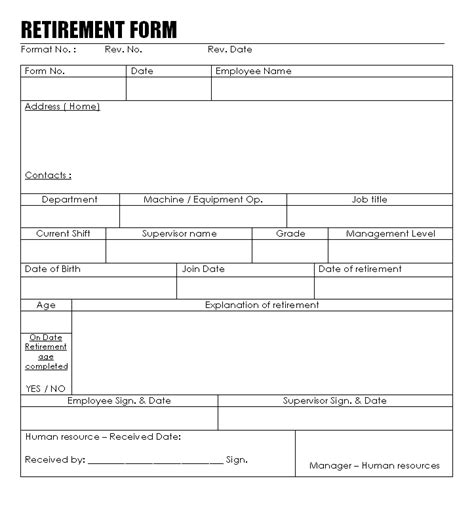

Retirement Paperwork Requirements

Introduction to Retirement Paperwork

When it comes to retirement, there are numerous aspects to consider, from financial planning to healthcare and lifestyle adjustments. One crucial, yet often overlooked, aspect is the paperwork required for a smooth transition into retirement. Understanding and completing the necessary paperwork is vital to ensure that you receive the benefits you are entitled to and that your retirement plans are executed as intended. In this article, we will delve into the various types of retirement paperwork, their requirements, and the steps you need to take to navigate this process efficiently.

Types of Retirement Paperwork

The paperwork involved in retirement can be broadly categorized into several types, each serving a different purpose. These include: - Social Security Claims: Applying for Social Security benefits is a critical step for many retirees, as it often represents a significant portion of their retirement income. - Pension and Retirement Account Documents: If you are eligible for a pension or have retirement accounts such as 401(k), IRA, or annuities, you will need to complete specific paperwork to access these funds. - Medicare and Health Insurance Applications: As you approach retirement age, you will need to enroll in Medicare and possibly supplement it with additional health insurance coverage. - Tax-Related Documents: Retirement income is subject to taxation, and understanding which forms you need to file and how to report your income accurately is essential for avoiding tax penalties.

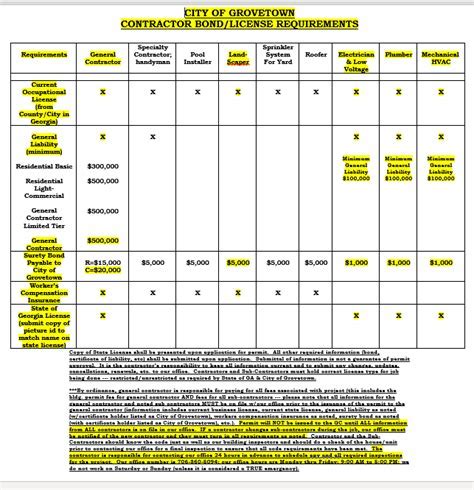

Preparing for Retirement Paperwork

To prepare for the paperwork associated with retirement, it is essential to stay organized and plan ahead. Here are some steps you can take: - Gather Necessary Documents: Ensure you have all required documents, such as your Social Security number, birth certificate, marriage certificate (if applicable), and military discharge papers (for veterans). - Research Requirements: Look into the specific paperwork requirements for your situation, including any deadlines or eligibility criteria. - Consult with Professionals: Consider consulting with a financial advisor or attorney specializing in retirement planning to guide you through the process.

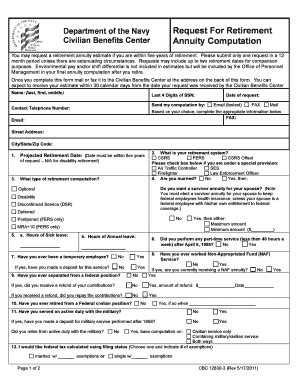

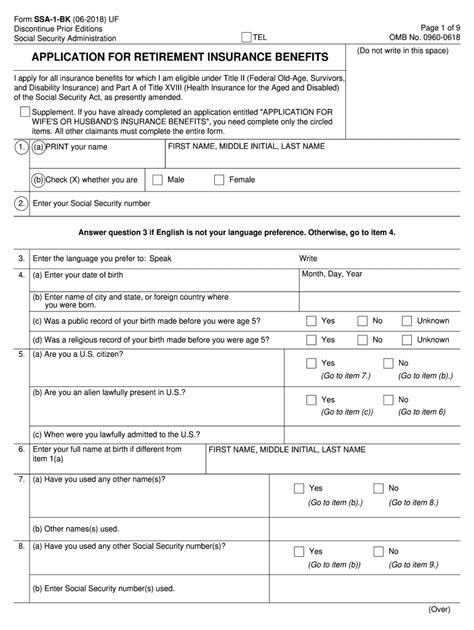

Completing Social Security Claims

Applying for Social Security benefits involves several steps: - Check Your Eligibility: Ensure you have enough work credits to qualify for benefits. - Gather Required Documents: Typically, you will need proof of age, citizenship, and marriage (if applicable). - Apply Online, by Phone, or in Person: The Social Security Administration (SSA) offers multiple ways to apply for benefits. Choose the method that is most convenient for you. - Follow Up: After applying, keep track of your application status and be prepared to provide additional information if requested.

