5 NYC Work Papers

Introduction to 5 NYC Work Papers

The city of New York, known for its fast-paced lifestyle and diverse job market, requires various documents for employment, also known as work papers. These documents are essential for verifying an individual’s identity, age, and eligibility to work in the United States. In this blog post, we will discuss the 5 NYC work papers that are commonly required for employment in New York City.

Understanding the Importance of Work Papers

Work papers are crucial for employers to ensure compliance with federal and state laws. They help prevent unauthorized employment and protect both the employer and the employee from potential legal issues. The 5 NYC work papers are designed to verify an individual’s identity, age, and authorization to work in the United States.

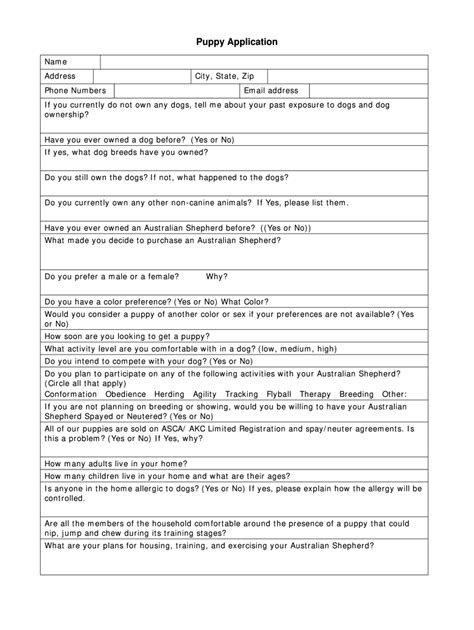

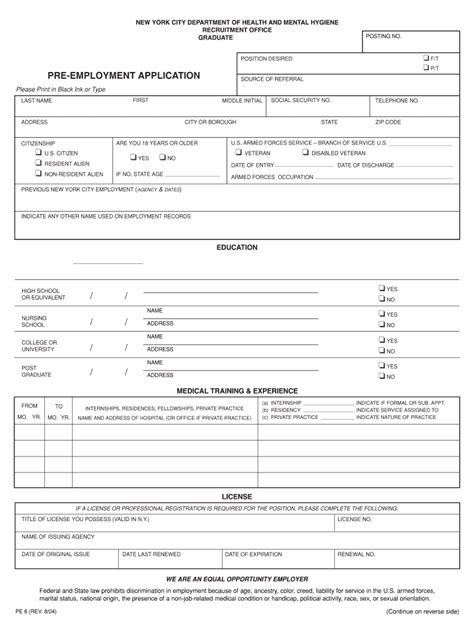

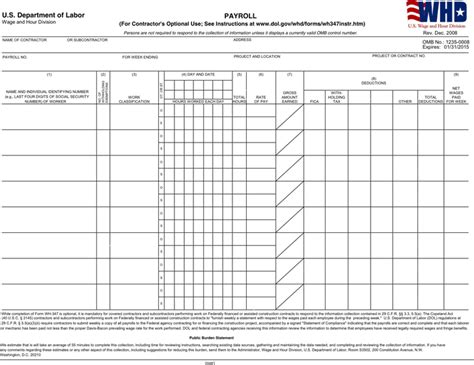

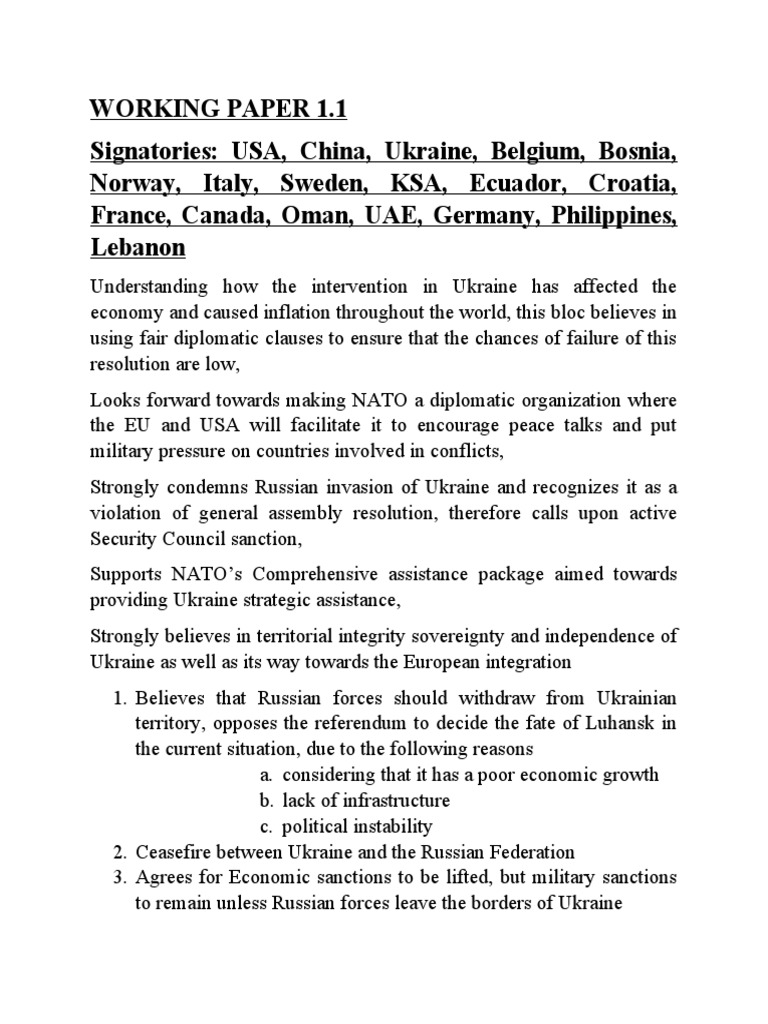

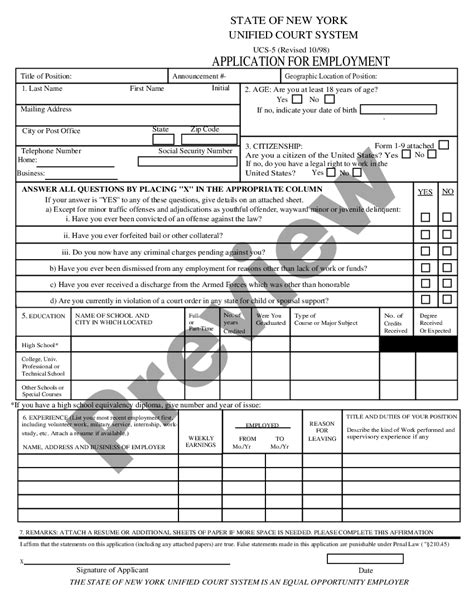

5 NYC Work Papers Required for Employment

The following are the 5 NYC work papers that are typically required for employment in New York City: * Form I-9: This form is used to verify an individual’s identity and authorization to work in the United States. * Form W-4: This form is used to determine the amount of federal income tax to withhold from an employee’s wages. * Form IT-2104: This form is used to determine the amount of New York State income tax to withhold from an employee’s wages. * Form DW-4: This form is not applicable in NYC as NYC does not have a separate withholding form, however some employers may still request this form. * New York State New Hire Reporting Form: This form is used to report new hires to the New York State Department of Taxation and Finance.

Additional Requirements for NYC Employers

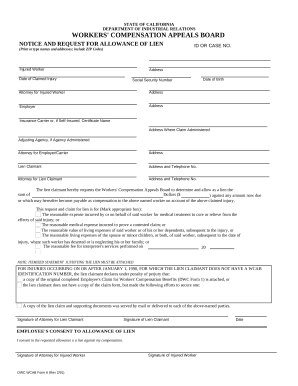

In addition to the 5 NYC work papers, employers in New York City are required to comply with other regulations, such as: * Paid Sick Leave Law: Employers with 5 or more employees must provide paid sick leave to their employees. * Minimum Wage Law: Employers must pay their employees at least the minimum wage, which is currently $15 per hour in NYC. * Workers’ Compensation Law: Employers must provide workers’ compensation insurance to their employees.

