Buy Home Paperwork Requirements

Introduction to Buying a Home

When it comes to buying a home, the process can be quite overwhelming, especially for first-time buyers. One of the most critical aspects of this process is the paperwork required. Understanding the various documents and requirements involved can help make the experience less daunting. In this article, we will delve into the key paperwork requirements for buying a home, exploring what each document entails and why it’s necessary.

Pre-Purchase Paperwork

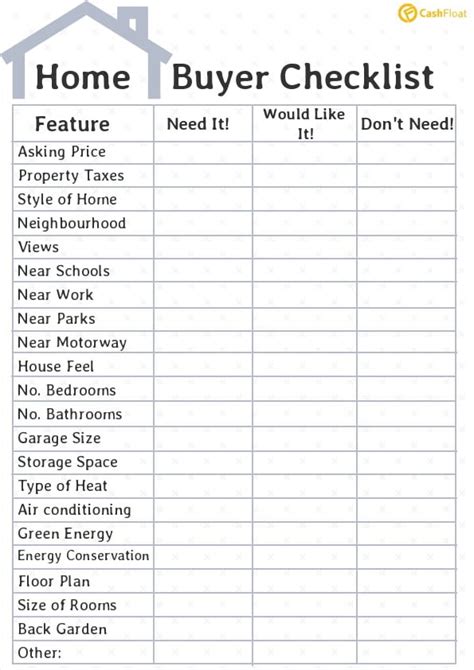

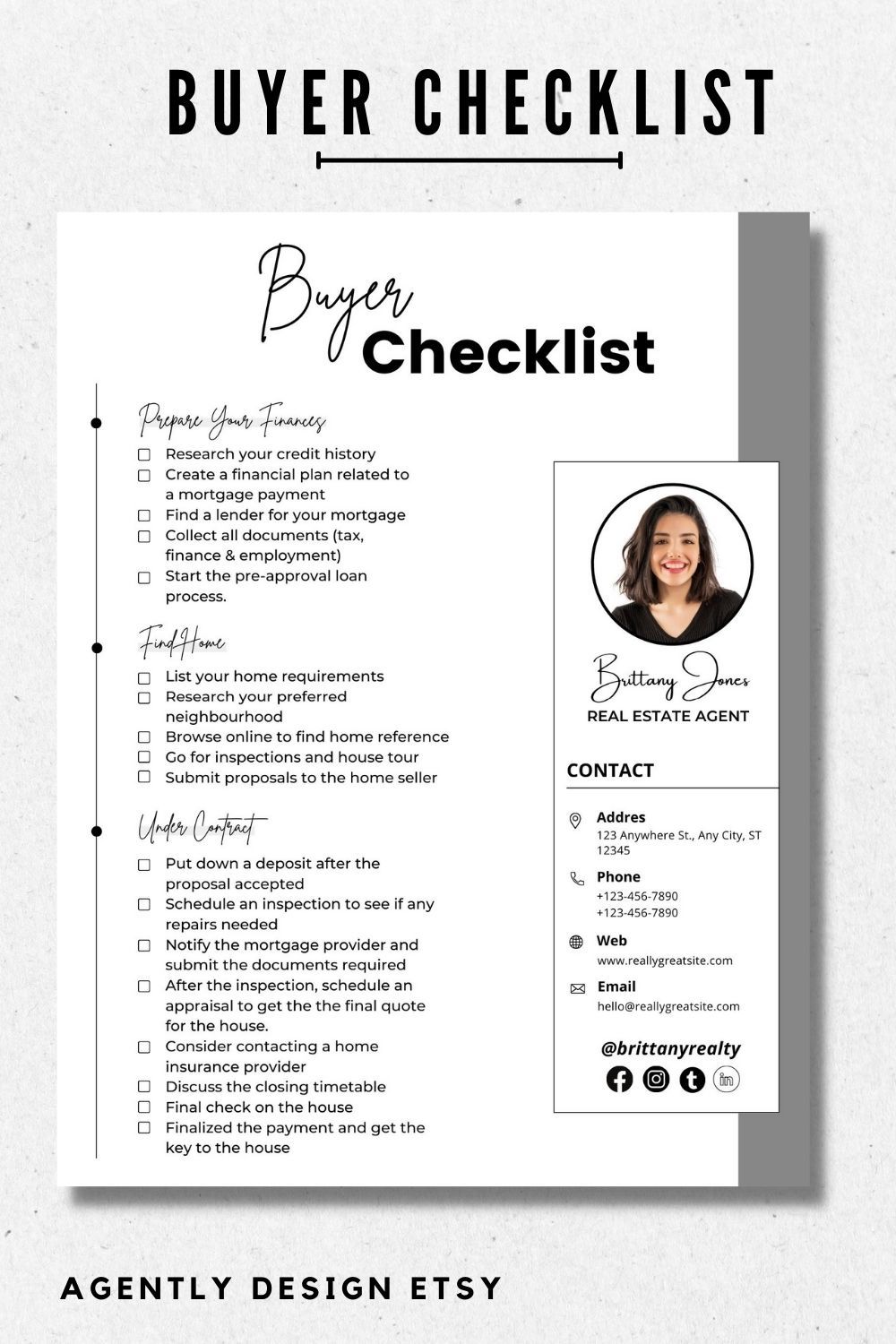

Before you start house hunting, it’s essential to get your finances in order. This involves several steps and documents: - Pre-approval letter: This is a document from a lender stating the amount they are willing to lend you to purchase a home. It’s based on your credit score, income, and other financial factors. - Identification documents: You’ll need to provide identification, such as a driver’s license or passport, to verify your identity. - Income verification: Pay stubs, W-2 forms, and tax returns are used to verify your income.

Offer and Acceptance Paperwork

Once you find a home you wish to purchase, the next step involves making an offer and negotiating the terms of the sale. The key documents in this phase include: - Purchase agreement: This is the contract that outlines the terms of the sale, including the