5 Docs to Buy Car

Introduction to Buying a Car

When it comes to purchasing a vehicle, there are several documents that you need to have in order to complete the transaction. These documents are essential for verifying your identity, income, and other important details. In this article, we will discuss the 5 most important documents that you need to buy a car.

Document 1: Valid Government-Issued ID

A valid government-issued ID is the first document that you need to provide when buying a car. This can be a driver’s license, passport, or state ID. The ID should have your name, address, and date of birth, and it should not be expired. The dealer will use this ID to verify your identity and ensure that you are who you claim to be.

Document 2: Proof of Income

The next document that you need to provide is proof of income. This can be a pay stub, W-2 form, or tax return. The dealer will use this document to determine your creditworthiness and ensure that you can afford the monthly payments. You may also need to provide proof of employment, such as a letter from your employer or a business card.

Document 3: Proof of Insurance

Proof of insurance is another essential document that you need to provide when buying a car. This can be a insurance card or a policy document. The dealer will use this document to ensure that you have the necessary insurance coverage to drive the vehicle off the lot.

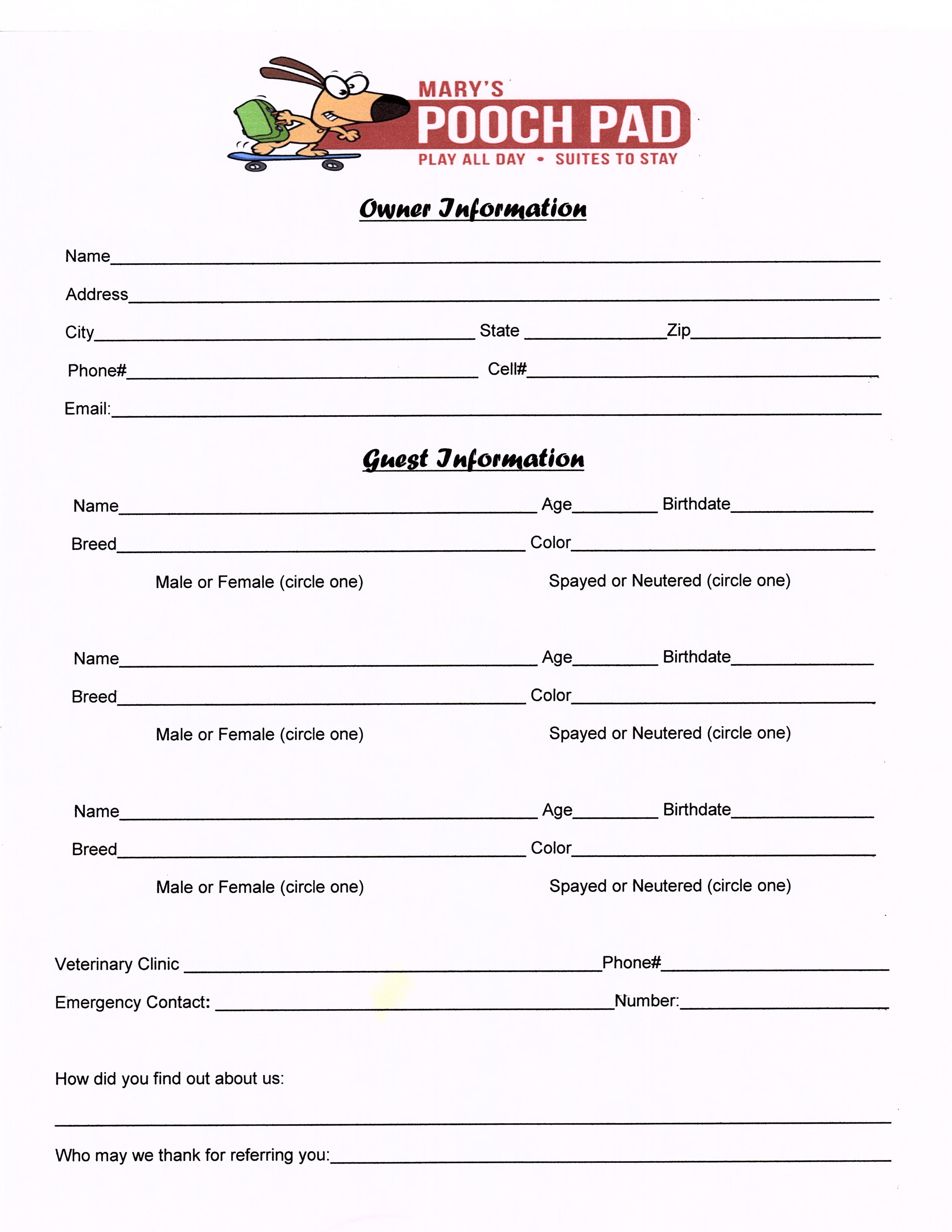

Document 4: Proof of Address

The fourth document that you need to provide is proof of address. This can be a utility bill, lease agreement, or bank statement. The dealer will use this document to verify your address and ensure that you are a resident of the state or country where you are purchasing the vehicle.

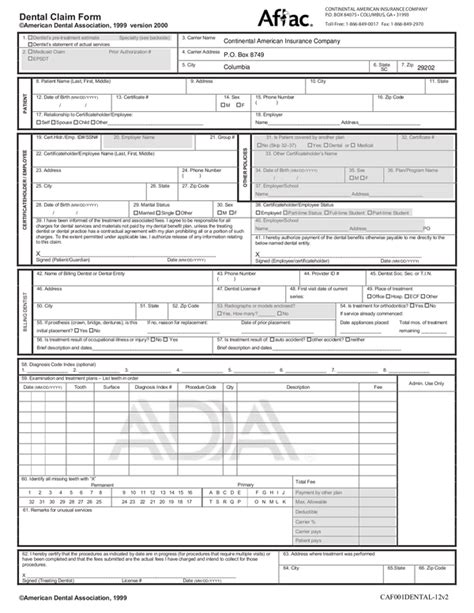

Document 5: Credit Report

The final document that you need to provide is a credit report. This document will show your credit history and score, which the dealer will use to determine your creditworthiness. You can obtain a credit report from one of the three major credit reporting agencies, such as Experian, Equifax, or TransUnion.

