Paperwork

Car Insurance Paperwork Requirements

Introduction to Car Insurance Paperwork

When it comes to car insurance, there are numerous paperwork requirements that policyholders must comply with. From the initial application process to the renewal of policies, understanding these requirements is crucial for a smooth and hassle-free experience. In this article, we will delve into the world of car insurance paperwork, exploring the various documents needed, the process of obtaining them, and the importance of maintaining accurate records.

Types of Car Insurance Paperwork

There are several types of paperwork associated with car insurance, including:

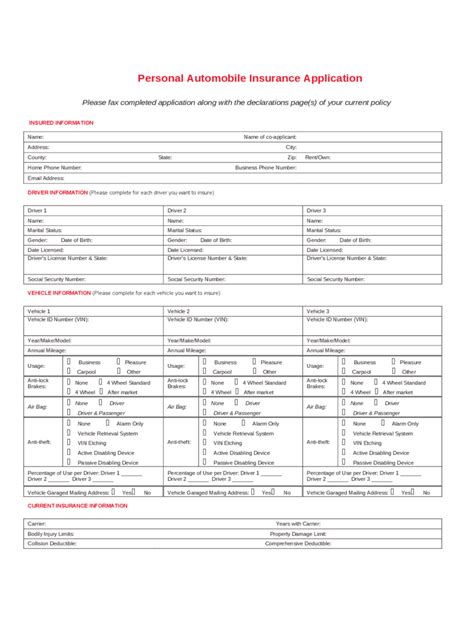

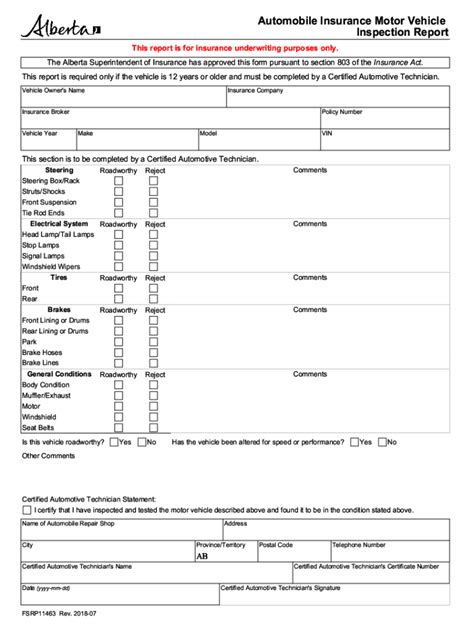

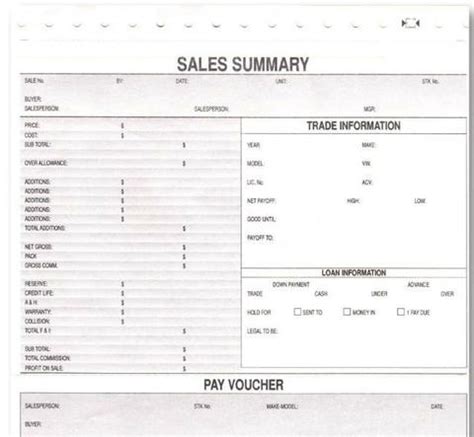

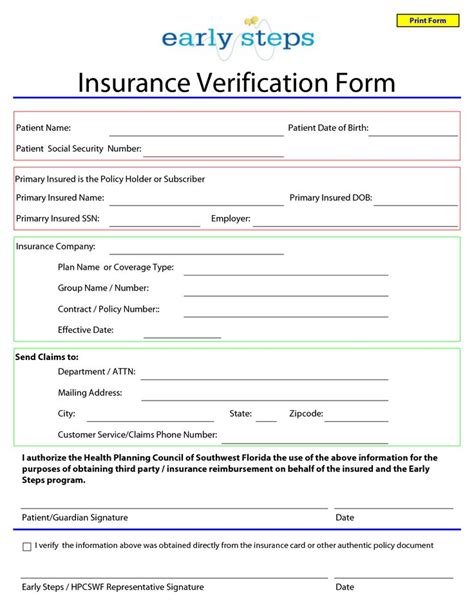

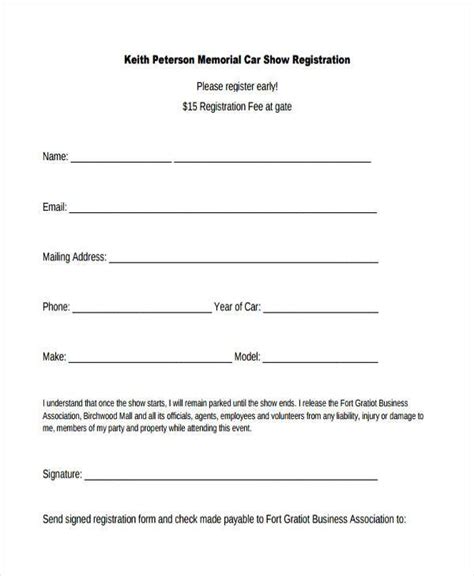

- Application forms: These forms are used to collect personal and vehicle information from potential policyholders.