price, contingencies, and closing date. It’s a legally binding document once signed by both the buyer and the seller. - Earnest money deposit: This is a deposit made by the buyer to demonstrate their commitment to the purchase. It’s usually a percentage of the purchase price and is held in escrow until the sale is finalized.

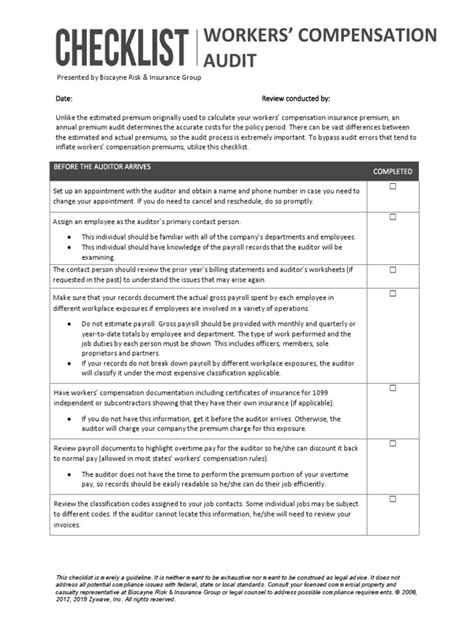

Inspection and Due Diligence Paperwork

After your offer is accepted, you’ll enter a due diligence period where you can conduct inspections and review the property’s condition and legal status. Important documents in this phase include: - Inspection reports: These are reports from professionals who inspect the property for any defects or needed repairs. Common inspections include termite, home, and septic inspections. - Appraisal report: An appraisal is an independent opinion of the property’s value, which can affect the amount a lender is willing to lend.

Financing Paperwork

Securing financing for your home purchase involves several documents: - Loan application: You’ll need to apply for a mortgage, providing detailed financial information. - Credit report: Your credit score plays a significant role in determining the interest rate you’ll qualify for and whether you’ll be approved for a loan. - Loan estimate and closing disclosure: These documents outline the terms of your loan, including the interest rate, monthly payments, and closing costs.

