Tax Return Paperwork Guide

Introduction to Tax Return Paperwork

Completing tax return paperwork can be a daunting task, especially for those who are new to the process. The numerous forms, deadlines, and requirements can be overwhelming, leading to mistakes that may result in delays or even penalties. However, understanding the basics of tax return paperwork and staying organized can make the process significantly easier. In this guide, we will walk you through the essential steps and provide tips on how to navigate the complex world of tax returns.

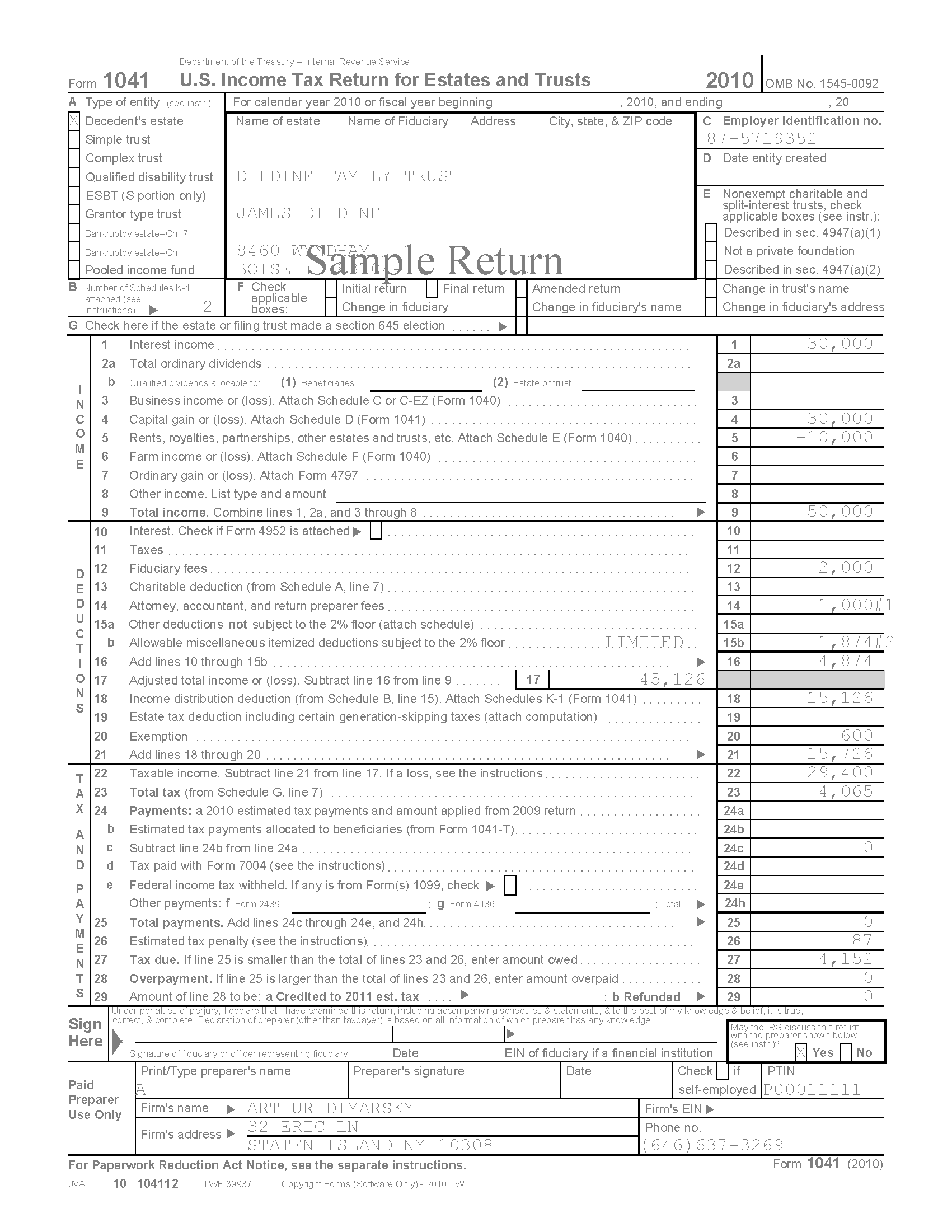

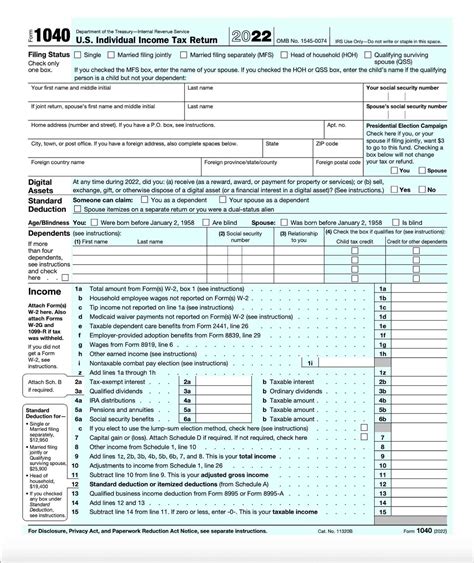

Understanding Tax Forms

The first step in tackling tax return paperwork is to familiarize yourself with the various tax forms. The most common form for individual taxpayers is the Form 1040, which is used to report income, deductions, and credits. Other forms you might encounter include: * Form W-2: Reports income and taxes withheld from your employer * Form 1099: Reports income from self-employment, freelance work, or investments * Schedule A: Itemizes deductions, such as charitable donations and medical expenses * Schedule C: Reports business income and expenses for self-employed individuals

Gathering Necessary Documents

To complete your tax return paperwork, you will need to gather various documents, including: * Identification documents (e.g., driver’s license, passport) * Income statements (e.g., Form W-2, Form 1099) * Expense records (e.g., receipts, invoices) * Bank statements * Investment documents (e.g., brokerage statements, dividend statements) * Charitable donation receipts * Medical expense records

📝 Note: Make sure to keep all documents organized and easily accessible to avoid delays in the tax filing process.

