Paperwork

Tax Paperwork Needed

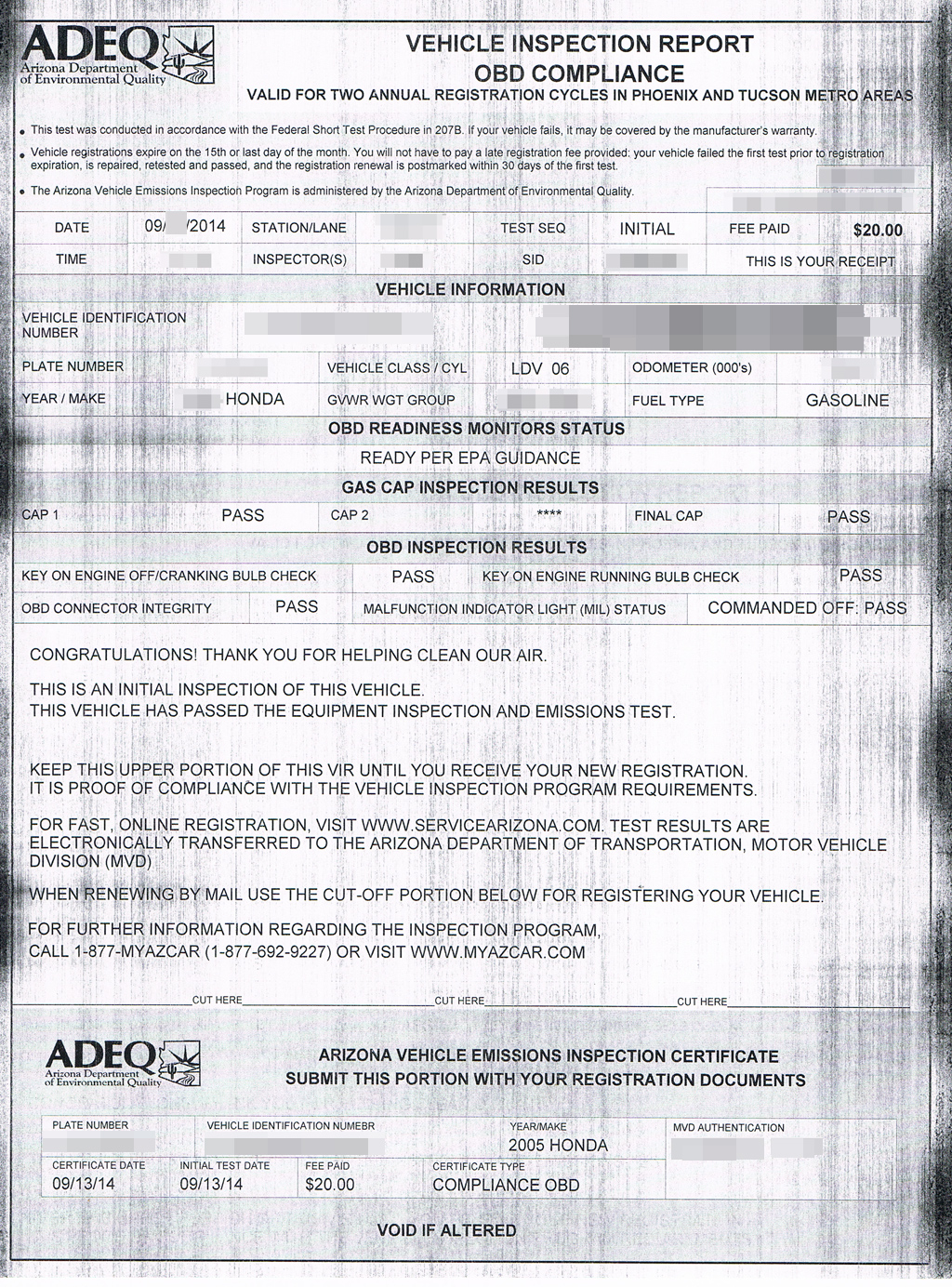

Introduction to Tax Paperwork

When it comes to tax season, one of the most daunting tasks for individuals and businesses alike is gathering and completing the necessary tax paperwork. The process can be overwhelming, especially for those who are not familiar with the various forms and documents required. In this article, we will break down the essential tax paperwork needed for individuals and businesses, providing a clear understanding of what is required and how to navigate the process.

