5 Michigan Estate Tax Forms

Introduction to Michigan Estate Tax Forms

Michigan, like other states, has its own set of laws and regulations regarding estate taxes. Understanding these laws and the necessary forms is crucial for anyone dealing with the estate of a deceased person. The estate tax is a tax on the transfer of property after someone’s death, and it can include a wide range of assets such as cash, real estate, and other possessions. In Michigan, the estate tax is not a state tax but rather a federal tax, as Michigan does not have a state estate tax. However, the federal estate tax still applies, and there are forms and processes that must be followed.

Understanding the Forms

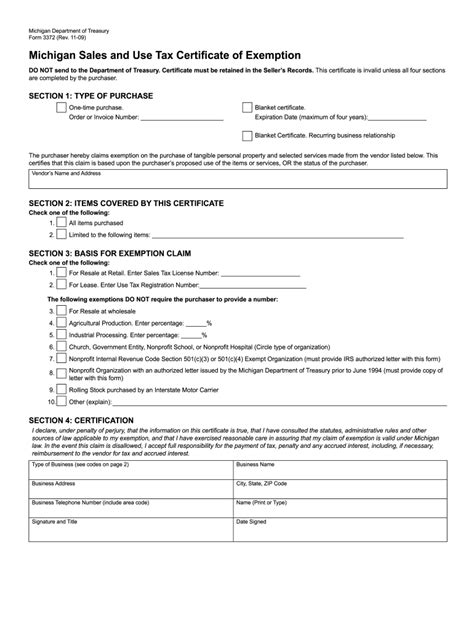

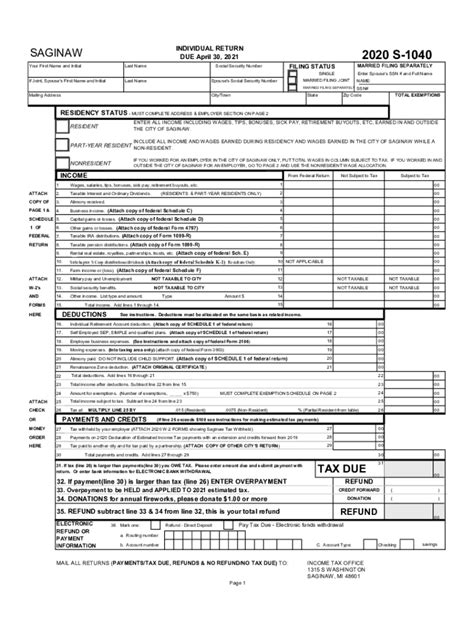

There are several forms that may be relevant when dealing with estate taxes in Michigan. These forms are used for various purposes, including reporting the value of the estate, claiming exemptions, and paying any taxes that are due. Here are five key forms that are often involved in the process:

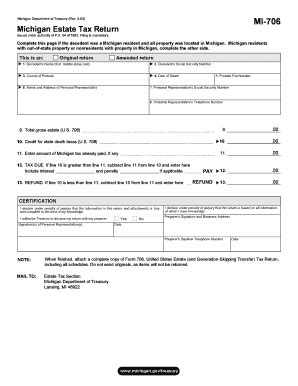

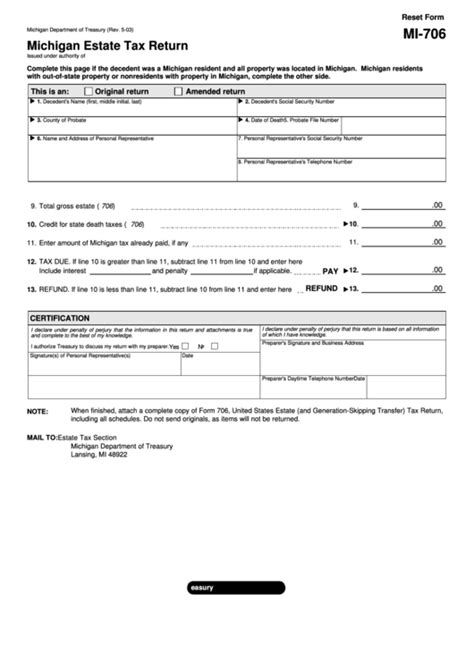

- Form 706: This is the United States Estate (and Generation-Skipping Transfer) Tax Return. It’s used to report the value of the estate and to calculate the estate tax. The form is quite detailed and requires a list of all the assets in the estate, their value, and any deductions or exemptions that apply.

- Form 709: This form is used for the gift tax, which can also impact the estate tax. Gifts made during the lifetime of the deceased can reduce the amount of the exemption available for the estate tax.