Consequences of Non-Compliance

Failure to comply with the 5 NYC work papers and other employment regulations can result in severe consequences, including: * Fines and Penalties: Employers who fail to comply with employment regulations can face fines and penalties. * Lawsuits: Employers who fail to comply with employment regulations can be sued by their employees. * Loss of Business License: Employers who fail to comply with employment regulations can lose their business license.

Best Practices for Employers

To avoid non-compliance and ensure a smooth hiring process, employers should: * Verify Employee Documents: Employers should verify the identity and authorization to work of all new hires. * Maintain Accurate Records: Employers should maintain accurate and up-to-date records of all employee documents. * Provide Clear Communication: Employers should provide clear communication to their employees regarding their rights and responsibilities.

📝 Note: Employers should consult with an attorney or HR expert to ensure compliance with all employment regulations.

In summary, the 5 NYC work papers are essential for employment in New York City, and employers must comply with these regulations to avoid non-compliance. By understanding the importance of work papers and following best practices, employers can ensure a smooth hiring process and maintain a positive work environment.

What are the 5 NYC work papers required for employment?

+

The 5 NYC work papers required for employment are Form I-9, Form W-4, Form IT-2104, New York State New Hire Reporting Form, and additional requirements such as Paid Sick Leave Law and Minimum Wage Law.

What is the purpose of Form I-9?

+

Form I-9 is used to verify an individual’s identity and authorization to work in the United States.

What are the consequences of non-compliance with employment regulations?

+

Failure to comply with employment regulations can result in fines and penalties, lawsuits, and loss of business license.