Wage Garnishment Paperwork Requirements

Understanding Wage Garnishment Paperwork Requirements

Wage garnishment is a legal process that allows creditors to deduct a portion of an individual’s wages to satisfy a debt. The paperwork requirements for wage garnishment vary by state, but there are some general requirements that apply across the board. In this article, we will explore the necessary paperwork and procedures for wage garnishment, as well as the rights and obligations of both creditors and debtors.

Types of Wage Garnishment

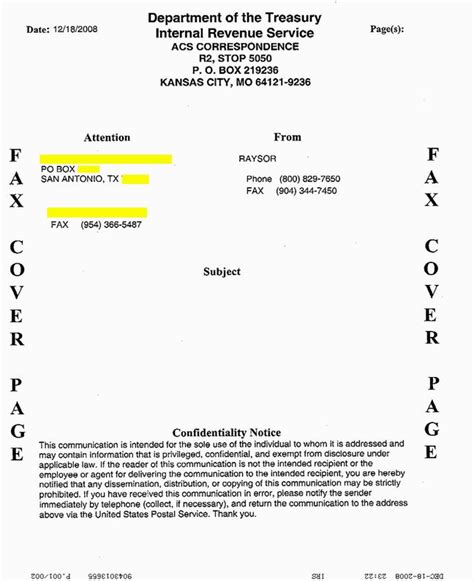

There are several types of wage garnishment, including: * Federal wage garnishment: This type of garnishment is used to collect debts owed to the federal government, such as back taxes or student loans. * State wage garnishment: This type of garnishment is used to collect debts owed to state or local governments, such as court-ordered child support or alimony. * Private wage garnishment: This type of garnishment is used to collect debts owed to private creditors, such as credit card companies or banks. Each type of garnishment has its own set of paperwork requirements, which we will discuss in more detail below.