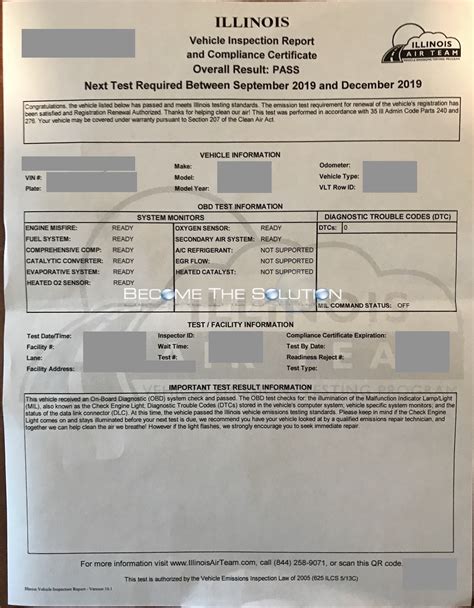

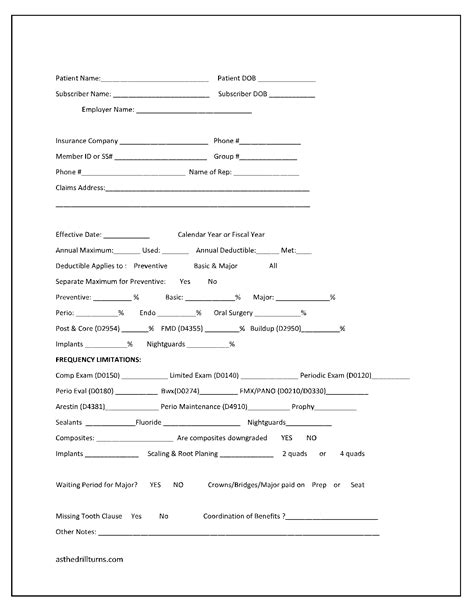

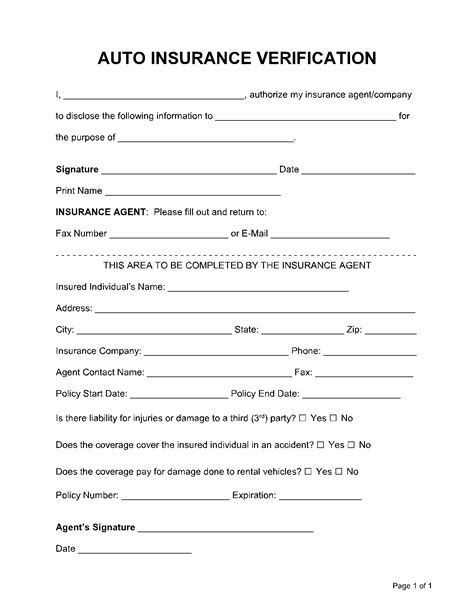

- Policy documents: Once a policy is issued, the insurance company provides policy documents that outline the terms and conditions of the coverage.