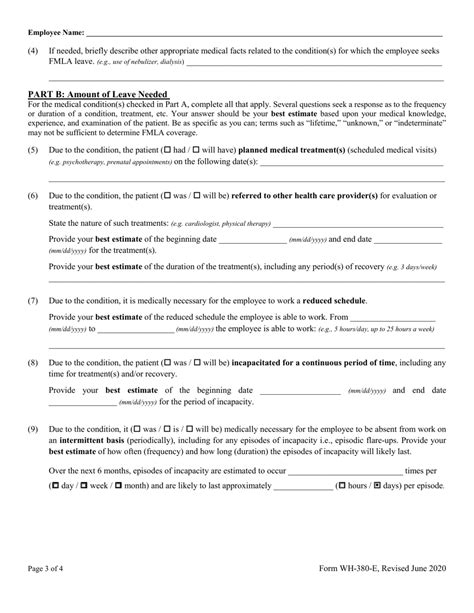

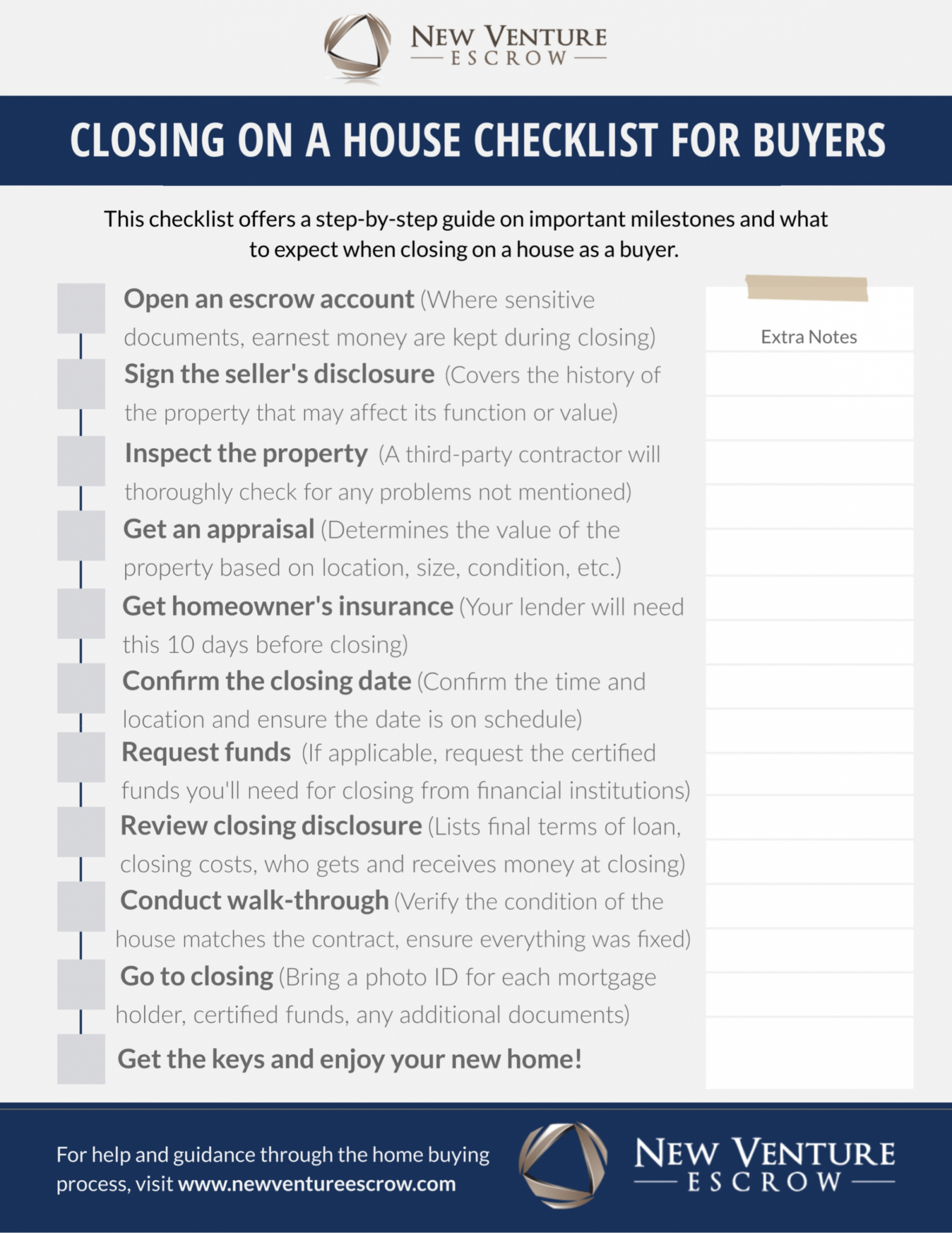

Closing Paperwork

The final step in the home-buying process is the closing, where the property is transferred from the seller to the buyer. Key documents at closing include: - Deed: This document transfers the ownership of the property from the seller to the buyer. - Title insurance: This insurance protects the buyer and the lender from any errors in the title search that could lead to legal claims against the property. - Mortgage note: This is the borrower’s promise to repay the loan, and it includes the terms of the loan. - Closing statement: This document itemizes all the costs associated with the purchase and sale of the property.

| Document | Description |

|---|---|

| Pre-approval Letter | States the amount a lender is willing to lend. |

| Purchase Agreement | Outlines the terms of the sale. |

| Inspection Reports | Detail the condition of the property. |

| Loan Application | Required for mortgage approval. |

| Deed | Transfers ownership of the property. |

📝 Note: It's crucial to carefully review all documents before signing to ensure you understand your obligations and the terms of the purchase.

As you navigate the complex process of buying a home, understanding the paperwork requirements can make the experience less stressful. By being prepared and knowing what to expect, you can ensure a smoother transaction. Remember, each document plays a vital role in the home-buying process, from pre-approval to closing. Whether you’re a first-time buyer or a seasoned homeowner, knowledge of these requirements can empower you to make informed decisions throughout your journey to homeownership.

What is the first step in the home-buying process?

+

The first step typically involves getting pre-approved for a mortgage. This gives you an idea of how much you can afford and makes your offer more attractive to sellers.

Why is a home inspection important?

+

A home inspection can reveal hidden defects in the property, allowing you to negotiate the price or request repairs. It’s a critical step in protecting your investment.

What does a deed do in the home-buying process?

+

The deed is the document that officially transfers the ownership of the property from the seller to the buyer. It’s recorded in public records to provide legal evidence of ownership.