Paperwork

New Employee Paperwork Requirements

Introduction to New Employee Paperwork Requirements

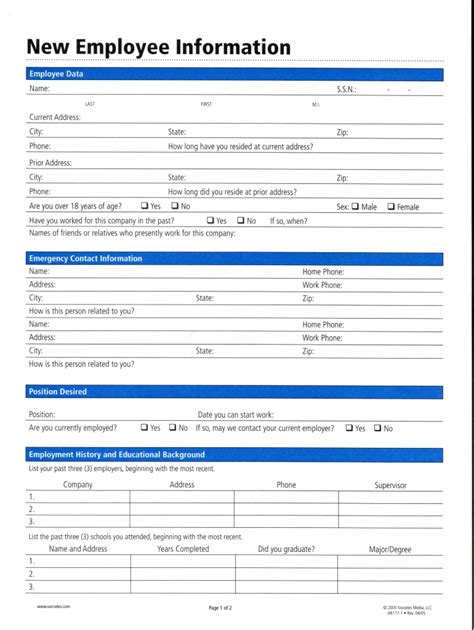

When a new employee joins an organization, there are several paperwork requirements that must be completed to ensure a smooth transition and compliance with various laws and regulations. These requirements can vary depending on the country, state, or province, but there are some common documents that are typically required. In this article, we will explore the different types of paperwork that new employees are usually required to complete, and the importance of each document.

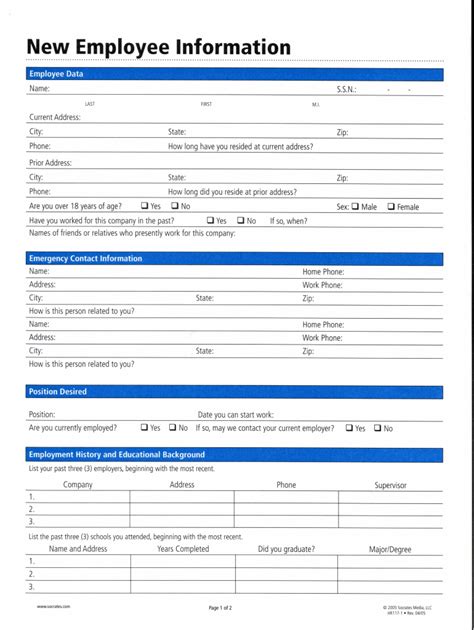

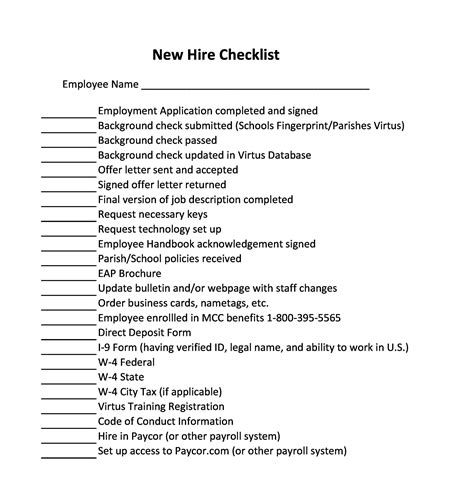

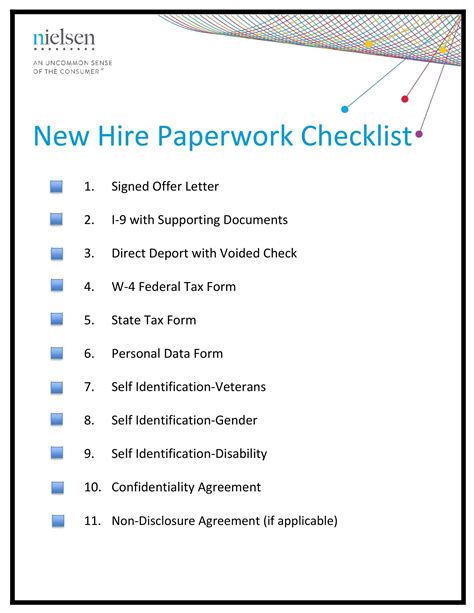

Pre-Employment Paperwork

Before a new employee starts working, there are several pre-employment documents that must be completed. These include: * Job application form: This is the initial document that an applicant fills out to express interest in a job opening. * Resume and cover letter: These documents provide more detailed information about the applicant’s qualifications and experience. * References: Many employers require applicants to provide professional references, which can be contacted to verify the applicant’s previous work experience and performance. * Background check consent form: Depending on the type of job and the employer’s policies, a background check may be required. The applicant must provide consent for the employer to conduct a background check.

