5 Mortgage Payoff Papers

Understanding the Basics of Mortgage Payoff Papers

When it comes to owning a home, one of the most significant financial commitments you’ll make is paying off your mortgage. The process of paying off a mortgage involves several key documents, known as mortgage payoff papers, which play a crucial role in ensuring that the transfer of ownership is smooth and legally binding. In this article, we’ll delve into the details of these papers, exploring their importance, the information they contain, and the steps involved in the payoff process.

What are Mortgage Payoff Papers?

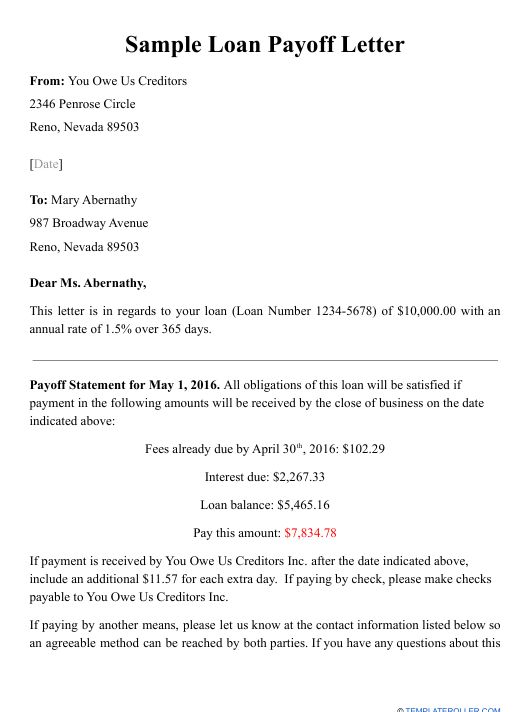

Mortgage payoff papers, also known as a payoff statement or payoff letter, are documents provided by the lender that outline the exact amount needed to pay off a mortgage loan. This amount includes the outstanding principal balance, accrued interest, and any other fees associated with the loan. The payoff papers are typically requested by the borrower or their representative when they are ready to pay off the mortgage in full, either through refinancing, selling the property, or using personal funds.

Types of Mortgage Payoff Papers

There are several types of documents that may be included in the mortgage payoff papers, including: * Payoff Statement: This document provides the borrower with the exact amount needed to pay off the mortgage, including the principal balance, interest, and fees. * Reconveyance Deed: This deed is used to transfer the title of the property from the lender back to the borrower once the mortgage has been paid in full. * Satisfaction of Mortgage: This document is recorded with the county to show that the mortgage has been paid off and that the lender no longer has a lien on the property. * Release of Lien: Similar to the satisfaction of mortgage, this document releases the lender’s lien on the property, allowing the borrower to sell or refinance the property without any encumbrances.