🚨 Note: Make sure to review your credit report carefully before applying for a car loan, as errors or inaccuracies can affect your credit score and ability to secure financing.

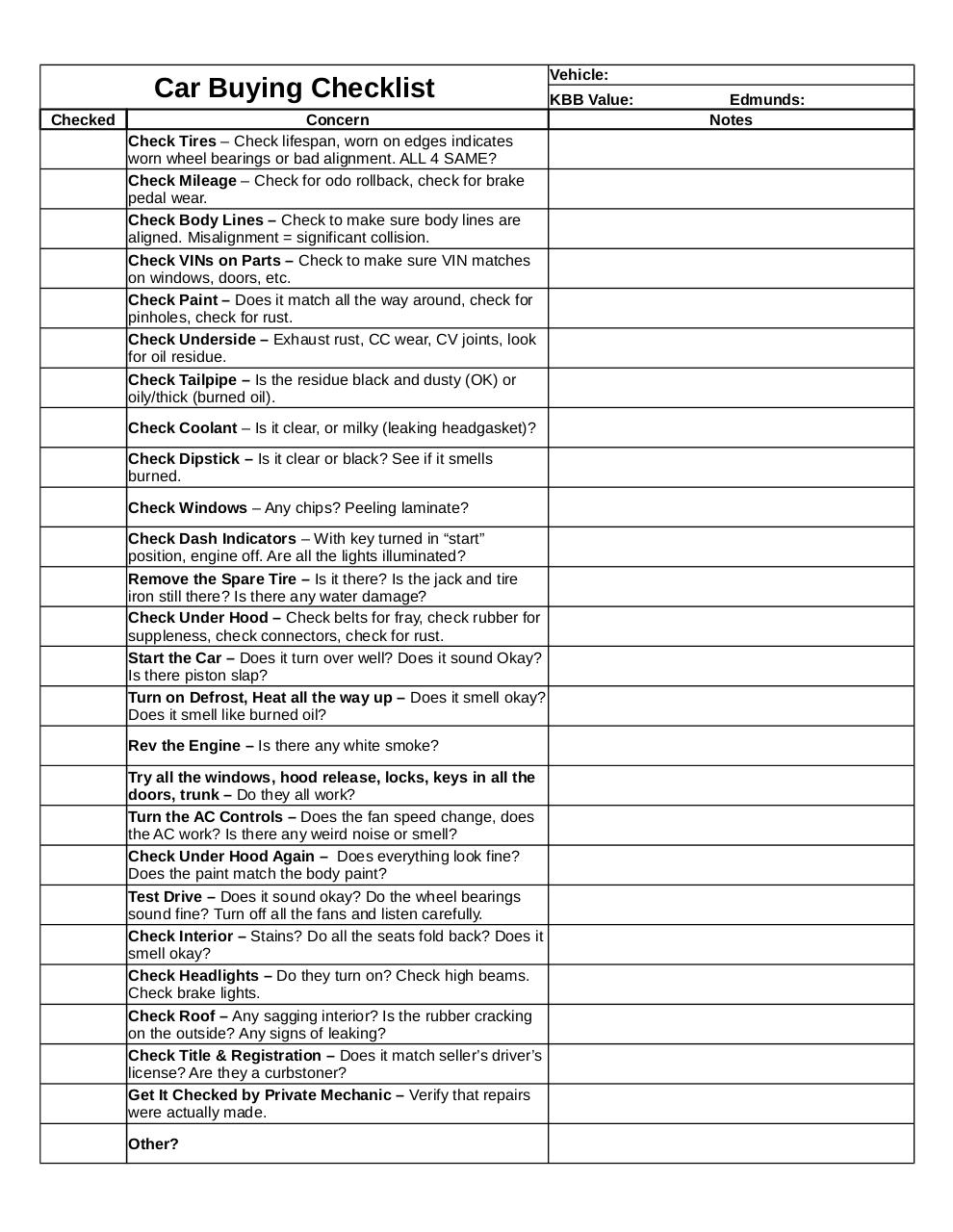

Here is a summary of the 5 documents that you need to buy a car:

| Document | Description |

|---|---|

| Valid Government-Issued ID | Verifies your identity |

| Proof of Income | Verifies your income and creditworthiness |

| Proof of Insurance | Verifies your insurance coverage |

| Proof of Address | Verifies your address |

| Credit Report | Verifies your credit history and score |

In summary, buying a car requires several important documents, including a valid government-issued ID, proof of income, proof of insurance, proof of address, and a credit report. By having these documents in order, you can ensure a smooth and successful car-buying experience.

What is the most important document when buying a car?

+

The most important document when buying a car is a valid government-issued ID, as it verifies your identity and ensures that you are who you claim to be.

Can I buy a car without a credit report?

+

It is possible to buy a car without a credit report, but it may be more difficult to secure financing. Some dealers may offer alternative financing options, such as a co-signer or a larger down payment.

How long does it take to process the documents when buying a car?

+

The time it takes to process the documents when buying a car can vary depending on the dealer and the complexity of the transaction. On average, it can take anywhere from 30 minutes to several hours to complete the paperwork.