Employment Contract and Related Documents

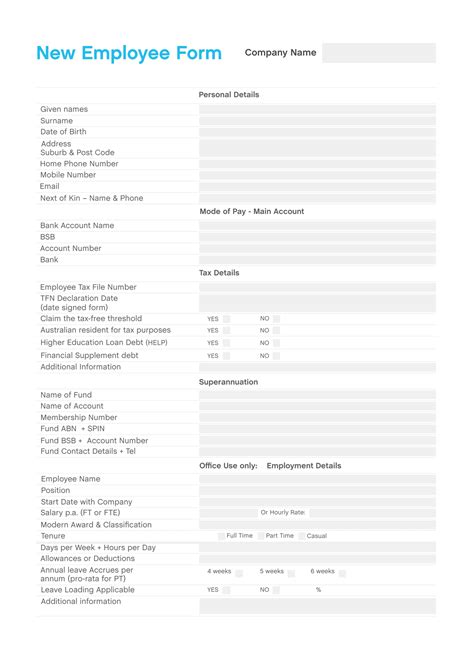

Once a new employee has been hired, they will typically be required to sign an employment contract, which outlines the terms and conditions of their employment. This contract may include information such as: * Job title and description: A detailed description of the job duties and responsibilities. * Salary and benefits: Information about the employee’s compensation package, including salary, bonuses, and benefits. * Work schedule: The employee’s working hours, including start and end times, breaks, and days off. * Confidentiality and non-disclosure agreements: The employee may be required to sign a confidentiality agreement to protect the employer’s proprietary information.

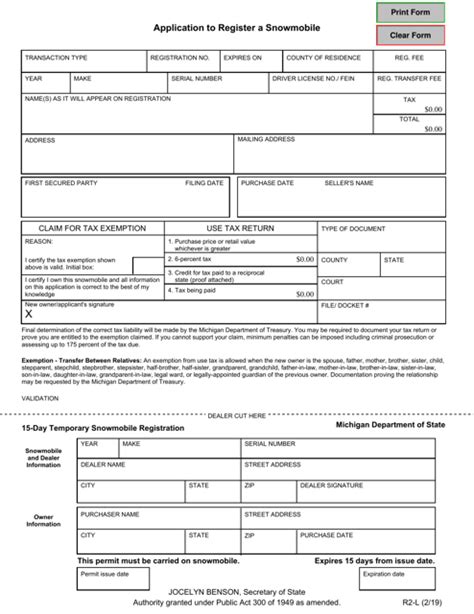

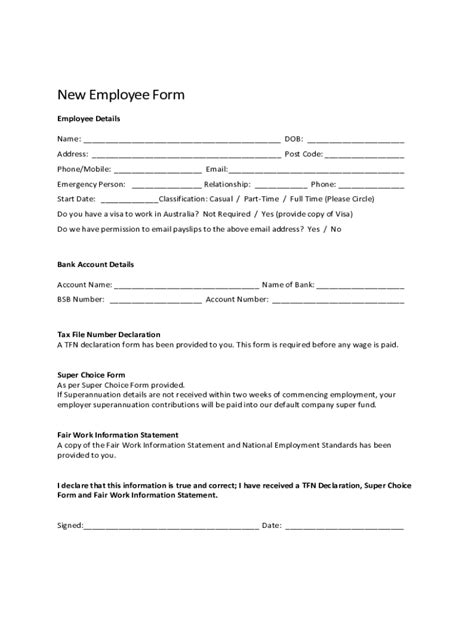

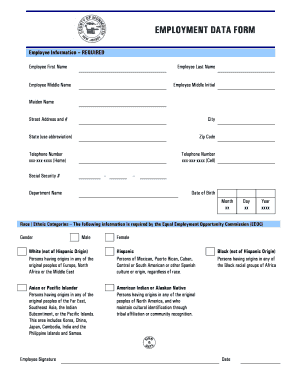

Tax-Related Paperwork

New employees are also required to complete tax-related paperwork, including: * W-4 form: This form is used to determine the amount of federal income tax to be withheld from the employee’s wages. * State and local tax forms: Depending on the state and locality, there may be additional tax forms that must be completed. * Benefits enrollment forms: If the employer offers benefits such as health insurance, retirement plans, or life insurance, the employee will need to complete enrollment forms.

