5 Steps Homestead Exemption

Introduction to Homestead Exemption

The homestead exemption is a valuable benefit that can help homeowners reduce their property tax liability. It is a legal provision that exempts a certain amount of the value of a primary residence from taxation. In this blog post, we will guide you through the process of applying for a homestead exemption, highlighting the key steps and requirements.

What is Homestead Exemption?

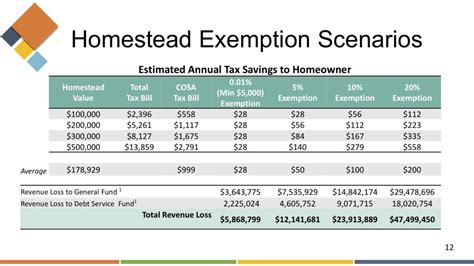

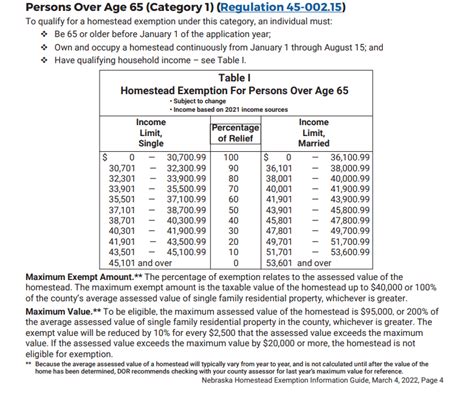

The homestead exemption is a tax exemption that can be claimed on a primary residence, which is the home that the owner lives in for the majority of the year. The exemption amount varies by state and can range from a few thousand dollars to tens of thousands of dollars. This exemption can significantly reduce the amount of property taxes that a homeowner owes, making it an essential benefit for many individuals and families.

5 Steps to Apply for Homestead Exemption

To apply for a homestead exemption, follow these steps:

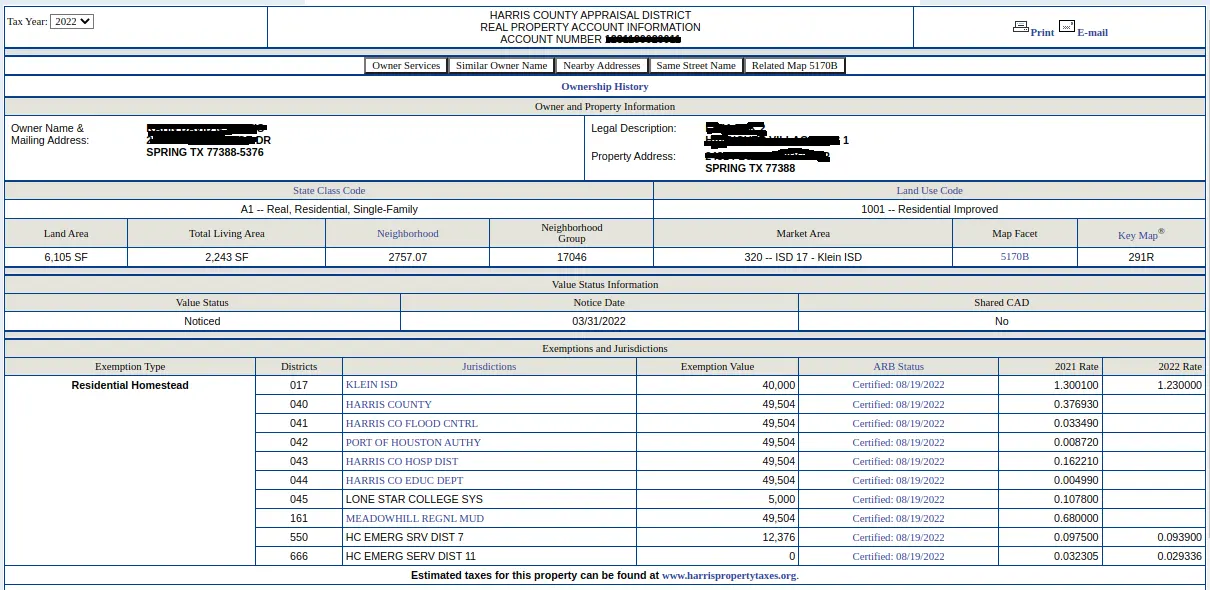

- Step 1: Determine Eligibility: Check with your local tax authority to see if you are eligible for a homestead exemption. Generally, you must own and occupy the property as your primary residence to qualify.