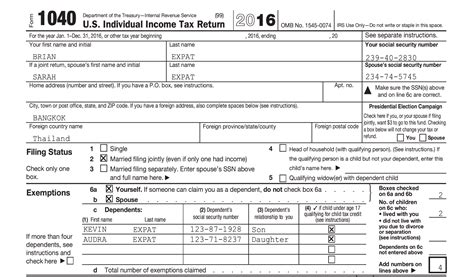

Filing Status and Dependents

Your filing status and dependents can significantly impact your tax return. The most common filing statuses include: * Single * Married Filing Jointly * Married Filing Separately * Head of Household * Qualifying Widow(er) When claiming dependents, you will need to provide their Social Security number or Individual Taxpayer Identification Number (ITIN).

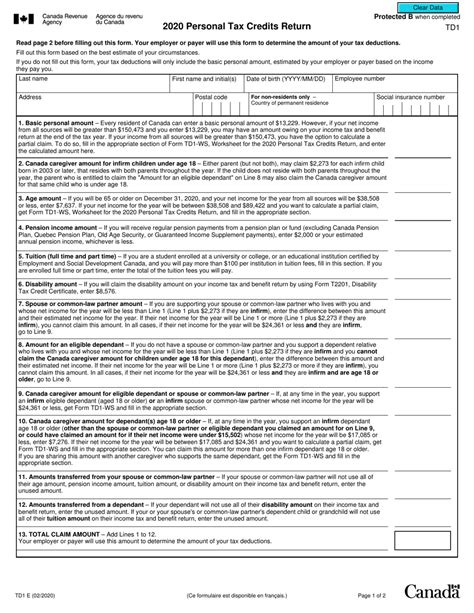

Tax Credits and Deductions

Tax credits and deductions can help reduce your taxable income and lower your tax liability. Common tax credits include: * Earned Income Tax Credit (EITC) * Child Tax Credit * Education Credits Common tax deductions include: * Standard Deduction * Itemized Deductions (e.g., charitable donations, medical expenses) * Mortgage Interest Deduction

Electronic Filing and Payment

The IRS encourages electronic filing and payment, which can help reduce errors and expedite the refund process. You can file your tax return electronically using: * IRS Free File: A free tax preparation and filing service for eligible taxpayers * Tax Preparation Software: Commercial software, such as TurboTax or H&R Block * Tax Professional: A certified public accountant (CPA) or enrolled agent (EA)

Deadlines and Extensions

The standard deadline for filing individual tax returns is April 15th. However, you can request an automatic six-month extension by filing Form 4868. Keep in mind that an extension to file does not grant an extension to pay, and you may be subject to penalties and interest on any unpaid taxes.

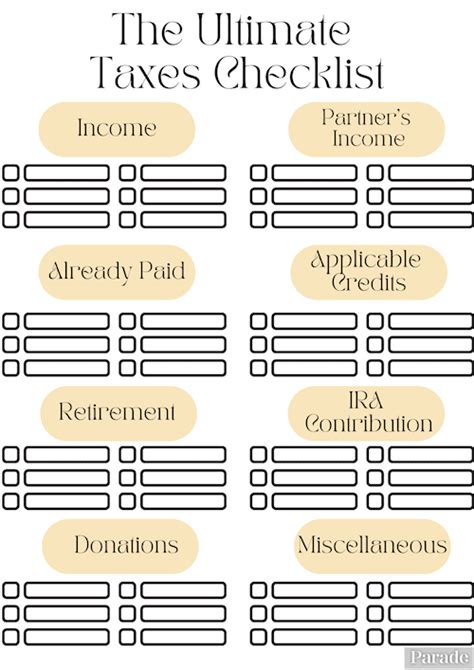

Tax Return Paperwork Checklist

To ensure you have all the necessary documents and information, use the following checklist: * Identification documents * Income statements * Expense records * Bank statements * Investment documents * Charitable donation receipts * Medical expense records * Filing status and dependent information * Tax credit and deduction documentation

| Document | Description |

|---|---|

| Form 1040 | Individual tax return |

| Form W-2 | Income and taxes withheld from employer |

| Form 1099 | Income from self-employment, freelance work, or investments |

As you complete your tax return paperwork, remember to stay organized, and don’t hesitate to seek help if you need it. By following these guidelines and using the resources available to you, you can navigate the complex world of tax returns with confidence.

In the end, completing tax return paperwork requires attention to detail, organization, and patience. By understanding the basics of tax forms, gathering necessary documents, and taking advantage of tax credits and deductions, you can ensure a smooth and successful tax filing experience. Whether you choose to file electronically or by mail, remember to stay informed and seek help when needed to avoid any potential issues or delays.