5 USDA Loan Documents

Introduction to USDA Loan Documents

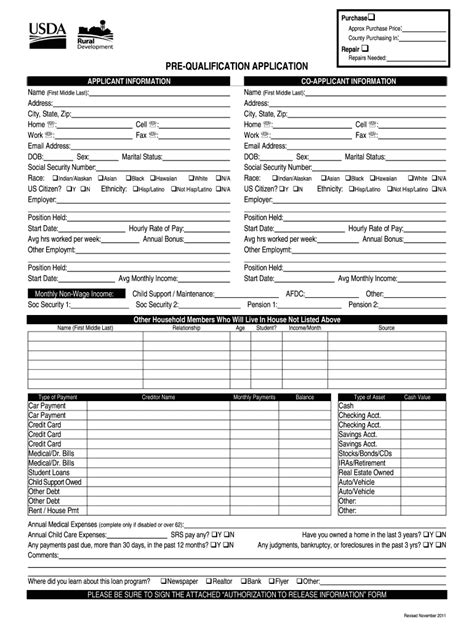

When applying for a USDA loan, it’s essential to understand the various documents required to complete the process. The United States Department of Agriculture (USDA) provides loans to borrowers who purchase homes in rural areas, and the documentation needed can be extensive. In this article, we’ll explore the five key USDA loan documents that borrowers must provide to secure their loan.

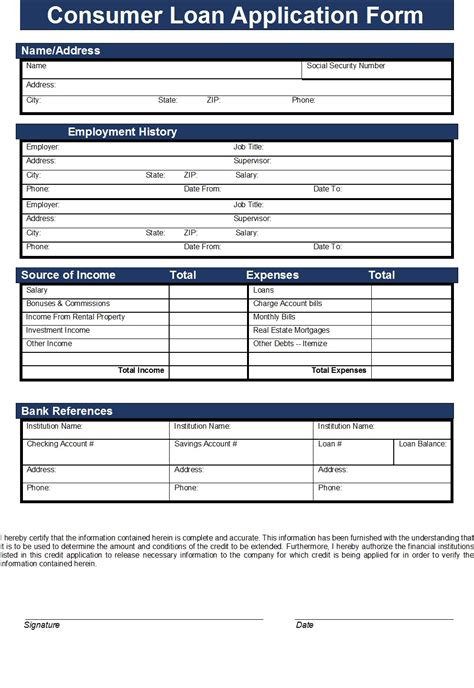

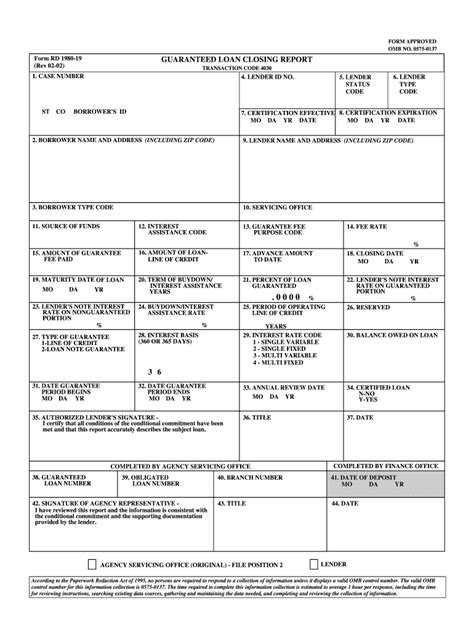

1. Uniform Residential Loan Application

The Uniform Residential Loan Application, also known as the URLA, is the standard form used by lenders to collect borrower information. This document requires borrowers to provide personal, financial, and employment details, as well as information about the property they’re purchasing. The URLA is typically the first document completed in the loan application process.

2. Pay Stubs and W-2 Forms

To verify employment and income, borrowers must provide pay stubs and W-2 forms from the past two years. These documents help lenders determine the borrower’s income stability and ability to repay the loan. Self-employed borrowers may need to provide additional documentation, such as tax returns and financial statements.

3. Bank Statements and Asset Documents

Borrowers must provide bank statements and other asset documents to demonstrate their financial resources and ability to cover closing costs. These documents may include: * Bank statements from the past 60 days * Investment account statements * Retirement account statements * Other asset documents, such as stocks or bonds

4. Credit Reports and Score

Lenders require credit reports and credit scores to evaluate the borrower’s creditworthiness. The credit report will show the borrower’s payment history, credit utilization, and other credit-related information. The credit score will help lenders determine the borrower’s risk level and interest rate.

5. Appraisal Report

An appraisal report is required to determine the value of the property being purchased. The appraisal report will include information about the property’s condition, size, and location, as well as comparable sales data. The appraisal report helps lenders ensure that the loan amount is not excessive compared to the property’s value.

💡 Note: Borrowers should be prepared to provide additional documentation, such as identification and insurance information, as required by the lender or the USDA.

To summarize, the five key USDA loan documents are: * Uniform Residential Loan Application (URLA) * Pay stubs and W-2 forms * Bank statements and asset documents * Credit reports and score * Appraisal report

These documents are essential to the USDA loan application process, and borrowers should be prepared to provide them to their lender. By understanding the required documentation, borrowers can ensure a smooth and efficient loan application process.

In the end, securing a USDA loan requires careful planning, attention to detail, and a thorough understanding of the documentation required. By following the guidelines outlined in this article, borrowers can navigate the process with confidence and achieve their goal of homeownership.

What is the minimum credit score required for a USDA loan?

+

The minimum credit score required for a USDA loan is 640, but some lenders may have stricter requirements.

Can I use a USDA loan to purchase a condo or townhouse?

+

Yes, you can use a USDA loan to purchase a condo or townhouse, but the property must meet specific requirements and be located in a rural area.

How long does the USDA loan application process typically take?

+

The USDA loan application process can take anywhere from 30 to 60 days, depending on the complexity of the application and the efficiency of the lender.