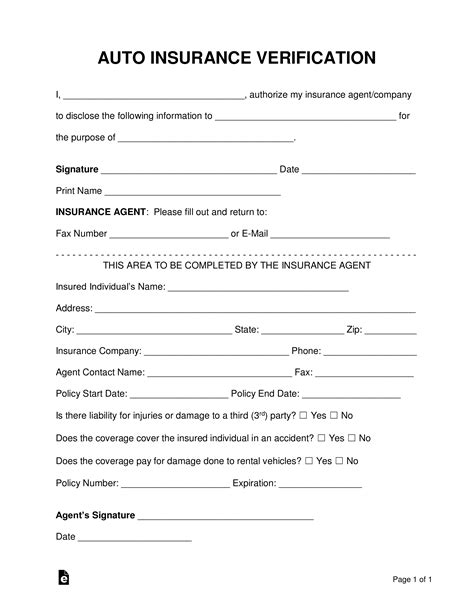

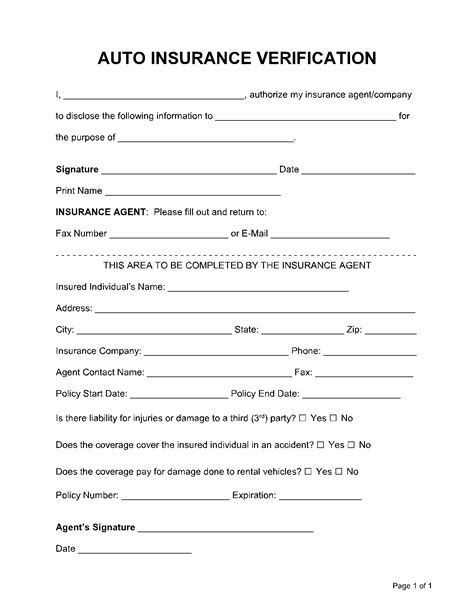

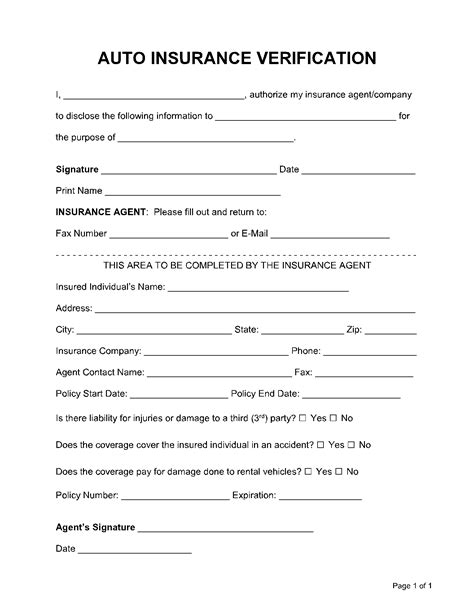

- Insurance cards: Also known as proof of insurance, these cards are used to verify that a vehicle is insured.

- Claims forms: In the event of an accident or damage to the vehicle, policyholders must complete claims forms to initiate the claims process.

Required Documents for Car Insurance

To obtain car insurance, policyholders typically need to provide the following documents:

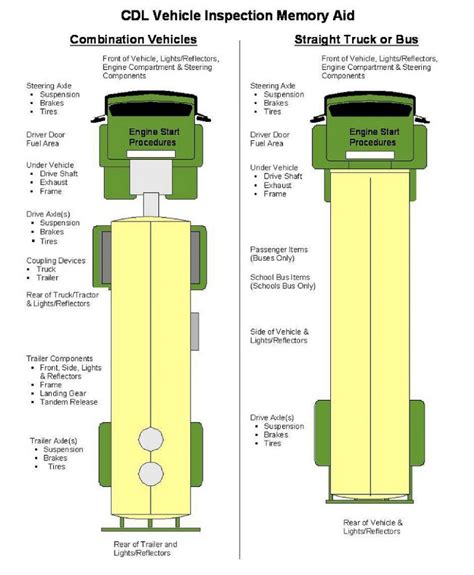

- Valid driver’s license: A valid driver’s license is required to verify the policyholder’s identity and driving history.

- Vehicle registration: The vehicle registration document is used to verify the ownership and details of the vehicle.

- Proof of income: Some insurance companies may require proof of income to determine the policyholder’s eligibility for certain coverage options.

- Proof of address: A utility bill or other document showing the policyholder’s address may be required to verify their residency.

Process of Obtaining Car Insurance Paperwork

The process of obtaining car insurance paperwork typically involves the following steps:

- Application submission: The policyholder submits an application form to the insurance company, either online or through an agent.

- Document verification: The insurance company verifies the documents provided by the policyholder to ensure their accuracy and authenticity.

- Policy issuance: Once the documents are verified, the insurance company issues a policy document outlining the terms and conditions of the coverage.

- Policy renewal: Prior to the expiration of the policy, the insurance company will typically send a renewal notice to the policyholder, outlining the premium rates and coverage options for the upcoming policy period.

Importance of Maintaining Accurate Records

Maintaining accurate records of car insurance paperwork is crucial for several reasons:

- Proof of insurance: In the event of an accident or traffic stop, policyholders must be able to provide proof of insurance to avoid penalties and fines.

- Claims processing: Accurate records are necessary for efficient claims processing, as they provide essential information about the policy and the incident.

- Policy renewal: Maintaining accurate records ensures that policyholders receive timely renewal notices and can make informed decisions about their coverage options.

📝 Note: Policyholders should always review their policy documents carefully to ensure that they understand the terms and conditions of their coverage.

Common Mistakes to Avoid

When dealing with car insurance paperwork, there are several common mistakes to avoid:

- Incomplete application forms: Failing to provide complete and accurate information on the application form can lead to delays or even policy cancellation.

- Missing documents: Failing to provide required documents can result in policy cancellation or claims being denied.

- Incorrect policy information: Providing incorrect information on the policy documents can lead to coverage gaps or inadequate protection.

Conclusion

In conclusion, car insurance paperwork requirements are an essential aspect of the insurance process. By understanding the types of paperwork involved, the required documents, and the process of obtaining them, policyholders can navigate the system with confidence. Maintaining accurate records and avoiding common mistakes can help ensure a smooth experience and provide peace of mind. Whether you are a new policyholder or an existing one, it is crucial to stay informed and up-to-date on the latest car insurance paperwork requirements.

What documents are required to obtain car insurance?

+

To obtain car insurance, policyholders typically need to provide a valid driver’s license, vehicle registration, proof of income, and proof of address.

How do I maintain accurate records of my car insurance paperwork?

+

To maintain accurate records, policyholders should keep copies of their policy documents, application forms, and other relevant paperwork in a safe and secure location.

What are the consequences of not providing complete and accurate information on the application form?

+

Failing to provide complete and accurate information on the application form can lead to delays or even policy cancellation. It is essential to review the application form carefully and provide all required information.