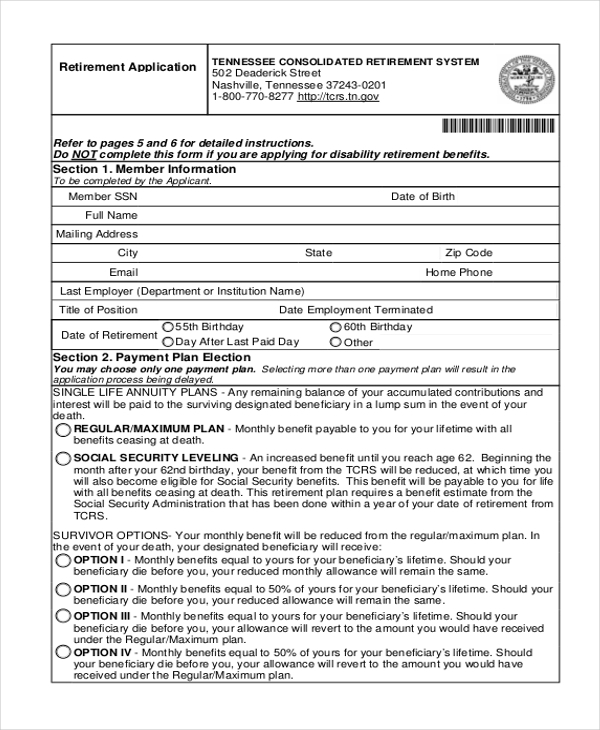

Managing Pension and Retirement Accounts

For those with pensions or retirement accounts, the process involves: - Reviewing Plan Documents: Understand the rules and options available in your plan. - Choosing a Distribution Method: Decide how you want to receive your retirement funds, considering options such as lump sums, annuities, or systematic withdrawals. - Completing Distribution Forms: Fill out the necessary forms to initiate payments according to your chosen method.

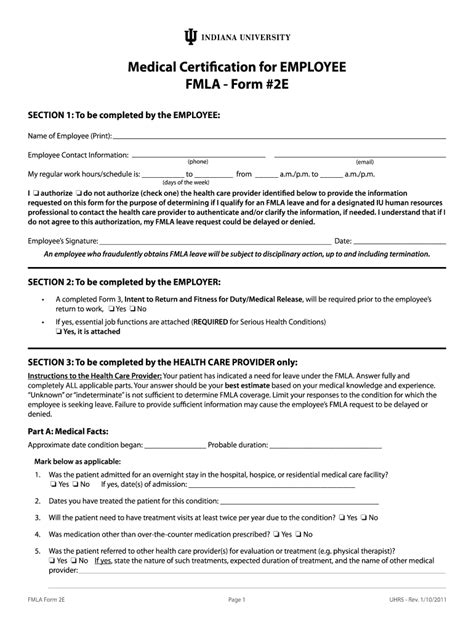

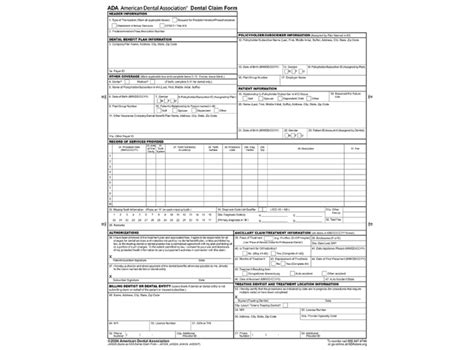

Enrolling in Medicare and Health Insurance

As you approach retirement age, enrolling in Medicare and considering supplemental insurance is crucial: - Understanding Medicare Parts: Familiarize yourself with Medicare Part A, Part B, Part C (Medicare Advantage), and Part D (prescription drug coverage). - Choosing Supplemental Insurance: Decide if you need Medigap or a Medicare Advantage plan to cover gaps in Original Medicare. - Applying During Enrollment Periods: Be aware of the Initial Enrollment Period and other special enrollment periods to avoid penalties.

Tax Considerations in Retirement

Retirement income is taxable, and proper planning can help minimize your tax burden: - Understanding Taxable Income: Know which sources of retirement income are taxable, such as pensions, 401(k) distributions, and Social Security benefits. - Claiming Deductions and Credits: Take advantage of deductions and credits available to retirees, such as the deduction for retirement account contributions. - Filing Tax Returns: Ensure you file your tax returns accurately and on time, reporting all retirement income and claiming eligible deductions and credits.

| Type of Retirement Income | Tax Treatment |

|---|---|

| Social Security Benefits | Partially taxable, depending on income level |

| Pensions and Annuities | Taxable as ordinary income |

| 401(k) and IRA Distributions | Taxable as ordinary income |

| Roth IRA Distributions | Tax-free if certain conditions are met |

📝 Note: Tax laws and regulations can change, so it's essential to consult with a tax professional or financial advisor to get the most accurate and up-to-date advice.

In summary, navigating the paperwork requirements of retirement involves understanding and preparing for various types of applications and forms, from Social Security claims and pension distributions to Medicare enrollment and tax filings. By planning ahead, staying organized, and seeking professional advice when needed, you can ensure a smoother transition into retirement and make the most of your post-work life.

What is the earliest age I can apply for Social Security benefits?

+

The earliest age you can apply for Social Security benefits is 62, but taking benefits early can result in reduced monthly payments.

Do I need to enroll in Medicare if I have retiree health insurance from my former employer?

+

It depends on the specifics of your retiree health insurance and your eligibility for Medicare. You should compare the coverage and costs of both options to decide what’s best for you.

How do I report retirement income on my tax return?

+

You will typically report retirement income on Form 1040 and may need to complete additional forms or schedules, depending on the types of income you receive. It’s recommended to consult with a tax professional to ensure accuracy.