Home Loan Paperwork Requirements

Introduction to Home Loan Paperwork Requirements

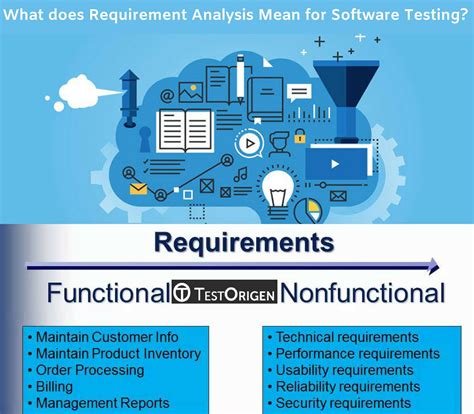

When considering purchasing a home, one of the most critical steps in the process is securing a home loan. The journey to becoming a homeowner can be complex and involves a substantial amount of paperwork. Understanding the requirements and being prepared can significantly streamline the process, reducing stress and uncertainty. Home loan paperwork is a critical component of the mortgage application process, as it provides lenders with the necessary information to assess the borrower’s creditworthiness and ability to repay the loan.

Essential Documents for Home Loan Application

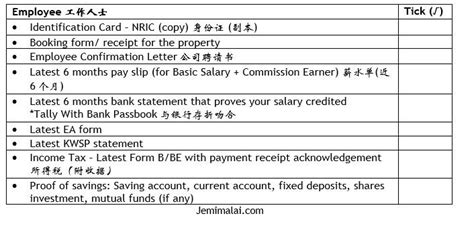

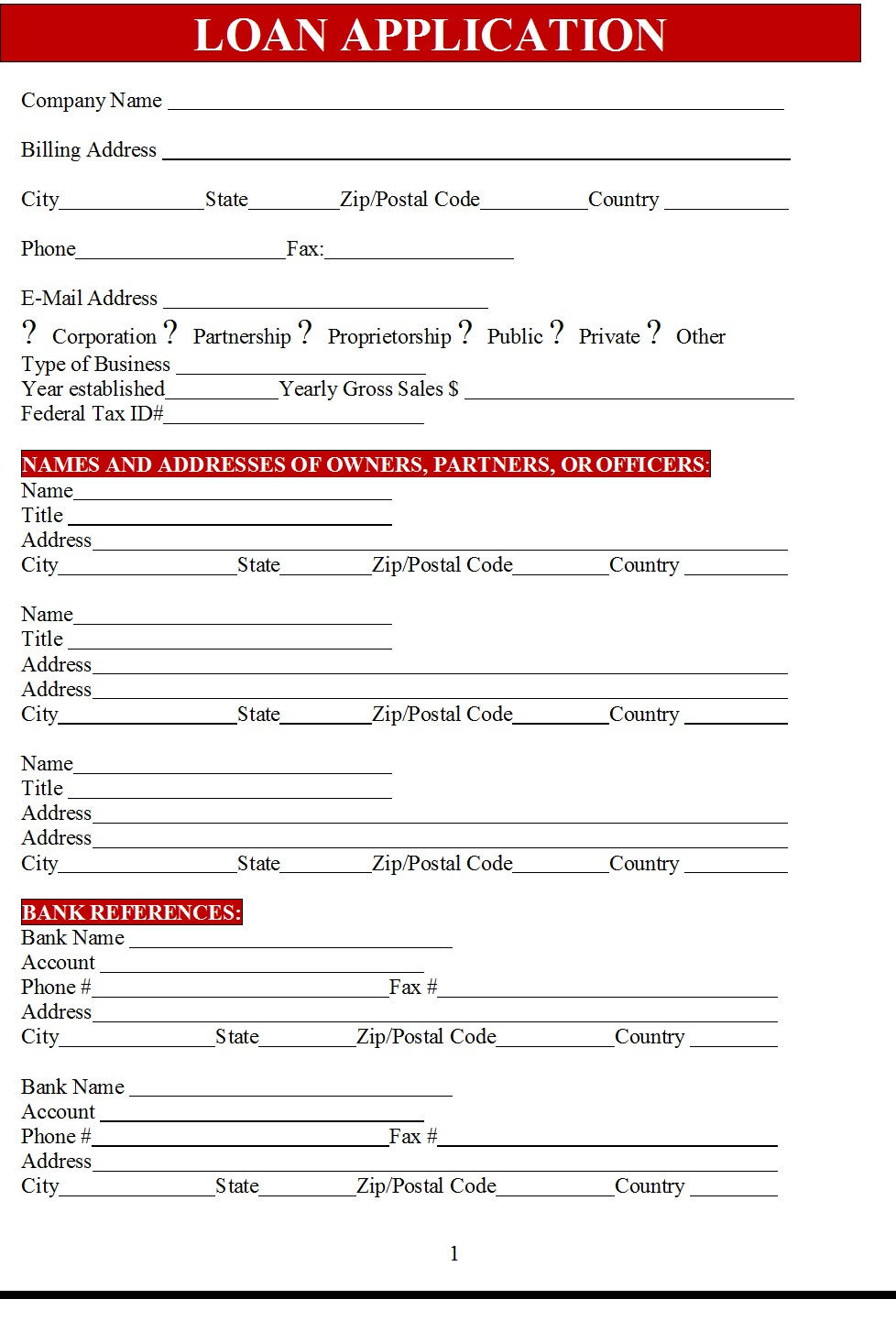

To initiate the home loan application process, several key documents are required. These include: - Identification Documents: Such as a driver’s license, passport, or state ID, which serve as proof of identity. - Income Proof: Pay stubs, W-2 forms, and tax returns are essential to verify the borrower’s income and employment status. - Credit Reports: Lenders obtain credit reports to evaluate the borrower’s credit history and score, which plays a significant role in determining the loan’s interest rate and approval. - Bank Statements: Providing bank statements helps lenders assess the borrower’s financial stability, savings, and ability to make down payments and monthly mortgage payments. - Asset Documentation: Documents related to assets such as savings accounts, investments, and other properties are necessary for lenders to understand the borrower’s overall financial situation.