Individual Tax Paperwork

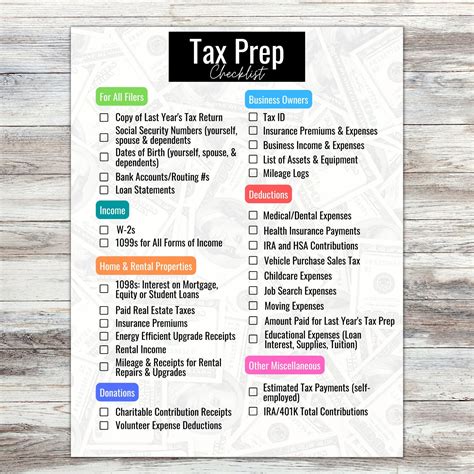

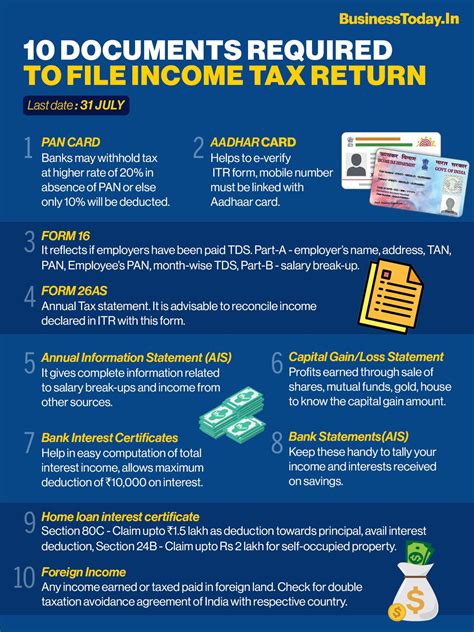

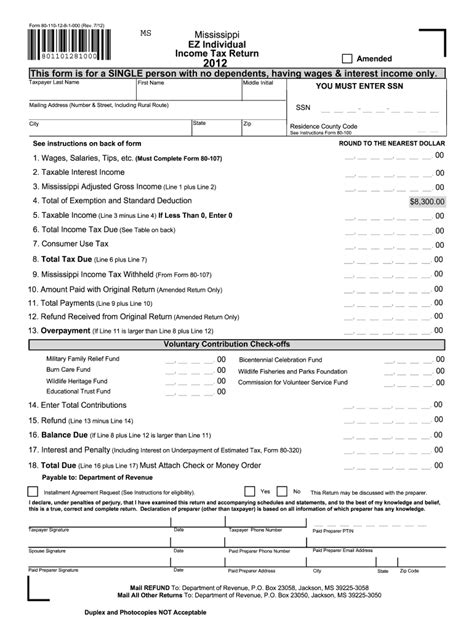

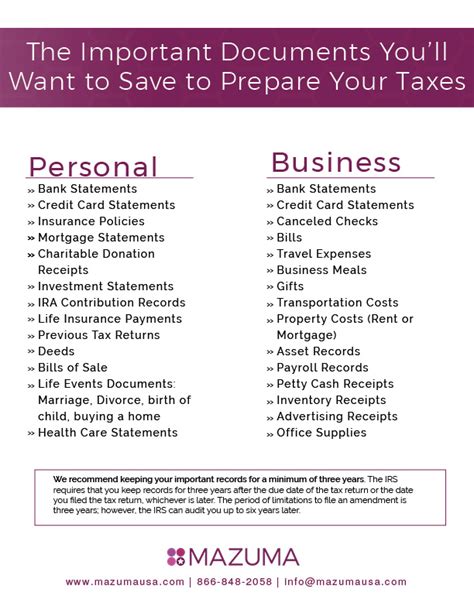

For individuals, the primary tax paperwork needed includes: * W-2 forms: Provided by employers, these forms outline an individual’s income and taxes withheld. * 1099 forms: For freelancers or independent contractors, these forms report income earned. * Interest statements: Banks and financial institutions provide these statements, detailing interest earned on accounts. * Dividend statements: Investors receive these statements, showing dividends earned from investments. * Charitable donation receipts: For those who donate to charity, these receipts are necessary for claiming deductions.

📝 Note: It is essential to keep accurate records of all tax-related documents, as they may be required for auditing purposes.

Business Tax Paperwork

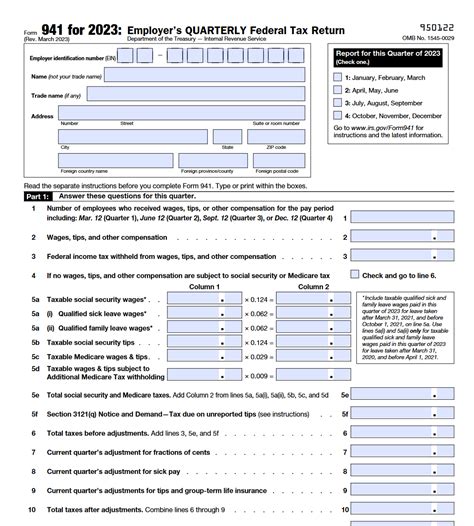

Businesses, on the other hand, require more extensive tax paperwork, including: * W-2 forms for employees: Employers must provide these forms to their employees, detailing income and taxes withheld. * 1099 forms for contractors: Businesses must issue these forms to independent contractors, reporting income earned. * Business income statements: Outlining revenue and expenses, these statements are crucial for calculating taxable income. * Expense receipts: Businesses must keep accurate records of expenses, including receipts for equipment, supplies, and travel. * Depreciation schedules: For businesses with assets, such as equipment or property, depreciation schedules are necessary for calculating tax deductions.

Tax Credits and Deductions

Both individuals and businesses can claim tax credits and deductions, which can significantly reduce their tax liability. Some common tax credits and deductions include: * Earned Income Tax Credit (EITC): A refundable credit for low-to-moderate income individuals and families. * Child Tax Credit: A credit for families with qualifying children. * Mortgage interest deduction: A deduction for homeowners, allowing them to claim interest paid on their mortgage. * Charitable donations: Donations to qualified charitable organizations can be deducted from taxable income.

Table of Common Tax Forms

The following table outlines some of the most common tax forms required for individuals and businesses:

| Form | Purpose |

|---|---|

| W-2 | Reports income and taxes withheld for employees |

| 1099 | Reports income earned by freelancers and independent contractors |

| 1040 | Individual income tax return |

| 1120 | Business income tax return |

Conclusion and Final Thoughts

In conclusion, navigating the world of tax paperwork can be complex and time-consuming. However, by understanding the necessary forms and documents required, individuals and businesses can ensure they are in compliance with tax laws and regulations. It is essential to keep accurate records, claim eligible tax credits and deductions, and seek professional help when needed. By doing so, individuals and businesses can minimize their tax liability and avoid potential penalties.

What is the deadline for filing individual tax returns?

+

The deadline for filing individual tax returns is typically April 15th of each year.

What is the difference between a tax credit and a tax deduction?

+

A tax credit reduces the amount of tax owed, while a tax deduction reduces taxable income.

Can I file my tax return electronically?

+

Yes, you can file your tax return electronically through the IRS website or authorized tax preparation software.