Student Loan Forgiveness Paperwork Needed

Introduction to Student Loan Forgiveness

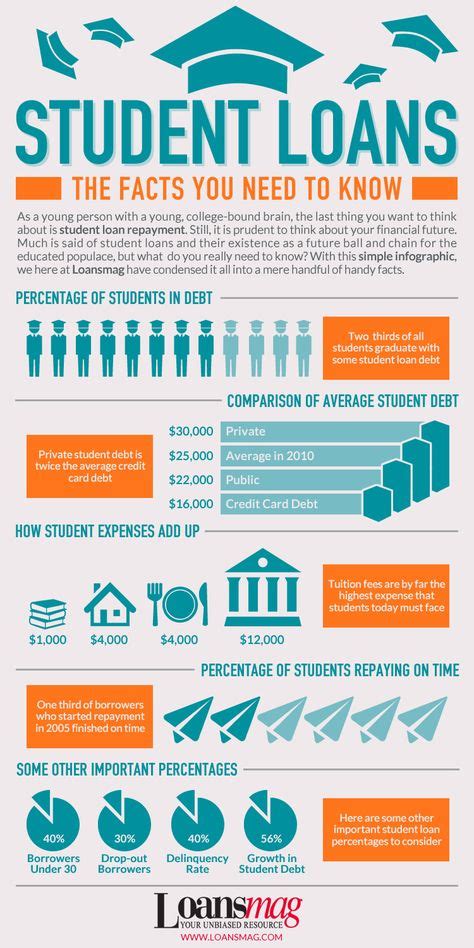

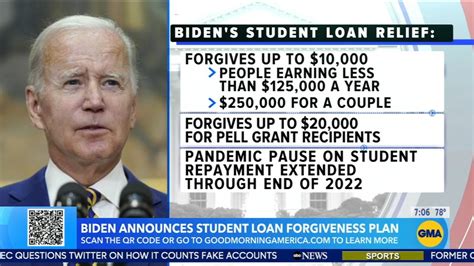

Student loan forgiveness is a process that allows borrowers to have their loans partially or fully forgiven, depending on their occupation, income, and other factors. This process can be complex and requires specific paperwork to be completed. In this article, we will explore the different types of student loan forgiveness and the paperwork needed to apply for each.

Types of Student Loan Forgiveness

There are several types of student loan forgiveness, including: * Public Service Loan Forgiveness (PSLF): This program is for borrowers who work in public service jobs, such as teachers, nurses, and government employees. * Teacher Loan Forgiveness: This program is for teachers who work in low-income schools or teach certain subjects, such as math or science. * Perkins Loan Cancellation: This program is for borrowers who work in certain fields, such as nursing or teaching, and have Perkins loans. * Income-Driven Repayment (IDR) Forgiveness: This program is for borrowers who are enrolled in income-driven repayment plans and have made payments for a certain number of years.