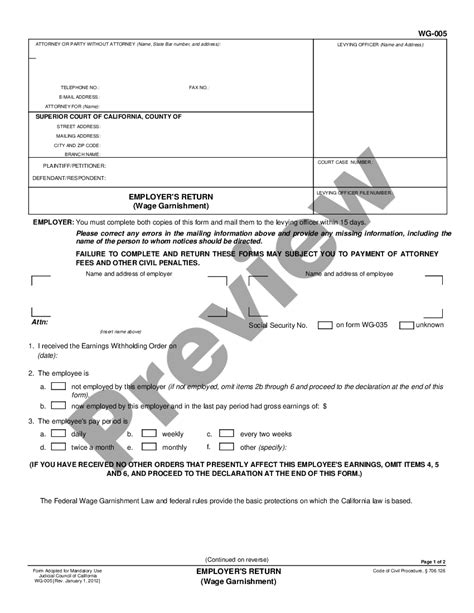

Wage Garnishment Paperwork Requirements

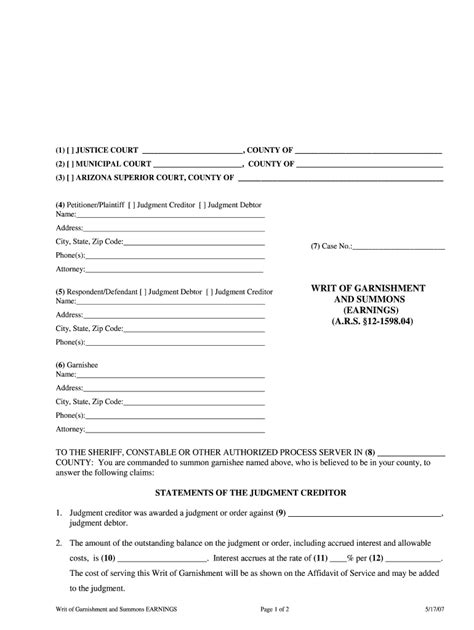

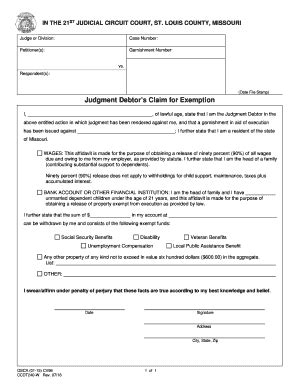

The paperwork requirements for wage garnishment typically include: * Court order: A court order is required to initiate the wage garnishment process. The creditor must obtain a judgment against the debtor and then file a petition with the court to garnish the debtor’s wages. * Writ of garnishment: A writ of garnishment is a legal document that orders the debtor’s employer to withhold a portion of the debtor’s wages and pay it to the creditor. * Notice to the debtor: The debtor must be notified of the wage garnishment in writing, which includes the amount of the debt, the amount of the garnishment, and the name and address of the creditor. * Exemption claim form: The debtor may be eligible to claim an exemption from the wage garnishment, which would reduce the amount of the garnishment or eliminate it altogether.

Procedure for Wage Garnishment

The procedure for wage garnishment typically involves the following steps: * The creditor obtains a judgment against the debtor and files a petition with the court to garnish the debtor’s wages. * The court issues a writ of garnishment, which is served on the debtor’s employer. * The employer withholds the specified amount from the debtor’s wages and pays it to the creditor. * The debtor receives notice of the wage garnishment and has the opportunity to claim an exemption. * The creditor receives the garnished wages and applies them to the debt.

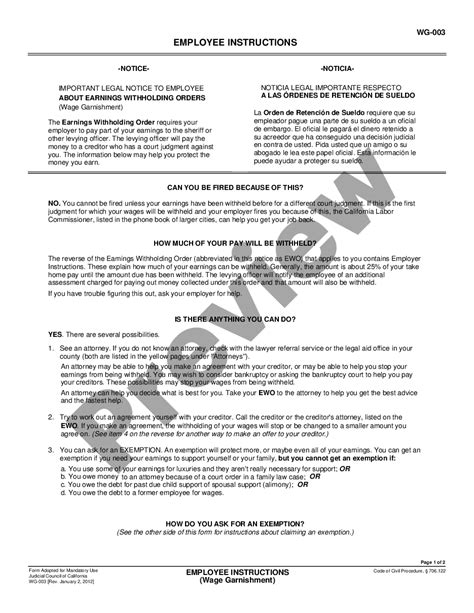

Rights and Obligations of Creditors and Debtors

Both creditors and debtors have certain rights and obligations in the wage garnishment process. Creditors have the right to collect debts owed to them, but they must follow the proper procedures and respect the debtor’s rights. Debtors have the right to claim an exemption from the wage garnishment and to dispute the debt if they believe it is incorrect. Employers also have obligations in the wage garnishment process, including withholding the specified amount from the debtor’s wages and paying it to the creditor.

📝 Note: Debtors who are facing wage garnishment should seek the advice of a qualified attorney to understand their rights and options.

Table of Wage Garnishment Limits

The following table shows the limits on wage garnishment in the United States:

| Type of Debt | Limit on Garnishment |

|---|---|

| Federal student loans | Up to 15% of disposable income |

| Child support and alimony | Up to 50% of disposable income |

| Taxes | Up to 15% of disposable income |

| Credit card debt and other consumer debt | Up to 25% of disposable income |

In summary, wage garnishment is a complex process that involves specific paperwork requirements and procedures. Creditors, debtors, and employers all have certain rights and obligations in the wage garnishment process. By understanding these requirements and procedures, individuals can better navigate the wage garnishment process and protect their rights.

As we reflect on the key points discussed, it’s clear that wage garnishment is a serious matter that requires careful attention to detail and a thorough understanding of the law. By being informed and proactive, individuals can avoid the negative consequences of wage garnishment and work towards a more stable financial future.

What is wage garnishment?

+

Wage garnishment is a legal process that allows creditors to deduct a portion of an individual’s wages to satisfy a debt.

What are the paperwork requirements for wage garnishment?

+

The paperwork requirements for wage garnishment typically include a court order, writ of garnishment, notice to the debtor, and exemption claim form.

Can I claim an exemption from wage garnishment?

+

Yes, you may be eligible to claim an exemption from wage garnishment, which would reduce the amount of the garnishment or eliminate it altogether.