Mortgage Paperwork Needed

Introduction to Mortgage Paperwork

When applying for a mortgage, it’s essential to understand the various documents and paperwork required throughout the process. The mortgage application process can be complex and time-consuming, but being prepared with the necessary documents can help streamline the experience. In this article, we will guide you through the typical mortgage paperwork needed, providing you with a comprehensive understanding of what to expect.

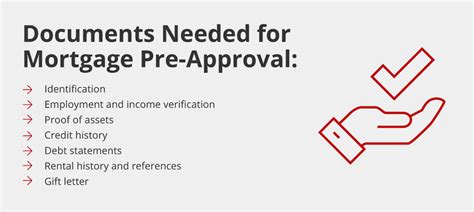

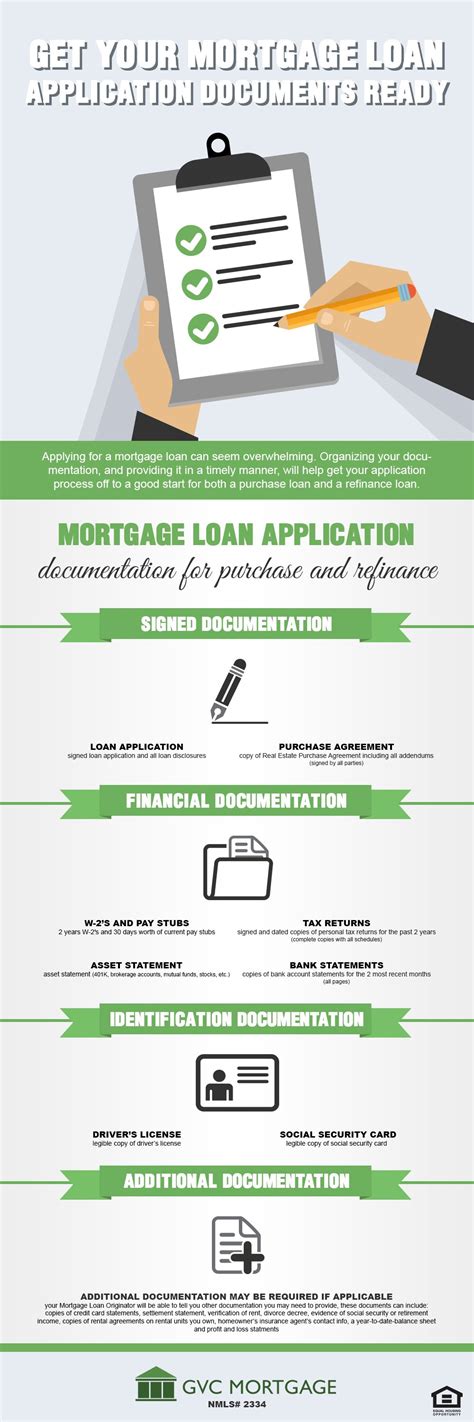

Pre-Approval Documents

Before starting your home search, it’s recommended to get pre-approved for a mortgage. This step requires submitting financial documents to your lender, who will then provide you with a pre-approval letter stating the approved loan amount. The following documents are typically required for pre-approval: * Identification: Valid government-issued ID, such as a driver’s license or passport * Income verification: Pay stubs, W-2 forms, and tax returns * Asset documentation: Bank statements, investment accounts, and retirement accounts * Credit reports: Your lender will pull your credit report, but it’s a good idea to review it beforehand to ensure accuracy