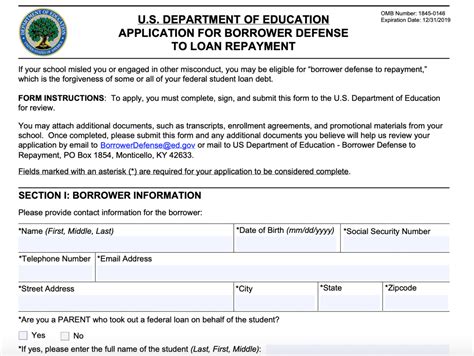

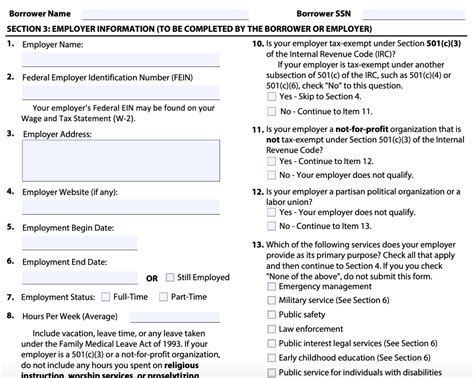

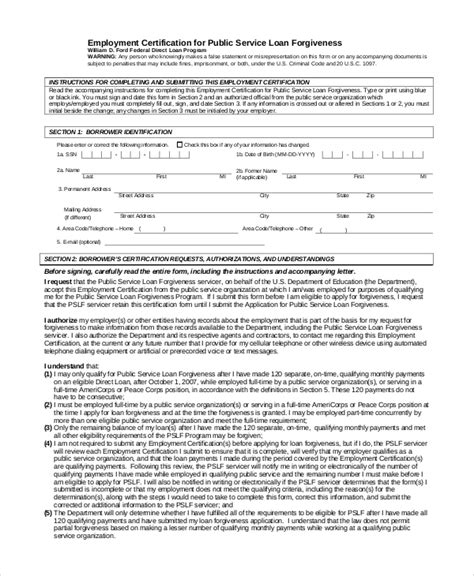

Public Service Loan Forgiveness (PSLF) Paperwork

To apply for PSLF, borrowers need to complete the following paperwork: * Employment Certification Form: This form must be completed and signed by the borrower’s employer to certify that they work in a public service job. * Loan Forgiveness Application: This application must be completed and submitted to the borrower’s loan servicer. * Tax Returns: Borrowers may need to provide tax returns to verify their income and employment.

Teacher Loan Forgiveness Paperwork

To apply for Teacher Loan Forgiveness, borrowers need to complete the following paperwork: * Teacher Loan Forgiveness Application: This application must be completed and submitted to the borrower’s loan servicer. * Certification Form: This form must be completed and signed by the borrower’s school administrator to certify that they teach in a low-income school or teach certain subjects. * Transcripts: Borrowers may need to provide transcripts to verify their teaching credentials.

Perkins Loan Cancellation Paperwork

To apply for Perkins Loan Cancellation, borrowers need to complete the following paperwork: * Perkins Loan Cancellation Application: This application must be completed and submitted to the borrower’s loan servicer. * Certification Form: This form must be completed and signed by the borrower’s employer to certify that they work in a qualifying field. * License or Certification: Borrowers may need to provide proof of licensure or certification in their field.

Income-Driven Repayment (IDR) Forgiveness Paperwork

To apply for IDR Forgiveness, borrowers need to complete the following paperwork: * IDR Application: This application must be completed and submitted to the borrower’s loan servicer. * Tax Returns: Borrowers may need to provide tax returns to verify their income. * Payment History: Borrowers may need to provide proof of payment history to verify that they have made payments for the required number of years.

💡 Note: Borrowers should keep track of their payments and employment history, as this information may be required to complete the forgiveness application.

Table of Required Paperwork

| Type of Forgiveness | Required Paperwork |

|---|---|

| PSLF | Employment Certification Form, Loan Forgiveness Application, Tax Returns |

| Teacher Loan Forgiveness | Teacher Loan Forgiveness Application, Certification Form, Transcripts |

| Perkins Loan Cancellation | Perkins Loan Cancellation Application, Certification Form, License or Certification |

| IDR Forgiveness | IDR Application, Tax Returns, Payment History |

In summary, student loan forgiveness requires specific paperwork to be completed, depending on the type of forgiveness. Borrowers should review the requirements carefully and keep track of their payments and employment history to ensure a smooth application process. By understanding the paperwork needed, borrowers can take the first step towards having their loans forgiven.

What is Public Service Loan Forgiveness (PSLF)?

+

Public Service Loan Forgiveness (PSLF) is a program that forgives the remaining balance on a borrower’s Direct Loans after they have made 120 qualifying payments while working full-time for a qualifying employer.

How do I apply for Teacher Loan Forgiveness?

+

To apply for Teacher Loan Forgiveness, borrowers must complete the Teacher Loan Forgiveness Application and submit it to their loan servicer. They must also provide certification from their school administrator and transcripts to verify their teaching credentials.

What is Income-Driven Repayment (IDR) Forgiveness?

+

Income-Driven Repayment (IDR) Forgiveness is a program that forgives the remaining balance on a borrower’s Direct Loans after they have made payments for a certain number of years while enrolled in an income-driven repayment plan.