7 Mortgage Papers

Understanding the 7 Essential Mortgage Papers

When applying for a mortgage, it’s essential to understand the various documents involved in the process. These documents, often referred to as mortgage papers, are crucial for lenders to assess your creditworthiness and determine the terms of your loan. In this article, we’ll delve into the 7 essential mortgage papers you need to know about, including their purpose, content, and significance in the mortgage application process.

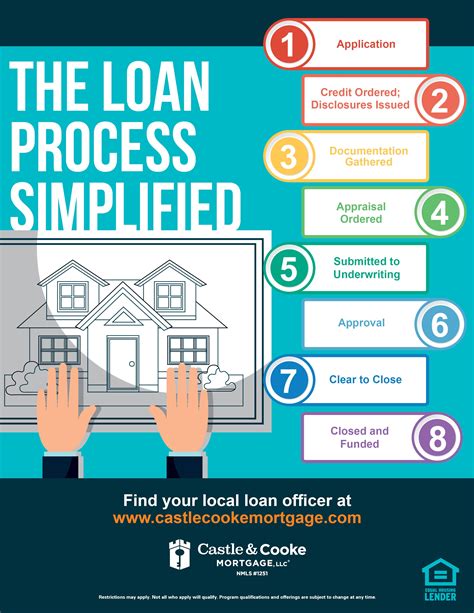

1. Mortgage Application

The mortgage application is the first step in the mortgage process. It’s a document that provides lenders with your personal and financial information, which they use to evaluate your creditworthiness. The application typically includes:

- Personal details: name, address, date of birth, and social security number

- Employment information: income, job title, and employer details

- Financial information: assets, liabilities, and credit history

- Loan details: loan amount, interest rate, and repayment terms

2. Credit Report

A credit report is a document that outlines your credit history, including your payment history, credit accounts, and public records. Lenders use credit reports to assess your creditworthiness and determine the risk of lending to you. A good credit score can help you qualify for better loan terms, while a poor credit score may result in higher interest rates or loan rejection.

📝 Note: It’s essential to review your credit report for errors or inaccuracies before applying for a mortgage, as this can impact your credit score and loan eligibility.

3. Income Verification

Income verification is a document that confirms your income and employment status. Lenders require this document to ensure that you have a stable income and can afford the mortgage payments. Common forms of income verification include:

- Payslips

- W-2 forms

- Tax returns

- Letter from employer

4. Bank Statements

Bank statements are documents that provide lenders with information about your financial transactions, including your income, expenses, and savings. Lenders use bank statements to assess your financial stability and determine your ability to make mortgage payments.

| Type of Account | Statement Period | Required Documents |

|---|---|---|

| Checking Account | 3-6 months | Bank statements, cancelled checks |

| Savings Account | 3-6 months | Bank statements, passbook |

Lenders may require bank statements for multiple accounts, including checking and savings accounts.

5. Identification Documents

Identification documents are essential for verifying your identity and preventing fraud. Common identification documents required for mortgage applications include:

- Driver’s license

- Passport

- State ID

- Social security card

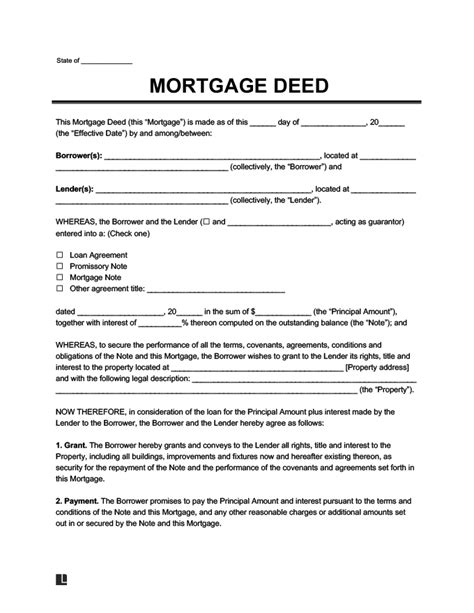

6. Title Report

A title report is a document that provides information about the property’s ownership and any liens or encumbrances on the property. The report typically includes:

- Property description

- Owner’s name and address

- Liens and encumbrances

- Tax information

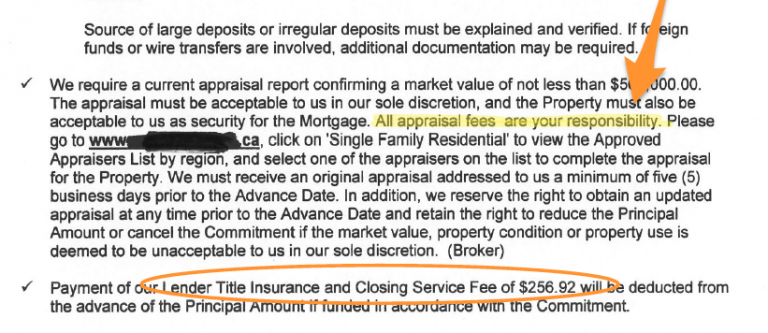

7. Appraisal Report

An appraisal report is a document that provides an independent assessment of the property’s value. The report typically includes:

- Property description

- Comparable sales

- Appraised value

- Photos and diagrams

In summary, understanding the 7 essential mortgage papers is crucial for a smooth and successful mortgage application process. By providing accurate and complete documentation, you can increase your chances of loan approval and secure better loan terms. It’s essential to work closely with your lender and provide all required documents in a timely manner to avoid delays or loan rejection.

What is the purpose of a credit report in the mortgage application process?

+

A credit report is used to assess your creditworthiness and determine the risk of lending to you. It provides lenders with information about your payment history, credit accounts, and public records.

What documents are required for income verification?

+

Common documents required for income verification include payslips, W-2 forms, tax returns, and a letter from your employer. Lenders may also contact your employer to verify your employment status and income.

Why is a title report important in the mortgage application process?

+

A title report is essential for ensuring that the property is free from any unexpected liens or encumbrances that could impact the loan. It provides lenders with information about the property’s ownership and any liens or encumbrances on the property.