Start LLC Paperwork Requirements

Understanding the LLC Paperwork Requirements

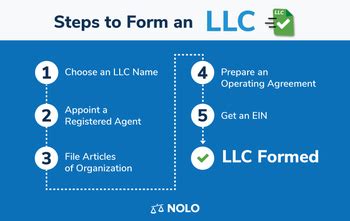

When it comes to forming a Limited Liability Company (LLC), one of the most crucial steps is completing the necessary paperwork. LLC paperwork requirements vary from state to state, but there are some common documents and filings that are typically required. In this article, we will delve into the world of LLC paperwork, exploring the different types of documents you need to file, the information you need to provide, and the fees associated with forming an LLC.

Articles of Organization

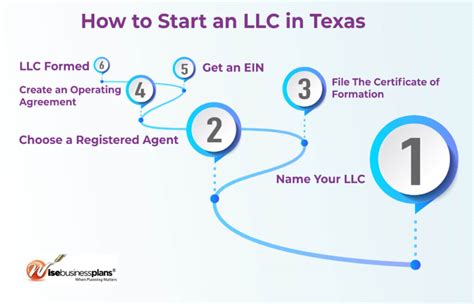

The first and most important document you need to file when forming an LLC is the Articles of Organization. This document is typically filed with the state’s Secretary of State office and provides basic information about your LLC, such as: * The name and address of your LLC * The purpose of your LLC * The names and addresses of the LLC’s members and managers * The LLC’s registered agent and registered office

The Articles of Organization are usually a standard form that can be downloaded from the state’s website or obtained from the Secretary of State office. You will need to fill out the form, sign it, and submit it along with the required filing fee.