Additional Requirements for Self-Employed Individuals

Self-employed individuals or those with non-traditional income sources may need to provide additional documentation, including: - Business Financial Statements: Balance sheets, profit and loss statements, and business tax returns are crucial for lenders to evaluate the stability and profitability of the business. - Letter from a CPA: A letter from a Certified Public Accountant (CPA) can provide additional verification of the business’s financial health and the individual’s income. - More Detailed Income Documentation: Self-employed borrowers might need to provide more extensive documentation to prove their income, such as invoices, contracts, and expense reports.

Understanding the Role of Credit Score in Home Loan Approval

A credit score is a three-digit number that represents an individual’s creditworthiness, ranging from 300 to 850. It is calculated based on payment history, credit utilization, length of credit history, credit mix, and new credit inquiries. A good credit score can significantly improve the chances of home loan approval and may also qualify the borrower for better interest rates. It is essential for potential homeowners to check their credit reports for errors and work on improving their credit score before applying for a home loan.

Mortgage Pre-Approval Process

Before starting the house hunt, it is highly recommended to get pre-approved for a mortgage. The pre-approval process involves submitting financial documents to a lender, who then provides a pre-approval letter stating the approved loan amount and interest rate. This step is beneficial for several reasons: - Defines Budget: Pre-approval helps buyers understand how much they can afford, narrowing down their home search. - Strengthens Offer: Sellers often prefer buyers who are pre-approved, as it indicates a higher likelihood of the sale proceeding without financing issues. - Saves Time: The pre-approval process can expedite the final loan approval once the buyer finds a home, as much of the paperwork has already been completed.

Home Appraisal and Inspection

After finding a home and having the offer accepted, the next steps involve the home appraisal and inspection. - Home Appraisal: The lender hires an appraiser to assess the home’s value, ensuring it matches the sale price. This step protects the lender by confirming the property’s value is sufficient to secure the loan. - Home Inspection: While not required by lenders, a home inspection is highly recommended for buyers. It can reveal hidden issues with the property, providing leverage for negotiations or even a reason to reconsider the purchase.

Finalizing the Home Loan

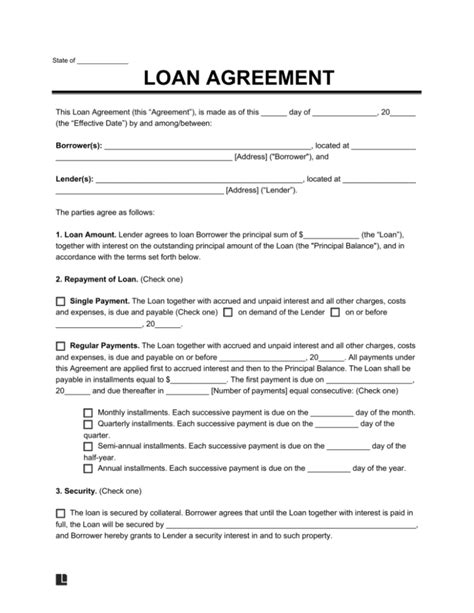

Once all the paperwork and evaluations are complete, the process moves to the loan closing. This is where the borrower signs the final loan documents, and the loan is disbursed. It is crucial to carefully review all documents before signing, ensuring everything is accurate and as agreed upon. The closing costs, which can include fees for the loan origination, title insurance, and appraisal, are typically paid at this stage.

📝 Note: It is essential to work with a reputable lender and consider seeking advice from a financial advisor to navigate the complexities of the home loan process effectively.

Post-Purchase Considerations

After the loan is finalized, and the home is purchased, there are ongoing responsibilities, including: - Mortgage Payments: Regular payments must be made to repay the loan, including interest. - Property Maintenance: Homeowners are responsible for maintaining the property to preserve its value. - Tax Obligations: Homeownership comes with tax responsibilities, including potential deductions for mortgage interest and property taxes.

| Document Type | Description |

|---|---|

| Identification Documents | Proof of identity, such as a driver's license or passport |

| Income Proof | Pay stubs, W-2 forms, and tax returns to verify income and employment |

| Credit Reports | Evaluation of credit history and score |

In summary, the process of securing a home loan involves a considerable amount of paperwork and several steps, from pre-approval to the final loan closing. Being prepared, understanding the requirements, and maintaining a good credit score can make the journey to homeownership smoother and less daunting. By carefully navigating each stage, individuals can ensure they find the right home and secure a mortgage that fits their financial situation.

What are the primary documents required for a home loan application?

+

The primary documents include identification, income proof, credit reports, bank statements, and asset documentation.

How does credit score affect home loan approval and interest rates?

+

A good credit score can improve the chances of loan approval and qualify the borrower for better interest rates, as it reflects better creditworthiness.

What is the purpose of the home appraisal in the home loan process?

+

The home appraisal is conducted to assess the value of the property, ensuring it matches the sale price and can secure the loan.