5 PPP Loan Papers

Introduction to PPP Loan Papers

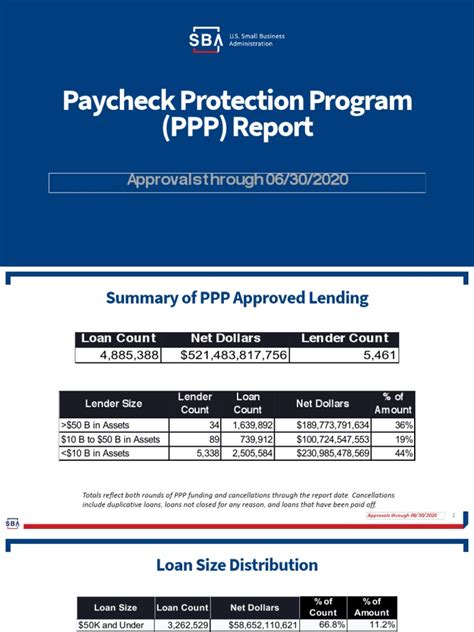

The Paycheck Protection Program (PPP) was a vital initiative introduced by the US government to help small businesses and non-profit organizations cope with the economic impact of the COVID-19 pandemic. The program allowed eligible entities to receive loans that could be partially or fully forgiven if certain conditions were met. Managing and applying for a PPP loan involves several critical documents, often referred to as PPP loan papers. These documents are essential for the loan application process, loan forgiveness, and compliance with the program’s requirements. In this article, we will delve into the details of five key PPP loan papers that businesses and lenders need to be familiar with.

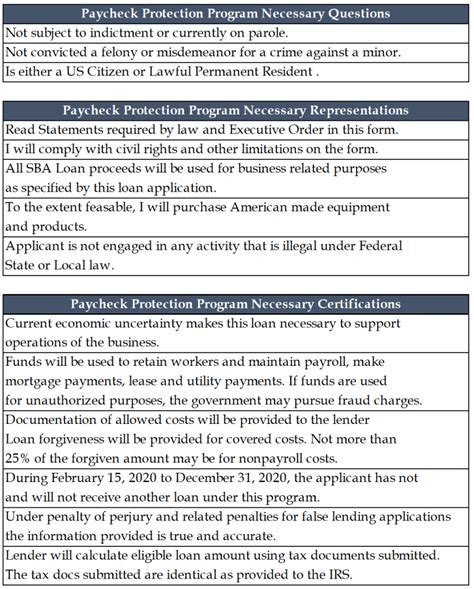

1. PPP Loan Application Form

The PPP Loan Application Form is the initial document that borrowers must complete to apply for a PPP loan. This form requires detailed information about the borrower, including business name, address, ownership structure, average monthly payroll costs, and the requested loan amount. It’s crucial for borrowers to ensure the accuracy of the information provided, as any discrepancies or inaccuracies can lead to delays or rejection of the application. Lenders use this form to assess the borrower’s eligibility and to process the loan application.

2. PPP Loan Note

The PPP Loan Note is a legal document that outlines the terms and conditions of the loan, including the loan amount, interest rate, maturity date, and repayment terms. This note serves as evidence of the debt and is signed by both the borrower and the lender. It’s essential for borrowers to carefully review the terms of the note to understand their obligations and ensure they can meet the repayment requirements. The PPP Loan Note is a critical document for both lenders and borrowers, as it formalizes the loan agreement and provides a basis for enforcement if the borrower defaults.

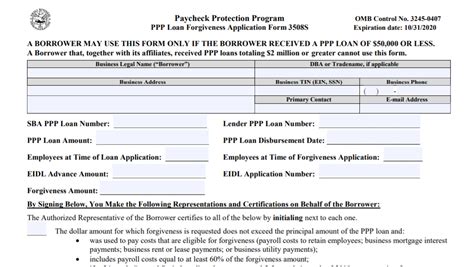

3. PPP Loan Forgiveness Application

After receiving a PPP loan, borrowers can apply for loan forgiveness if they meet specific requirements, such as using at least 60% of the loan proceeds for payroll costs and maintaining employee headcount and compensation levels. The PPP Loan Forgiveness Application is the document used for this purpose. Borrowers must provide detailed documentation to support their forgiveness application, including payroll records, bank statements, and tax forms. The lender reviews the application and may request additional information before submitting it to the Small Business Administration (SBA) for approval.

