5 Documents Needed

Introduction to Essential Documents

When it comes to legal, financial, and personal matters, having the right documents in order can make a significant difference. These documents not only help in times of need but also provide a sense of security and organization. In this article, we will explore five crucial documents that everyone should have. Understanding the importance and the process of obtaining these documents can be instrumental in planning for the future.

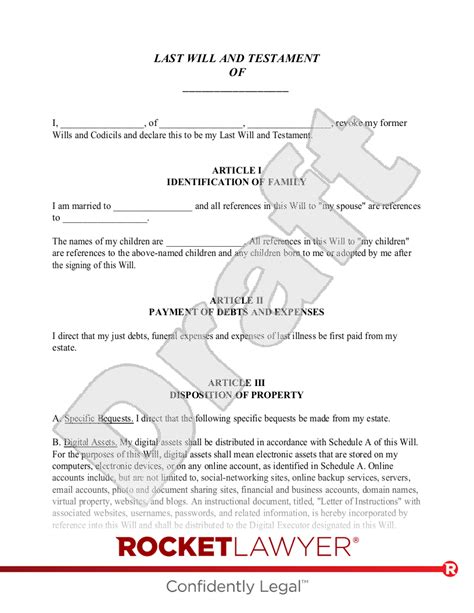

1. Will or Last Testament

A will or last testament is a document that outlines how a person’s assets should be distributed after their death. It is a critical document for ensuring that one’s wishes are respected and that loved ones are taken care of. Creating a will involves specifying the distribution of property, naming an executor, and sometimes including provisions for minor children. It’s essential to have a will to avoid disputes among family members and to ensure that assets are distributed according to one’s intentions.

2. Power of Attorney (POA)

A Power of Attorney is a document that grants someone the authority to act on another person’s behalf in legal, financial, or health matters. This document is vital in situations where an individual becomes incapacitated and cannot make decisions for themselves. There are different types of POA, including: - General Power of Attorney: Gives broad powers to the attorney-in-fact. - Special Power of Attorney: Limits the attorney-in-fact’s powers to specific actions. - Durable Power of Attorney: Remains in effect even if the principal becomes incapacitated.

3. Advance Directive

An Advance Directive, also known as a living will, is a document that specifies the type of medical care an individual wants to receive if they become unable to make decisions for themselves. It includes: - Living Will: Outlines the medical treatments one wants or does not want to receive. - Do Not Resuscitate (DNR) Order: Instructs healthcare providers not to perform CPR if a person’s heart stops or if they stop breathing. - Healthcare Proxy: Appoints someone to make medical decisions on one’s behalf.

4. Insurance Policies

Insurance policies provide financial protection against various risks. Key types of insurance include: - Life Insurance: Provides a death benefit to beneficiaries. - Health Insurance: Covers medical expenses. - Disability Insurance: Offers income replacement if one becomes unable to work due to illness or injury. - Long-term Care Insurance: Helps cover costs associated with long-term care, such as nursing home care.

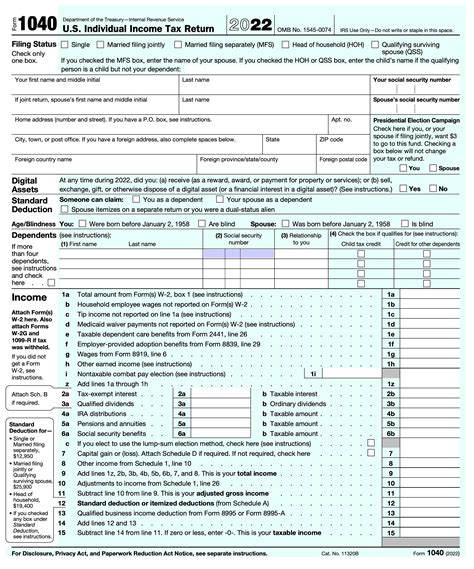

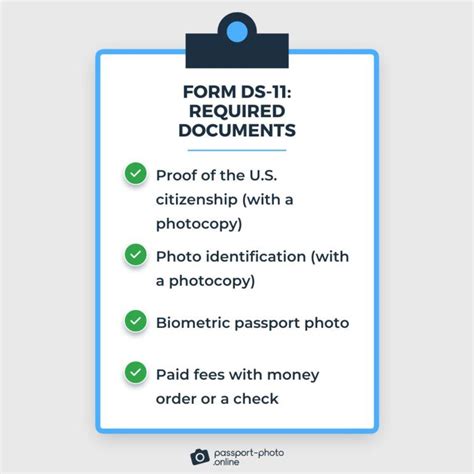

5. Identity and Financial Documents

Important identity and financial documents include: - Passport: Essential for international travel. - Driver’s License or State ID: Required for identification and driving purposes. - Social Security Card: Necessary for employment and accessing government benefits. - Birth Certificate: Needed for various legal and administrative tasks. - Bank Statements and Investment Records: Crucial for managing finances and taxes.

📝 Note: It's essential to keep these documents up to date and stored in a secure, easily accessible location, such as a safe or a secure online storage service.

To summarize, having the right documents in place is crucial for protecting one’s assets, ensuring wishes are respected, and providing for loved ones. By understanding the importance of a will, power of attorney, advance directive, insurance policies, and key identity and financial documents, individuals can better prepare for the future and face life’s challenges with confidence.

What is the primary purpose of having a will?

+

The primary purpose of having a will is to ensure that one’s assets are distributed according to their wishes after their death, avoiding potential disputes among family members.

Why is it important to have a Power of Attorney?

+

Having a Power of Attorney is crucial because it allows someone to act on your behalf in legal, financial, or health matters if you become incapacitated, ensuring your interests are protected.

What types of insurance policies are considered essential?

+

Essential insurance policies include life insurance, health insurance, disability insurance, and long-term care insurance, which provide financial protection against various risks and help ensure one’s financial security and well-being.