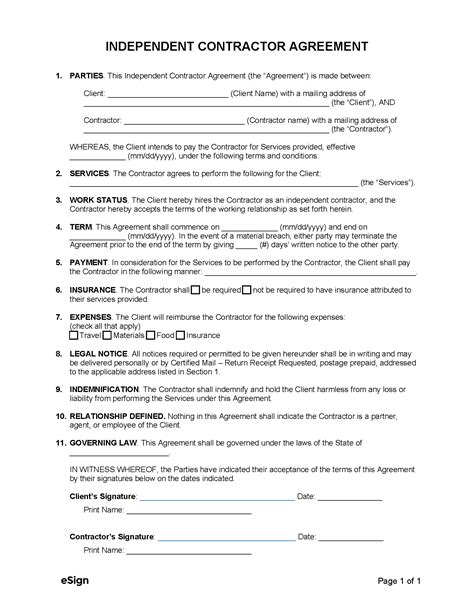

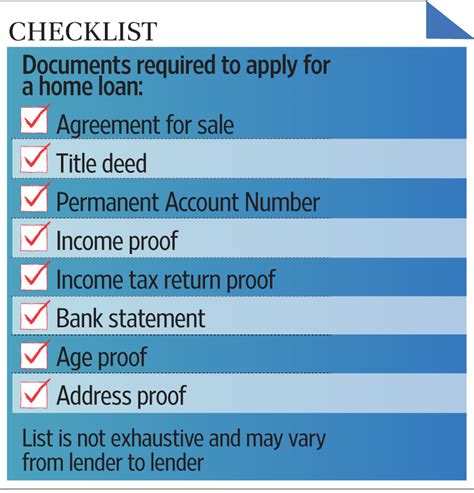

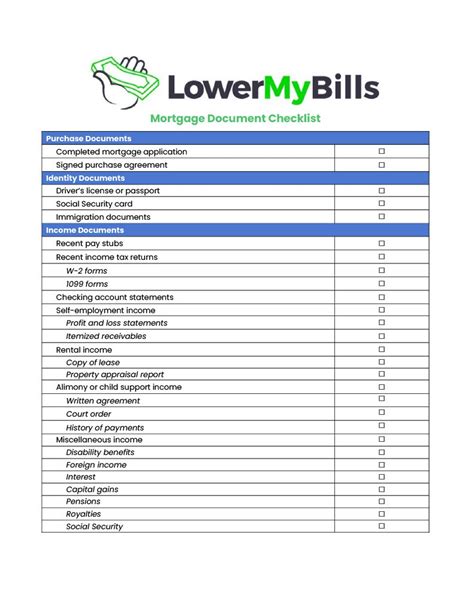

Mortgage Application Documents

Once you’ve found a home and are ready to apply for a mortgage, you’ll need to provide additional documentation. The following documents are typically required: * Loan application: A completed mortgage application, which will include information about the property, loan amount, and your financial situation * Property information: Details about the property, including the address, purchase price, and property type * Appraisal report: An appraisal report, which provides an independent assessment of the property’s value * Title report: A title report, which verifies the property’s ownership and identifies any potential issues

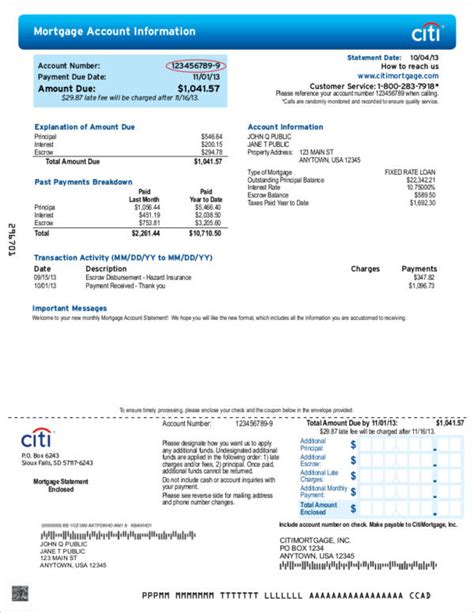

Financial Documentation

Your lender will require detailed financial documentation to assess your creditworthiness and ability to repay the loan. The following documents are typically required: * Pay stubs: Recent pay stubs, which show your income and employment status * Bank statements: Bank statements, which demonstrate your savings and asset history * Tax returns: Tax returns, which provide a comprehensive view of your income and financial situation * Retirement accounts: Statements from retirement accounts, such as 401(k) or IRA accounts

Credit Report and Score

Your credit report and score play a significant role in determining your mortgage eligibility and interest rate. It’s essential to review your credit report beforehand to ensure accuracy and address any potential issues. A good credit score can help you qualify for better loan terms, while a poor credit score may result in higher interest rates or even loan denial.

Additional Documents

Depending on your situation, you may need to provide additional documentation, such as: * Divorce or separation documents: If you’re divorced or separated, you may need to provide documentation related to alimony or child support * Bankruptcy or foreclosure documents: If you’ve experienced bankruptcy or foreclosure, you may need to provide documentation explaining the circumstances * Gift letter: If you’re using a gift from a family member or friend for your down payment, you’ll need to provide a gift letter, which states that the funds are a gift and not a loan

📝 Note: The specific documents required may vary depending on your lender, loan type, and individual circumstances. It's essential to check with your lender to ensure you have all the necessary paperwork.

Organizing Your Documents

To ensure a smooth mortgage application process, it’s crucial to keep your documents organized and easily accessible. Consider creating a folder or digital file with the following categories: * Identification * Income verification * Asset documentation * Credit reports * Property information * Loan application

| Document Type | Description |

|---|---|

| Identification | Valid government-issued ID, such as a driver's license or passport |

| Income verification | Pay stubs, W-2 forms, and tax returns |

| Asset documentation | Bank statements, investment accounts, and retirement accounts |

| Credit reports | Credit report and score |

In summary, the mortgage application process requires a significant amount of documentation, including identification, income verification, asset documentation, and credit reports. By understanding the necessary paperwork and keeping your documents organized, you can help ensure a smooth and efficient mortgage application process. It’s essential to check with your lender to determine the specific documents required for your situation, as these may vary depending on your loan type and individual circumstances.

What documents are required for mortgage pre-approval?

+

The documents required for mortgage pre-approval typically include identification, income verification, asset documentation, and credit reports.

How long does the mortgage application process typically take?

+

The mortgage application process can take anywhere from 30 to 60 days, depending on the complexity of the application and the lender’s workload.

Can I apply for a mortgage online?

+

Yes, many lenders offer online mortgage applications, which can streamline the process and reduce paperwork.