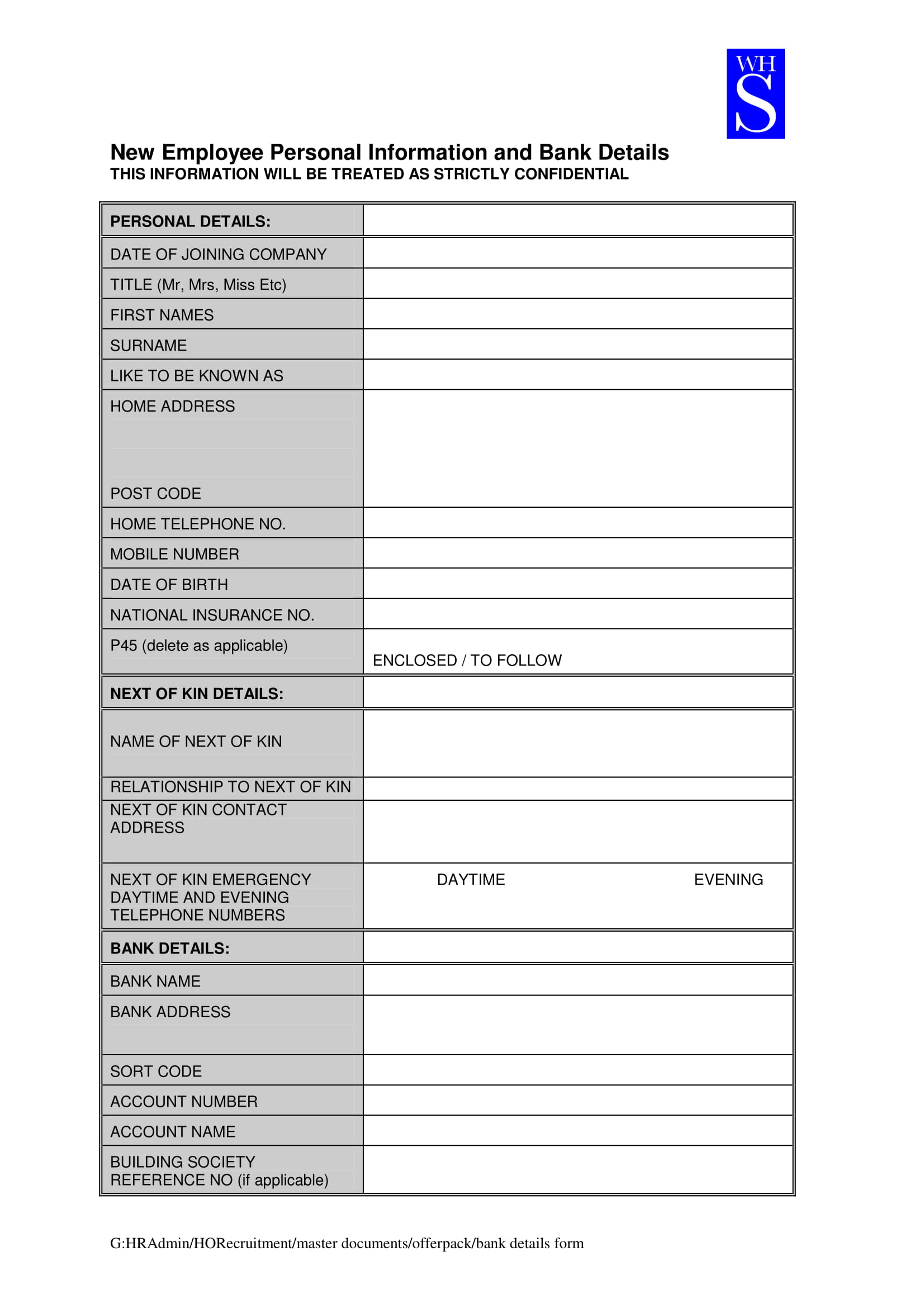

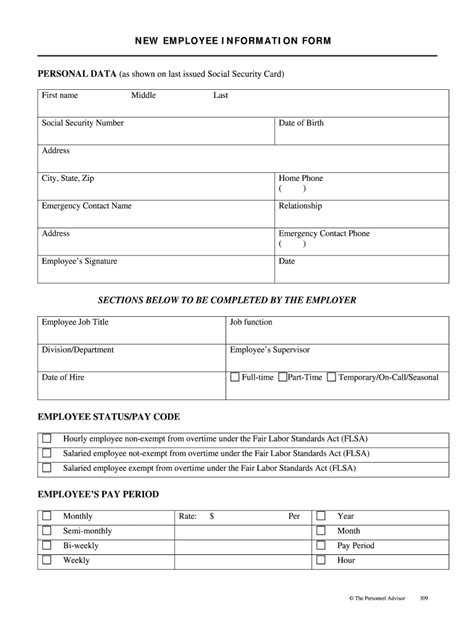

Other Required Documents

In addition to the above documents, new employees may be required to complete other paperwork, such as: * Emergency contact information: The employee’s emergency contact information, including name, address, and phone number. * Banking information: The employee’s banking information, including account number and routing number, for direct deposit purposes. * Employee handbook acknowledgement form: The employee may be required to sign an acknowledgement form indicating that they have received and read the employee handbook.

| Document | Purpose |

|---|---|

| Job application form | To express interest in a job opening |

| Employment contract | To outline the terms and conditions of employment |

| W-4 form | To determine the amount of federal income tax to be withheld |

| Benefits enrollment forms | To enroll in benefits such as health insurance and retirement plans |

📝 Note: The specific paperwork requirements may vary depending on the employer and the type of job. It's essential to review and complete all required documents carefully to ensure compliance with laws and regulations.

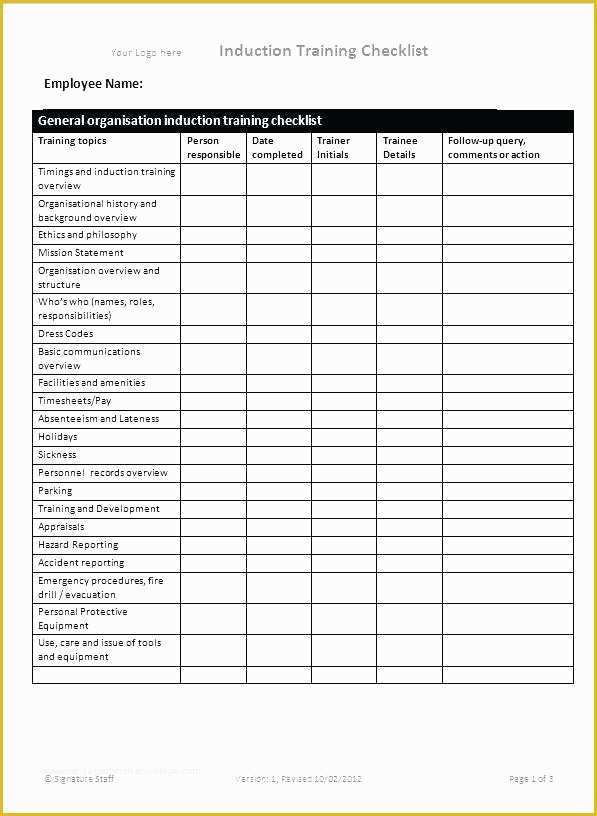

Best Practices for Managing New Employee Paperwork

