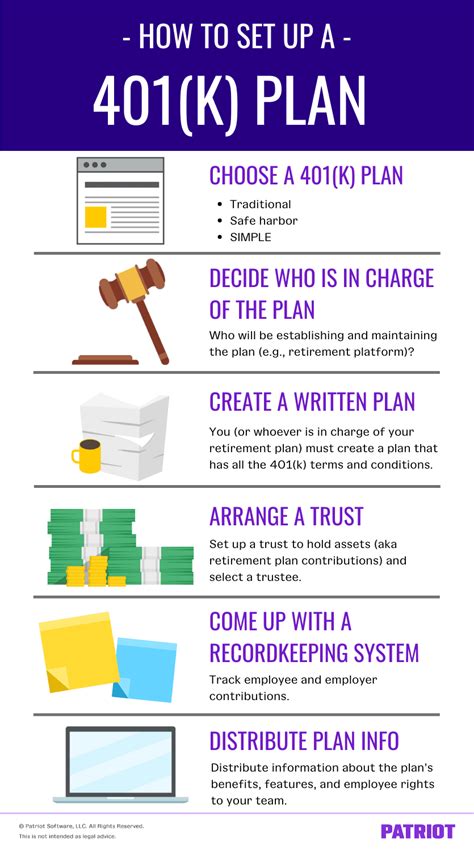

When setting up a 401k plan for your business, it’s essential to understand the necessary paperwork requirements to ensure compliance with regulatory bodies. The process involves several steps, including plan design, document preparation, and employee communication. In this article, we will delve into the details of 401k setup paperwork requirements, providing you with a comprehensive guide to navigate this complex process.

Understanding 401k Plan Documents

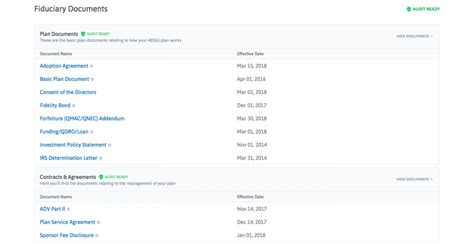

A 401k plan is a type of retirement savings plan that allows employees to contribute a portion of their salary to a tax-deferred investment account. The plan is governed by a set of documents that outline the terms and conditions of the plan, including the plan document, summary plan description (SPD), and trust agreement. These documents are crucial in defining the plan’s rules, eligibility, and benefits.

Plan Document

The plan document is the primary document that outlines the terms and conditions of the 401k plan. It includes information such as: * Plan name and type * Eligibility requirements * Contribution rules * Vesting schedules * Loan provisions * Distribution rules The plan document serves as a blueprint for the plan’s administration and is typically prepared by the plan sponsor or a third-party administrator.

Summary Plan Description (SPD)

The SPD is a summary of the plan document that provides employees with an overview of the plan’s benefits, rights, and obligations. The SPD must be written in a clear and concise manner, making it easy for employees to understand the plan’s provisions. The SPD typically includes information such as: * Plan name and type * Eligibility requirements * Contribution rules * Benefits and distributions * Claims procedures The SPD is an essential document that helps employees make informed decisions about their participation in the plan.

Trust Agreement

The trust agreement is a document that establishes the trust that holds the plan’s assets. The trust agreement outlines the responsibilities of the trustee, the plan’s investment options, and the rules for managing the plan’s assets. The trust agreement is typically prepared by the plan sponsor or a third-party administrator.

Other Paperwork Requirements

In addition to the plan document, SPD, and trust agreement, there are other paperwork requirements that must be completed when setting up a 401k plan. These include: * IRS Form 5300: This form is used to apply for a determination letter from the IRS, which confirms that the plan is qualified under Section 401(a) of the Internal Revenue Code. * IRS Form 5500: This form is used to report the plan’s financial information and compliance with ERISA requirements. * Participant notices: These notices are used to inform participants about the plan’s provisions, benefits, and any changes to the plan. * Beneficiary designations: These forms are used to designate beneficiaries in the event of a participant’s death.

💡 Note: It's essential to review and update the plan documents and other paperwork requirements regularly to ensure compliance with changing regulations and laws.

Best Practices for 401k Setup Paperwork Requirements

To ensure a smooth and compliant 401k setup process, it’s essential to follow best practices when preparing and maintaining the necessary paperwork. These best practices include: * Working with a qualified third-party administrator or plan sponsor to prepare and review the plan documents * Ensuring that all paperwork is completed accurately and timely * Maintaining accurate and up-to-date records * Communicating clearly with employees about the plan’s provisions and benefits * Reviewing and updating the plan documents regularly to ensure compliance with changing regulations and laws

Conclusion

Setting up a 401k plan requires careful attention to the necessary paperwork requirements. By understanding the plan document, SPD, trust agreement, and other paperwork requirements, you can ensure a compliant and successful 401k setup process. Remember to follow best practices, such as working with a qualified third-party administrator, maintaining accurate records, and communicating clearly with employees. With the right guidance and support, you can create a 401k plan that meets the needs of your business and employees, providing a valuable retirement savings benefit that attracts and retains top talent.

What is the purpose of the plan document?

+

The plan document outlines the terms and conditions of the 401k plan, including eligibility, contributions, and benefits.

What is the difference between the plan document and the SPD?

+

The plan document is the primary document that outlines the plan’s provisions, while the SPD is a summary of the plan document that provides employees with an overview of the plan’s benefits and rules.

What are the consequences of not completing the necessary paperwork requirements?

+

Failing to complete the necessary paperwork requirements can result in penalties, fines, and even plan disqualification, so it’s essential to work with a qualified third-party administrator or plan sponsor to ensure compliance.