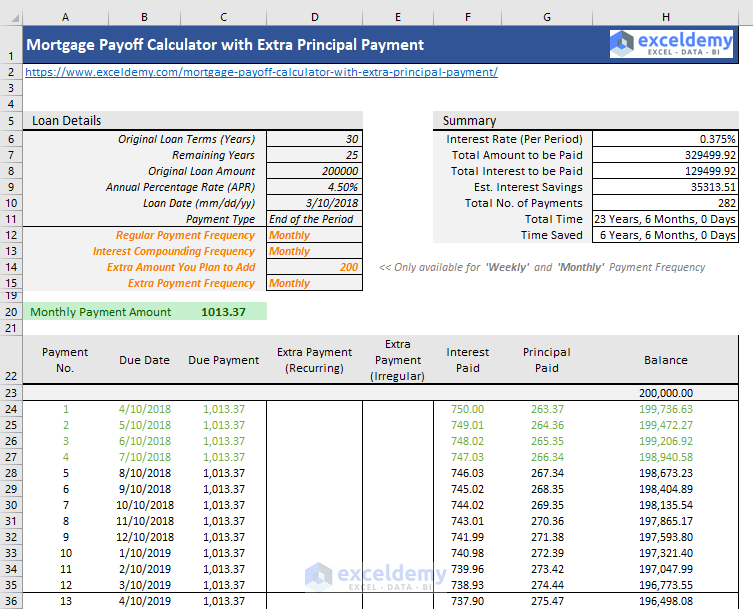

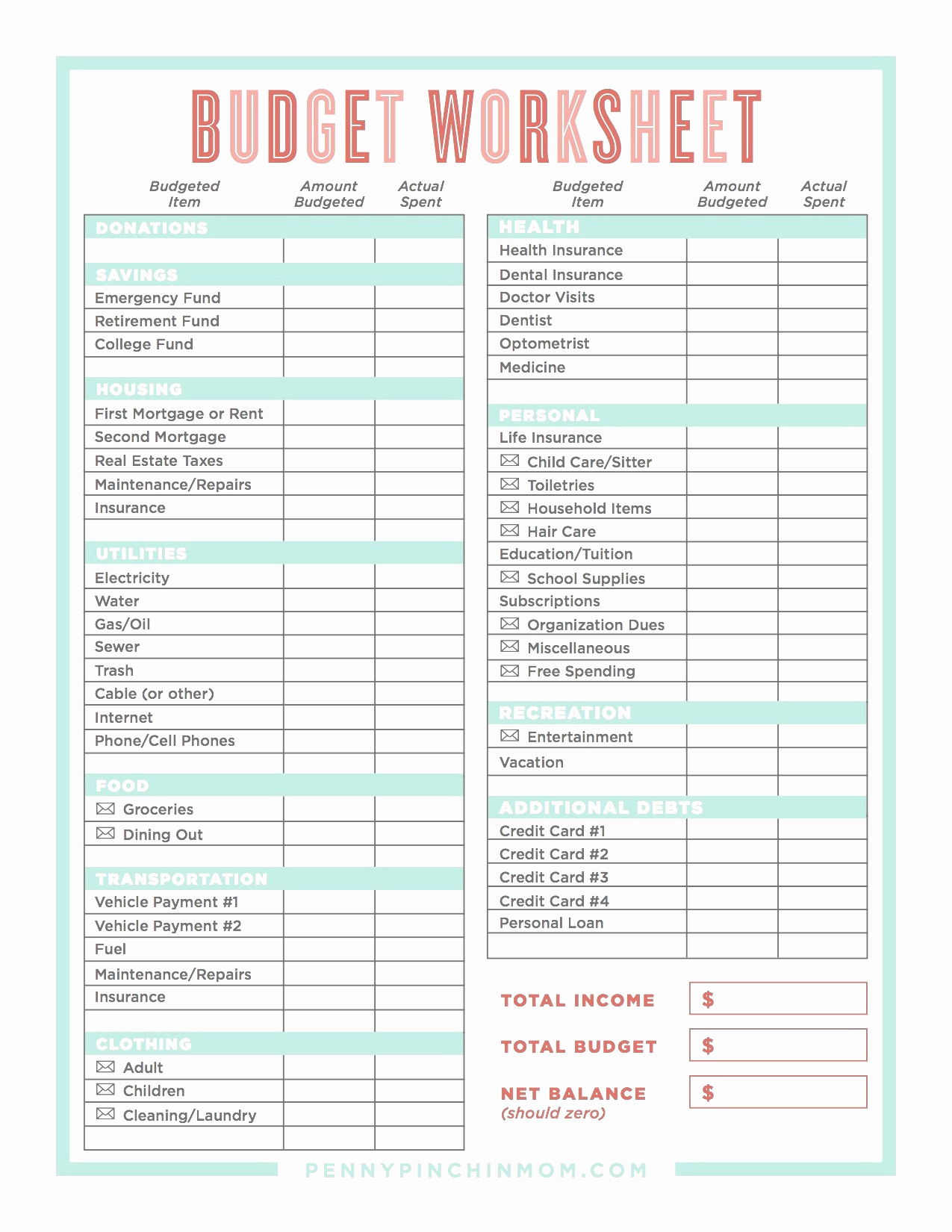

Information Contained in Mortgage Payoff Papers

The mortgage payoff papers will typically contain the following information: * The outstanding principal balance of the loan * The accrued interest up to the date of payoff * Any fees associated with the payoff, such as prepayment penalties or administrative fees * The total amount due to pay off the loan * Instructions on how to make the payoff, including the payment method and address * A deadline for making the payoff, after which additional interest may accrue

Steps Involved in the Payoff Process

The payoff process typically involves the following steps: * The borrower requests a payoff statement from the lender * The lender provides the payoff statement, which includes the total amount due * The borrower reviews the payoff statement and ensures that all information is accurate * The borrower makes the payoff, either by wire transfer, check, or other approved payment method * The lender processes the payoff and releases the lien on the property * The borrower receives a satisfaction of mortgage or release of lien, which is recorded with the county

📝 Note: It's essential to carefully review the payoff statement and ensure that all information is accurate before making the payoff. Any errors or discrepancies can delay the payoff process and potentially result in additional fees or penalties.