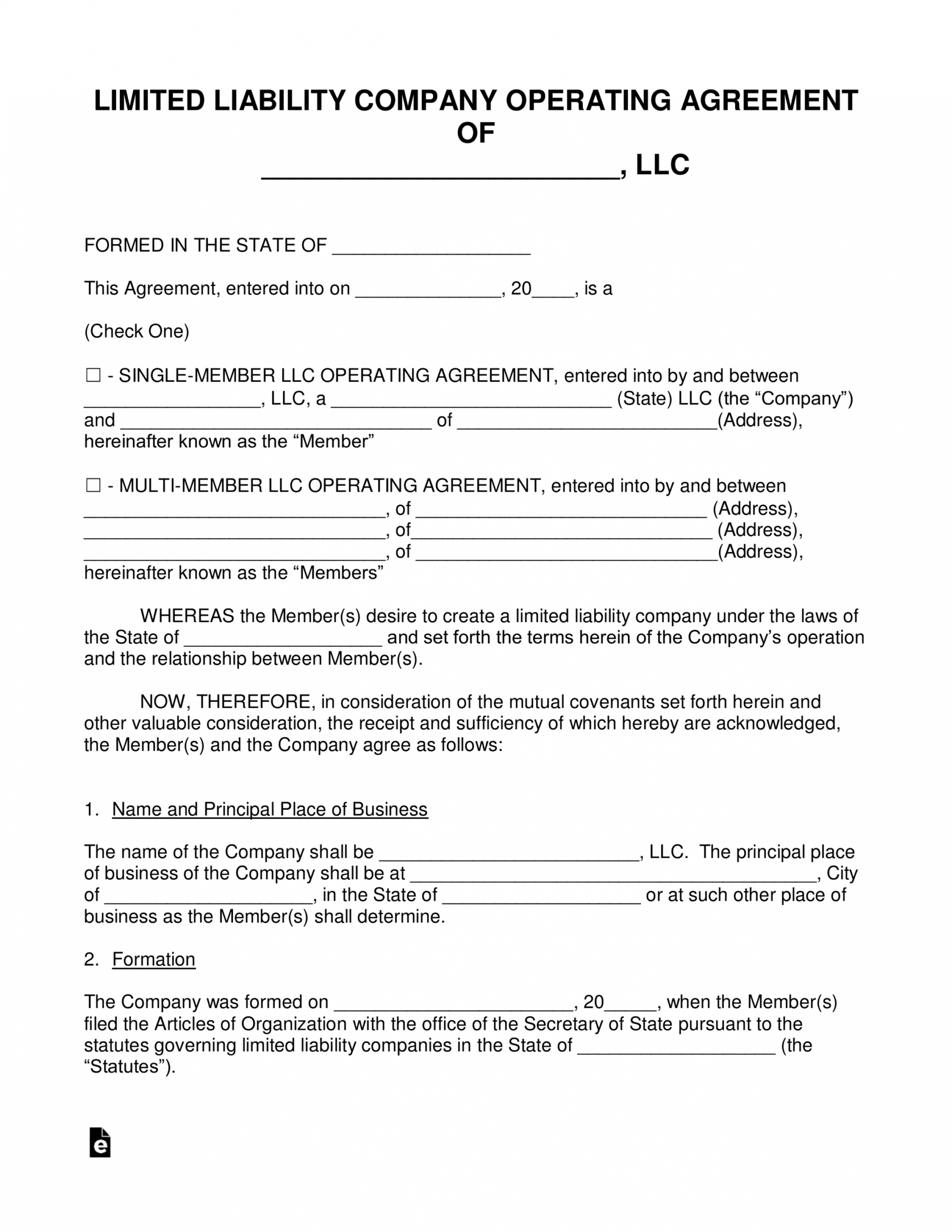

Operating Agreement

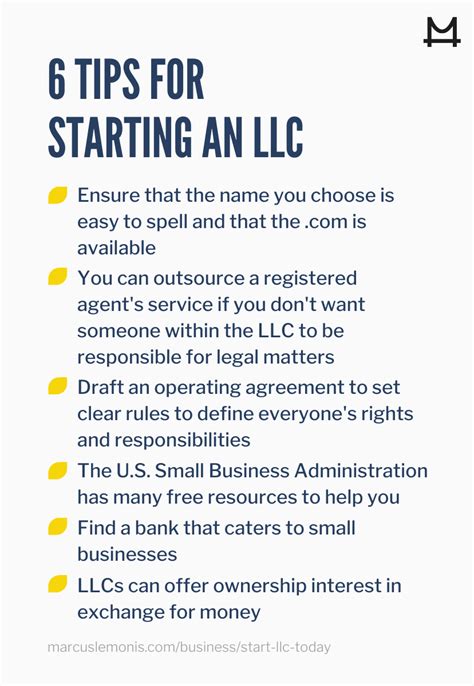

While not always required, an operating agreement is a crucial document that outlines the ownership, management, and operation of your LLC. This document should include: * The ownership structure of the LLC * The roles and responsibilities of the members and managers * The voting rights and decision-making processes * The procedures for distributing profits and losses * The rules for meetings and decision-making

An operating agreement is essential for establishing a clear understanding of how your LLC will be run and can help prevent disputes among members.

Business License and Permits

In addition to the Articles of Organization and operating agreement, you may need to obtain business licenses and permits to operate your LLC. These requirements vary depending on the type of business you are starting, the location, and the industry. Some common licenses and permits include: * Business license * Sales tax permit * Employer identification number (EIN) * Health department permit * Zoning permit

You can check with your state and local government to determine what licenses and permits are required for your specific business.

Employer Identification Number (EIN)

An Employer Identification Number (EIN) is a unique nine-digit number assigned to your LLC by the Internal Revenue Service (IRS). You will need an EIN to: * Open a business bank account * File tax returns * Hire employees * Obtain credit

You can apply for an EIN online through the IRS website or by mail using Form SS-4.

Registered Agent and Registered Office

A registered agent is a person or business that agrees to receive legal documents and notices on behalf of your LLC. You will need to appoint a registered agent and provide their name and address on the Articles of Organization. The registered agent must have a physical address in the state where your LLC is formed.

A registered office is the physical location where your LLC’s records are kept and where the registered agent can be reached. You will need to provide the address of your registered office on the Articles of Organization.

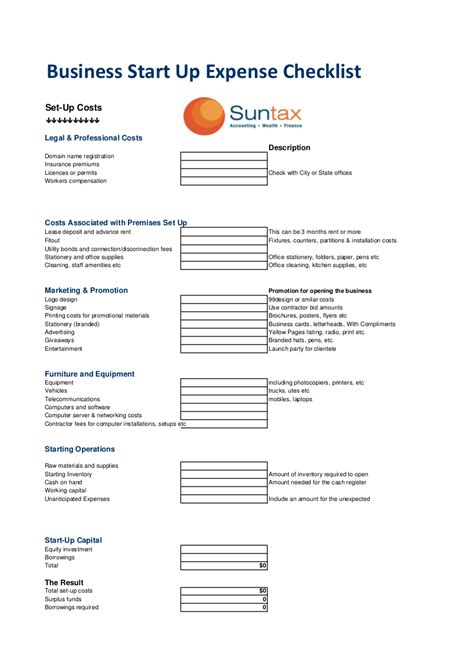

Fees and Costs

The fees and costs associated with forming an LLC vary from state to state. Some common fees include: * Filing fee for Articles of Organization: 50-500 * Business license fee: 50-1,000 * EIN application fee: free * Registered agent fee: 100-300 per year

You should check with your state and local government to determine the specific fees and costs required to form an LLC in your area.

| State | Filing Fee | Business License Fee |

|---|---|---|

| California | $70 | $100 |

| Florida | $125 | $50 |

| New York | $200 | $100 |

📝 Note: The fees listed in the table are subject to change and may not reflect the current fees. You should check with your state and local government for the most up-to-date information.

Conclusion and Final Thoughts

Forming an LLC requires careful planning and attention to detail. By understanding the LLC paperwork requirements, you can ensure that your business is properly established and compliant with state and local regulations. Remember to file the necessary documents, obtain the required licenses and permits, and appoint a registered agent to receive legal documents on behalf of your LLC. With the right guidance and support, you can successfully form an LLC and start building a strong foundation for your business.

What is the purpose of the Articles of Organization?

+

The Articles of Organization provide basic information about your LLC, such as the name and address, purpose, and management structure.

Do I need to obtain a business license to operate an LLC?

+

Yes, you may need to obtain a business license to operate an LLC, depending on the type of business and location.

What is the role of a registered agent in an LLC?

+

A registered agent receives legal documents and notices on behalf of the LLC and must have a physical address in the state where the LLC is formed.