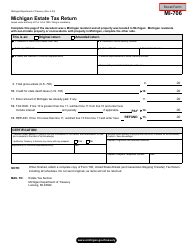

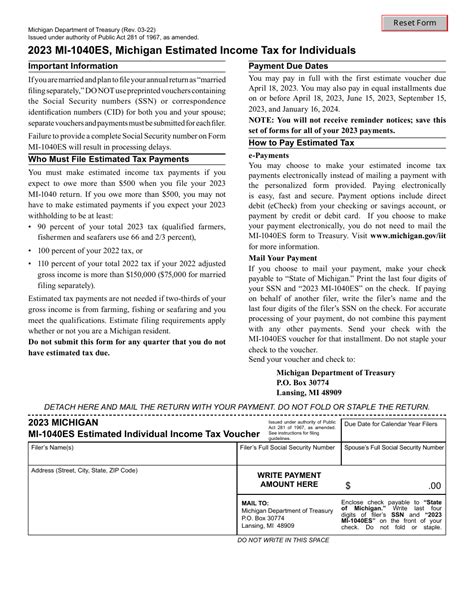

- Form 1041: This is the income tax return for estates and trusts. While it’s not directly an estate tax form, it’s relevant because income that is earned by the estate after the death of the owner is subject to income tax.

- Form 8939: This form is used to allocate the generation-skipping transfer (GST) exemption. The GST tax is a tax on transfers to skip persons, typically grandchildren or more remote descendants.

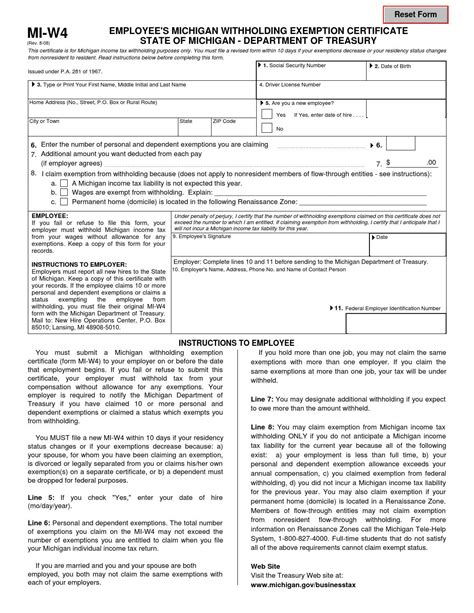

- Form 2848: This form is a power of attorney, which allows someone else to represent the estate in dealings with the IRS, including filing forms and negotiating any tax disputes.

Filing the Forms

Filing these forms correctly and on time is crucial to avoid penalties and interest. The deadline for filing Form 706, for example, is typically nine months after the date of death, although a six-month extension can be requested. It’s also important to ensure that all necessary information is included and that the forms are signed and dated correctly. For complex estates, it may be beneficial to hire a professional, such as an attorney or accountant, who has experience with estate taxes and the necessary forms.

Additional Considerations

In addition to understanding and filing the correct forms, there are other considerations when dealing with estate taxes in Michigan. These include: - Exemptions: There are exemptions available that can reduce the amount of estate tax owed. For example, assets left to a spouse or charity are generally exempt from estate tax. - Portability: The concept of portability allows the surviving spouse to use any unused exemption of the deceased spouse, which can significantly reduce or even eliminate the estate tax. - State Taxes: While Michigan does not have a state estate tax, there may be other state taxes, such as income tax on income earned by the estate, that need to be considered.

| Form Number | |

|---|---|

| 706 | United States Estate (and Generation-Skipping Transfer) Tax Return |

| 709 | United States Gift (and Generation-Skipping Transfer) Tax Return |

| 1041 | U.S. Income Tax Return for Estates and Trusts |

| 8939 | Allocation of Increase in Lifetime Exemption (Completed Only if the Election is Being Made) |

| 2848 | Power of Attorney and Declaration of Representative |

💡 Note: It's essential to consult with a tax professional or attorney to ensure compliance with all tax laws and regulations, as they can provide guidance tailored to the specific circumstances of the estate.

In summary, dealing with estate taxes in Michigan involves understanding and correctly filing several important forms, including Form 706, Form 709, Form 1041, Form 8939, and Form 2848. Each form serves a specific purpose, from reporting the estate’s value and calculating the estate tax to allocating exemptions and representing the estate before the IRS. By being aware of these forms and the processes involved, individuals can better navigate the complex world of estate taxes and ensure that the estate is managed in a compliant and efficient manner.

What is the purpose of Form 706 in estate tax?

+

Form 706 is used to report the value of the estate and to calculate the estate tax. It requires a detailed list of all assets in the estate, their value, and any deductions or exemptions that apply.

Does Michigan have a state estate tax?

+

No, Michigan does not have a state estate tax. However, the federal estate tax still applies to estates in Michigan.

What is the deadline for filing Form 706?

+

The deadline for filing Form 706 is typically nine months after the date of death, although a six-month extension can be requested.