4. SBA Form 3508

SBA Form 3508 is a critical document in the PPP loan forgiveness process. It’s used to calculate the amount of loan forgiveness and to provide the necessary documentation to support the forgiveness application. This form requires borrowers to disclose how they used the loan proceeds, including the amount spent on payroll costs, rent, utilities, and mortgage interest. Borrowers must also provide documentation to support these expenditures, such as invoices, bank statements, and cancelled checks. The SBA uses this form to verify the borrower’s eligibility for loan forgiveness and to determine the amount of forgiveness.

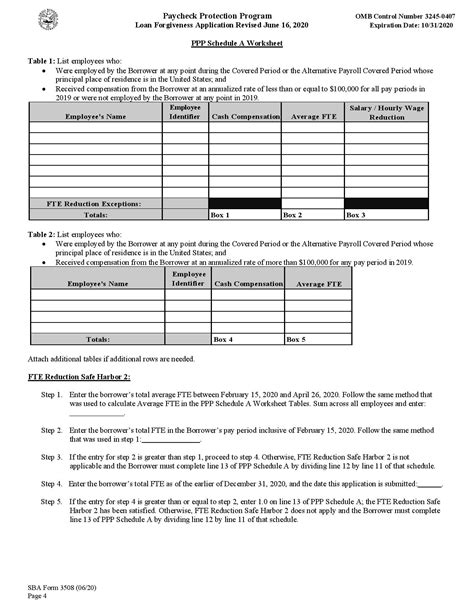

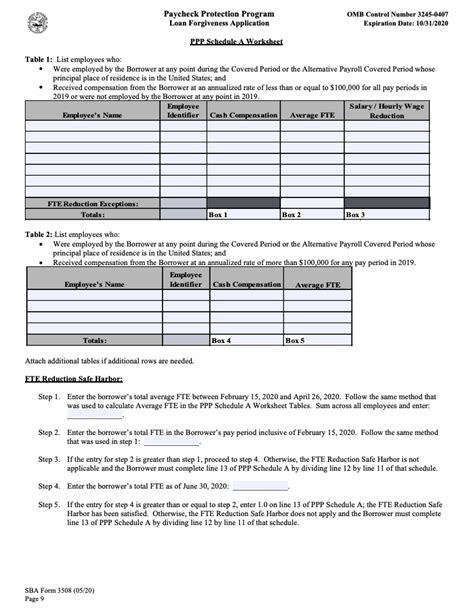

5. PPP Loan Forgiveness Schedule A

PPP Loan Forgiveness Schedule A is a supporting document to the PPP Loan Forgiveness Application. It’s used to calculate the borrower’s eligible payroll costs and to determine the amount of loan forgiveness. This schedule requires borrowers to provide detailed information about their payroll costs, including employee compensation, benefits, and taxes. Borrowers must also disclose any reductions in employee headcount or compensation, which can affect the amount of loan forgiveness. The lender and the SBA review Schedule A to ensure the borrower’s calculations are accurate and to verify the borrower’s eligibility for loan forgiveness.

💡 Note: Borrowers should maintain accurate and detailed records of their loan expenditures and forgiveness applications, as these documents may be subject to audit by the SBA or other government agencies.

In summary, managing a PPP loan involves several critical documents that borrowers and lenders must be familiar with. These documents, including the PPP Loan Application Form, PPP Loan Note, PPP Loan Forgiveness Application, SBA Form 3508, and PPP Loan Forgiveness Schedule A, play a vital role in the loan application process, loan forgiveness, and compliance with the program’s requirements. By understanding the purpose and importance of these documents, businesses can navigate the PPP loan process more effectively and ensure they meet the necessary conditions for loan forgiveness.

What is the purpose of the PPP Loan Application Form?

+

The PPP Loan Application Form is used to apply for a PPP loan and requires detailed information about the borrower, including business name, address, ownership structure, average monthly payroll costs, and the requested loan amount.

What documents are required to support a PPP Loan Forgiveness Application?

+

Borrowers must provide detailed documentation to support their forgiveness application, including payroll records, bank statements, tax forms, and invoices.

What is the purpose of SBA Form 3508?

+

SBA Form 3508 is used to calculate the amount of loan forgiveness and to provide the necessary documentation to support the forgiveness application.