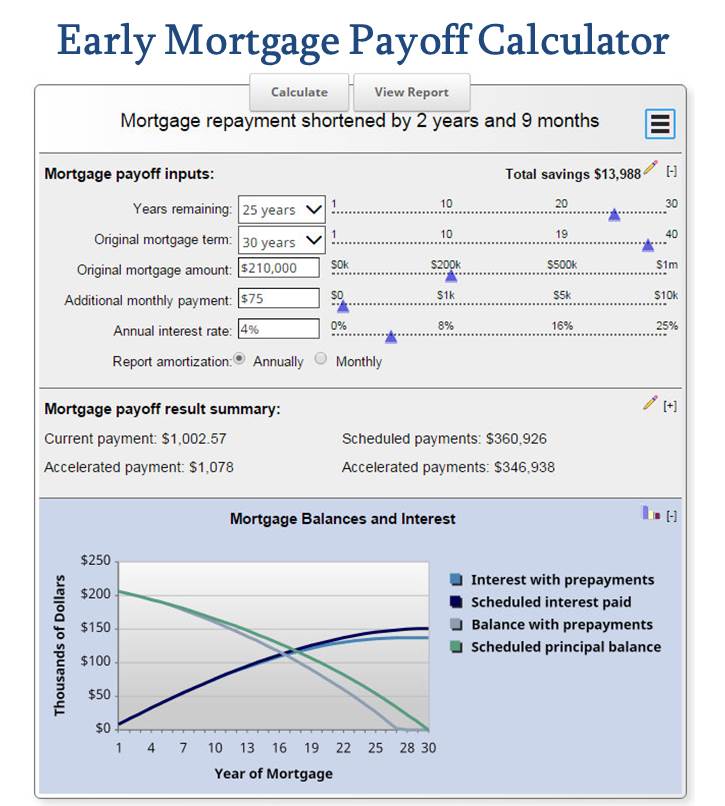

Benefits of Paying Off a Mortgage

Paying off a mortgage can have several benefits, including: * Eliminating monthly mortgage payments * Reducing overall debt * Increasing equity in the property * Improving credit score * Providing a sense of financial security and freedom

Challenges and Considerations

While paying off a mortgage can be a significant achievement, there are also challenges and considerations to keep in mind, such as: * Prepayment penalties: Some mortgages may include prepayment penalties, which can add thousands of dollars to the payoff amount. * Tax implications: Paying off a mortgage can have tax implications, such as reducing the amount of interest that can be deducted on tax returns. * Opportunity costs: Using a large sum of money to pay off a mortgage may mean missing out on other investment opportunities or financial goals.

Conclusion

In conclusion, mortgage payoff papers play a critical role in the process of paying off a mortgage. Understanding the different types of documents involved, the information they contain, and the steps involved in the payoff process can help borrowers navigate this complex process with confidence. By carefully reviewing the payoff statement and ensuring that all information is accurate, borrowers can avoid delays and additional fees, and enjoy the benefits of owning their home outright.

What is a mortgage payoff statement?

+

A mortgage payoff statement is a document provided by the lender that outlines the exact amount needed to pay off a mortgage loan, including the outstanding principal balance, accrued interest, and any other fees associated with the loan.

How do I request a payoff statement?

+

To request a payoff statement, contact your lender directly and ask for a payoff statement. You can typically do this by phone, email, or through the lender’s website. Be sure to provide your loan account number and any other required information.

What happens after I make the payoff?

+

After you make the payoff, the lender will process the payment and release the lien on the property. You will typically receive a satisfaction of mortgage or release of lien, which is recorded with the county. This document confirms that the mortgage has been paid in full and that the lender no longer has a claim on the property.