To ensure a smooth onboarding process, employers should have a well-organized system in place for managing new employee paperwork. This can include: * Electronic document management: Using digital tools to store and manage employee documents can help reduce paperwork and increase efficiency. * Clear communication: Employers should clearly communicate the paperwork requirements to new employees and provide guidance on how to complete each document. * Timely completion: Employers should ensure that all paperwork is completed in a timely manner to avoid delays in the onboarding process.

Conclusion and Final Thoughts

In conclusion, new employee paperwork requirements are an essential part of the hiring process. Employers must ensure that all necessary documents are completed to comply with laws and regulations, and to provide a smooth transition for new employees. By having a well-organized system in place and clearly communicating the paperwork requirements, employers can reduce paperwork and increase efficiency. It’s also essential for new employees to carefully review and complete all required documents to avoid any issues or delays.

What is the purpose of a W-4 form?

+

The W-4 form is used to determine the amount of federal income tax to be withheld from an employee’s wages.

Why is it important to complete all required paperwork?

+

Completing all required paperwork is essential to comply with laws and regulations, and to provide a smooth transition for new employees.

How can employers manage new employee paperwork efficiently?

+

Employers can manage new employee paperwork efficiently by using electronic document management tools, clearly communicating the paperwork requirements, and ensuring timely completion of all documents.