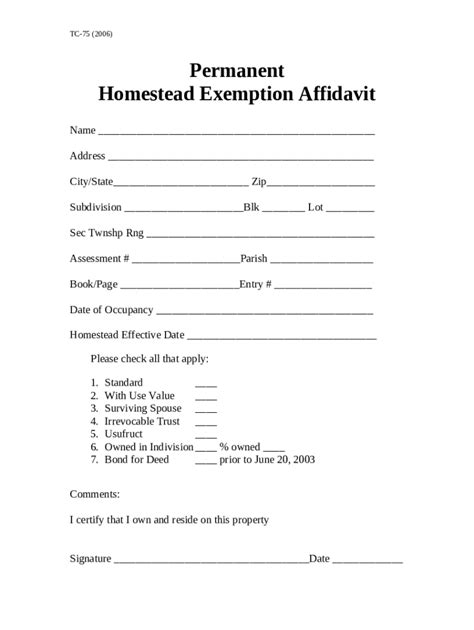

- Step 2: Gather Required Documents: Typically, you will need to provide proof of ownership, such as a deed or title, and proof of residency, such as a driver’s license or utility bills.

- Step 3: Fill Out the Application: Obtain the homestead exemption application form from your local tax authority or download it from their website. Fill out the form accurately and completely, providing all required information and documentation.

- Step 4: Submit the Application: Submit the completed application and supporting documents to your local tax authority by the designated deadline. This is usually between January 1 and April 30, but the deadline may vary depending on your location.

- Step 5: Review and Approval: The tax authority will review your application and verify the information provided. If your application is approved, you will receive a notification stating the amount of the exemption and the resulting reduction in your property taxes.

📝 Note: The specific requirements and deadlines for applying for a homestead exemption vary by state and locality, so it is essential to check with your local tax authority for specific information and guidance.

Benefits of Homestead Exemption

The homestead exemption provides several benefits to homeowners, including:

- Reduced Property Taxes: The most significant advantage of the homestead exemption is the reduction in property taxes. This can result in significant savings, especially for homeowners with high-value properties.

- Increased Affordability: By reducing property taxes, the homestead exemption can make homeownership more affordable, especially for low- and moderate-income families.

- Protection from Tax Increases: In some states, the homestead exemption can also provide protection from large increases in property taxes, which can help to prevent homeowners from being priced out of their homes due to rising tax bills.

Common Mistakes to Avoid

When applying for a homestead exemption, it is essential to avoid common mistakes that can result in denial or delay of the application. These mistakes include:

- Incomplete or Inaccurate Application: Failing to provide complete and accurate information on the application form can lead to delays or denial of the exemption.

- Missing Deadline: Submitting the application after the deadline can result in denial of the exemption for that year.

- Insufficient Documentation: Failing to provide required documentation, such as proof of ownership or residency, can lead to denial of the exemption.

| State | Exemption Amount | Deadline |

|---|---|---|

| Florida | $50,000 | March 1 |

| California | $7,000 | February 15 |

| Texas | $25,000 | April 30 |

In summary, the homestead exemption is a valuable benefit that can help homeowners reduce their property tax liability. By following the 5 steps outlined in this blog post and avoiding common mistakes, homeowners can ensure that they receive the exemption and enjoy the resulting savings.

The main points to remember are to determine eligibility, gather required documents, fill out the application, submit the application, and review and approval. Additionally, it is essential to be aware of the benefits of the homestead exemption, including reduced property taxes, increased affordability, and protection from tax increases.

As we finalize this discussion, it is clear that the homestead exemption is a crucial aspect of homeownership, and understanding the application process and requirements is vital for maximizing its benefits.

What is the purpose of the homestead exemption?

+

The purpose of the homestead exemption is to reduce the property tax liability of homeowners, making homeownership more affordable and providing protection from large increases in property taxes.

How do I apply for a homestead exemption?

+

To apply for a homestead exemption, follow the 5 steps outlined in this blog post: determine eligibility, gather required documents, fill out the application, submit the application, and review and approval.

What are the benefits of the homestead exemption?

+

The benefits of the homestead exemption include reduced property taxes, increased affordability, and protection from large increases in property taxes.