Paperwork

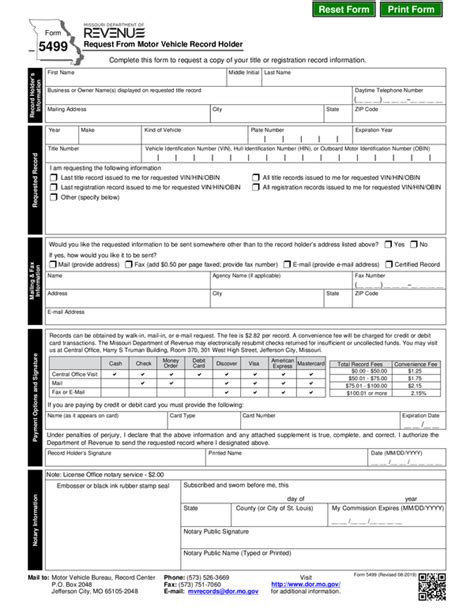

5 Missouri Forms

Introduction to Missouri Forms

Missouri forms are a set of documents used for various purposes, including tax returns, voter registration, and business filings. These forms are designed to help individuals and businesses navigate the complexities of Missouri’s laws and regulations. In this article, we will explore five common Missouri forms, their purposes, and how to fill them out correctly.

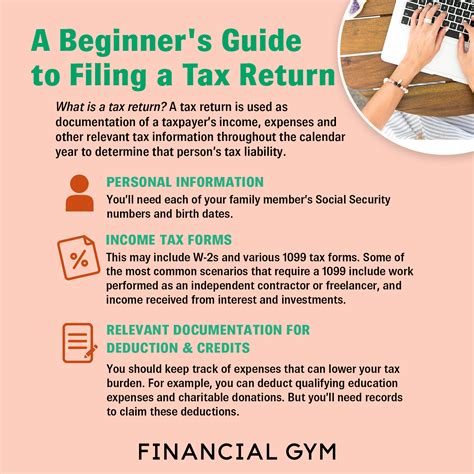

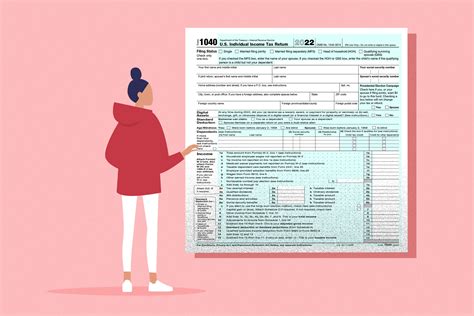

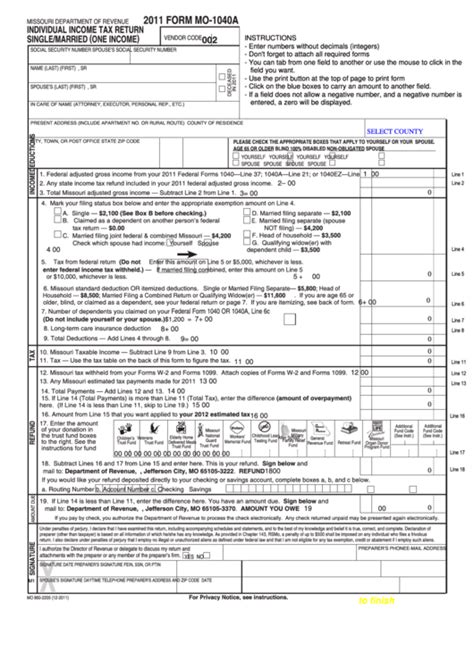

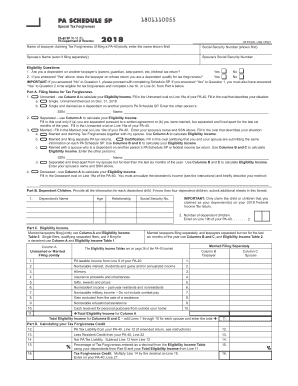

Missouri Form 1: Missouri Individual Income Tax Return (MO-1040)

The MO-1040 is the standard form used for filing individual income tax returns in Missouri. This form is used to report income, claim deductions and credits, and calculate tax liability. The MO-1040 is typically filed by April 15th of each year, and it is essential to fill it out accurately to avoid any delays or penalties. Some key components of the MO-1040 include: * Personal information, such as name, address, and Social Security number * Income from all sources, including wages, salaries, and investments * Deductions and credits, such as the standard deduction, itemized deductions, and the earned income tax credit * Tax liability, including any taxes owed or refunds due

Missouri Form 2: Missouri Business Tax Application (MO-426)

The MO-426 is used to register a new business with the Missouri Department of Revenue. This form is required for all businesses, including sole proprietorships, partnerships, and corporations. The MO-426 includes information such as: * Business name and address * Type of business entity (e.g., sole proprietorship, partnership, corporation) * Federal Employer Identification Number (EIN) * Type of tax returns to be filed (e.g., income tax, sales tax, withholding tax)

Missouri Form 3: Missouri Voter Registration Application (MO-VOTER)

The MO-VOTER is used to register to vote in Missouri. This form can be completed online or by mail, and it requires basic information such as: * Name and address * Date of birth and Social Security number * Party affiliation (optional) * Signature and date

Missouri Form 4: Missouri Sales Tax Exemption Certificate (MO-149)

The MO-149 is used to claim exemption from Missouri sales tax on certain purchases. This form is typically used by businesses, organizations, and individuals who are exempt from sales tax under Missouri law. The MO-149 includes information such as: * Name and address of the purchaser * Type of exemption claimed (e.g., charitable, educational, governmental) * Description of the items purchased * Signature and date

Missouri Form 5: Missouri W-4P, Withholding Certificate for Pension or Annuity Payments (MO-W4P)

The MO-W4P is used to withhold Missouri state income tax from pension or annuity payments. This form is typically completed by the payer (e.g., employer, pension fund) and includes information such as: * Name and address of the payer * Name and address of the recipient * Type of payment (e.g., pension, annuity) * Withholding amount or percentage

| Form Number | Form Name | Purpose |

|---|---|---|

| MO-1040 | Missouri Individual Income Tax Return | File individual income tax returns |

| MO-426 | Missouri Business Tax Application | Register a new business with the Missouri Department of Revenue |

| MO-VOTER | Missouri Voter Registration Application | Register to vote in Missouri |

| MO-149 | Missouri Sales Tax Exemption Certificate | Claim exemption from Missouri sales tax |

| MO-W4P | Missouri W-4P, Withholding Certificate for Pension or Annuity Payments | Withhold Missouri state income tax from pension or annuity payments |

📝 Note: It is essential to carefully review and fill out each form to ensure accuracy and avoid any delays or penalties.

In summary, Missouri forms are an essential part of navigating the state’s laws and regulations. By understanding the purposes and requirements of each form, individuals and businesses can ensure compliance and avoid any potential issues. Whether it’s filing tax returns, registering to vote, or claiming exemptions, Missouri forms play a critical role in facilitating various aspects of life and business in the state. As such, it is crucial to approach these forms with care and attention to detail to ensure that all necessary information is provided accurately and efficiently.